Datarails Cash

Datarails Cash connects to company bank data in real-time, enabling finance teams to monitor cash position, forecast liquidity, and manage cash flow with accuracy and ease.

More visibility. More time back.

Cash Management without stretching your budget

Your data can come in any format or from any banking system. Datarails consolidates your different data sources into one source of truth that can be utilized across the board.

Confident and controlled cash flow management

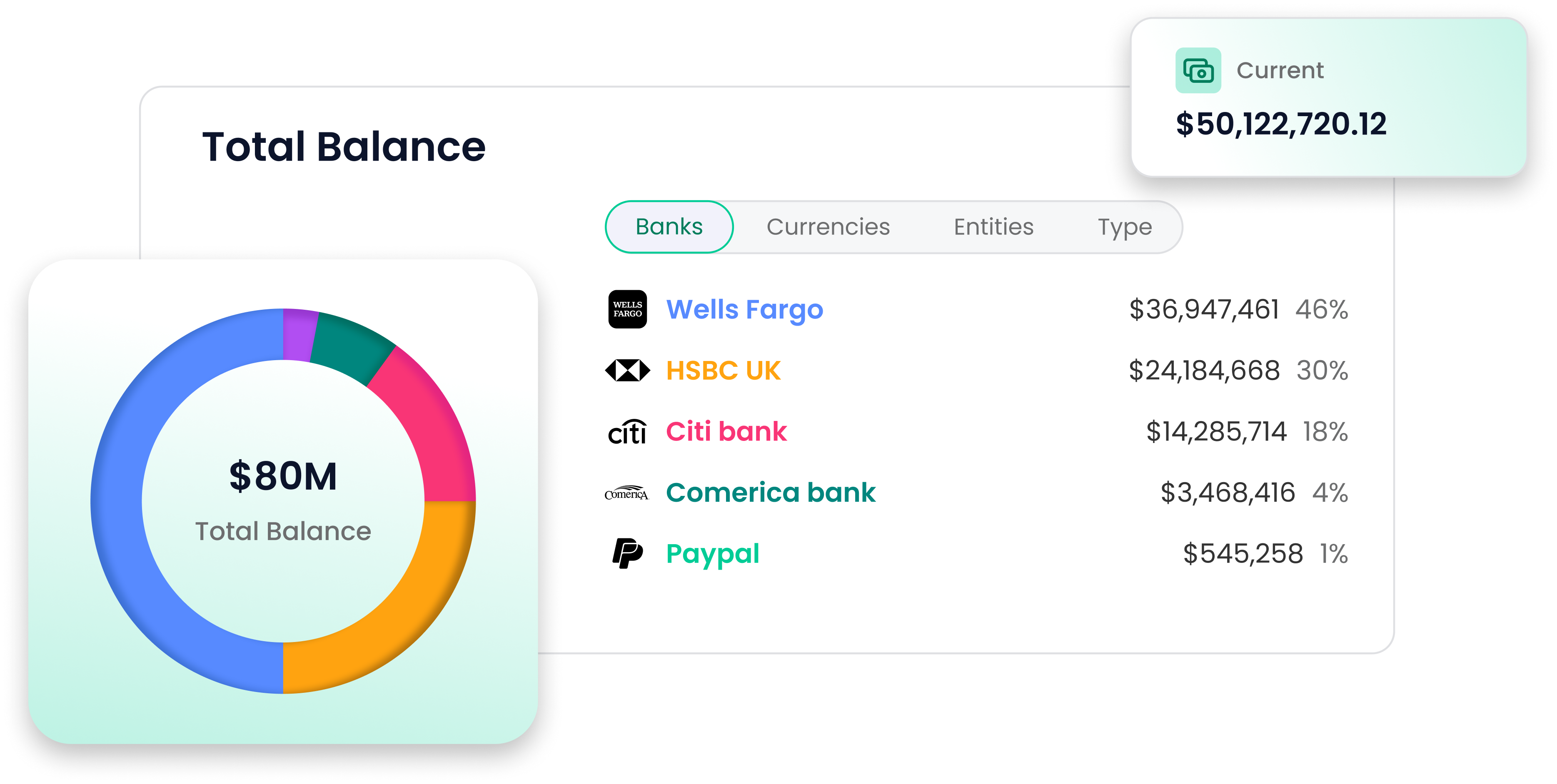

Live bank visibility

Stay up to date with your company’s cash position at all times. Datarails Cash syncs with your bank accounts, giving you an accurate view of balances, transactions, and cash flow across all entities, with no manual uploads or delays.

