Aside from cost and technology infrastructure requirements, there are 5 things to consider when choosing FP&A software for any organization. These are specific to the needs of the organization and how the business intends to utilize its finance department.

Like any technology solution, it is easy to go overboard on the best FP&A software, so it is important to always understand the core needs when seeking cloud FP&A software.

Balancing needs with wants is also important, especially from the context of managing cost. Software and technology packages can quickly become expensive, so being willing to make concessions when needed is critical.

Understanding The Unique Needs Of Finance Departments

Finance departments are undergoing a sort of data renaissance at this point in time. More and more often, finance departments are being tapped for data and analytics that are blending the lines between business intelligence and financial analysis. These data-heavy requests are being answered in the form of reports and dashboards that can take significant time to update, manage, and conduct quality assurance on.

Traditionally, finance departments existed and survived in Microsoft Excel. The software has long been the gold standard for finance departments across the globe, and it certainly is not going away. However, Excel has its own limitations, and when it comes to managing data, using Excel sheets can be both difficult to manage and risky.

Additionally, finance departments are faced with the unique challenge of presenting data in an increasingly dynamic way. Charts, graphs, and tables are more often expected to be responsive to user inputs and display real-time data that changes autonomously.

This presents a deep challenge for finance departments who are being forced to balance the core aspects of financial analysis and planning (FP&A) with presentation and data management.

This change in the way finance departments are being utilized has created a need for more responsive software solutions that interface with Excel and allow users the comfort of operating in a platform that is familiar but presents data in a more robust and dynamic way without taking a lot of time.

What is FP&A Software?

FP&A software is meant to help businesses perform and streamline a number of financial practices. At the same time, this software tends to offer up more in-depth insights than humans can collect on their own. Ideally, it also displays this information in a digestable way that allows finance teams to make the smartest moves for their business.

What does FP&A software do?

Until you’ve tried it, the sheer scope of practices FP&A software can streamline and optimize is hard to imagine. But when these platforms are used to their maximum potential, they can perform a number of tasks, including:

- Forecasting

- Data consolidation

- Budgeting

- Scenario analysis

- Data visualization

- Performance reporting

- Planning and modeling

- AI capabilities

Now, imagine the time you and your finance team would get back each day if these tasks were sped up and optimized like you’ve never seen before—that’s just the beginning of what the best FP&A software can do.

FP&A for small businesses vs. enterprises and large ones

It’s also worth mentioning that the FP&A platform appropriate for your business can often depend on the size and scope of your operations. That means the best FP&A software for startups might not be the same solution as the ideal option for larger enterprises. But don’t worry—we break down the five best FP&A software which includes the best overall option (one that works for businesses of all sizes), as well as options specifically suited to big and small businesses.

What makes the best FP&A Software?

5 Critical Aspects To Consider When Choosing FP&A Software

While there are many considerations you should make when selecting a software solution, here are five of the most important aspects that you must consider to ensure the package you select meets your needs.

1. Time To Implement

Choosing software that is a good fit for both your organization and your existing infrastructure is critical. Large software can often have significant implementation schedules that can span several months and even years depending on the size and scope of the project.

Understanding if the system can integrate into your existing infrastructure is an important first step in identifying how long the implementation will take.

The longer the project takes, the higher the cost associated with the implementation becomes. Included in that cost sink is the time taken away from finance, accounting, and IT staff to focus on implementation.

One way to bypass the cost, time, and infrastructure needed to support FP&A software implementation is to choose a solution that is cloud-based.

2. How The Software Collects Data

The intention of implementing FP&A software should be to reduce the time required and burden placed on finance departments to collect, manage, and convert raw data into digestible information. If a software solution is selected that requires manual inputs, it can disrupt the efficiencies and put a larger time burden on finance departments.

Moreover, if the system is incapable of managing data, it can put a massive burden on staff to manually validate all of the data points. In both of these scenarios, the software can actually create more problems than it solves.

Much of the data validation in FP&A happens at the front end when historical data is collected and imported into models. Selecting a system that can do this efficiently will yield benefits to your organization.

