How to Succeed in Best in Class FP&A

Bryan Lapidus has more than 20 years of experience in the corporate FP&A and treasury space working at organizations like American Express, Fannie Mae and private equity-owned companies. At AFP he is the staff subject matter expert on FP&A, which includes creating and curating content to meet the needs of the profession and membership. Bryan also manages FP&A Advisory Councils in North America and Asia-Pacific that act as a voice to align AFP with the needs of the profession.

Bryan speaks to Paul Barnhurst aka The FP&A Guy giving the benefit of everything he has learned speaking to thousands of practitioners of FP&A at the AFP’s conferences, roundtables and interview sessions. He discusses everything from the importance of a finance passport, FP&A certifications, core skills to be an effective challenger, how budgets have changed – and not changed – since COVID-19, and the one change that FP&A pros all need to master.

Paul Barnhurst

Hello, everyone. Welcome to a brand new FP&A podcast. I am your host, Paul Barnhurst, aka the FP&A Guy. And you are listening to FP&A Today. FP&A Today is brought to you by Datarails, financial planning and analysis platform for Excel users. Every week, we will welcome a leader from the world of financial planning and analysis and discuss some of the biggest stories and challenges in the world of FP&A. We will provide you with actionable advice about financial planning and analysis today. This is going to be your go-to resource for everything FP&A Today’s guest is Bryan Lapidus. He is a director of FP&A at the association for finance professionals, The AFP. He is located in Maryland. He has spent his career working in finance as a director at many companies. He started his career in management consulting at Booz Allen Hamilton. He got his degree from the University of Michigan and an MBA from the Stern school of Business. And an interesting fact, I noticed as I was learning about him, is he worked for American Express supporting travelers check and prepaid services. I did the same Bryan. I was head of, I was over FP&A for them for a few years back in 2016-17

Bryan Lapidus

Back back when they had a travelers check group.

Paul Barnhurst

They still did. It was mostly prepaid at that point. It was pretty small by the time I was there. Cause I was, you know, this was about six years ago, so I’m sure it was a lot bigger when you were there, but welcome to the show. We’re really thrilled to have you as a guest, Bryan.

Companies like Amex recognize the importance of a finance passport. In order to do well in finance, there’s so many different things that you need to know.

Bryan Lapidus

Bryan Lapidus

Well, Paul, thank you so much for the invitation. Happy to be here and talking to you.

Paul Barnhurst

Great. Well, can you start by maybe just taking us a little bit through your career, you know, how you got intoFP&A, and what made you join the association for finance professionals?

Bryan Lapidus

Paul, if I go through all the details of my career, I don’t know that your podcast is that long . You know, I got into, I got into finance because I kept finding that in order to really have impact, you had to explain the cost benefit analysis and you had to go through the economics, and the strategy had to make sense, whatever it was that you were trying to do came down to that ability to quantify. And I recognized that I didn’t have it. And I was really frustrated. I really felt limited by that. So I went to NYU Stern, got my MBA. And when I graduated, I joined this really fantastic rotational program at American Express. You know, Amex is a company that really values, values employees and values growing employees.

And they recognize this idea of what I call now is kind of the finance passport. In order to do well in finance, there’s so many different things that you need to know. So the way that this rotational program was set up was with three different roles in three different functions over three different years. So I was in FP&A at Traveler’s Check. I was in audit and risk services, and then I was in treasury. And it’s just funny because each time, each time you think, you know something and you think, you know, finance then there’s a whole new category of things to learn a whole new set of expertise. It actually brings up an interesting discussion about depth versus breadth and what’s the right thing for your career, but that’s a whole different discussion.

So I was at American Express for almost five years. We were in New York, my wife and I were starting to grow our family. And we just decided that New York was not where we wanted to be. She and I are both from Metro DC and we spent so much time on the Jersey turnpike commuting back to see family and cousins and friends. And, and we just decided that that’s really where we wanted to be. So I guess if, if we were a basketball team, I’d say we engineered a trade . But we found a way we moved down to DC. I worked at Fannie Mae almost two years and didn’t know that I was joining Fannie Mae right before the financial crisis. That’s a whole, again, that’s a whole different story by itself.

Paul Barnhurst

Of course.

Bryan Lapidus

And then, I spent five years as the head of FP&A, at a direct to consumer marketing company. And that’s really where….it was a midsize company and I really had my fingers on all parts of FP&A. It was the planning, right. It was the budgeting and forecasting and I reforecasted, you know, all three financial statements plus covenants on a weekly basis, right? For each week. Right. It was just really intense. It was a private equity back firm. So we had a board that always wanted to know everything and actually it was while I was there that I joined AFP as a member. And I recall that there was a notice that went out, it said, you know, have something interesting to say, write an article for us.

