Financial

Data Analytics

Dive deeper into your financial or operational data to examine anything from key variance drivers to head count, sales performance, COGS and (virtually) everything in between

Move from reporting what happened to making things happen

Thanks to the ability to automate reporting and easily track variances, switch your focus from reporting to problem-solving by identifying key drivers and spotting red flags in your business.

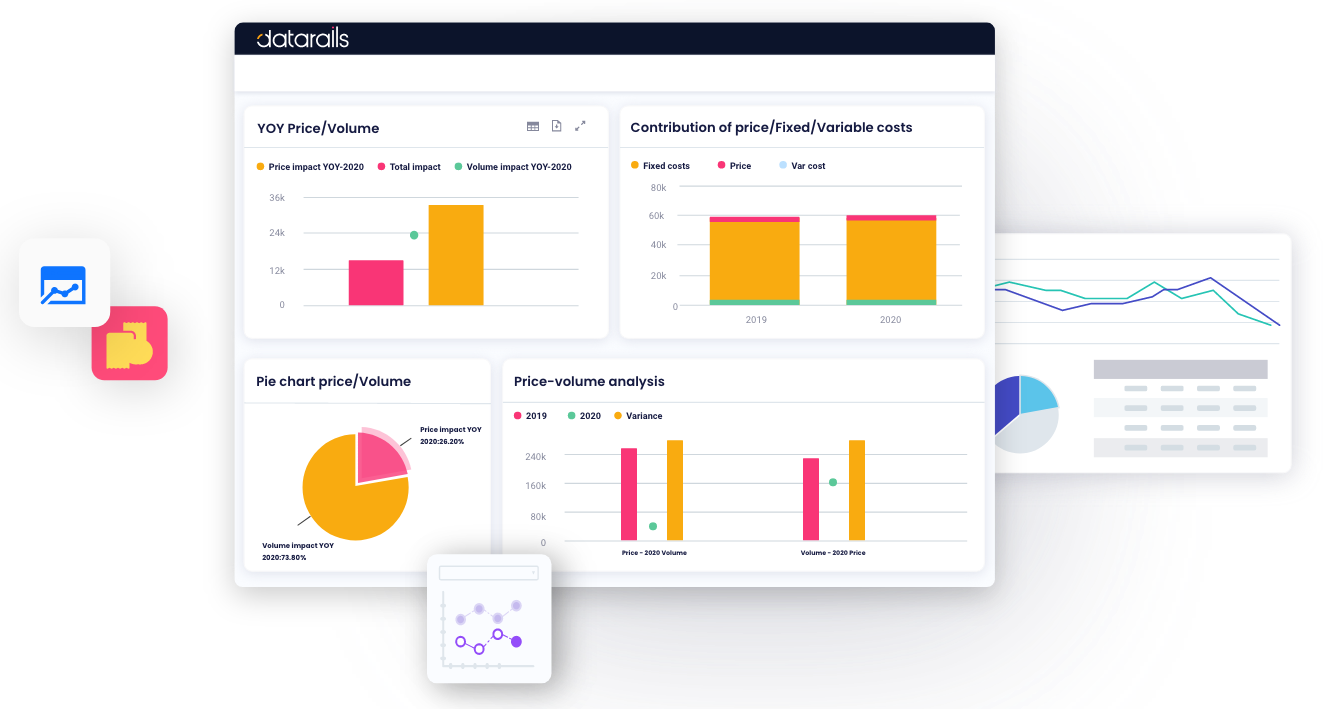

Gain a deeper understanding

of your business

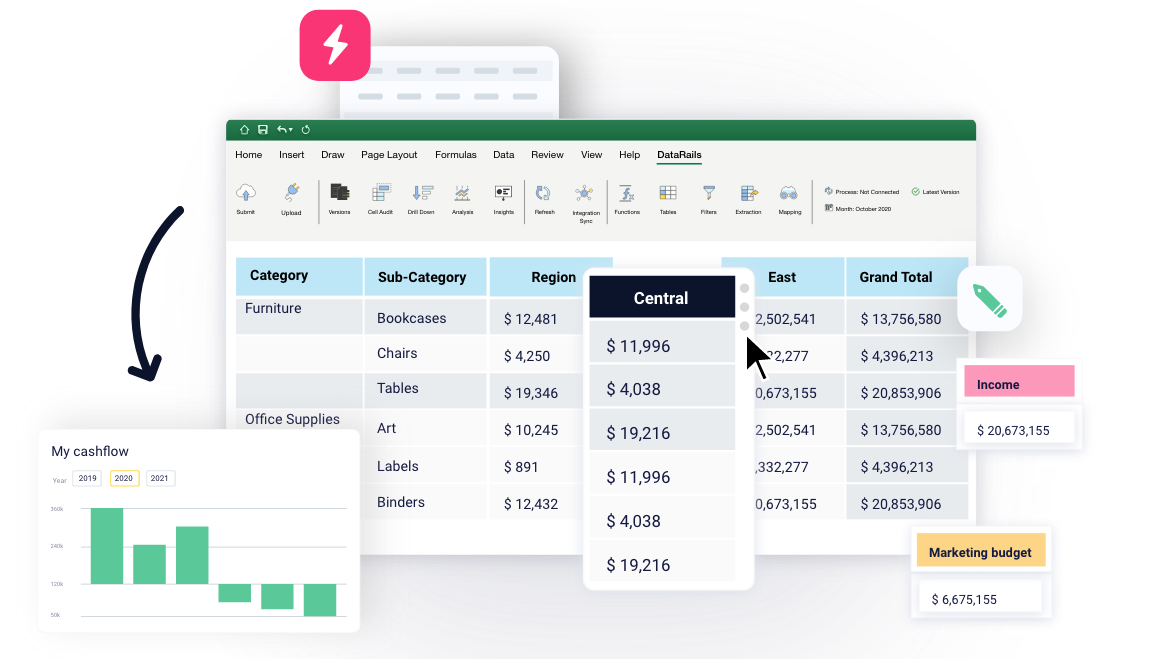

With all your data centralized in one place, get meaningful insights for each segment of your business. Drill down from the P&L into your price/volume/mix or direct material pricing changes vs. the prior year. Use Datarails to explore the high-level picture, while drilling down for full-scale granularity.

