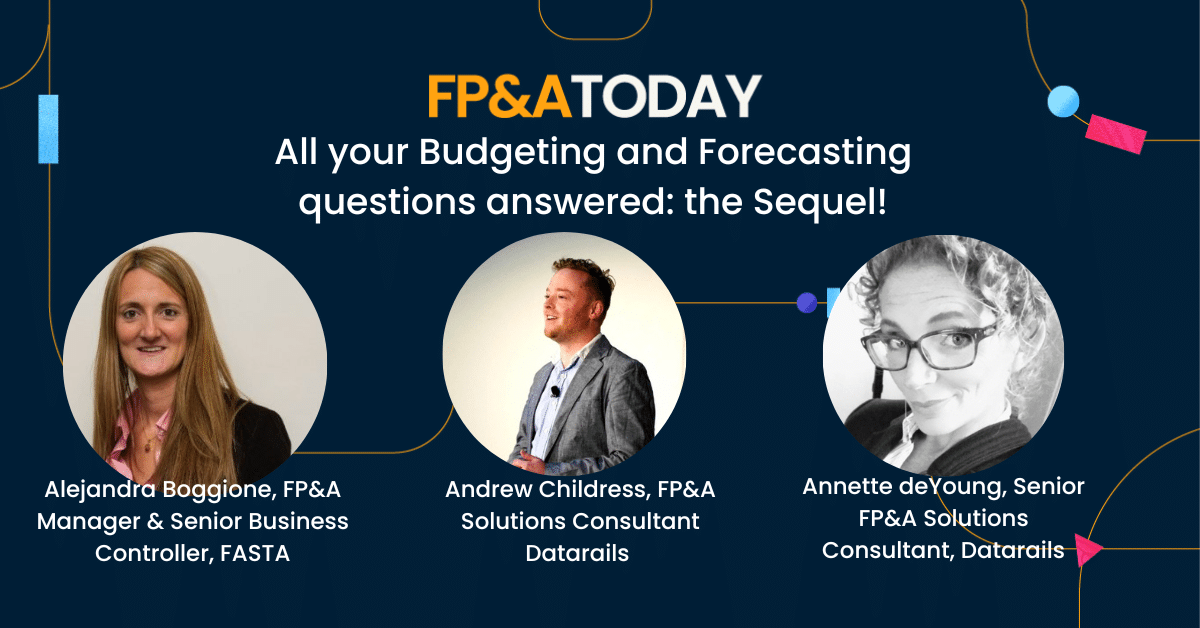

This follows one of our most popular ever episodes of FP&A Today (episode 19: Budgeting all your questions answered). In this sequel episode, new and returning guests answer all your new burning budget and forecasting questions and challenges. Joining us in the budget and forecasting war-room are:

Alejandra Boggione, FP&A Manager and Senior Business Controller, FASTA

Follow ⏩https://www.linkedin.com/in/alejandraboggione/

Andrew Childress, FP&A Solutions Consultant Datarails (ex finance at Accupac, One Inc and Flint Group)

Follow ⏩https://www.linkedin.com/in/andrewrchildress/

Annette deYoung, Senior FP&A Solutions Consultant, Datarails (ex finance at JL Clark, Berner Food & Beverage, Fairbanks Morse Engine)

Follow ⏩ https://www.linkedin.com/in/ahdeyoung/

Some of the questions tackled in this LinkedIn Live episode of FP&A Today (November 2023):

- What’s budgeting and forecasting good for?

- How do you approach budgeting in consulting firms?

- Which type of budget process works best (top down or bottom up?)

- How can FP&A be the bridge between the two?

- How does the budget work in a startup?

- What is the linkage between forecasting and the model?

- How can finance best prepare for the budget ahead of time to avoid crazy late nights?

- Revisiting the previous year’s budget – (what can be cut)?

- How can you ensure alignment between the financial plan and operational plan?

- Static annual budget versus a rolling forecast?

- How do budgets help with inflation challenges?

- How do you kickstart scenario planning?

- How often should you reforecast?

FP&A Today is brought to you by Datarails the AI-powered Financial Planning and Analysis platform for Excel users.

Paul Barnhurst:

Hello everyone. Welcome to FP&A Today, and we’re gonna talk about some best practice budgeting and forecasting. And a little bit of background, a year ago around this time, the first LinkedIn Live we ever did for FP&A Today was on budgeting and forecasting. So the show’s been going long enough that we’ve brought back a similar episode, and we even brought back one of the same guests. We swapped out a few, but we brought back Annette de Young, she was with us last year. We also have Andrew Childress and Alejandro with us. And what I’m gonna do is I’m gonna let each of them introduce themselves. Tell us just a little bit about yourself and what you’re currently doing today. Let’s see. We’ll go ahead and start with Annette.

Annette deYoung:

Oh, boy. So hello everybody. Right. See me on a couple of episodes with, with the wonderful Paul here. Nice to see everybody. So a little background for you. I spent most of my career actually in finance and accounting, 23 years to be exact. Mostly in manufacturing in the Midwest until just shy of two years ago when I switched careers, had a little midlife crisis, decided I didn’t wanna do budgeting and forecasting anymore, And I actually work for data reels, so as a solutions consultant, FP&A solutions consultant there. Absolutely loving it. Never gonna look back, but you know what, after a very long career in finance and accounting, right, I do bring right, obviously, a wealth o knowledge and experience. So to the new company’s, nice to see everybody.

Paul Barnhurst:

Thanks, Annette. Alejandra, if you could introduce yourself, tell us a little bit about yourself and what you’re doing.

Alejandra Boggione:

Yeah, sure, Paul. But if you let me, I will start to tell you, telling you that I’m really glad to be sharing this panel with this, with you and these great colleagues to whom I’ve been listening in several podcasts and events. So really thank You for the invite.

I’m Alejandra, born and raised in Argentina and living in Spain.

Right now I am the FPA manager at FASTA, which is a nonprofit organization that delivers education services across different countries, mainly in Latin America, so a little bit about the role that I am currently in. Perhaps one thing that I can share is that it’s been a really huge step to build the FP&A function within the financial department and make room to this kind of analysis and get this feeling that you really give the, an insight that was needed to shift focus from, from risk mitigation or just reaction responses to making the department able to proactively seek for new growing opportunities. So that’s one of the things that I love about this FP&A position.