I said, well, you know, I’ve, I’ve got something to say. Some things that we did well at the company and some things that we didn’t. So that was my start as a member. And I kept, and I maintained the ties, maintained my membership. I wrote a little bit here and there. And then a couple years after that, I was in a different position at a small consulting company. So my second stint in consulting. And I wanted to build out the practice. I was trying to build the financial advisory, the implementation of EPM CPM tools. And in order to find my audience as a consultant, I started speaking at AFP conferences and I ran the round tables and I started writing more. And at some point I said to the guy who’s now my boss, I said, Jeff, I gotta tell you the truth. I’m enjoying all these things I do on the side for AFP, much more than I like my day job. And he said, well, that’s great, Bryan, because we, we like what you’re doing for us. So then we, I guess, engineered another, another trade, another move. And I’ve been with AFP on a full-time basis for four years now, four years this month.

Paul Barnhurst

Oh, great. No, that’s a great story. And I know what you mean by liking some of the stuff on the side, you know, having started my own business in FP&A, and really enjoying writing the articles and a lot of the stuff beyond the day to day practitioner kind of work that we do in FP&A.

Bryan Lapidus

Yeah. And after 20 years of doing the day to day the ability to sit back, be thoughtful, think about how you bring out the great things about FP&A, the exploratory, the kind of solving mysteries and puzzles. And how do you try to minimize the things that are, that are more painful? Right? The budget process at this company was incredibly intense. It was minute. I mean, it was every campaign planned over a 60 week period. Right? Incredible level of detail down to every single customer. We actually divided the customer segmentation into 48 different groups, and we had a forecast for each 48 different parts, with a recency frequency and monetary value for each one. I mean, it was pretty intense.

Paul Barnhurst

And, and I’m curious, do you feel like you got value going down to that level or was it, was the value worth the pain because I can imagine in Excel that was painful.

Bryan Lapidus

Oh, sorry. just had a flashback, as you said that right. You talk about because it was, it was all in Excel. And it was 135 tabs, one for each campaign and each tab would then go back and hit this RFM model. Right. But that was just for one year and one market. We had four markets, right. We had the U.S. and three global markets. So now I have four spreadsheets with 135 tabs per year. So when you want to do a rolling forecast and get into the next year, right now, you’re doubling. Right. And that was just for the revenue and COGs component. That didn’t even include everything else in all the other statements. Was there value in it? The value was not to finance in that. The value was probably to the marketing team because all of those plans tied into how many units we were going to, on the marketing side, how many catalogs we were gonna print? Who were we going to mail them to? Where were they going to go?

But honestly in times of calm, right? When the waters were calm, it worked pretty well, but various things happened and the water ceased to be calm and it lost its predictive value. And so then we had this incredibly complex model, this black box, which, you know, two to three people in the whole company really understood. And most people didn’t know what was going in. They didn’t know what was coming out. All they knew was the final answer. And so it lost its predictive value. As the market changed, you know, there were new competitors coming in as our promotions actually fundamentally changed our relationship with the customers

And that gets into, because we were owned by a private equity company, there were certain forces and pressures that changed our normal course of business. So the short answer is that over time, no, it, it lost the, the increased level of detail lost the benefit

Paul Barnhurst

Now. And that makes sense. And I, I would say that’s, I think usually what happens when you try to be that granular is it gets really difficult to maintain and continue to get the value. And it’s always a balancing act, right. You know, how detailed should you be versus bottoms up top down. Everybody has a different opinion, but I’d say that’s definitely one of the more intense models I’ve heard of – 135 sheets and four different, you know, workbooks.

Bryan Lapidus

I think what happened was there was a confusion of role responsibility among the different areas and finance managed things that it really shouldn’t, right. I had my finger in every single ad, every single catalog, and we were printing 6 billion pages of catalogs per year. So we had our finger on every single catalog in every campaign when honestly, you know, that’s what the product development team, the product marketing team should have been working on. But I think they, I think it was over engineered and the financial forecast got confused with the marketing forecast and the supply chain forecast and what had to be ordered. And so by trying to put all these three areas together, then it simply bogged down under its own weight.

Paul Barnhurst

Yeah, no, I, I would imagine especially doing it all on Excel, you know, I mean that, that’s a real challenge to, to maintain that, that level of detail. I appreciate you sharing how it did provide value at one time and how, you know, some things got lost. I think that often happens, you know, in different companies. There’s a lot of challenges defining what FP&A is, what role they should play and how they integrate. It’s different in every company. For sure. And I know obviously with you being part of the AFP, you offer a lot of resources to help people understand what FP&A is and to, to learn about FP&A, so maybe, could you talk a little bit about, you know, some of the resources, what does, you know, AFP have available for people in the FP&A space? Why should they be a member? You know, what can they learn?

I had one CFO of a major company say to me I know what FP&A is. It’s everyone who reports to me, who’s not in audit, treasury, or accounting. That’s what FP&A is. And the problem with that is one, you’re not really defining the skills – you’re not saying this is what it means to be great.

