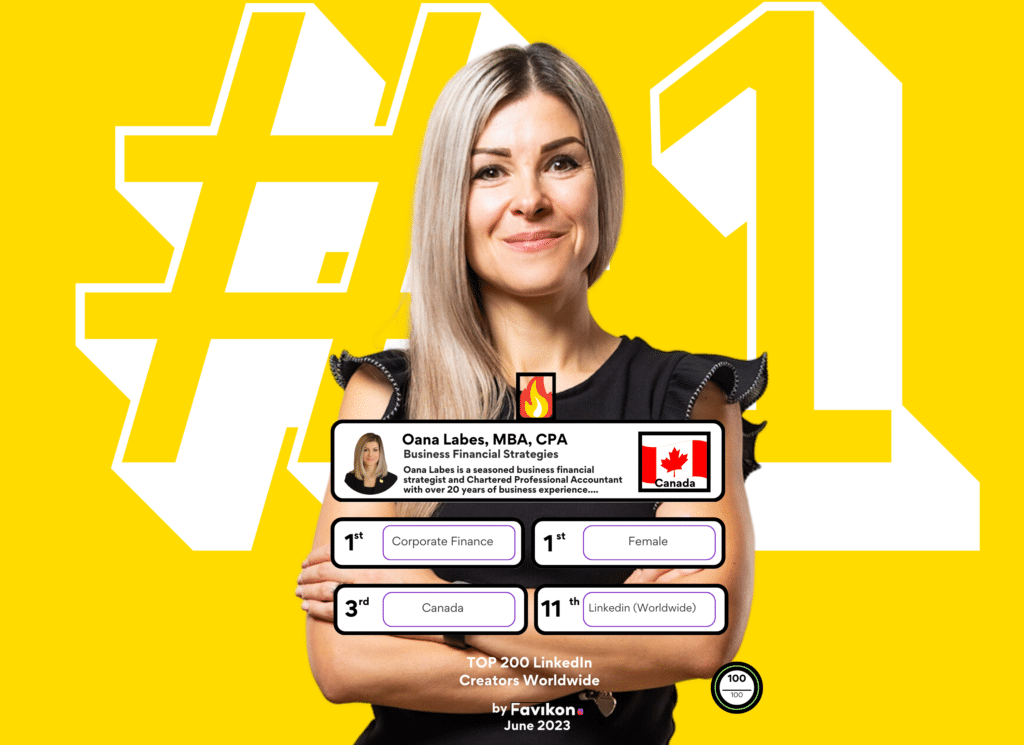

The #1 female voice on LinkedIn! According to Favikon, a listening and creator ranking platform, Oana Labes ranked (June 2023) as the highest placed female and 11th placed most influential creator on the entire platform.

Though the algorithm continues to ebb and flow, Labes consistently sees higher engagement than British PM Rishi Sunak, business thinker Adam Grant, and Mark Randolph, co-founder of Netflix.

By this stage you are probably expecting her to be branding expert, actor, or doyen of fluffy soundbites.

Credit to those people. But no.