Paul Barnhurst:

Great. Yeah. And, and building out FP&A can always be exciting and challenging at the same time. Yeah. So tha thanks for sharing that. Andrew, if you could tell us a little bit about yourself and where you’re coming from.

Andrew Childress:

Yeah, thank you. So Andrew Childress currently traveling full-time and in Mexico currently.One of the things I love about what I do working for Data Rails as a solutions consultant is being able to travel full-time. But I don’t wanna sound like I stole Annette’s bio too much, but very similar backgrounds. Finance, leadership, mostly in manufacturing companies and all of the things that come with that. It’s a lot of fun, but also some really unique challenges as well. Spent about 11 years in a combination of accounting and finance roles. And I think one of the things that’s really amazing to see here is just the international audience that’s joining us for this. And it makes me feel a little better that that budgeting and forecasting is a challenge across the whole globe. So, awesome to see everybody and excited to, to have this chat.

Paul Barnhurst:

Thanks, Andrew. And it definitely is, I mean, just in the time we’ve been chatting, we’ve had a number of other people mention where they’re coming from. We got Ghana, Venezuela, Minnesota, Wisconsin, all just all, all over the world. Dubai, Sweden, Romania, South Africa, Columbia’s really great Oman, and I could keep going, but we do have a show to get to. And where we’re gonna start with today is just before we get into the budgeting and forecasting questions, I would just like to start with a really basic question, and we’ll throw this to Andrew. How do you define budgeting and forecasting? If someone was to ask you, you’re at the dinner party, and someone’s like, what is budgeting and forecasting? How are you gonna define it?

Andrew Childress:

I’d probably try a different subject first, but if they pinned me down, <laugh>, you know, and I had to come back to budgeting and forecasting, I mean, look, one of the things that I’ve thought my whole career is that really everything we build in terms of forward looking is about a story, right? It’s a story that captures what the business thinks is gonna happen. It it’s really your job and FP&A to facilitate those conversations between your business partners, so that what you build up is a representation of where we think the business is going, and really having those drivers and capturing what’s inside of that story is the texture of our business that helps us think about what we need to watch for, what the metrics need to be, how we need to operate the business from day to day. But at the end of the day, I think it really is about telling a story about what we collectively believe is gonna happen in the business.

Paul Barnhurst:

Annette, anything you would add to that?

Annette deYoung:

Yeah, I’m, I’m with Andrew at the first part. Run away, you know, change the subject, <laugh>. Yeah, I mean, budgeting and forecasting, it’s, it’s, it’s like, it’s one of those, it’s, it’s a necessity. It’s, you know, it’s an evil, you know, an evil necessity that every business has to do. You know, if they really wanna grow, if they want tocontinue, you know, because you need a baseline, you kind of need to know, you know, where are we gonna be next year? Let’s budget for that. Now, we all know too, the moment you publish that budget, it’s outdated, right? That’s what the, that’s what the forecast is for. Now we get to Reforecast, right? This is our initial thoughts because look at the world around us. Any day, any given day, it changes. And so you just gotta be able to kind of figure out, you know, number one, where have you been? Absolutely that historical, but where are you going?

Paul Barnhurst:

Yeah. You know, and it’s funny when you mentioned kind of a necessary evil, I was talking to somebody this morning. He joined a company in 2020 and the company had been around for almost 25 years and been dealing with 20 years of hypergrowth. And he goes, we really didn’t have defined budgets or forecasts. All of a sudden they had to start figuring out how much are we spending? Because now they’re starting to become a mature industry. And it was just kind of shocking. ’cause They’re a, a global Fortune 500 company and had a very loose budgeting process, not something you see very often. Usually they’re pretty buttoned up. So it was kind of a fascinating conversation. And they were, they were having to mature themselves quickly as they recognized you know, the importance of being in an industry that no longer had hypergrowth all the time. So it was really interesting. But Alejandra, anything you would add to that of how you think of budgeting and forecasting?

Alejandra Boggione:

I think of budgeting as a way to get everybody on the same page. Because when you think about growing or moving forward, maybe everyone may have their own idea of what that means, and budgeting. It’s like this simpletool or roadway to put everybody on the same page and move forward at the same pace. So that’s how I see it.

Paul Barnhurst:

Great, thank you. So why is it so important for companies to build a budget to forecast? I mean, what, why do they need to do it? Obviously some companies don’t do it as often as they should, but Annette, why would you say it’s so important?

Annette deYoung:

I, again, I think too, right? You, you need to know where you’re going. Historicals will only tell you where you’ve been a good budget. Number one, you can see where right your profits are coming in, where your, even your cost in that re-forecasting, again, as we see things changing in the world today, as we see, you know, inflation, as we see changes in the cost of everything from, you know you know, a small, you know, from your pen that you can use in the office to labor, everything fluctuates. And so, you know, you’ve gotta make sure that you’re in line, your right, your revenues and your expenses are all in line. And so to kind of go in blind and not know I mean, some companies are lucky, right? They get away with that, as you were saying, for, for quite a few years. And, you know, I would imagine that the first time they actually sat down and did the budget, they were quite surprised what they found.

Paul Barnhurst:

Oh, yes, no, we’ve all seen it where the budgeting process has been loose. And I’ll use the term loose lightly. And you get in there and you start digging. You’re like, wait, we’re spending how much on this and that. And you start realizing why it’s so important to budget, right? How many have ever done this where you look at how much you spent last month and you weren’t budgeting, and all of a sudden you’re like, wait, I’m spending how much on what? No different with the company, just on a much larger scale and bigger numbers, the same

Annette deYoung:

Thing is true. Doesn’t go, it doesn’t go noticed until cashflow becomes an issue. When cashflow becomes an issue, then everybody’s like, whoa, where’s all of our money going? <Laugh>, right? So that’s again, right, that’s that forecasting. That’s where it’s so important is, you know, obviously we talk about budget and forecast and you know, your financial statements, but if you’re not on a, you know, but cash is king. No cash, no business.