Bryan Lapidus

Bryan Lapidus

Yeah, well membership definitely has its privileges, which is for us, and for our membership we think pretty reasonably priced. And what it does is it unlocks various other, you know, almost like a secret, right? It unlocks various other doors and, and opportunities such as discounts on our conference. We believe we have the biggest and the best conference in the business . Pre-pandemic, we were at 7,000 people. I think we’re, we’re building back to that again this year in October in Philadelphia. The certification, right? We have the only real certification and it’s very comprehensive and there’s a discount on the certification that you get with your membership. And some of the content we have available for free, a lot of our written content. We also have other things that are behind a paywall, which includes access to playback and our deeper content. To your other question about what we offer, especially for, because you really framed it in terms of, for people who wanna learn more about FP&A. We do have offerings for all levels for the senior level CFOs and strategizing and the role of FP&A in the organization.

But for someone who’s really trying to understand what FP&A is, we actually just put out this phenomenal tool. It’s both an interactive webpage, as well as a PDF document that you could download. It’s called The Who, The What and the Why of Financial Planning and Analysis. Or for shorthand, we just call it the FP&A handbook. And in it, it includes examples day in the life, examples of people around the world saying, what is it that they do on a day by day basis? There’s also about a half dozen career paths that are all shared, right. And what we found in this research is that for most people, their journey takes them to, and through FP&A, and we profile six people, some who have started, actually very few started inFP&A. Most moved in. Some have moved into CFO and then intoFP&A roles, some have gone FP&A to CFO.

We have people talking about moving or running a center of excellence. Other people who have taken their FP&A benefit, and what they’ve learned and now are the general manager at a company. So we, so we share career paths. We share the day in their lives. We share best practices on what it could be to what your department could be aspiring to. And this is going to sound funny, but we spend a lot of time, not only defining what it means to work there, but why it is important to define it.

And I’ll give you a quick example. I had one CFO of a major company say to me I know what FP&A is. It’s everyone who reports to me, who’s not in audit, treasury, or accounting. That’s what FP&A is. And the problem with that is one, you’re not really defining the skills – you’re not saying this is what it means to be great. And because you’re not defining the skills, you’re not defining the training path and the curriculum and the job resources in order to allow people to be great. And so we go through why it’s important to define it as well as how to, well, how to be great and give the view of, of what it’s like to make a life in FP&A.

Paul Barnhurst

Now that sounds like a really handy document for people. And, you know, one of the, probably most common questions I get a lot, and especially from accountants, is how do I break into FP&A? You know, I think I get a message probably almost weekly, sometimes multiple times in a week, you know, sometimes a little less, but pretty regularly of, Hey, can you help me? What resources? And when they ask me for training and certifications, I always mention, Hey, you can look at this, if you want a full certification, you know, here’s some other resources and often point them in the direction of the AFP. Because I know you guys have a lot of, a lot of great content and that handbook does sound like, you know, something that’s very handy. I like how you talked about the different paths. Because right, there is no, there’s no one path to FP&A, and there’s really no one path after, you know, there’s a lot of different things you can do because FP&A, when done right, you learn so much about the business. You really get your hands dirty and learn a lot of things about how the company works and partner with a lot of people. And I found it opens up a lot of opportunities.

The CFO is the steward of capital and that’s broken out into where the capital goes. Proper controls and reporting. We call that accounting. How do you move that capital around the company for deployment? How do you receive it? We call that treasury. And then FP&A asks where is that next dollar of capital going to go?

Bryan Lapidus

Bryan Lapidus

You’re, you’re really spot on. In order to be good at FP&A, well here’s how I usually describe it. So FP&A sits in the CFO function, and that’s really important. The CFO is the steward of capital and that’s broken out into where the capital goes, right? Proper controls and reporting. We call that accounting. How do you move that capital around the company for deployment? And how do you receive it right? We call that treasury. And then FP&A asks where is that next dollar of capital going to go? And it’s really important to think about it that way. So that FP&A understands its role, it understands what it should do, and what it shouldn’t. And this is gonna sound funny. It understands that it reports to the CFO. So often people talk about business partnership and providing people what they want, what they need, right?

That is an important element, but being a partner to whatever your business is, whoever’s sitting on the other side of the table, whether that’s IT, HR or marketing or, or customer service, right? It doesn’t mean that you give them everything that they want, because then you’re not being true to your role as the steward of capital finance. FP&A needs to be a partner in a way that supports, but also challenges right. You have to know the business, but you are a business person with finance expertise. And when you sit down at the table with your C-suite or whatever executives they’re looking for marketing to bring customer strategy or product strategy, or they’re looking for HR to talk about how to bring people strategy. They’re looking to finance to bring capital discipline, modeling, and quantification. And I get frustrated when I hear people talk about how they’re bending over backwards and doing all these things to be a great partner. There is a limit to what it means to be a great partner. FP&A works for the CFO first and foremost.