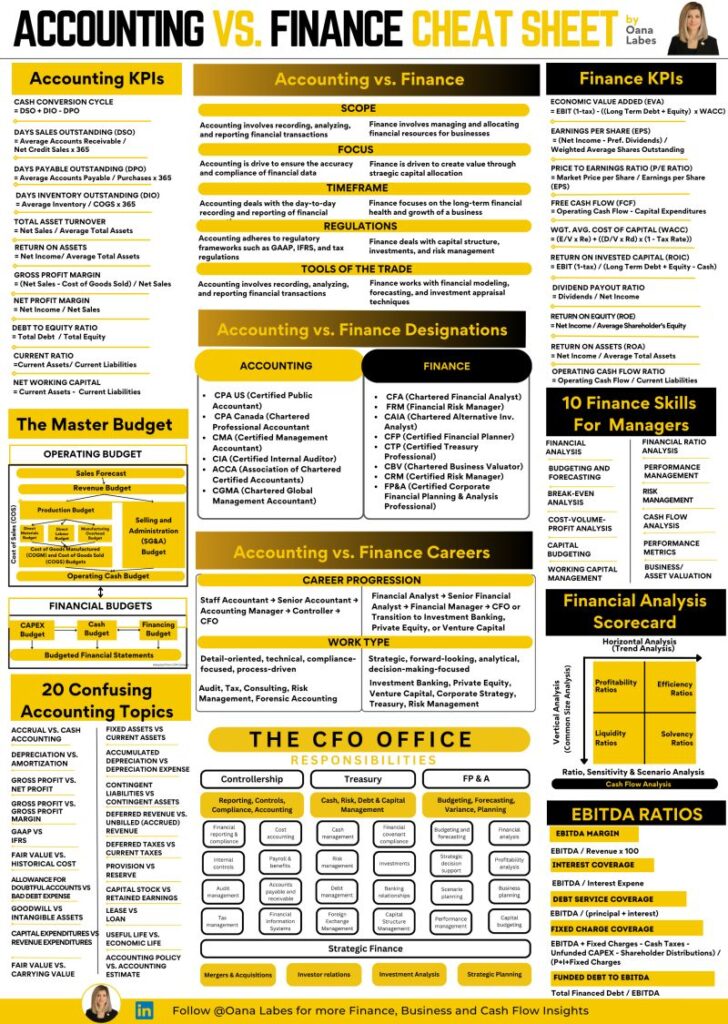

This female creator goes deep into EBITDA, cash flow, and KPIs.

And LinkedIn can’t get enough.

Labes has gone from a sprinkling of followers to 311,000 since she started posting daily in fall 2022. One of her most viewed pieces shows “300 KPIs broken down by C-Suite role”. There is “Accounting vs Finance explained”. Another is on EBITDA, and Cash Flow ratios. A post on top free accounting and finance courses triggered 2159 reposts and counting.

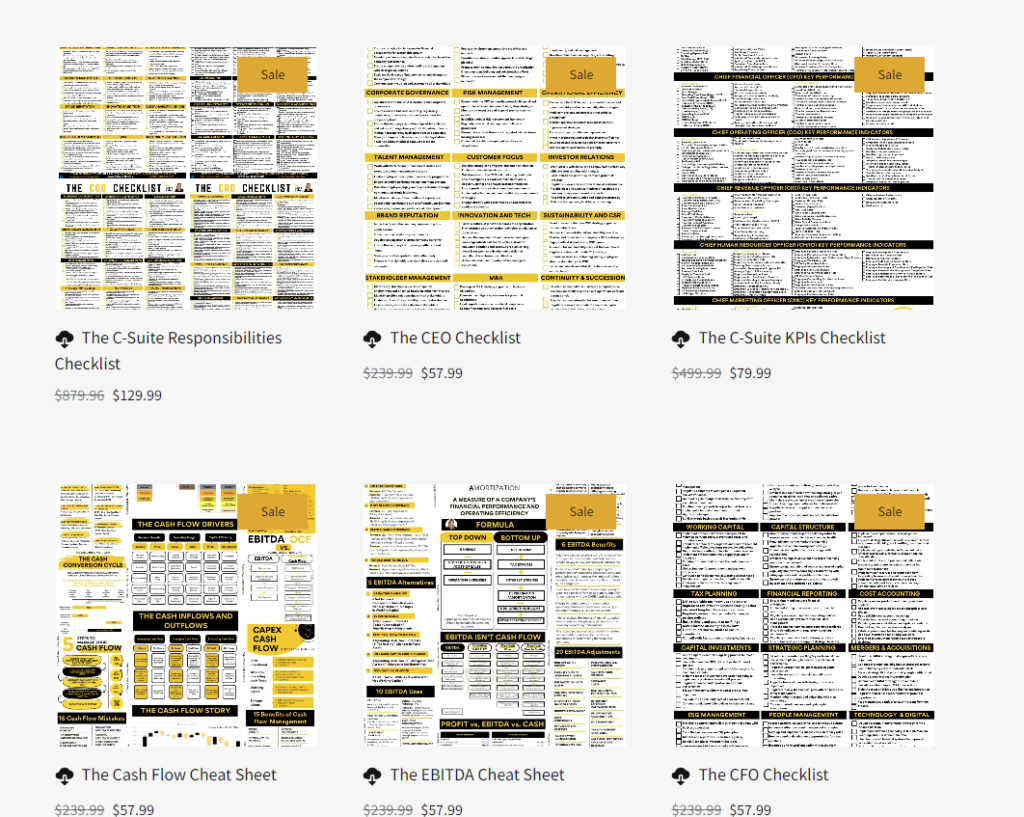

LinkedIn serves as an appetizer for her paid offerings which have multiplied as Labes tries to meet demand from an audience of both finance and non-finance professionals.