Paul Barnhurst:

Very true. When cash flow slows or revenue slows and all of a sudden you’re not growing, then it’s like expenses matter. It’s amazing how high growth can hide a multitude of sins, but they can only do that for so long as the saying goes. So we had a couple questions here, and before we jump into our questions, I’m gonna throw one of them up and just see if anyone’s had experience with, with this. I’ll also share my thoughts. So one person just said you’ll kind of highlight more on budgeting and consultancy firms. What are your thoughts on importance of budgeting and consulting firms? So I would say consulting firms are gonna need to budget just like anyone else. There are definitely some challenges, you know, just like all firms of how you do it, right? Are you doing it based on historic run rates and how much you think each consultant will bring in for business?

Are you basing it on what’s in the pipeline? You know, how many people do you need to hire? But I think it’s, it’s gonna be similar to other businesses, it’s just understanding what your key drivers are and then coming up with a method that makes sense. But I definitely think it’s something you should do. Because without that budget, how do you know where you’re going? How do you know if your expenses are in line? Any thoughts anyone would add to that? I’ll throw that out to our panel. I dunno if any of you have worked in a consulting firm. I have not.

Andrew Childress:

Yeah, I think, you know, you, you really wanna make sure that your utilization stays where it needs to, right? I, I’ve had some experience with something pretty similar to this, and it’s really important, you know, if you want to grow the consulting practice, a big part of that is making sure that your, you know, your cost of employing that person versus what you’re billing out the client for stays in line, right? Because otherwise you could really get into a situation where you still have high payroll costs, but don’t have the billings to go with it. And that, that’s where you can really hit a difficult spot. So the only way we know that is if we budget it and we keep our eye on those metrics.

Paul Barnhurst:

Yeah, no, definitely. You have to track utilization and understand billable hours and all those type of things. And a budget will help with that. So I hope that helped a little bit there.

You know what, it is like 13 different spreadsheets emailed out to 23 different budget holders, multiple iterations, version control errors, back and forth updates you never really feel in control of the consolidation and collection process. Yep, I’ve been there. Stop. Breathe. Data rails is the financial planning and analysis platform for Excel users. Data rails takes data from all your company’s disparate sources. No organization is too complex, consolidating everything into one place, secured in the cloud. Now all your data finally talking to each other, everything is automated. Back into your report in Excel. Cashflow FX conversion, intercompany transactions now automated and up to date, drill down and variance analysis in seconds. Don’t replace Excel, embrace Excel, turn your Excel into a lean mean fp and a machine. Find out more@www.data rails.com.

Paul Barnhurst

So going into the, the next question, and we’ll throw this one to Alejandra for the budgeting process. Now, you’ve been through it a few times. Do you have a method you think works better? Or what’s your thoughts? We always talk about top Down, Bottom up, how do you think about those approaches when it comes to budgeting?

Alejandra Boggione:

Yeah, I believe that the approach, it, it depends a little bit on which step of the process you are in, but also depends on the organizational culture in which you are planning, because it is not the same to be working in, in any kind, in any culture. So perhaps during the kickoff of the budgeting process, I would prefer a top down approach because I believe it gives you a clear goal and it’s better for everybody to, to align towards a common, yeah, to, to align every effort towards a common goal. And in the next steps of the process. I prefer a bottom up approach in order to get better insight of the day-to-day operation. But in other steps of the budgeting process, perhaps, I think it depends a lot more on the culture of the organization. And to give an example, like I think that when you are talking about shifting from one scenario to another, in, in my experience, that is a, a top down decision, but I know there are other companies that that approach that step of the budgeting process in a different way.

Paul Barnhurst:

Yeah. Thank you. I no, I agree. Annette, what is your thoughts on kind of bottoms up versus top down and how to manage those in the budgeting process?

Annette deYoung:

Yeah, and, and I have to agree with Alejandro, right? It’s, it’s, it’s the culture too, right? So when I, I mean I’ve worked for companies where it really was top down we got sales numbers and it was really finance’s job to push the budgets down to the owners, quote unquote, I’m gonna use the the word owners very loosely because they didn’t have a say. Yeah, right? They were fed a budget. And then of course they’re like, well, it’s not my budget, right? <Laugh>, then you then you tend to not get a lot of ownership of said budget when it’s truly a top down budget, bottoms up. And, and, and I think that you can, you can really have both of those so bottoms up, give them the say what they want, right? Give them the say in the budget process so that there are parts so that they own it. Once you have that, as we all know, it’s always overblown. So now we have to do the top down that says, okay, we can’t support the current budget as submitted. Now we need you to go back and edit, right? So it has to be collaborative if you’re gonna make that work for your company. So I think you have to have a blend of both of those.

Paul Barnhurst:

Yeah, and, and I tend to agree with you and we’ll come to you in a second, Andrew, but I was gonna say, you mean when when you roll it all up and expenses grown by 10% and revenue’s grown by five, that doesn’t work <laugh>, it’s amazing, isn’t it? <Laugh>, everybody’s laughing ’cause we’ve all seen that kind of budget, right? When you let the business roll everything up, there’s always more needs than you can fund. Yeah. And so I agree with you, it’s really a combination. I tend to like to see something where you have the high level targets when you start, not at the end, but you tell the the business, okay, you need to build a bottoms up of how you get there. And then often how they get there is too expensive. Then that’s where the fun or the negotiation begins of, okay, do we take revenue down a little bit? Where can we shave expense? And it’s almost always, no, no leave revenue but shave expense and then you kind of have to explain what you’re creating more and more risk if we do that or that’s not achievable. And Andrew, any thoughts or anything you’d add to this discussion?

Andrew Childress:

I Think you all Really hit All the key points, but for me, I think the only thing I’d add is, you know, I think FP a’s job is to help be that bridge between top down and bottoms up. Like truly driving how those two ideas meet. Because if you think about it in extremes, if I run a pure top down approach, I get no organizational buy-in and now people can’t go execute. And if I run pure bottoms up, stop me if you’ve seen this movie before, but theanswer usually isn’t what ownership and management wants, right? <Laugh>. So some hybrid between the two where we decide, you know, guys, I’m hearing this from my VPGM, I think we need to be in this range. And then pushing back and saying, look, these are the expense requests that the business has in order to support these targets. You can really kind of set yourself up to be that great connector between the functions.

Paul Barnhurst:

Hundred percent agree FP&A needs to be that connector for a couple reasons. If you don’t play that connector role and tell me, please comment if you’ve heard this before, I’m gonna guess almost all of you, if you’ve been through a budget can comment, you get into a meeting a couple months later and that’s not my number. I don’t recognize that number. That’s finance’s number. Anyone ever heard that one before? I see all the panelists nodding their head and I’m gonna guess a lot of the audience. Go ahead Andrew.

