“Going digital” is a popular slogan nowadays. For many established institutions, it’s a way of signaling to the world that they’re adapting their practices to our modern day and age.

Digital adoption is all encompassing, applying just as much to internal practices as it does to external services. Within an organization, one trademark of digital adoption is the integration of Robotic Process Automation (RPA).

“Firms that…resist those changes or are too slow to adapt risk being rendered irrelevant.”

-Cliff Justice, KPMG Advisory principal

What is RPA?

Robotic process automation (RPA) is a form of business process automation. Put simply, it’s a program that executes specific steps of work that a person would typically do.

AI-enabled software is able to follow set parameters in order to perform tasks that were previously done manually such as verifying data, generating reports, reviewing documents, and extracting information from forms.

An example of a top financial firm that has successfully integrated RPA into their business is JP Morgan Chase. They rely on RPA for tasks such as extracting data, complying with Know Your Customer regulations, and reviewing documents. JP Morgan Chase even recognized RPA as one of five emerging technologies that they are currently using to enhance their processes.

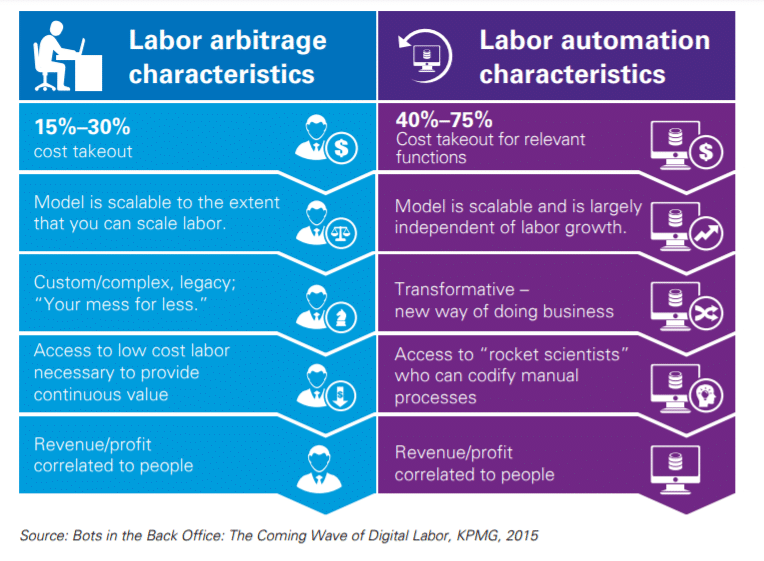

According to KPMG, “robotic process automation can cut costs for financial services firms by up to 75%.”

“The transformational potential of RPA and cognitive automation is unparalleled.”

– Bill Cline, KPMG Advisory principal

What are the advantages?

1. Cut costs

Integrating RPA can significantly cut operational costs and boost productivity. RPA makes it possible to automate a variety of time-consuming, tedious tasks that would otherwise take up thousands of work hours and inflate payrolls.

2.Quality and control: Eliminate human error

High-frequency repetitive tasks often lead to mistakes. With RPA, human error is significantly reduced and workforce efforts can be refocused on tasks that truly require human contributions.

3.Workforce advantages

A digital workforce is capable of working 24/7 and requires limited to no oversight. While RPA takes care of repetitive tasks, human workers can shift their attention to business development activities and higher value responsibilities.

4. Easy deployment

RPA is flexible and allows for speed and agility. While human workers require training, RPA requires no such thing. This means that after laying down the right infrastructure, implementation is relatively easy and scalable.

As Forbes put it, RPA is a “gateway drug to digital transformation.”

“Success in today’s…financial markets requires unprecedented levels of speed, accuracy, and cost efficiency beyond what a human workforce can provide.”

– Bill Cline, KPMG Advisory principal

What’s the holdup?

Despite all its many advantages, there are a few reasons why RPA is not as ubiquitous as it should be.

Only 6% of companies think their companies are advanced in robotic process automation (Deloitte).

1. It’s an expensive endeavour

RPA involves a big investment in technology, which translates to big expenses. This can be a difficult pill to swallow for upper management and decision-makers.

2.The groundworks take time

It takes a lot of time and effort to review and document a firm’s procedures and processes in order to translate them into “instructions” that robots or AI software can follow.

3. Resistant organizational culture

People tend to resist unfamiliar territory. There may be cultural resistance to change from management and workers alike who don’t want to welcome change or are blind to the advantages it can bring.

4. Financial services tend to be laggards

Few financial services firms have a “culture of innovation.” Rather, they tend to be behind the curve when it comes to implementing drastic changes.

There’s much to gain, but only if you’re willing to take the leap

RPA can help companies prepare themselves for the future. By redefining work processes, RPA takes companies to the next level of productivity optimization.

Datarails is one such platform that can give organizations a significant boost.

Datarails automatically consolidates data, providing finance professionals with swift access to all the information they need to make healthy business decisions.

With Datarails, finance professionals can:

- Forecast more accurately and budget reliably

- Reduce the likelihood of human error

- Cut down manual spreadsheet work by over 3\4

- Quickly adjust plans according to real-time data and respond nimbly

Finally, employees can dedicate maximum time to strategy and analysis instead of valueless busywork.

About Datarails

Datarails is an enterprise-class software that empowers each finance professional to independently work with data and deliver actionable, data-driven insights. Finally, count on numbers you can trust and reduce inefficiencies without having to change how you work on Excel. With Datarails, strengthen the connection between finance and operations to drive better organizational decisions.