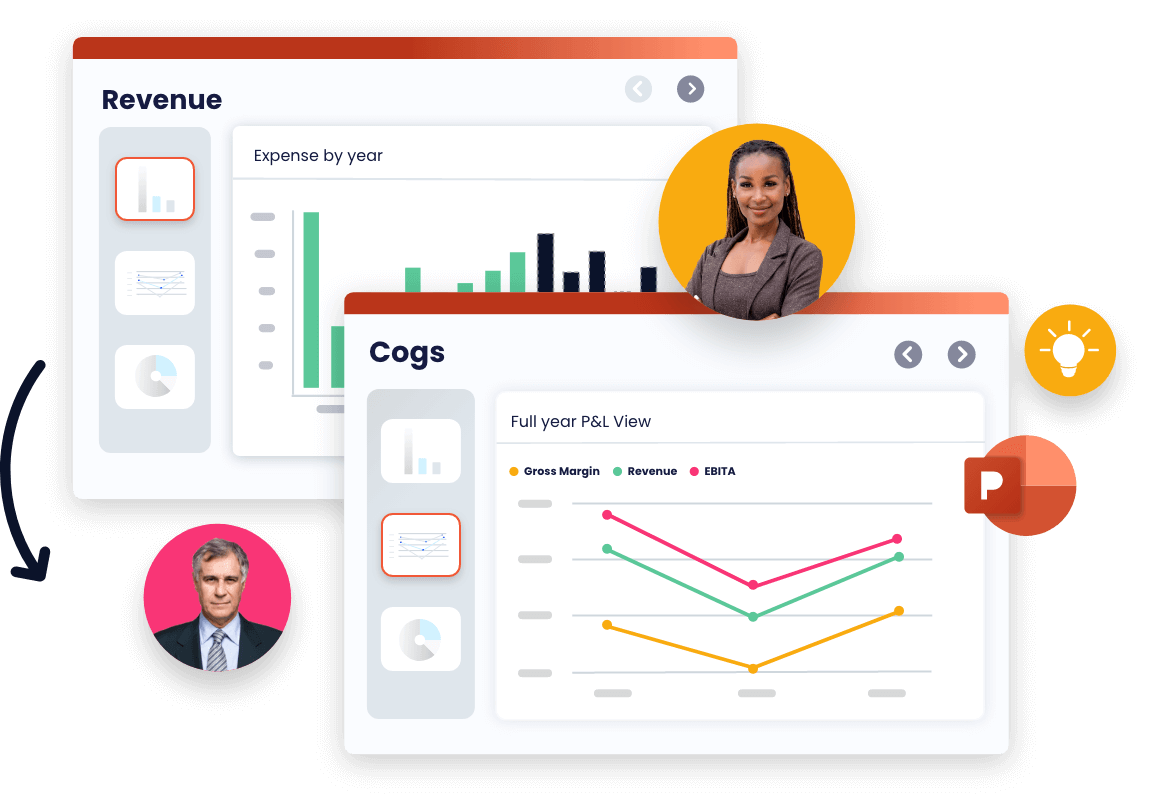

Provide management with accurate analyses

Review all areas of the business to provide management with in-depth analyses that paint an accurate picture of the organization’s strengths and weaknesses. Help stakeholders understand performance in areas including revenue, COGS, OPEX, CAPEX, AP, AR and others.

Use operational and financial data in tandem to get meaningful insights, and understand drivers for revenue and expense swings. These insights help drive improved behaviors going forward.