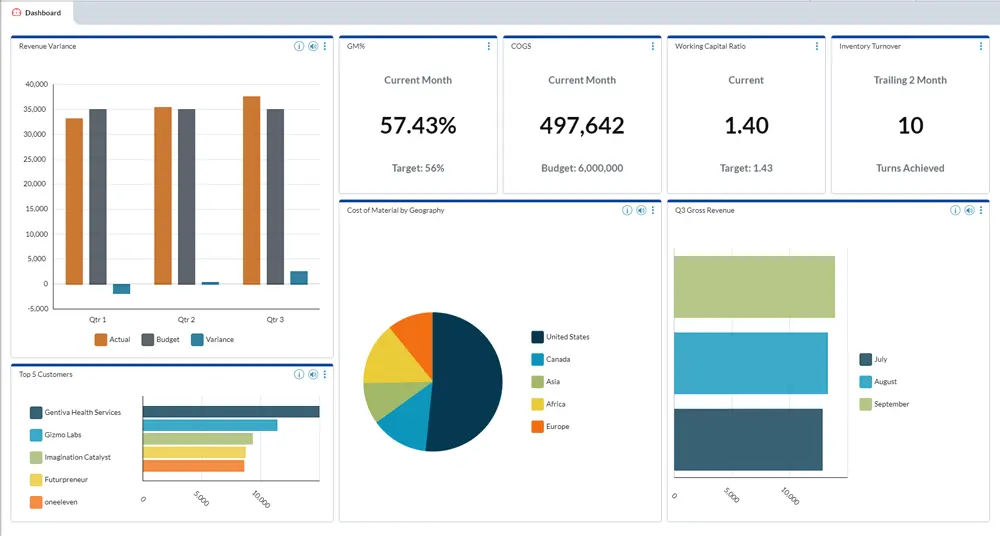

3. Ability To Present Data

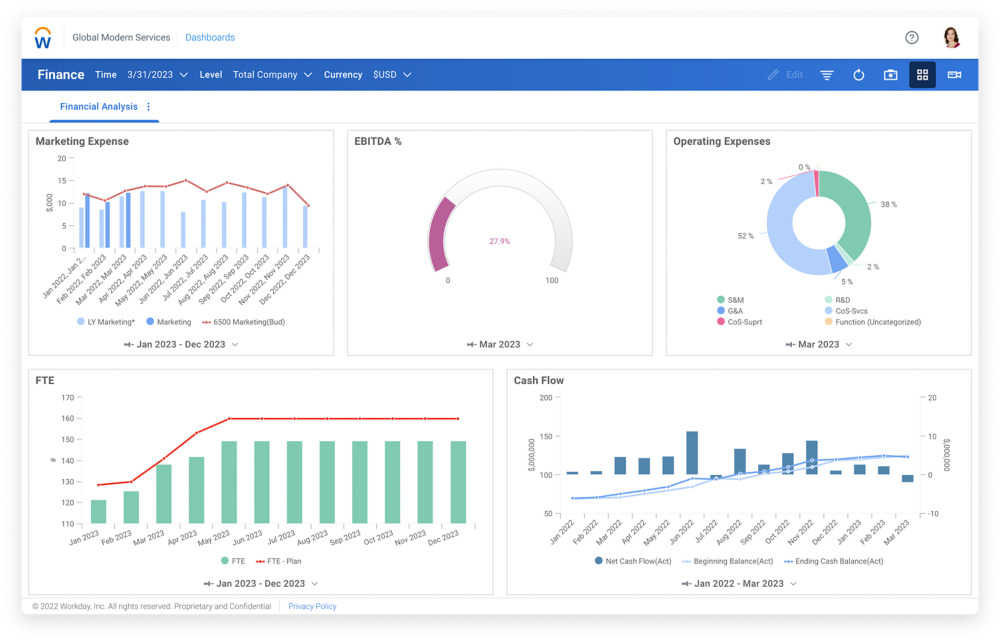

As finance departments are being leaned on more by other departments for data and analytics, it is critical that a software solution assists in presenting the data requested. For many users, dynamic financial dashboards are a critical aspect of any good software package.