Andrew Childress:

And, and, and one thing I’d just add too is you can really tee up these conversations powerfully if you phrase them as conditionals, which is, if we’re going to deliver $10 million in new revenue, the business is saying this is what’s required to support it. Whether it’s these new product enhancements, these new salespeople really build that bridge where you force that conversation and say, if this is what we’re expected to deliver, this is what’s needed.

Paul Barnhurst:

Yep. Agree. So we have a question here. I’m gonna go to a question before we continue on the list of questions we have. And one of them there, there are two similar questions. So also the first one, one ask how the budgeting works on startups. And then we had someone else who said, I had the fp and a function as startup, could you please throw some light on a static annual budget versus a rolling forecast, which is more beneficial? We’ll get to that, that question particularly in a minute, but just a little bit. I’ll say with startups, you know, with startups, the budgeting process really starts with educating the team, taking them through why they need to do a budget, how you support them. And often there’s not a lot of historicals, you’re making a lot of assumptions. So it’s really being a partner and being there to guide them and think through those, those first assumptions and building that first budget.

Odds are, as a startup, you’re gonna be further off than a mature business that you know knows its growth rates and has been around for 50 years. And that’s okay. It’s really about thinking of how you should use resources and starting to think about, okay, where are we gonna be in a year, two years? And is, Annette said, especially with the small business cash, it’s about that burn and understanding what’s happening with cash. And I’ll throw this question out to the, to our panel. Anything you guys would add to that as a startup, what should you really be thinking about as you’re doing that budgeting?

Alejandra Boggione:

So I would say that when you are budgeting in a startup, perhaps a focus should not be in being accurate or, or being able to, to guess where you are going to be next year. The focus should be on building a useful tool that will make you able to grow consistently during the next years. And, and obviously your budget will not be perfect in the sense that you will look backwards and you will say, yeah, we got it right. But <laugh>, I would be really glad if it was a really useful way to make decisions, to allocate resources and to be a real partner to the business itself.

Paul Barnhurst:

I love you said the linkage and be valuable to the business help and making decisions. Because that’s really why we’re planning, right? If you’re planning to be right and you can be right, then go bet on the stock market and retire early because you’re in the wrong profession.

Andrew Childress:

Yeah,

Paul Barnhurst:

Right. We wanna be directionally correct and are there areas we can be right? Like, okay, if they never hire anyone, we know they’re gonna be all there all year and we know their salary, we better be pretty close to accurate on that number. But in general, there’s so many moving parts that it’s about smart decisions, smart assumptions, and you know, building that model up to support the forecast, right? That’s where someone asks kind of the linkage between forecasting and modeling really, you know, a model is a forecast, whether it’s a model for a budget, whether it’s a model for a rolling forecast, whether it’s a model for a capital investment. That’s what, you know, a model is. A model is just a representation of what you think is gonna happen. A budget happens one form of a model,.A forecast is one form of a model. Often sometimes multiple models depending on the company size, all rolled up together.

Andrew Childress:

I’m reminded of the phrase, all models are wrong, some are useful.

Paul Barnhurst:

Yes. George Box, one of my favorite quotes

Andrew Childress:

And using it to guide, I, I love what Alejandra said about using it to guide the business. The point isn’t to get it right, the point is to have something down that we measure ourselves against periodically and say what changes are needed.

Paul Barnhurst:

Yep. I I agree. So, you know, obviously a lot of companies have kicked off the budgeting process. Some may still be doing it. We’ve all gone through that annual process, so, you know, what should finance be doing ahead of time so that they don’t get into the annual chaos and up all night. You still may get there, but what are some things you can do to try to prevent that, to make the process go smoother? So those, you know, months ahead of the kickoff, what should we be thinking about and we’ll, this one with you, Andrew.

Andrew Childress:

So I think the number one thing you can do to get off to a good start is work backwards, right? So you’ve got owners, you’ve got stakeholders that have maybe due dates in mind for when they need to see that finished budget. And I think when you think about it like that, setting up a planning calendar that locks in those key milestones is really helpful so that you can kind of trend towards finishing it up. There’s no mad rush at the end. And then circulating and socializing that calendar within your business partners is really helpful to know where their inputs will be required. So I think, again, setting the expectations early, having that budgeting kickoff session with your business partners to say, this is the journey we’re going on, this is what’s important and here’s how we’ll collaborate with you so that they feel aligned to the planning process, you know, the communication thing. There’s just, there’s no such thing as too much communication when it comes to planning. And I think leading off with those kickoff sessions and calendars really sets the tone strong.

Paul Barnhurst:

I love one thing you said in there, there really isn’t such a thing as too much communication, and I agree you’re always better off over communicating than under communicating. For sure. Alejandra, what’s your thoughts? What are some things do you find finance can do ahead of time that makes the process go smoother?

Alejandra Boggione:

Yeah, I think one thing one thing that you can do to, to get ahead of the process is to go over the tools that you’ve been using for the last years and try to think which of them are are still useful and, and which features perhaps has no longer used. So I do this little exercise to to, to look again at the last budget that I’ve been working in. And if I find some piece of information that has been not used during the whole year, perhaps a chart, a detail or anything in which you’ll, you have been spending a lot of time and effort to get it, but was not relevant in the decision making process. So I would just rethink it because if it’s not relevant, perhaps you can find ways to aggregate that information into a broader category and, and just focus your time and resources in, in other, in other aspects.

And the same exercise would be like looking at the actual strategic plan and see if there is anything new there that should be taken into account in your next budget. Perhaps there is a new corporate policy or perhaps there is a new project that you need to take into consideration specifically in your new budget and then make room for that. But last week I had an interesting conversation with a friend of mine. He is a plant manager in, in the United Kingdom, and he told me that he hated when from finance, we changed it the way that they had to budget from one year to the other <laugh>. So I started thinking about that again. So that would be my, my advice, but I had to address for that for that comment too. <Laugh>.