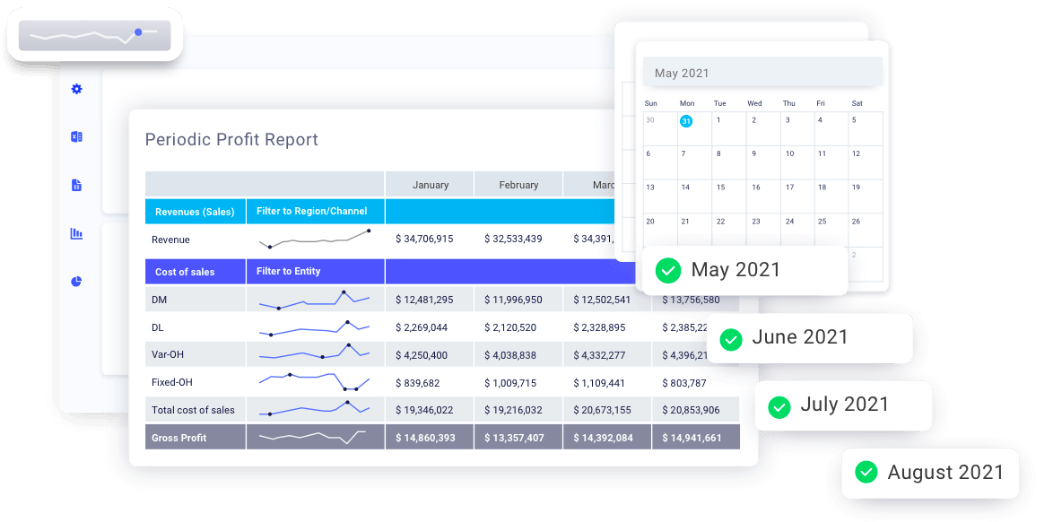

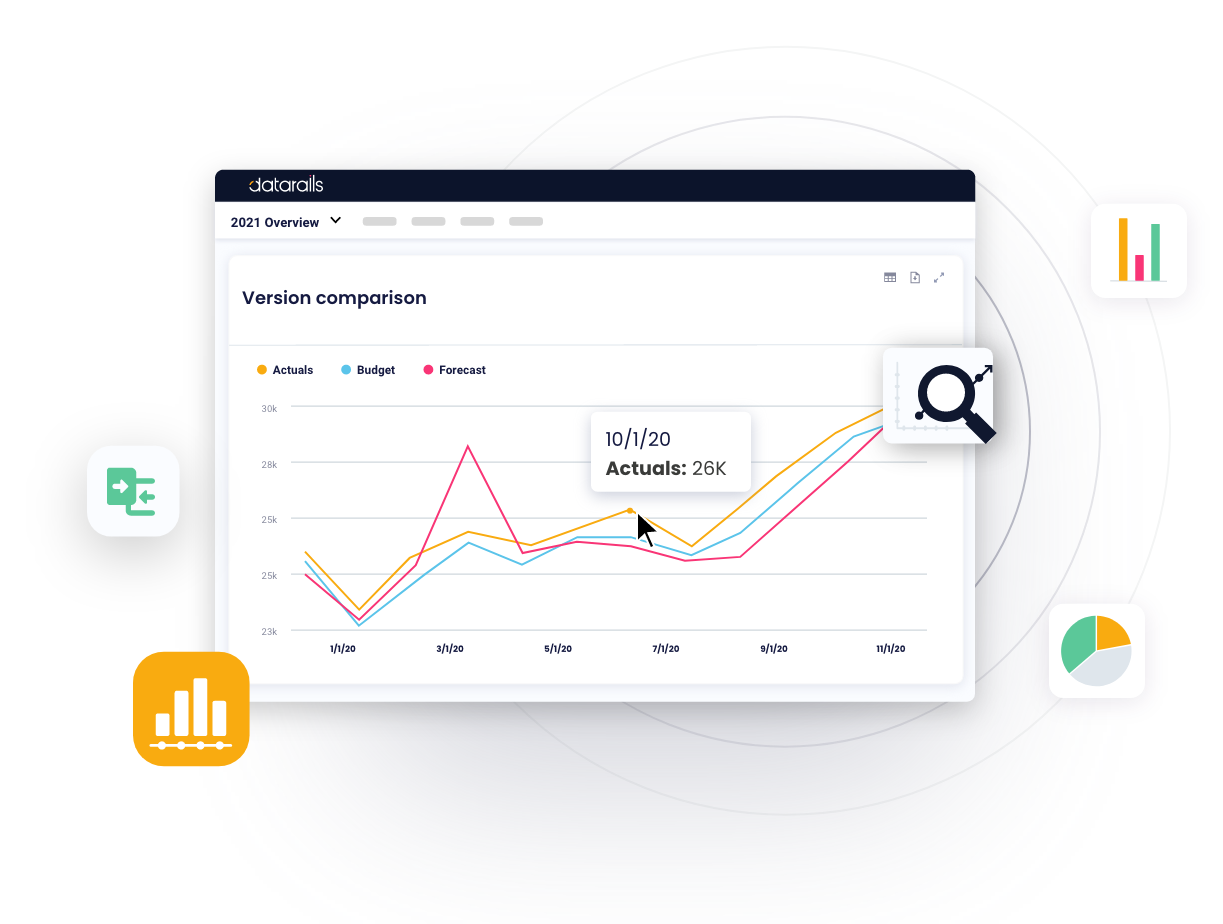

Conduct diverse comparisons to understand drivers

Compare any part of your business by conducting variance analyses by any relevant driver. Compare actuals vs. budget, actuals vs. the latest forecast or compare year-over-year to track seasonality.

Conduct ad hoc analyses on the fly

Look at your numbers from a new and fresh perspective by conducting ad hoc analyses, instantly creating newly calculated metrics, and creating insightful KPIs.

“Datarails helps us avoid crises. I have the chance to uncover insights that I wouldn’t have otherwise.”Alex Lessin

Frequently Asked Questions

Financial data analytics is a subset of BI and EPM. This form of analytics refers to looking into financial numbers in order to extract insights pertaining to the business. Financial data analytics can help businesses decide on strategic measures and make improved business decisions.

Financial data analysts are responsible for preparing financial and analytical reports, identifying valuable insights, and helping guide managerial decisions. Oftentimes, financial data analysts prepare forecasts as well. They typically collect information from various divisions within the company in order to produce reports. Generally speaking, financial data analysts make sure that relevant decision-makers have all the information they need to make optimal business decisions.

Financial analytics software provides an overview of financial, and oftentimes also operational, data from different organizational systems. Combined with drilldown capabilities, they provide real-time information that help in tracking figures such as revenue, expenses and profitability, as well as producing forecasts, budgets, reports and planning. All in all, this aids in improving business efficiency and creating tailored reports that can help address particular topics.

There are numerous tools and techniques that can be leveraged to evaluate an organization’s financial status. These include a time series analysis, which compares a company’s financial data over time, a cross-sectional analysis, which compares performance with performance of other companies, as well as financial ratios, common-size financial statements, currency translations, and chart analysis.