Psst, want to drive business growth? Analyze your data, don’t just report it

Identify the key trends and drivers that trigger growth, and prepare the business for whatever lies ahead

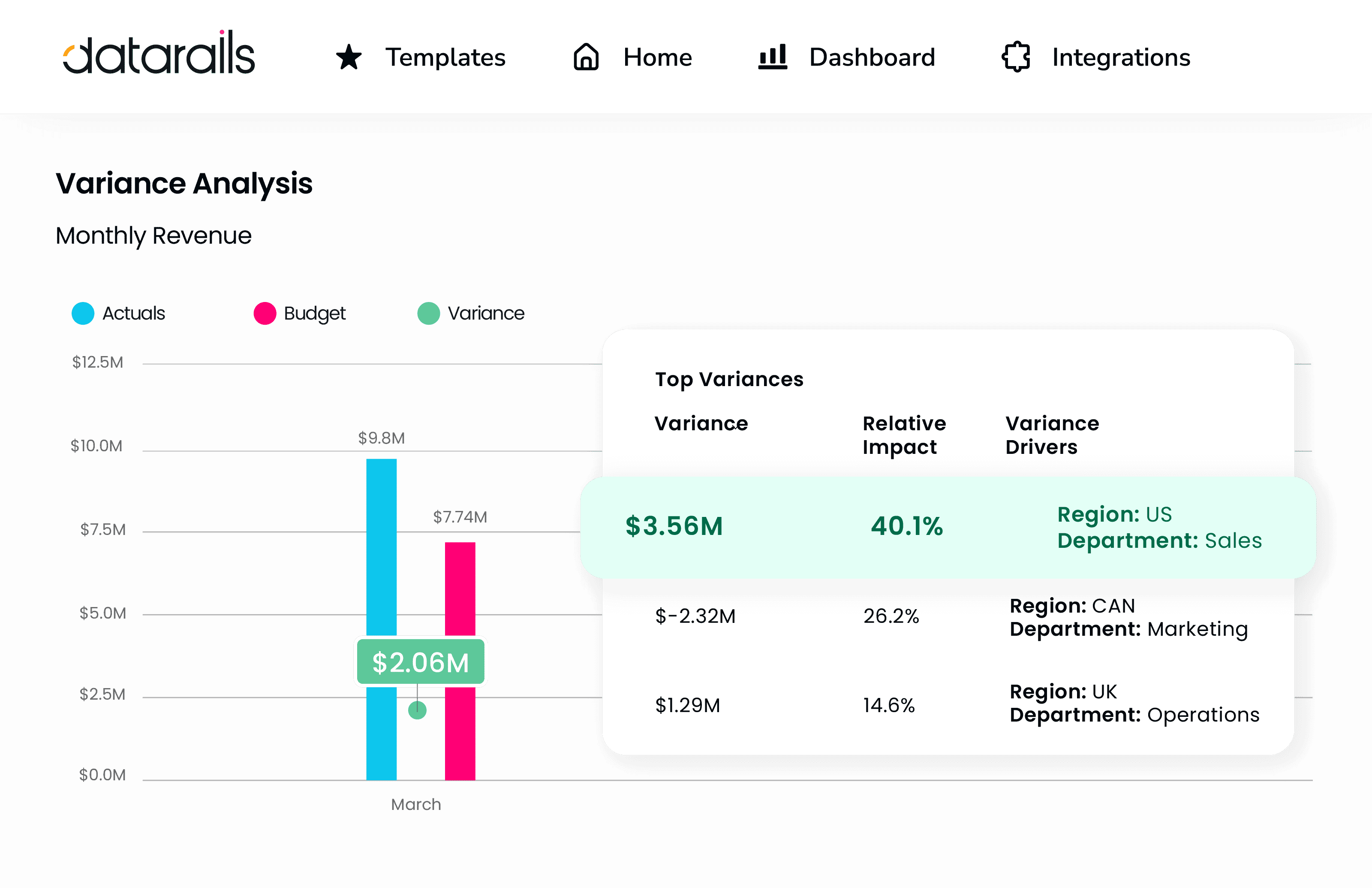

Discover what’s behind your raw financials

How big is the variance? What are the drivers? What should the company do in response? Gain the time for analysis by automating consolidation and reporting. Then leverage analysis tools to help you provide the actionable insights that will increase revenues and decrease costs.