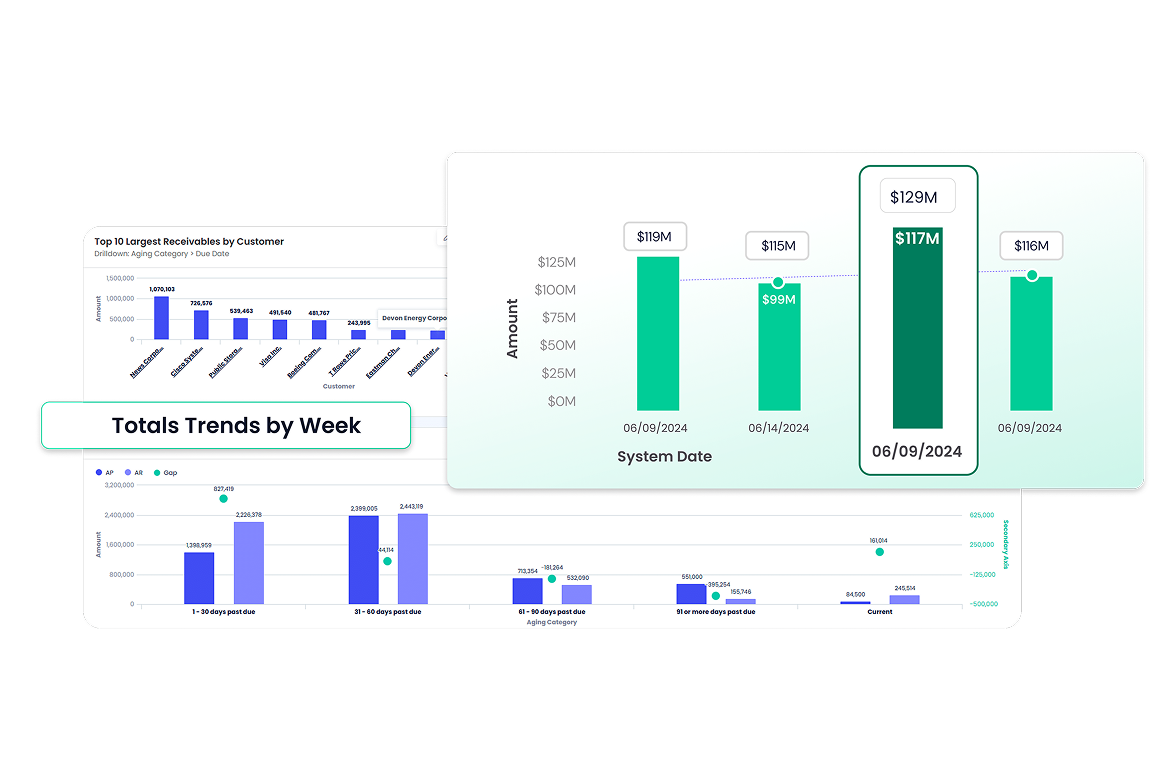

Cash flow forecasting

Datarails Cash leverages data from cash inflows, outflows, and your GL to help you project future cash positions. Avoid liquidity risks, plan for upcoming needs, and maintain healthy reserves with confidence.

Live data drill-downs

Go beyond the summary view in a matter of seconds. Datarails Cash lets you click into any figure to see the underlying transactions and details, instantly. Explore variances, investigate anomalies, and validate your data all without leaving your dashboard.