Paul Barnhurst

You know, and kind of, I’d love to add something to that that really drove that point home for me in my career. So I had, we had this new CFO come in and he had worked in the business before and he was a very, very tough guy. One of the hardest people I’d worked for since he was very demanding. But I learned a ton and I remember one time he set me aside. He goes, you’re great at your job, but you’re not hard enough on the business. And at first I was like, because he was a very hard guy. I’m like, I don’t wanna be like you. He had a reputation where, you know, a lot of people had a hard time with them, but then I stepped back and kind of looked at it and said, you know, he’s right. And I learned because too often, I bend over backwards for the business.

And I learned my job is to take care of that capital. And there’s times I have to say no. And what happened is the relationships became better. And I became a better partner by recognizing that, I report to the CFO . There’s kind of a funny end of the story because he ended up becoming my general manager. And I was basically his, you know, CFO as a director. And I remember one day we were on a call and there’s something where, you know, I, I got, I got on him about it. He’s like, no, you’re not supposed to do that with me.Well you told me I was supposed to be harder with the business, you know? And it’s kinda like not for me, but with the other people.

You know, it was one of those. We kinda had a little bit of fun, we kinda laughed about it. And right.

Bryan Lapidus

So I love the phrase effective challenge, right? Finance is supposed to provide an effective challenge to the assumptions, right. And sometimes we’ll be overruled and that’s fine. Sometimes you make decisions for strategic, non-quantitative reasons. That’s fine. But our job is to bring that point of view.

Paul Barnhurst

No, I totally agree. I mean, I remember one time seeing in a company where finance had pushed so hard on the business that, and this is not what you want, was unhealthy, but it was before I got there. They actually had a business plan and a finance plan, because finance had let the business know their plan was not achievable. They could not go to the CFO and sign up for it. So they actually ran two plans for the year. And I could tell you, it was nowhere close to what the business thought it was going to be at the end of that year. You know?

Bryan Lapidus

But yeah, yeah. Two sets of books is a juggling act.

Paul Barnhurst

Yeah. It was a bad idea. It should have never happened, but it just shows that at least they were pushing back and saying, look, this isn’t realistic. It’s not achievable. And you have to understand that we can’t, you know, we can’t as a company in finance sign up to these numbers and what we give as a result.

Bryan Lapidus

So no, to totally agree. I wanna, I wanna return back to something you had said earlier about people who are trying to transition from accounting to finance. I know this is, this is really top of mind for me. We have a guide that we wrote. It’s a couple years old, it’s called making the transition from accounting to FP&A. The reason it’s top of mind is this summer probably mid to late summer, we’re going to refresh it, but the original version is out. Now we’re gonna refresh it with kind of updated examples and a little bit more technicality, but as far as resources it’s really helpful. And it really explains kind of the basic idea of what is different from accounting to finance. What’s different about the mindset who you talk to is different and ultimately what you’re trying to produce is different. So I just wanna throw that out there for your listeners.

Paul Barnhurst

No, that’s great. I appreciate you sharing that and I’m sure that will be a great guide. You know, and many people in the community know Anders Liu Lindberg. The most searched thing for him is transitioning from accounting to FP&A. He wrote an article a few years ago and it’s still the number one thing that gets searched on Google for all the stuff he’s written. So it just shows how, you know, how many people are looking to make that transition.

Bryan Lapidus

So absolutely

Paul Barnhurst

Switching gears here a little bit. Can you talk a little bit about the FP&A certification? Who should take that? What are some of the benefits? What should people think about that certification for their career?

Certifications exist to do a couple different things. One is to establish a baseline of knowledge. So if you are, if you’re the boss, you want to know that your team has a certain baseline of knowledge to do the job well. And so you might want your team to do that. On the flip side if you’re the employee or you’re an applicant, and you want to demonstrate that you have that baseline of knowledge, the certification will help with that.

Bryan Lapidus on

Bryan Lapidus

Certifications exist to do a couple different things, right? It’s to establish a baseline of knowledge. So if you are, if you’re the boss, you want to know that your team has a certain baseline of knowledge to do the job well. And so you might want your team to do that. On the flip side, if you’re trying to demonstrate, right, if you’re the employee or you’re an applicant, and you want to demonstrate that you have that baseline of knowledge, the certification will help with that. Similarly, if you want to demonstrate expertise, I call this the check-the-box, right? If you wanna show, yes, I’ve done this, I understand it. I know it. Then the certification will help you do that as well. It’s funny, you know, when we talk about needing to move around finance, right.

That idea of a finance passport, and you’ve got a, you know, stamp stamp that you’ve done your time or your service in reporting or in accounting or in audit or in treasury, right. Each one of those has a certification. How do you know that you’ve mastered treasury while you’ve got the CTP? How do you know that you, how can you demonstrate that you’ve mastered FP and a, I’ve got the F P a C. So as you go around and you build your resume and your finance passport in order to get those higher level roles, those more senior CFO roles, you know, it’s a great way of saying I’ve done that. And then kind of the third way is that it helps, especially for job applicants, if you really want to get into the field, right. If you are in accounting and you wanna move into FP&A having the certification will signal your interest. It will show I’m really serious about this. I really wanna make the move. I’ve done my homework. I know what it’s about. And so the certification will help you with that.