Paul Barnhurst:

Yeah, no, I think you make a lot of great points. One, you know, review what you should add to the process, what you shouldn’t. I think it’s always good to review it at the end of the year, see how it went, make those changes, but try not to reinvent the whole process. So every year they never know what they’re going to get. And I’ve seen that, especially sometimes when you’re dealing, dealing it all in Excel and all manual and you have turnover and the new person comes in and I like this file or I like that file and you know, the business is like, all right, I have no idea how to fill this form out. It’s completely different than last year. Help me here. And I see everybody smiling. I know everybody can relate to that one. So we’re gonna move on to the next question here, and we’re gonna start with you on this one. Annette, this is a fun one. How do you ensure that the financial plan she’s smiling already is aligned with the operational plan? You know, the finance and business are on the same page. How do you make sure there’s that alignment?

Annette deYoung:

Oh wow. Yeah. Communication. No, but no communication, right? So, you know, you got signup meetings as long as you’ve got that open communication and I’ve done that throughout my career, you know, where are sales going, okay, let’s get operations. Everybody has to be in the same room and they all have to have the same voice, right? So a lot of times you get where, you know, operations is doing something and sales is doing something else, and that’s where you create like that gap. So really it’s our job to get everybody in the room to talk, right? Where is, you know, where are our revenues going, you know, for the next, you know, even if it’s just the next two to three months, right? And operations, you know, how can you meet this demand or pull back But when you’ve got, you know, one hand doesn’t know what the other one’s doing, that’s where you have a lot of those issues because operations doesn’t know any better. They’re just gonna run whatever it’s right that they’re told to do. And so I just think getting everybody together, making sure that everybody has a voice in the future of the business and their strategic partners, not just, right, I just do this or I just do this. Right? Everything that you do really has to be for the benefit of the company as a whole.

Paul Barnhurst:

I really like something you said there, you know, beyond obviously the communicate, but you know, that strategic partner and everybody has to be in it together because I’ve definitely seen times where people are kind of disconnected and they feel like they’re just given a number and you’re not gonna be aligned when that’s the case. That’s a great point there. Alejandra, any thoughts from you on this question?

Alejandra Boggione:

Yeah, I think Annettecovered it up pretty well. So I would only emphasize, I like what she says because communication needs to go both ways. So I think that from financial department, we just need to also figure out ways not on, not only to be clear enough, but also to learn how to listen and, and search of the, of which, which are those things that we can do to make those plans to be aligned and not just sit back and wait for everybody else to align their themselves to our financial plan. So that would be, that would be it.

Paul Barnhurst:

Thanks, and I appreciate that. Great, great points there from both of you. Thank you. So I’m gonna go back to a question we had earlier and then we’ll go back to list of questions we had here. And I’m gonna send this over your way, Andrew. So, you know, Shaheel here mentioned she’s working for a startup and just ask, can you throw some light on a static annual budget versus a rolling forecast? So maybe I, I’ll start with can you, can you explain for our audience the difference and then from your perspective, is it a one, is it an either or question, or should you have both or how do you think about it?

Andrew Childress:

Yeah, it is a great question. So just I guess for background, you know, the way that I think about these two kind of approaches is an annual budget is once a year you sit down with the business and your leadership and you lay out what the future should be, and you come up with ideally, you know a three statement model that says, here’s where we’re gonna be for our next calendar or fiscal year, right? And so then you measure yourself against that throughout the entirety of that period. Whereas a rolling forecast, typically what you’re gonna do is periodically you’re gonna update your forecast for the next X periods. So many companies will use an 18 month rolling forecast that every month or every quarter they’re dusting off and saying, this is what the next period of time looks like. So which of those two is better?

I would say both and neither each of them have their uses. Each of them have their, you know, pluses and minuses. I think for large organizations, you’re typically gonna see that annual budget. A lot of that in my view, has to do with compensation and how people are measured against targets, right?

So you have that locked in budget that you use for the entirety of the period, but I think it’s really important to kind of think about the environment that you’re in and what would work best for your environment. I noticed that they mentioned that this is a startup and I think in those types of environments, a rolling forecast can be really powerful. Most startups I’ve, I’ve worked for or been in, things are constantly changing. They’re constantly in fluxx. The product that we’re offering today is radically different than what we did a year ago. And I think the more dynamic you can be with your planning process, the more powerful it’s so that you can continually iterate on it. With that said, that requires having the staffing and the the bandwidth to do so. So it can be a challenge to set that up, but I think really if you can get to a rolling forecast for that type of fast moving environment, it’s really powerful.

Paul Barnhurst:

Yep. And, and I’ll just add one thing to that on my thoughts. I mean, I think they both have their power, they both have their place, and the reality is you can do both. They can go together, you can have an annual budget and then do a rolling forecast where you’re looking out 12 months every time and you track to both. So it’s not always an an either or. They both have their places and a lot of people like to have a frozen budget that no matter what changes, you don’t have to have that. There’s beyond budgeting earlier episode of FPA today, we had a guy by the name Bjorn and he wrote a book on beyond budgeting. We had another guy on from Chili Piper, who talked about how they didn’t, they did away with the traditional budgeting process. So there are other options. It’s a matter of figuring out what works best for you. And there are pros and cons to every one of these approaches, and we could spend a lot more time talking about it than we have in this hour, just on the pros and cons. Yeah, so I’ll just give an opportunity, Annette or Alejandra, any thoughts you would add to that on budget rolling forecast, that discussion there?

Annette deYoung:

Yeah, and I’m gonna be really American in that. I’m going to liken it to sports. So think of it almost like, you almost have to think of it like American football, right? Where the end zone, the goalposts, that’s your budget, right? That never moves, but your players move on that field. Every down is a forecast. Every down is like, you’re just, your really, your, your goal is to get to end zone. That’s kind of your budget, right? So every play kind of gets you directionally correct, right? At least going in the right direction. But it can definitely change. You go forward, you go backwards, right? Et cetera. But having a static budget, at least you have something to compare to as the year goes on, as the time goes on. And of course you’re gonna compare that forecast to your budget too. Are you doing better or worse? So I think to your point, like they’re both really necessary and I don’t think one’s better than the other by any means. I think they both can live harmoniously together you know, with very few tackling hopefully.