Dashboards are a unique and effective way to give users in various departments access to data that is both dynamic and visually more digestible. The benefit of software that has dashboard capability is that it takes the onus off of finance departments to field requests and instead uses a system interface to allow users the ability to answer their own questions.

In addition, the ability to create visually impressive and animated graphics makes it easier to captivate audiences with metrics that can sometimes be obscure. It also assists finance departments in creating dynamic means of tracking actuals against budgets.

4. Data Analytics

Probably the most important consideration is how FP&A software performs, or assists in the performing of, analytics. A good software solution should offer users flexible ways to forecast and create budgets.

More importantly, it should be able perform various types of analytics and should be able to adapt to a wide range of businesses. For example, a software solution that is only helpful in assisting manufacturing businesses would not be a good fit for a company that engages solely in logistics.

However, good software would be able to perform well regardless of industry or business type.

A good software solution should be able to undertake different methods of forecasting, budgeting, and even present a multitude of metrics. The flexibility to monitor specific key performance indicators is another tool that most good FP&A software will have.

5. Ease Of Usability

The final consideration, when thinking of the top fp&a tools, is how easily the software can be used. It is critical to select a software package that most users will be able to competently utilize. If the software is overly complicated or difficult to grasp, it can become underutilized and even make performing tasks more difficult.

Some software attempts to do too many tasks. and sometimes this can be detrimental to end-users who are trying to perform complex tasks. Any good software will balance the ability to do a multitude of things with the ability to be used easily.

This is one reason for Excel’s continued use among finance departments. The interface is easy-to-understand, familiar, and can do many things. Even as a beginner, Excel is an easy tool to adapt to. Software that requires significant training will almost certainly result in a scenario where many users are not competent and a few become so-called “superusers.”

Once this scenario arises, it will only serve to slow down the processes involved in FP&A and can actually have significant cost implications. Carefully consider how users interface with the software and whether or not the task they are currently performing is more efficient as a result of using the application.

Top 5 FP&A Software Solutions

Now that the five most critical aspects for choosing an FP&A software are explained, let’s go over the top three solutions that cover all of these important factors and more:

| Time to Implement | Data Collection | Data Presentation | Data Analytics | Ease of Usability | |

| Datarails | 5.0 Stars | 4.8 Stars | 4.6 stars | 4.8 Stars | 5 Stars |

| Workday | 3.5 Stars | 4.2 Stars | 5 Stars | 5 Stars | 3.8 Stars |

| Prophix | 4.2 Stars | 5.0 Stars | 4.5 Stars | 4.6 Stars | 4.2 Stars |

| Cube | 5.0 Stars | 4.0 Stars | 4.8 Stars | 4.6 Stars | 4.1 Stars |

| Planful | 4.0 Stars | 3.5 Stars | 3.5 Stars | 4.5 Stars | 3.8 Stars |

1) Best Overall FP&A Solution: Datarails

When considering all the factors in play, perhaps there is no better solution than Datarails. The biggest reason for this is how Datarails runs – it is the only completely native Excel FP&A solution. This directly influences how data is collected, analyzed, and presented, while finance teams are able to utilize the benefits of Datarails quickly by staying in the familiarity of Excel.

In terms of time to implement and ease of usability, the benefits of using Datarails are tremendous. While most other FP&A software attempt to replace Excel or change it so much that it takes a long time to relearn the new system, Datarails simply works with Excel. Therefore, the usability is incredibly simple – anyone who knows Excel can use Datarails. The time to implement is also far better than the competition as users reach implementation in only 2 weeks.

Data presentation and data analytics are also superior with Datarails than other FP&A solutions. Datarails’ dashboards are easy to create and present (they are Excel based) and the drill down capabilities provide granular data down to any level of detail. A simple refresh button updates data from all of the company’s sources so that it can always be up to date and trusted – as data is collected automatically and in real time. Lastly, Datarails’ dashboards can be customized for each organization’s specific needs.