Paul Barnhurst

No, that makes sense. And speaking of the certification, how long do people usually need to study? Like what’s kind of the time commitment to earn your certification. I imagine there’s some work if I remember right. Some work qualifications. I know there’s a couple of tests, but maybe talk a little bit about that.

Bryan Lapidus:

Sure. So, and, and you’ve really got it spelled out there, there are, there’s the testing part and then there’s the evidence of actually having worked in the field. And so we do, we do require both and the evidence can include education as well as time spent. And we’ll actually look at your activities. What you’ve done within certain roles. Is there a forecasting or an analytical component? As for the test itself, there are two parts. And the first part, if you have a CPA, you can waive out of it because the first part is heavily accounting and typical finance skills. So you can accelerate through that and get right to the second part. What our members tell us is that they expect to spend about 30 to 40 hours studying for each of the two tests. And so if you take them in consecutive windows you can and you’ve got the experience, then you can have the whole process taken up, taken care of in a year.

Paul Barnhurst

So you had mentioned earlier a little bit. I know you guys have an annual conference and I think this is the first year since COVID it’s in person. Right.

Bryan Lapidus

Second, last fall, we had a hybrid conference in DC. So this, this one I think will be even bigger than we were able to pull together last year.

Paul Barnhurst

Sure. Well, great. So it’s starting to return a little bit more to normal. You had a mix last year and now you’re going full, you know, on site. So maybe, can you talk a little bit about that conference? You know, what can people expect? What’s, you know, what do you hope to accomplish with doing that?

Bryan Lapidus

So from a high level, right, the conference this year, Philadelphia, October 23rd to the 26th, what to expect? We will have more than a hundred different educational sessions spread out over six tracks: FP&A, treasury, capital markets, career planning. I can’t remember all six rattling off quickly, but we will have a hundred different educational sessions in those areas. We’ll have a keynote, including Adam Grant who I look at his wisdom on LinkedIn every day. I think he has brilliant insights just on work, the nature of work and how to work. Laila Ali is our other keynote, an entrepreneur she’s been obviously an athlete. She has her own business lines, just a really interesting person with interesting lived experiences. And the FP&A keynote is going to be Stacey Vanek Smith, who is a podcaster, a host, a reporter, and an author.

The AFP sessions are wonderful, but some of the best learning happens in the hallways and it happens around peer to peer, Hey, I’ve got a problem. How did you solve this?

Bryan Lapidus

Bryan Lapidus

You know, I’ve been a fan of hers for years, and I love how she takes economic information and wraps a story around it. So you’ve got your keynotes, you’ve got your education, we’ve got networking sessions, whether they’re round tables or we have something really unique this year, it’s called the FP&A hub. That’s a little hard to explain, but when you’re there in person, it’s going to really foster more interaction and more networking. Because some of this feedback we’ve had before is great to go to the sessions. The sessions are wonderful, but some of the best learning happens in the hallways and it happens around peer to peer, Hey, I’ve got a problem. How did you solve this? And we’ve come up with a way to really identify what those problems are and introduce people to others and really help the individual get what they need and get different answers and, and meet their peers.

Paul Barnhurst

Yeah. I love the FP&A hub idea. You know, recently I launched a chapter here in Utah for FP&A to get people together every month. And it’s been fabulous to hear different people’s experiences, right? To be able to talk about real world problems that you’re facing and have 15 people in the room can be like, Hey, well I tried this or I did that because you don’t, you don’t get that out of a book. You rarely, you know, generally don’t get that out of a training. You don’t get that from a speaker. You might get some ideas, but you know, generally if you’re attending a big session with 50 people, you know, you can’t get to that one on one conversation or two, you know, two, three people, and really start to get some ideas that you can take back and, and use on a personal level.

Bryan Lapidus

I remember at one of our conferences a few years ago. I was talking to this one, this one person who I just met and he was telling me how he really was getting into Power Query and Power Pivot, you know, not just the power BI, but like the real deep, you know, Dax levels, technical stuff, and I’m listening to it. And I said, you have to meet this other person. So I introduced them, right? They skipped the next session because they just started talking, getting into the details about all this incredible detail. And so then, I mean, they were practically arm in arms, skipping down the hall, like they found each other. They had this meeting of the minds. The next year they came back and they were presenting on what they had talked about their mutual love of how to apply power query to scale it up throughout the entire organization. Right. That’s the kind of thing that, for me, gives me incredible joy. Right? I feel like I’ve made a match. I’ve helped people find their people. They’ve gone back and they’ve made their organization better. It’s a great feeling working for AFP to be able to provide those moments.

Paul Barnhurst

Now I could see where that’s incredibly rewarding. I mean, anytime you kind of get to make those connections and make a difference with people and make a difference, you know, both personally and professionally it’s rewarding. I love that example. So thanks for sharing a little bit about that conference. And, you know, I would just encourage members if you’re in a position where you can come, it should be a great event. I know I’m looking forward to being there. It’ll be my first event

Bryan Lapidus

And I was, and you know, to jump in here, one of the other reasons to come is that they can meet Paul Barnhurst and hear him speak on stage presenting about building trust with Christian Wattig.