Since achieving viral success on LinkedIn she launched a digital store in June 2023 offering paid “Viral Cheat Sheets and Checklists” starting from $57.99. A newsletter has attracted 37,000 subscribers after 9 months (open rates of over 40% vs the industry average open rate of 21.5%). Her Cash Flow Masterclass, a 2.5-hour video course with over 200 students per cohort ($299) was developed to provide deeper material based on the deluge of questions she can no longer answer individually on LinkedIn.

Labes says “It’s very early days, however current trends indicate my content business could soon quadruple my advisory work. This prospect energizes me to continue sharing my expertise through new courses and learning tools. I’m also considering a more flexible pricing strategy to make the courses accessible to a broader global audience.”

Building a content empire on finance and accounting

Fans of Labes are more than happy to flash a couple of hundred dollars to get career-bounding strategic finance concepts. Many flocking to Labes and other influencers such as Nicolas Boucher and Josh Aharanoff feel neglected by old-school finance teaching.

Dale W. Harrison, Commercial Strategy for Biotech & Clinical Diagnostics calls Labes “a unique talent among financial analysts.” He says: “Oana has a remarkable ability to bring a real sense of clarity to complex and, for many, opaque topics around finance.” Gerry Peletier, Director and Co-founder, Stage Left Partners who had a career in finance at IBM, finds value in the daily posts despite breathing accounting for 43 years (RIA, CMA, CPA). Peletier says: “I have never seen the Cash Flow Statement and the Cash Flow Management Process described with the level of clarity and completeness”. Like other fans he reflects that the explainers manage to bridge knowledge gaps between “non-financial executives and business owners working closely with their CFOs.”

“Finance people and accounting people don’t understand sales very well and most sales people don’t understand accounting and finance but everything is interrelated. Oana is great at making all of these nuances clear.”

Sales leader John Pohlaus at Ackley Machine Corporation

Sales leader John Pohlaus at Ackley Machine Corporation, adds: “Oana creates awesome content for anyone that wants to improve their companies by understanding how actions and inputs affect financial reporting. Finance people and accounting people don’t understand sales very well and most sales people don’t understand accounting and finance but everything is interrelated. Oana is great at making all of these nuances clear.”

Professors of accounting and finance also adore Labes’s resources in seeking to make financial concepts accessible and refreshing to more students, bringing her work to a new audience.

The path to a LinkedIn finance leader represents an unexpected phase of a career for a Canadian CPA with over 20 years of business experience. In this time, Labes built two companies as an entrepreneur, and financed hundreds of companies as a commercial banker. Born in Romania, Labes was raised by a military colonel and surgeon father and entrepreneur mother. Growing up within Communism and rationed food all year instilled resilience that is reflected in her work ethic and optimism about change.

Labes says the motivation for her work comes from hard-won lessons about the impact – and potholes – that finance can fall into. “Throughout my career, I’ve observed numerous high-stakes transactions, such as mergers, acquisitions, exits, expansions, all crumble like a house of cards, because those companies hadn’t laid the groundwork years in advance to facilitate such complex deals. It was disappointing to see how late in such strategic transactions companies were finally waking up to realize how weak their financing negotiating positions truly were. It was also disheartening to consider the impact of those suboptimal and short-sighted management decisions on the thousands of employees I’ve witnessed getting laid off to course-correct and try to salvage those deals at the last moment.”

These lessons inform her work both on LinkedIn and at her advisory firm Financiario which works with CEOs, and Boards of Directors working with Labes to scale revenues, improve profitability, and maximize enterprise value through “strategic financial planning”.