Overall, Datarails covers all of the important aspects that most companies look for in an FP&A solution and consistently ranks as a leader in the FP&A market. Datarails caters to a wide range of organizations, and is able to save users 30-40 hours of manual work a month as well as cost saving analysis through deeper insights.

2) Best FP&A Solution for Large Businesses: Workday Adaptive Planning

Workday Adaptive Planning is a consistently good choice for large organizations and enterprises. Although the implementation time is longer than many other FP&A software, this is mostly due to the fact that it caters to large businesses with more complex finance departments. Once implementation is complete, users are able to benefit from a large array of upgraded finance functions.

In terms of data collection and presentation, Workday Adaptive Planning works best for organizations who use any of Workday’s other software tools, such as their Financial Management and HR solutions. This way it can easily integrate all of the systems into one and provide an easy to use interface with all of the data in one place. However, Adaptive Planning still offers an excellent stand-alone solution for non-Workday customers that covers all of the factors needed for a good FP&A solution.

Adaptive Planning’s data analytics is also a strong point, as the software can run multiple and complex what-if scenarios and flexible forecasts (weekly, monthly, yearly etc.). This is especially important in times of volatility.

Adaptive Planning is a great choice for large businesses as the brand name, internal integrations, and advanced analytics are all strong selling points. However, due to the lengthy implementation time and higher pricing, it is not the best option for organizations that are smaller than large businesses or enterprises.

3) Best FP&A Solution for Small Businesses: Prophix

Prophix has excellent reporting and analytics functions thanks to its drill down capabilities (down to the transactional level) and user security profiles (audit control). This allows for companies to have more control over the data and more control over who sees and changes the numbers. This avoids much of the chaos of traditional spreadsheets with multiple users.

While Prophix significantly upgrades spreadsheet capabilities, there is still a learning curve involved since it is not Excel native. Its ease-of-use is better than most non-spreadsheet native FP&A tools, however, the implementation time is longer than FP&A software with a completely native Excel interface such as Datarails.

Like most other solutions, Prophix’s data collection is consolidated into one source in real time, taking away the old-fashioned data silos and huge amounts of time spent simply gathering data. Overall, Prophix is a great solution for small businesses looking to move away from Excel.

4) Best FP&A Solution for Fast Implementation: Cube Software

Cube Software prides itself on being quick to implement and reducing the mental load of many of the FP&A tasks finance teams have to handle each day. If speed and user-friendliness are two of the most important qualities to you, this option is worth considering. That being said, it doesn’t necessarily have all of the bells and whistles you’ll get from a more comprehensive solution, like Datarails.

Some users also note that there are challenges with the platform once it’s up and running. One such challenge is the delays users experience when they upload their new data for month or quarter-end. They say the time it takes to import and refresh their data often holds them back during this critical period.

All of this being said, Cube is still a good choice for mid-sized businesses who prioritize user-friendliness and ease of implementation in their FP&A software.

5) Best FP&A Solution for Growing Businesses: Planful

Planful is a scalable FP&A solution that is suitable for businesses from their beginning stages onward. Their goal is to help finance teams reach their full potential by offering a scalable, agile, and user-friendly platform. With this platform, Planful provides users with helpful insights and powerful data to make the most informed and empowered business decisions.

No platform is perfect, and some of the areas users think Planful could improve include its breakout sessions and training capabilities. They note they are too fast, short, and often, ineffective. They also point out that the integration process has not been smoothe for many teams with lots of hiccups along the way and a delay in customer service fixing these issues when they arise.

Overall, Planful still offers a lot to be excited about and it’s worth considering for businesses hoping to scale in the coming months and years.

Conclusion

There are many important aspects to evaluate when choosing an FP&A software. Datarails is a native Excel platform, and therefore has a very low implementation time and intuitive interface. The advanced drill down capabilities and easy-to-use, real time dashboards provide a high level of data presentation and is why Datarails is the top choice for an FP&A solution.