“We, as a finance and FP&A team, have a lot more time to actually drive into results and do relevant analytics to help the company’s decision-making process.”

CFO, Echo Engineering

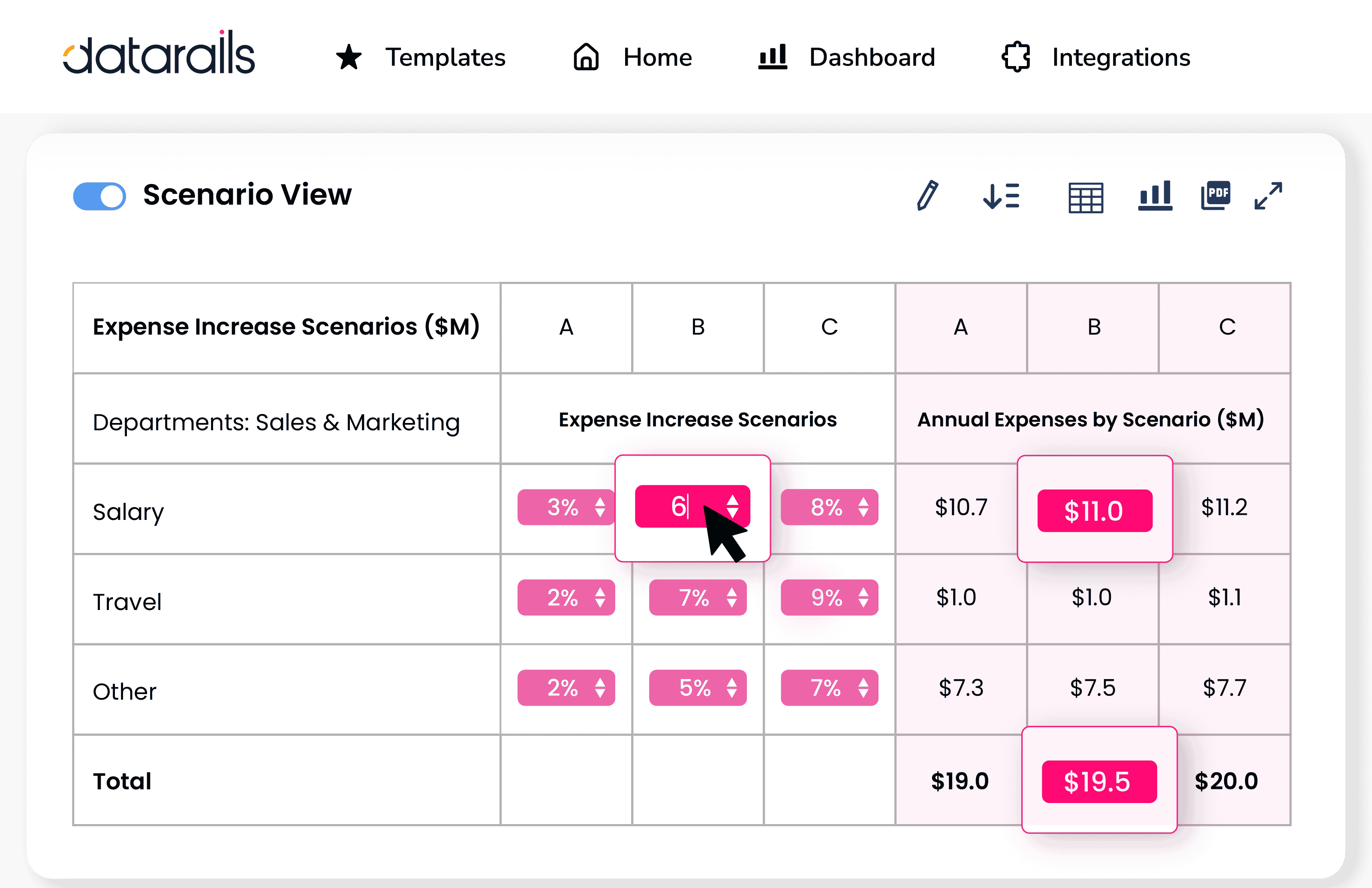

Optimize scenario analysis

• Prepare for the best-case scenario, the worst-case scenario, and everything in between

• Keep working with your Excel financial models, create new ones, or change your assumptions on the fly

• Be ready for anything that might happen – before it happens