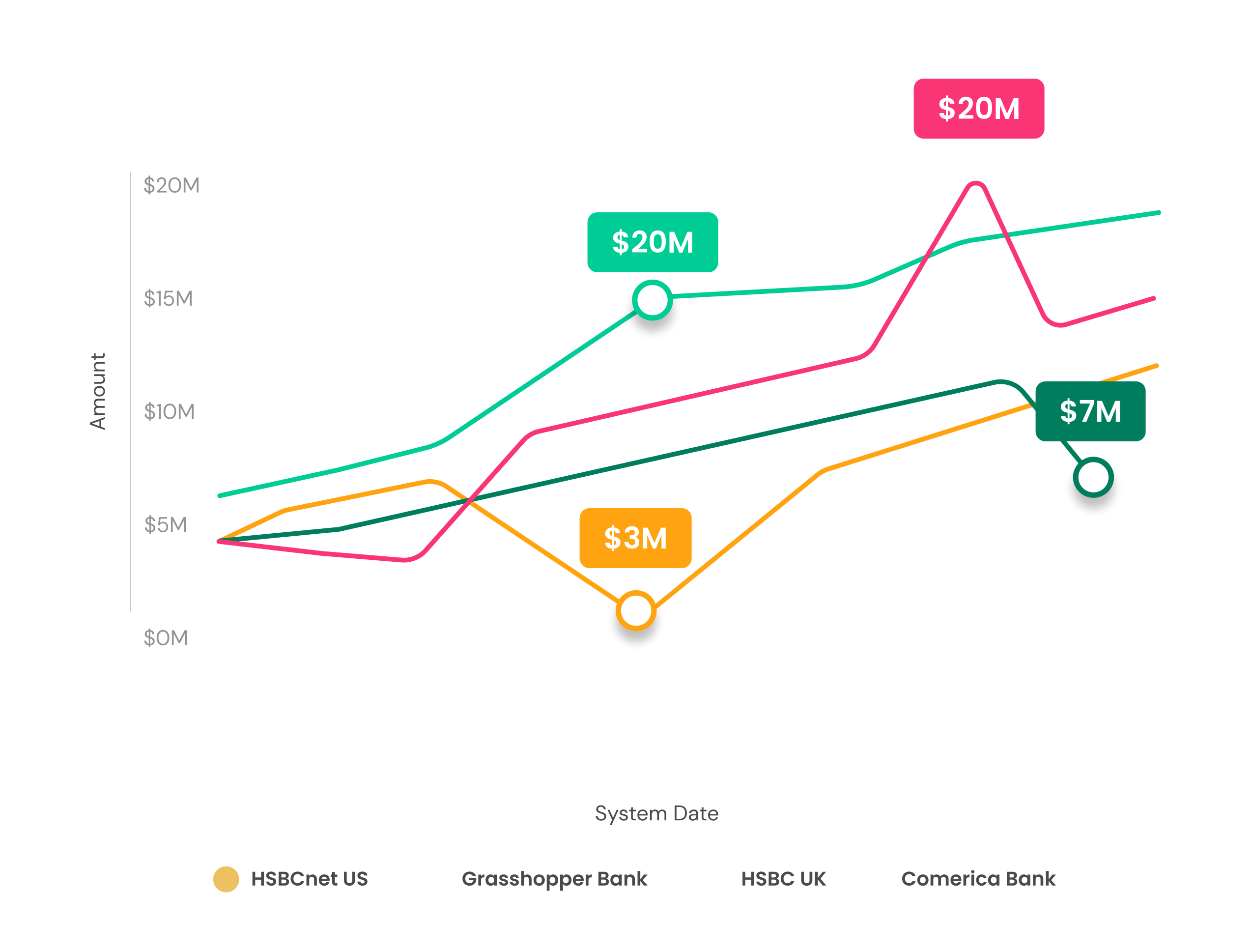

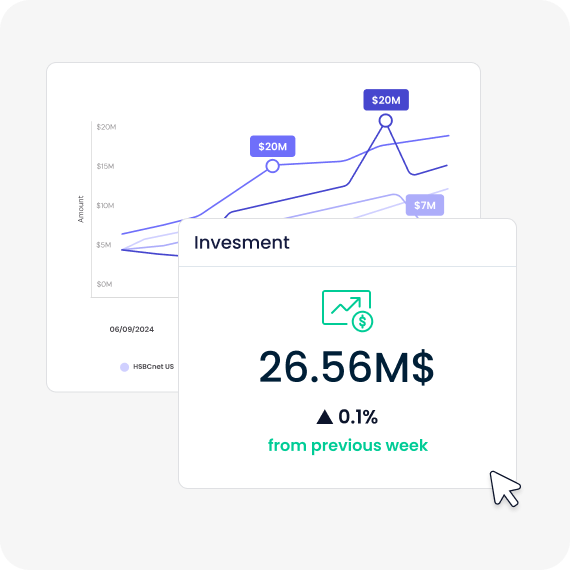

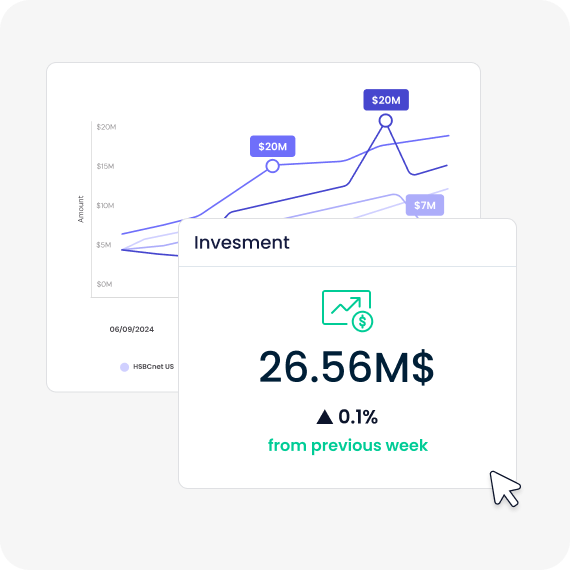

Dashboards & visualizations

Visualize your data in a way that makes sense to you. Create and share real-time dashboards for easy access to information. Whether you’re looking at cash positions or trends by type, entity, or currency, Datarails Cash gives you instant visibility, helping you take quicker actions and make better decisions.

Excel integration

Work where you’re most comfortable. Datarails Cash connects seamlessly with Excel, so you can analyze and model data without changing the way you work. Every number stays live, linked, and accurate.

In-house implementation & support

Our implementation and customer success teams all come from finance, ensuring practical guidance from setup to optimization. Your dedicated customer support manager guides you through every step to make sure you get full value from Datarails Cash.

Learn why finance teams choose Datarails

What bank integrations do you support?

We support 100% of banks globally by leveraging a multi-faceted approach to our bank integrations.

How long does it take to implement?

2-3 weeks after the bank connection is established

Can you pull in credit card data along with bank account information?

Yes!

Does your platform support connecting to crypto wallets?

Yes! We also pull in daily spot rates for all crypto coins to enable currency conversions.

Do you provide automated currency conversion?

Yes! We apply daily exchange rates sourced from a global provider to automatically convert foreign currency transactions.