Paul Barnhurst:

Alright, thanks Annette. Alejandra, anything you wanna add to that discussion or,

Alejandra Boggione:

Yeah, I believe that I agree with, with what you were saying and, and actually in my experience, we use both together and that’s the way that we find that they work the best. So when you are facing also high levels of uncertainty, perhaps right now most of our operations are in countries that are facing high rates of inflation between a hundred to 200 percent. So in that matter, we, we find that having a a clear budget is really appreciated because with inflation comes confusion and you need something to tell you, which is the direction you need to be leading on. But also the, the, the forecast is what gives you the flexibility to choose different paths in order to achieve the goal. So I agree with you and especially either because you are in a startup that it’s a fits a business with a lot of changes or you are in a mature industry, but in a really uncertain market, I believe that these two tools are really important to move forward.

Paul Barnhurst:

Great point. So I’m gonna just share a couple comments. We got, you know, we have here Carolina, in my opinion, it’s still necessary to freeze one version of the rolling forecast, kind of what Annette was talking about, the goal post to be used as comparison, you know, for all other matters, rolling forecast work wonderfully. So there’s one opinion, another I know org I used to support would say the original budget was strategic and the updates rolling. Were tactical, right? And so there’s a lot of different ways to think of it. Everybody’s gonna have different, different opinions. What we’re gonna move on to here is a little bit about scenario planning. And so I’m gonna throw a question out to our audience and if you guys just can throw in the chat, how many of you are doing scenario planning today? I know that number has grown over the last couple years, as it feels like every time we turn around the world turns upside down. There’s an energy crisis inflation, a crisis abroad, a global pandemic. I’m sure I’m missing 10 or 12 other things that we could throw in there. Interest rates going up, right? All, all those type of things. So it’s really, scenario planning has become much more important. And I’d love to just get all of your thoughts on what advice you could offer around scenario planning. How should people think about it? Maybe how have you used it in your businesses and in your processes? So why don’t we start with you on this one, Annette?

Annette deYoung:

Yeah. best case, worst case, and reality. I mean, honestly, that’s, you know, that’s kind of been the way that I’ve always done scenario planning is really those three best case. We’re actually gonna do what the sales team says we’re gonna do. There’s my best case, right? We’re gonna roll it back a little bit to reality. And then again, we look at what’s kind of going on in the world and then we have to do a worst case. What if, you know, for instance, what if we lose our top customer, right? Those types of things. You have to think about that, right? There’s a lot of competition out there regardless of what industry you’re in, you know, so you always have to have, okay, worst case, if this happens, this is where we need to pivot as a business where, where we need to cut costs. And you have to have a plan in place for that, right? Best case, we all hope for that, right? But you, you, I’ve always just kind of done those three different scenarios that really any company I’ve ever worked for.

Paul Barnhurst:

I think that’s great. No, I had on an episode shruthie Lanka, she’s the CFO of public.com, and she mentioned her worst case. What she always does is strip out everything but only the guaranteed revenue, only things we have contracts for and say, okay, what does my profile look like in this situation? How long can I survive? What’s my cash like? And then she builds up from there to the other scenarios. So now I have kind of that doomsday scenario, so to speak, and at least I know, okay, if that happens, here are my options and I can build from there. So I think it’s similar to what you’re saying, Annette. There’s a lot of different ways to look at it. And yes, often, depending on what kind of sales leader you have, the optimistic is the sales team. Or if they’re really good at sandbagging and I’ve had a few <laugh>, then you’re pessimistic is the sales team and you have to go back to ’em and say, no, I know you have this, this, and this. Like, I one time had a salesperson who I think they put in, in a number for a big supplier of like 600,000 and it ended up being 11 million for the year. Like what was an uncertain, we didn’t know where the contract would end up. And the head of sales was just like, are you kidding me? Like you put that number in. So yeah, I’ve seen some definite sandbagging before, but we’ll go to you. Alejandra, what’s your thoughts around scenario planning?

Alejandra Boggione:

Yeah, I, I believe that scenario planning itself is like really great fun, even interesting, but you need to be careful not to overwhelm the whole system and to keep it relevant. So I agree with Annette to identify only like a few and impactful situations and try to think of the reaction to those. And for me it is also very important to, to be very clear of which is the shifting point with from one to the other, who’s gonna take that decision and how is that going to be communicated to the rest of the organization? Because in this cities scenario planning can be very interesting, but can be not so effective if you don’t have like this criteria really well established among the, the whole company. And another thing that perhaps I I have been thinking about the last few years was if it’s useful to plan for like a black swan scenario. I know it’s kind of paradox because you, you don’t know what a black swan event can look like. But I know that you can identify which is the key driver of your business and just try to think what a shock to that would look like. And and outline which will the course of action be in that matter.

Paul Barnhurst:

Yeah, I, I love two points you made there that really stuck out to me. One, I agree with the black swan. We don’t know the details of a black swan, but they happen every so often and you can still plan at a high level for one. And then the second thing that I really like that you talked about is not going overboard and making sure it’s actionable. Okay, if I got the scenario, if like you have a scenario that says what are we gonna do in a recession, then you also need to go, okay, when do we start implementing that plan that goes with the scenario. ’cause Often we just build the scenarios and then we take the middle and forget all about it. And that’s not really scenario planning, that’s just extra work. If you don’t really think about what’s the steps we’re gonna take if situation A, B or C happens, that’s where the real benefit can come.

’cause That puts you ahead of the curve and you start to see those trends. You can say, okay, we already know what we’re gonna do. And you could start to prepare yourself, whether that be a growth phase, whether that be contraction, whatever it might be from that scenario. So I really like that you pointed that out because I think sometimes we forget about that part really, that they’re, each of those scenario plans need to have those actions with them. It’s not enough to just put a number on the board and be like, all right, we got our number, we can move on now.

Andrew Childress:

Yeah. You know, I think going back to the original question of why is scenario planning important, to me, it’s to make your budget more useful, make your plan more useful. Because how many times have we had a significant event that radically changes the outlook for the business and then we tear up the budget and stop using it as a measuring stick, right? . So alternatively, if you have some flexibility and some scenarios built into your budget, you’re basically making it a much more useful output. And yeah, I really like what Alejandra said about, you know, the black Swan events because even though we dunno what they’re by nature, we still need to have plans for whatever our scenarios include. So many FP&A professionals will get overwhelmed about what to forecast as a scenario when in reality you don’t have to know the specifics. You just have to know if my COG shoots up 10%, what will be the actions I take as a result? You don’t have to have the individual drivers or actions named, you’re looking for those heuristics that say, when this trigger point happens, here’s the action we’ll take.