Paul Barnhurst

Yeah, no, I’m, I’m super excited about that. You know, the opportunity to speak with Christian. Didn’t think I’d be at the conference this year. He approached me about that and I was like, well, it’s a great opportunity. And so I’m really looking forward to it. So thanks. So, you know, kind of, what advice would you offer? Let’s just say someone’s starting a career in FP&A. You know particularly today with all the uncertainty and you know, what we see is I, I would say rapid change going on in, in the profession. What advice would you give to someone who’s looking to start a career in FP&A?

FP&A is about getting it out of the system and integrating that financial knowledge with the operational knowledge and the market knowledge

Bryan Lapidus

Bryan Lapidus

The way that I think work is being done and will continue to be done is this idea of integrative intelligence. And this is part of what separates FP&A from accounting, right? Accounting is a lot about finding the information and getting it into the system, FP&A is about getting it out of the system and integrating that financial knowledge with the operational knowledge and the market knowledge. And so the way to integrate it is you have to understand the business. You have to understand that the answer is not there and the answer is not known, right? Again, differentiating from other parts of finance, it’s an exploratory process. And so you don’t have all the answers and the person you’re talking with doesn’t have all the answers. So that integrative intelligence means collaboration with people, collaboration of data, from different data sets.

And because you’re collaborating, what it means is that the work itself often gets disaggregated. So that all these different people are working on it and then brought back together at the end. And so that’s, I think the mindset that’s so helpful. And with that, there’s lots of things underneath it, right? You have to be curious, you have to be a good teammate. You have to be open minded and be willing to learn and have a growth mindset. Right? There’s all those great adjectives under it. But the overarching thing is you don’t have all the knowledge, create a good question, go out and research it and pull together from all these different areas in order to bring back what you think is your, your best estimate of what’s. Right?

Paul Barnhurst

No, and I appreciate that. And I like what you said at the end, the best estimate of what you think is right, because there’s no such thing as a perfect plan.

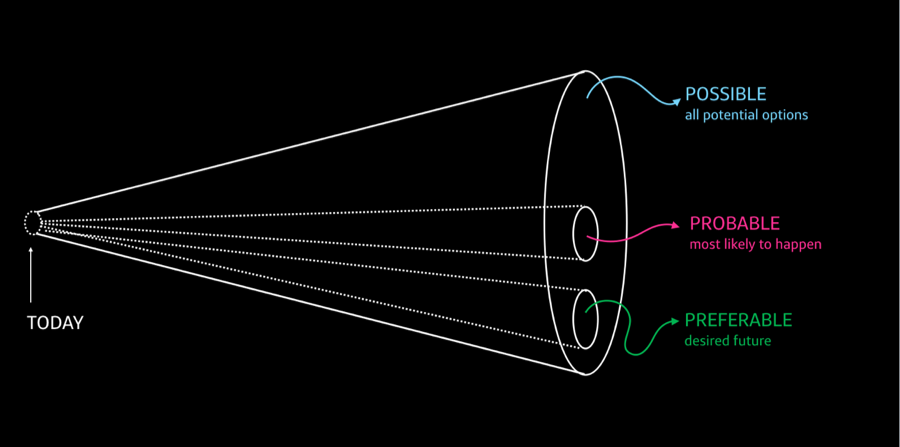

The Cone of Possibilities is a tool we use in foresight and futures studies to help depict the idea that there are many future possibilities. This is an easy way of visualizing how we can examine many different futures to understand how to make better decisions in the present.

Bryan Lapidus

Yeah. I know. I’m a believer in that cone of possibility or cone of probability, right? You don’t know what’s gonna happen. You know, you could, you could have the most amazing model that comes out with your NPV, but you know, all models are wrong. Hopefully yours can be helpful, can be useful, right. So you’ve got, you know, its probability around its range, forecasting its scenarios of different things that could be out, could be an outcome. You know, it’s important for finance to hold multiple points of view at the same time in order to get into that cone of possibility. And so that’s another mindset thing, right? What is it like to work in FP&A, well, it’s not about accuracy and precision and granularity. It’s about estimates and probability and trying to make the right decision based on the information you have.

Paul Barnhurst

Now. I like making the right decision based on the information. One, it’s never perfect. Two, you’re always making assumptions. It’s about being able to make reasonable adjustments, trying to see what the future looks like in broad pictures and help the business chart a path that’s gonna wisely use the capital and being willing to quickly adjust when you’re wrong. Because sometimes you’re gonna put a plan together and it’s, you know, new product launch, different things that you help the business with that it’s not going to go, right?

Yeah. Sometimes you’re wrong. Sometimes the facts on the ground change, sometimes there’s new information. And so it’s, you know, one of the risks of budgets is people are too beholden to the budget.

