UPDATE:

At Datarails we acknowledge that this is a difficult time for many businesses, and that’s why we’re offering a special promotion to help organizations weather the storm. We’re offering a free one month trial and a quick 2-3 week implementation, after which the platform is offered on a monthly basis with no commitment. With Datarails, employees continue working on Excel while simultaneously benefiting from a cloud-based planning platform that centralizes ALL organizational data regardless of data structure.

With thorough analysis capabilities including ad hoc reporting, drill downs, and variance analyses, conduct rigorous investigations into your data to explore how different scenarios might affect your business in the short, medium and long term.

Business continuity and crisis management plans commonly prepare organisations for a one-off event. But few organizations, if at all, were prepared for a threat like COVID-19 that could potentially play out over months or longer.

Guiding businesses step by step

The role of the board in this type of situation is to work with management to decide when to enact business continuity, crisis management, and pandemic response plans and to pressure-test these plans to ensure they are appropriate for the evolving and unpredictable nature of the situation.

“This is a strategy derailing event and board members will have an active role to play in supporting management in its planning and resource allocation, and this will require constant engagement.”

-Arash Rashidian, Principal of Risk Management, Lighthouse Advisory

Given the circumstances, where should the board be involved?

Boards should be reviewing long-term impacts and threats

Boards have a role to play in taking a longer-term lens and actively monitoring the changing nature of the threat, anticipating and scenario testing how the spread of the virus is likely to affect the business and its stakeholders, as well as monitoring emerging threats.

Financial impact and cash flow

This is a crucial activity for any board as it will determine the survival or otherwise of the organisation. The board should regularly review with management the near-term and longer-term financial impact of the pandemic. Management assumptions underlying any revenue or cash projections should be fully understood and interrogated. Alternative financing arrangements should be explored on an ongoing basis along with ways of restructuring current debt obligations.

Risk oversight

The board should oversee management’s efforts to identify, prioritize, and manage the principal risks to business operations posed by Covid-19. In such a crisis, the board will almost certainly need more regular updates from management between regularly scheduled board meetings. Depending on the nature of the risk impact, there may be key new roles for one or more board sub-committees.

Business continuity

The board should determine if business continuity plans are in place, and if they are still appropriate. These may well relate to:

Employee disruption. As more employees begin working remotely or are unable to work due to disruptions caused by the pandemic, the board needs to assess what minimum staffing levels are and what remote work technology will be required to maintain operations.

Supply chain and production disruption. The risks associated with a disruption in the supply chain need to be assessed. Are there alternative sources of supply? What are the risks that the company will have difficulty in fulfilling its contractual obligations? What are the relevant provisions in customer contracts (e.g., force majeure, events of default, etc) to determine if legal compensation could be available?

COVID-19 has created unprecedented practical challenges for corporate reporting.

Rapid-cycle reporting during this time is crucial, as the board needs to remain well-informed of the latest numbers and developments within the organisation.

As concerns mount over the quality of corporate reporting during the pandemic, management must adopt new approaches to providing information to stakeholders.

With Datarails, executive teams produce accurate financials with up-to-the-minute figures. Thanks to its patented technology, powerpoints and reports include precise, real-time figures, as well as visuals that can be refreshed and adjusted with a simple click of a button.

Deliver to the board quickly and with ease

Real-time, accurate data

With Datarails’ CPM solution, you can easily examine consolidated numbers from disparate sources thanks to automated consolidation of all organizational data, irrespective of data structure. And when you present the business landscape to the board, the solution’s single-click drill downs will allow you to confidently back up answers on the fly to the boards’ questions, should they arise.

Clarity

Objectivity and accuracy are vital. The board needs to know where things stand, for better or for worse, and as soon as possible. Datarails has a live embedded charts feature that is perfect for this. When you present your report, your figures and charts update on the spot thanks to real-time, live charts.

Meetings with the board serve a preventative function too. So if there is a decline in sales, they need to know. And if things are looking up, they need to know as well. Remember- you’re not trying to make a sale to the board. As such bring up potential risks, before they arise, in order to mitigate them.

Show them the big picture

Give the board a quick refresher of how things were and how they are now before telling them where things seem to be going. Comprehensive coverage of the past and present will give them the perspective they need to look into the future.

Visuals can help with this and convey your message in a straightforward way. Datarails’ Insights feature is excellent for this. The web-based, real-time dashboards are fully customizable, allowing you to visualize your data as you see fit.

Datarails helps you ensure the board sees exactly what they need to see in order to make the best decisions for the organization. With Datarails, deliver to the board what they need, exactly when they need it.

About Datarails

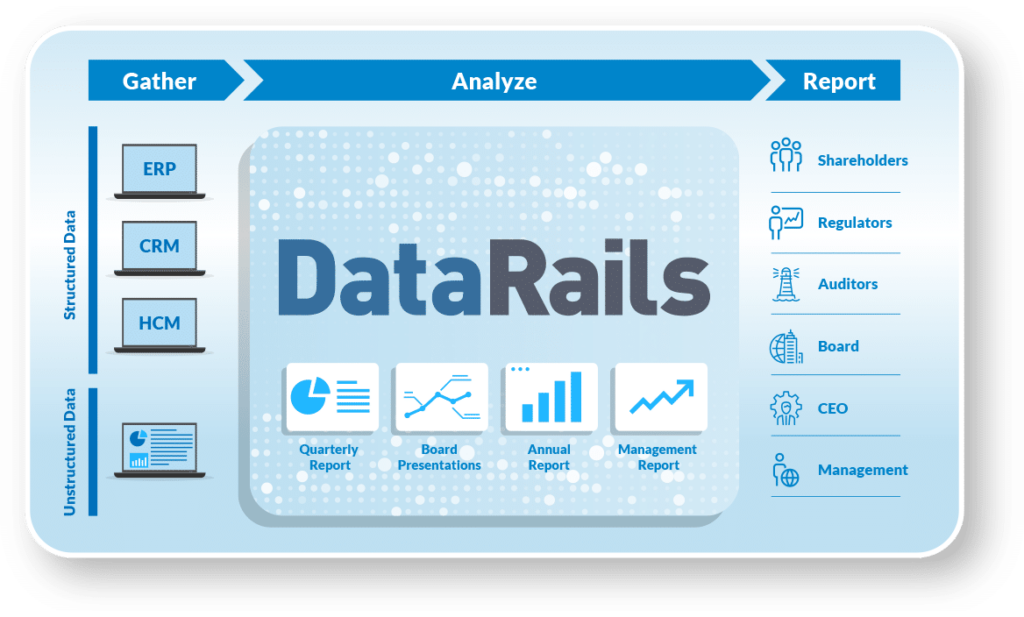

Datarails is developing a business augmented intelligence platform for the corporate finance function. Our FP&A solution allows for the connection and centralization of all organizational financial data from various systems (ERP, GL, CRM) alongside Excel spreadsheets and operational data. It also allows for the creation of automated financial reports (P&L, cash-flow, budgets, etc.), as well as thorough analysis of consolidated data for the creation of business and financial insights.