Paul Barnhurst:

And I think that’s a really good point. You don’t have to have the details of exactly everything that’s gonna happen in a scenario or even what triggered it per se. But if certain things happen, how are you gonna respond? So I really like that. I think that that’s a good point there. I like what ADI says here about black swan swans, I’ll just throw this up there. When those black swan events happen, I’ve seen effective managers push to find the bottom and plan accordingly. And I think that’s a good point. You try to figure out what’s the worst case and you know, kind of figure out from there. Ho hopefully you’ve already done that in a scenario, but yes, you need to do that. I mean, how many of us, I know, I’ll raise my hand. Our budgets were blown, oh, about end of March, 2020.

Did anyone have budget that was still any good? Right? I know mine was completely shot and we were re-forecasting and re-forecasting and re-forecasting again. So, you know, having thought through that can really save you a lot of time. So going to the next question here. So we’ve talked about scenario planning, we’ve talked a little bit about budget and thinking about that, how do each of you think about forecasting throughout the year and have you found an approach that you think works best for that? And Andrew, we’ll go ahead and start with you on this one.

Andrew Childress:

Yeah, it’s actually, I think a really good overlap with what we were talking about, about budget and rolling forecast. That if you can get to a place where you’re always forecasting and then simply carve out a period of time and make that your budget. So that can really be an effective process. But you know, again, just like we’ve been chatting about the budget is that goalpost that you need to have to always have that annual measuring stick, right? Really the goalpost analogy that Annette gave us, but the forecast is that ongoing continuous story of what we see is happening. So, you know, again, good business partnership and, and looking ahead to the future is about frequently revisiting it and constantly updating what our outlook is. And I think that is the role. The forecast is to manage, measure and message what we’re gonna do in the near term.

Paul Barnhurst:

And any thoughts on how often it should be done? Have you had, you know, best practice or do you find it varies from company to company? What’s your thoughts on how often you should be re-forecasting?

Andrew Childress:

You know, I think I, I’ve been different places that handled it differently. Some would do an ad hoc when changes are needed. Others were in a, you know, robust every month forecast process. I think you need to decide how often the fundamentals of your business are shifting such that you need to create a new forecast. So if you have a very interest rate sensitive business or you know, oil price sensitive business, this is where you’re probably touching it and and keeping it updated pretty often versus if you don’t have, you know, constantly shifting things, let’s do a quarterly forecast and focus on running the business instead. So I think you really have to assess the environment you’re in to know what’s right for you.

Paul Barnhurst:

Great point there. And I really like something you said let’s focus on running the business versus re-forecasting again. And it’s a balance. I can see Annette and Alejandro both smiling on that one ’cause I’m sure they’ve probably been on both sides of that, that equation. So we’ll go to Annette and then we’ll go to Alejandro. Any thoughts on this, Annette?

Annette deYoung:

Yeah, and, and I agree with Andrew and, and when you think about forecasting too don’t do forecasting for the sake of doing forecasting. <Laugh> honestly, I I mean, yes, thank you. It’s, I’ve had jobs where you reforecast every single month with very little change, but the amount of labor that you have to put into that, especially when you’re working with just excel right systems. And so really just the amount of like you know, it, it, it can get emotional sometimes, right? Because you’re literally re-forecasting with very few changes, but you’re doing this process, you’re almost doing a full budget process month after month after month after month without really seeing the benefit of it. So to your point, right, what are your key drivers? If it’s volatile, absolutely you should be re-forecasting more often if it’s not a quarterly reforecast. And even sometimes, you know, once you know, do your six plus six, see where you’re at, you know, half of the year, you know, reforecast and then move on. So it, it really just does depends, right? What is the company, what are the key metrics and how often do they fluctuate? Because I think we’ve all been there where we just did forecasting for the sake of doing forecasting and it doesn’t really benefit anybody. It really just burns you out.

Paul Barnhurst:

I, yeah, I had a place where we did it eight times a year, we did it everything but quarter close and we had to forecast the current year plus 36 months out and it was, it was not fun. I, I think I’ve been on bo both sides of that. Alejandro, what are your thoughts?

Alejandra Boggione:

Yeah we used to focus quarterly but since last year due to the inflation rates and the center and the, and the content context that I was telling you before, we decided to forecast every month. And although it is a lot of work, we believe that it was the right decision because so long we are being able to stay on top of the situation, but also we, we decided to simplify the process as much as we could. So we are really forecasting, I don’t know, like six or seven lines of, of our budget. And we are doing that process in, in a bottom up approach and trying to to consume as less effort as possible. But it is also given everybody this, this sense of security or safety or something that, that makes them feel that we are still on, on the good track. So, so long it’s been a good experience and, and we’ll we’ll see how it goes in the next months. Yeah.

Paul Barnhurst:

Thank you. Appreciate that. And you know, I worked at a large Fortune 500 company and we switched from doing, we did a quarterly forecast, we went to a monthly risk and opportunity process where we forecasted everything at a high level. They built out the system where we just loaded it no longer worrying about every cost center and all the details. And I found that worked well for us. It freed up time and I’ve implemented that in another company I went to. And funny thing, we weren’t doing any regular forecasting, so I implemented it, we got it all in place with my regional CFO and then the global CFO said, we want you to do a full forecast every month. Okay, glad I spent three months on that process, but that’s how it works sometimes. But I’ve always found that worked well as a good balance where you’re looking at things regularly and understanding, you know, what’s going on and making sure you’re focusing on those six or seven key things, but you’re not forecasting for the sake of forecasting.

You’re getting into every single detail. So I think the big thing here is you need to forecast periodically. It’s going to depend on your metrics, how your business changes, and there is no right method. It might be some areas you might be forecasting weekly, some you might be forecasting twice a year. Some you might be doing an R and O, some you might be doing a rolling. There are best practices and there are people you can talk to and things you should think about. But there is no right answer for forecasting or for budgeting. If there was, we’d give it to you, but we don’t have any secrets that just magically make the process happen. If I did, I’d be selling it to y’all. I’m kidding.. So, you know, we’re coming up near the end of our time. We just have a couple more questions left.

If anyone has any questions in the chat, you know, please feel free to put those in the comments. But this next question is gonna be a little bit around technology. Now this is an area where obviously we’ve seen a lot of change, but we all know the dominant tool for planning. And if I ask the people in the audience how many are using a spreadsheet to plan, overwhelmingly, I’d guess that’s, I would guess that’s the answer. But how should you think about technology and and tech stack in the budgeting and planning process? Like, you know, what role does it play? Maybe what are some of your thoughts? And on this one we’ll start with you, Alejandra. How do you think about technology to help you with budgeting and forecasting?