Bryan Lapidus

Bryan Lapidus

Yeah. Sometimes you’re wrong. Sometimes the facts on the ground change, sometimes there’s new information. And so it’s, you know, one of the risks of budgets is people are too beholden to the budget. They look at the budget as a control function for the future. Right. We talk about the part of the CFO that’s all about control and reporting. And they think that the budget is that control on the future. Well, the budget is your short term strategy of what you’re going to do and create alignment, but just like a model it’s gonna be wrong. Adjust reallocate capital, have that agility and flexibility.

Paul Barnhurst

Yep. And I, and I think when you said, you know, kinda about the budget, how there’s such a control on it. I think we saw a real change in how people thought about the budget with COVID, right? Because every company by April of 2020, their budget was blown. In some cases, it was a good thing. Some online, it was like, oh wow, it’s way better than we thought. And others, you know, it had fallen all apart and they had no business for a while and they had to learn about scenario planning and recognizing that having one path to get there, one short term plan, is dangerous.

Bryan Lapidus

So the whole budget issue is so interesting because you’re right. People just crumpled it up, threw it out the window and, and said, what do we do now? And I was expecting this drop off of people using budgets. I was expecting to see lots of searches for beyond budgeting methodologies. Here we are a little bit later. And our data shows that people are actually using budgets at the same or an increased rate from where they were in 2017 when we previously had done some significant research on the use of budgets.

The difference is that people don’t look at their budget as ironclad the way they used to. They don’t say this is the end all be all. And I’m gonna manage to this. So budgets are more in use because of the way that it creates alignment and a process for later forecasts. So it’s still in use, but people are just not holding to it as tightly.

Paul Barnhurst

No. And, and I think that’s great, right? Whether you do a budget or go beyond budget or forecasting, the important thing is you have a planning process, you have a plan to get there, you analyze it, you revise it and recognize it’s a living, breathing document. Everybody has different opinions on how to budget. How often do you forecast? Do you do risks and opportunities? How far out do you go? And the bottom line is there isn’t one right answer. It’s really about going through that process and making sure you’re planning and you’re linking things together.

Bryan Lapidus

Yeah. Perfectly well said. I wouldn’t add anything to that. You nailed it.

Paul Barnhurst

Well, good. Not something right. So kind of next, next question here is, you know, obviously FP&A’s been through a challenging couple of years. I think anyone who’s worked in FP&A over the last few years can say there’ve been some real challenges and long hours. And, you know, the world, the amount of uncertainty of the world continues to increase. We see it in energy crises, you know, conflicts, abroad, pandemics, you know, the rapid rate of change. So where do you see kind of FP&A going into the future and maybe with all this change, what do you see as the biggest opportunity and the biggest challenge going forward FP&A?

The biggest opportunity in FP&A is the flip side of the biggest challenge, which is managing your time really well.

Bryan Lapidus

Bryan Lapidus

The biggest? So the biggest opportunity is the flip side of the biggest challenge, which is managing your time really well. We have a session at a conference in October that’s called Doing Less in Order to Do Better. And what’s happened is FP&A, has been on the receiving end of multiple streams of requests. Right? Give me, give me another scenario. Give me another sensitivity. Give me another forecast. Our research shows that from pre-pandemic to pandemic times, the number of requests for forecasts is up by a little more than 50%, I believe. Right? And that’s just one portion of your job. So one portion of your job just got increased by 50%. The opportunity I think is to be better with your time. And honestly, the first part of that comes with having good, good technology in place. You’ve gotta be able to spin up a forecast on demand, right?

You can’t take a week, can’t take two weeks. Can’t go around, right. Find a way to spin up your forecast on demand, simplify your reporting. And again, our data shows the easiest, the lowest hanging fruit of automation is in reporting. Figure out what people want, set up routines in order to do it quickly, do it in an automated fashion and create as much self servicing as well, so that you can minimize the number of follow up questions, right. FP&A needs to create the time and the headspace in order to do what people really want, which is the analysis, right? We’re not adding value when we spend 50% of our time, you know, mashing together spreadsheets and doing X Lookups in order to pull from this data, set to this data set, right. Get your data, right.

Get your systems and your processes Right. And so, and it really all starts with that data layer. We actually have an event. It’s a half day virtual event in June, and it’s focused just on that question of how do you get your data, right? What does it mean? And, we’ll have case studies from four different companies. And they’re gonna talk about this is, you know, this is how we did it with the data lake. This is how we did it with our reporting. Pulling together these different views, because if you’re spending all of your time cleaning data and just writing and rewriting ETLs, you’re not using your time, well, you’re not re reacting quickly, which is what your, your partners need. And I’ll be honest. When I talk to recruiters, when I talk to young people in the finance space, and they’re saying, and you’re telling them you’re gonna come and you’re only gonna spend 10% of your time actually doing the interesting part of finance. You’re gonna spend the rest of your entry level, your beginning jobs, mashing together, spreadsheets, you know what they say? I’m gonna go work over there. And they’re really making a choice. Right. And I, so if I’m talking to, if I’m talking to your audience, that’s actually looking for a job, I would ask the employer, what systems do you have in place that are going to allow me to do good work? Because If I’m not doing good work, if I’m not doing interesting things, if I’m not using my degree or my experience to make, to add value, right? If all I’m doing is coding and adding things up, I’m gonna go get a better job because somebody else is hiring and they’re going to offer me the experience and the growth opportunities that I want.