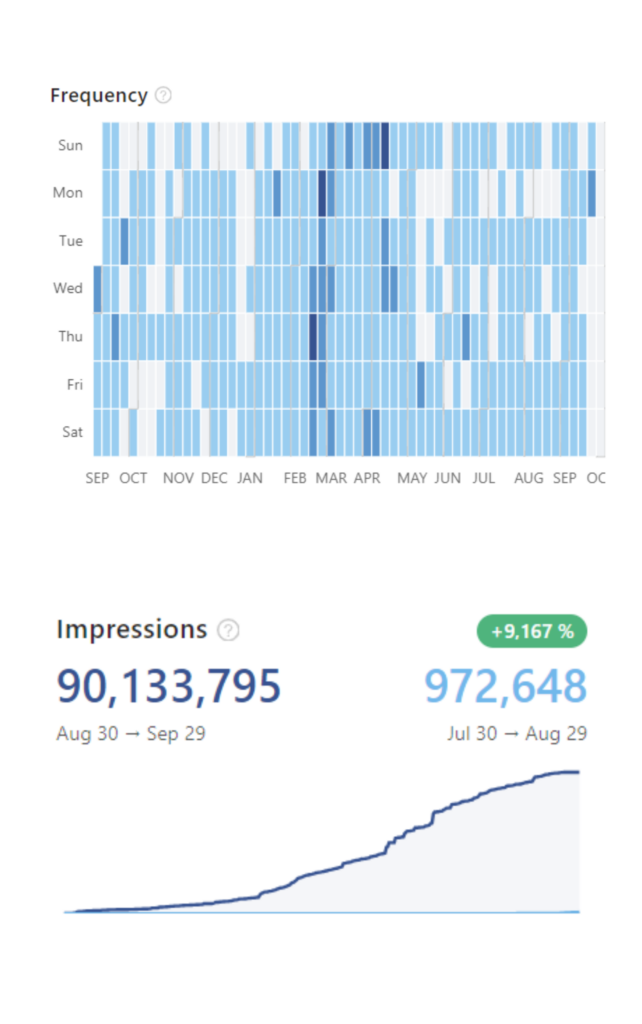

Getting to 90 million impressions (and beyond)

The deeper Labes has gone into finance the more eyeballs her content gets. In fact, “impressions” – counted by LinkedIn as the number of times each post is seen – shot up 9,167% in the past year as she mined strategic financial concepts. Overall she has seen more than 90 million impressions for her unmistakable yellow-branded explainers popping up on LinkedIn. Digging further still, 2023 saw 685,000 “Likes” on her posts (to put this in perspective LinkedIn itself only passed 1 billion total members across the entire platform).

“I will honestly admit running my business and posting on Linkedin at the same time was exhausting for a while.”

Oana Labes

Career-lessons, consistency, and Killer Visuals: central to Virality

What’s her secret to delivering a punishing creative schedule of daily posts?

“Never sleep” Labes suggests. “Just kidding, though I will honestly admit running my business and posting on Linkedin at the same time was exhausting for a while.

“My formula for creating content starts with my own experience working with hundreds of SMEs and advising hundreds of CEOs and CFOs how to achieve their long-term strategic objectives”, says Labes. Seeing where they failed and witnessing the aftermath, or seeing those that succeeded and analyzing their finance strategies.

“So when I post about the contribution margin being critical to a company’s ability to scale, I speak from experience because I worked with numerous product companies that struggled to improve this metric to fix their underlying business profitability, cash flow and capital availability to fund growth. Or when I post about EBITDA not being equivalent to cash flow, I recall the many companies I worked with that failed to track cash flow metrics in tandem with their EBITDA KPIs or covenants, and later found themselves insolvent.”

6 Content Takeaways for those wanting to share their learnings on LinkedIn

Labes offers 6 clear takeaways from her content career that other finance – or creators in general – can learn from.

- Be predictable in your posts – Labes posts daily and at the same time each day, so her burgeoning audience knows what it is getting- and when. “In my case, I have posted daily for the past year, always at the same time, always with engaging and complementing hi-value visuals, and using a very predictable post structure which my followers have gotten accustomed to.”

- Stay around for at least the first hour after posting – this gives a chance to engage with followers and answer comments. “So don’t post and ghost as they say” Labes.

- Lazer-focus on your audience – “Building an audience on LinkedIn takes time, and as this space is getting ever more crowded especially in the advent of AI, you should be laser focused on building a credible brand that attracts the right kind of followers for your objectives”.

- Spend time to understand your audience – “Understand their reasons for following your posts, and ensure those reasons align with your own reasons for posting.”

- Engage with other content creators in your space – “This brings one another’s audiences to your posts and helps build credibility and authority, assuming your comments are thoughtful and insightful.”

- Be strategic about interactions/comments – “Another tip which can be difficult for some creators to follow: your engagements on the platform, your comments and likes and shares are brought in the feeds of your followers and connections”, says Labes. “Be strategic about those interactions, and when in doubt ask yourself “if my followers read my comment on this post, would that make them want to follow me more or less?” If it’s not an “absolutely yes” don’t write it.

Labes has created a fanbase from one of the most unlikely watering holes. But her success proves the point that there are no boring industries, just poor execution.

Behind all the hard work and driving the process of always-on creation is a bid to transform the perception of finance and provide value for managers navigating turbulent waters. “First and foremost” says Labes, “ I have a social mission that is rooted in the hundreds of business stories I was a part of in my career.”“Spreading strategic financial education helps raise awareness of critical finance mistakes companies need to avoid so they can keep their businesses thriving and avert financial distress, keep their people employed and their families fed, and ultimately make their mark on humanity with their solutions and innovations.”