Alejandra Boggione:

I believe it is really helpful and it’s also depending on the size of the organization, quite a challenge to get passed through Excel and, and Excel and perhaps implementing someBI tools like Power BI or something like that. But when, when we are thinking of moving perhaps to a specific software or something like that, I personally have no experience because when we assessed that matter, we, we really thought that it was not the right fit for our organization. Sure. And, also implementing and, and moving forward with technology, one of the things that I believe it, it really in enriches the FP&A function is that all the flexibility about reporting and visualization tools helps you tell you tell a better story and, and communicate better with their stakeholders. So I, I believe that one of the great advantages of technology is also to smooth communication across the whole company.

Besides Be freeing you Up time to doBetterAnalysisAnd, and stuff.

Paul Barnhurst:

Thank you. I, yeah, it’s different for each company. You know, what you should put in place and if you need a tool and when you need it. And so I appreciate your thoughts there. Andrew, what are your thoughts?

Andrew Childress:

Yeah, so I think that the right way to think about it for teams is to start off by assessing what you wanna accomplish with your planning process, right? What level of detail do I need to deliver? How involved do my stakeholders need to be? How often do I need to do it? Get that process in place, even if you’re seeing that it’s running a little slow without a tool in place. And then assess what are the gaps in how I’m planning today? Do I need to be able to go faster. Do I need to be able to bring collaborators into the budget process, even if outside of Excel with a tool in a platform, and start, you know, push the limits of what you’re doing and then figure out where you need the help before you just go out and buy a planning tool for the sake of buying a planning tool. Right? And I think, again, it goes to getting your process in place and really getting that down pat, and then figuring out where tools can come along in the process.

Paul Barnhurst:

Kinda like buying a car without thinking about what kind of car, what you need to use it for. And then a month later you’re like, why did I do this? And you have a nice big purchase on your hand. So I think you make a great point of really going through the assessment and thinking about what you need. Annette, any thoughts you would add to this question?

Annette deYoung:

Yeah, I would honestly say that finance is probably the last department that gets funded for tech. <Laugh>. I, I mean, honestly, and especially in manufacturing, there are so many other areas where the company is willing to invest and spend money. Finance traditionally isn’t one of those, for the most part because we’ve learned to manage with the tools that we have, right? They’re still getting their reports, they’re still getting the metrics that they need, despite the fact that we work 60, 70 hours a week, right? But we’re getting the job done. We find a way to do it. And so when you do finally get to that point where you’re like, I, you know, I want time to myself, I want a better process, you know, I, I can’t make this any better than I have it today, right? Without now bringing in something else.

That’s where you, you’re, you know, then you have to sell it to management, right? This is why we need it. Again, it’s that, well, you always give what I need. Yes. But they don’t understand the human capital behind it. And so that’s where I think a lot of times finance is really the, the last department really, you know, within a business that gets funded for these types of things. But yes, so you get to the point, and I think we’ve all been to that point in that career. Were like, I just can’t do it like this anymore. There’s gotta be an easier way, right? Yes. All of us. And, you know, and, and for those of you who know me, you know, I’ve learned SQL, I learned, you know, I learned how to write VBA a I’m like, I learned as much as I could to make my job easier.

But there comes a breaking point, not just your sanity, but your Excel, right? I always joke that I, I work with coworkers, Al and Frank that stands for Albatross and Frankenstein, and we have those coworkers and those are Excel spreadsheets that we use today, right? They started out a simple process and we keep adding and adding and adding until it’s 20 megs, right? You have to turn off auto calculation in order to make any kind of change, because otherwise it just heats up all the memory on your computer. So yes, there will come a time when you’re going to need technology, right? And I would say plan for it sooner than later so that you don’t get to the breaking point before you finally, you know, get to where I need something, plan for that. Because technology is moving and I really believe that, you know, the sooner you can adapt that, you’re gonna be much further ahead than your competitors.

Paul Barnhurst:

Thank you, Annette. Appreciate that. And so, moving on to our last question here. We just have a couple minutes left. This is one we ask pretty much in every episode, every, so it’s, what is your favorite thing about Excel? It could be feature or function, and we’ll start with Andrew here.

Andrew Childress:

Yeah, definitely for me, hands down’s, Power Query. You know, I think being a little bit lazy in life is a good thing. You go searching for faster and easier ways to do things. And I think, you know, the power to automate, you know, the data pipeline and, and cleaning it up and getting it into my reports and analysis, probably the number one thing that shifted my career and freed me up to do more analysis work. So just a big fan of, of of that feature just to, because of the time it gives you back to do all the fun stuff.

Paul Barnhurst:

Love me some Power Query. It’s one of my favorite courses to train people on. ’cause The light bulb goes on when they see what they can do. Annette, how about you?

Annette deYoung:

Yeah, not necessarily a feature or a function, but the overall flexibility of Excel. You can literally do anything in Excel, literally anything you wanna do. And we’re talking outside of math, right? Outside of the numbers. I’ve used Excel for so many non-financial, you know, things that I’ve had to do over my career. And, and even personally, I’ve used it as design software when I’m trying to create something. So I just think the overall flexibility and the fact that you can make it do and look however you need to.

Paul Barnhurst:

Yeah, no, that’s, that’s a good one. Thank you, Annette. Alejandro, how about you? What’s your favorite thing? Okay, so the things that I use most

Alejandra Boggione:

Perhaps are like Pivot tables or VLookup, and I still find them, find them really useful. And I also love macros And started in, in investigating a little bit of BBA and, and starting to get the hang of that. And that’s really a new, a new world for me. So I would go with that.

Paul Barnhurst:

Great. So there’s a, a, a few different ones we had there from our audience and there’s so many different things. Flexibility is great in Excel. Thank you Annette, Alejandra and Andrew for joining us for this session. Really appreciate it. You know, if anyone from the audience wants to reach out, you can find each of ’em on LinkedIn and contact ’em there if you want. I’m sure they’ll be happy to answer your questions. And thank you for, for joining us. If it wasn’t for you, the audience who we wouldn’t be successful, so thank you.