Paul Barnhurst

Now that’s a great point. And, you know, as I heard somebody put it, when it comes to this whole digital transformation, the first thing is to get your house in order, which is your data. You know, you can’t layer in the right tools and have your processes really work the way you want. If you’re spending all your time with ETL, with power query, with SQL, with whatever it might be to try to make sense of the numbers so that you can provide that report that management needs.

Bryan Lapidus

Yeah. Yeah. A chef doesn’t make soup with dirty water, right. We’re not gonna make our great analyses with bad data.

Paul Barnhurst

Yeah. You know, and I, I think an important distinction is every company, you know, no company has perfect data and sometimes you think, well, I have got to get it perfect. You’ve got to get it good enough that you can make smart decisions and that’s gonna be different by industry and data set, what that needs to be. But I think having a clean process, so the data’s good and can drive you in the right direction versus trying to get that last mile. Right. You see people that want to get it a hundred percent and then all you’re ever doing is trying to improve your process. Because this doesn’t quite work. It’s just not quite where I need it. And so I think, you know, that distinction is very important to recognize in that process that it needs to be good enough to make intelligent decisions.

Bryan Lapidus

Right. Right.

Paul Barnhurst

So here, you know, as we’re wrapping up, we’re kind of toward the end of our time, just kind of two more questions here for you. One is what is something that not many people know about you, maybe kind of an interesting hobby or something they wouldn’t find online that you’d be really willing to share?

Bryan Lapidus

Interesting hobby. I think I’m just too boring. Maybe that’s the thing that they don’t know. I’m just pretty boring. You know, I’m sitting here in suburban DC, I’ve got two teenage kids, honestly. I think a lot about the fact that they’re going off to college and I feel that internal clock ticking that they’re only gonna be in the house, you know, for one of them for only 16 more months. So I feel that, so I definitely am trying to hold onto as much time as I can with my kids and, and free up that space.

Paul Barnhurst

No, I appreciate that advice. Having a daughter that’s nine and realizing how fast she’s growing and going late, she’s halfway to adulthood. Now I remember, you know, when she was born, it just, it goes by fast for sure.

Bryan Lapidus

Yeah. I used to coach, I used to coach their soccer teams and my younger daughter just came on the soccer field, you know, in a, in a rainbow Tutu. Right. You know, this is this, I look at her now and she’s a lot bigger now and you know, and she’s yeah, it’s, you know, count your days, watch them and it goes fast.

Paul Barnhurst

Yeah. It, you, you bring a great point. It does go fast and it reminds us all. What’s important? Right. You know, it’s about family friendship relationships at the end of the day. I mean, work can be fun and we want it to be fulfilling and enjoyable, but you know, we work so that we can enjoy life and take care of our family at the end of the day.

Bryan Lapidus

Agreed.

Paul Barnhurst

So, all right. Last question here. And as you know you know, our podcast is sponsored by datarails, which is big fans of Excel. So we’re gonna ask a question here. What’s your favorite Excel function?

My favorite Excel function. I remember when I discovered goal seek, I mean, it was just mind blowing, right? The ability to figure out or to simplify all those different inputs, to get the output that you need to figure out what the sensitivities are right. To build sensitivities around that. When I learned goal seek, it was mind opening. I think I ran around the office telling everybody, but nobody else was quite as enthralled as I was.

Paul Barnhurst

No goal seek is a great one. And I, a lot of people love using that, but yeah, that’s typically the case when we find a favorite Excel function and we’re sharing it with everybody, I’ve had that experience. They’re kinda like, that’s nice. You can go back to your cube now

Bryan Lapidus

Don’t, you know, don’t you get it?

Paul Barnhurst

Yeah. That’s kind of how I was when I learned power query and power pivot, you realize you could stop, stop copying and pasting. There’s all these things you can do. And they’re just like, yeah, that’s your thing. That’s nice, right? No, no, really. It will save you time. So, well, thanks for joining us today, Bryan, I really enjoyed chatting with you and getting to know a little bit more about you and I’m sure our guests will enjoy listening to the podcast and learning some of the great resources that AFP has available. So thanks again,

Bryan Lapidus

Paul. It’s been a pleasure. You know, I look forward to your posts. You and I are on LinkedIn all the time. So always look forward to conversing with you there and thanks for the opportunity to speak to your audience today.

Paul Barnhurst

You’re welcome. And like I said, look forward to seeing you on LinkedIn and then seeing you in person for the first time here in October,

Bryan Lapidus

It’ll be great.