Month-end close can be one of the most stressful periods for finance teams. A single mismatch between accounts can delay reports, raise compliance concerns, and create unnecessary back-and-forth with auditors. Companies need reliable account reconciliation software to bring all account data into one place and highlight mismatches before they become real problems.

Such accounting reconciliation software replaces time-consuming manual checks with clear and trackable records that make every adjustment easier to verify. Finance teams can see what needs attention instead of losing hours in spreadsheets and email threads.

The following guide rounds up the best reconciliation software for accountants and CFOs who want to experience visibility across every step of the financial close. We also provide guidance on how to choose the best account reconciliation software for your needs.

Key Takeaways: What is the Best Tool for Account Reconciliation?

When you’re choosing an account reconciliation software, the final decision depends on your finance team’s size, workflow, and preferred tools. Based on our analysis, here are the top three solutions that stand out for performance, integration depth, and usability.

- Datarails Month-End Close: Best overall choice for finance teams that depend on Excel but want a more controlled, connected close. Its Excel-native environment makes it easy for teams to transition from manual spreadsheets while gaining structured workflows, approval tracking and real-time visibility.

- BlackLine: Best enterprise-grade platform for organizations that manage complex reconciliations across multiple entities or geographies. AI-assisted workflows make it a go-to choice for companies prioritizing scalability.

- NetSuite: Best for businesses already operating within the Oracle NetSuite ecosystem. With advanced auto-matching capabilities and seamless ERP integration, it handles large transaction volumes with speed and precision.

Each of these tools brings a different strength to the table: Datarails for simplicity and structure, BlackLine for automation at scale and NetSuite for deep ERP-driven reconciliation.

What Is Account Reconciliation Software?

Account reconciliation software is a digital tool that helps businesses make sure their financial records match up. In simple terms, it compares two sets of data, like your company’s general ledger (GL) and bank statements, to confirm that every transaction adds up. If something doesn’t match, the software flags it for review and helps teams find and fix errors before they cause bigger problems.

Traditionally, accountants handled reconciliations manually with spreadsheets and long paper trails. That process was timely and easy to mess up.

Modern account reconciliation tools change that by automating data matching and tracking adjustments. They also keep everything organized in one place. These features result in faster and more transparent month-end close that reduces manual work.

Account reconciliation software also strengthens internal controls and financial visibility. Their use shortens the audit cycle, simplifies variance analysis, and supports faster financial reporting.

In addition, they have the following features:

- Automated transaction matching for quick comparison of large data sets.

- Exception management to flag discrepancies.

- Real-time dashboards to provide visibility into reconciliation status.

- Audit trails for transparency.

- Workflow automation to assign tasks and send reminders to the team.

- Data integration with ERPs, CRMs, and banking tools.

- Compliance support to follow financial reporting standards.

These capabilities make account reconciliation software an essential part of modern finance operations. More importantly, centralized visibility allows CFOs and controllers to monitor reconciliation status across all entities in real time, which reduces the risk of missed adjustments or compliance gaps.

Top 12 Account Reconciliation Software

| Account Reconciliation Software | Best For | Integrations | Compliance | Pricing |

| Datarails | Excel-using finance teams | All major ERP systems | SOX compliance | Custom |

| BlackLine | High-volume reconciliations | ERP and financial systems | Audit-ready compliance | Custom |

| NetSuite | NetSuite ERP users | Native NetSuite GL integration | SOX-ready, full audit trail | Add-on, custom quote |

| FloQast | Mid-sized finance teams | ERP & GL systems | Audit-ready & automated | Custom |

| Xero | Small businesses | Bank accounts & apps | Automated & tax-compliant | From $29 per month |

| Adra | Mid-sized businesses | NetSuite, Microsoft Dynamics, and Planful integrations | Audit-ready compliance | Custom |

| Solvexia | Large and mid-sized finance teams | ERP, GL, banks, PSPs | Audit-ready with full traceability | Custom quote-based |

| Redwood | Enterprise finance teams | Major ERP systems | Full audit trails | Custom quote-based |

| HighRadius | Large enterprises | ERP-agnostic | Continuous audit readiness | Custom quote |

| OneStream | Large enterprises | Unified CPM platform | Built-in audit trails | Custom quote |

| Numeric | Real-time reconciliations | Major ERP systems | SOX compliance and audit trail documentation | Custom pricing |

| Kosh | Multi-source financial reconciliations | ERP and banking systems | Transparent audit trails | Custom pricing |

The account reconciliation software market is full of options, from platforms built for large enterprises with complex reporting needs to simpler systems for small and mid-sized teams. Below, you’ll find 12 accounting reconciliation software that help finance teams maintain accurate records month after month.

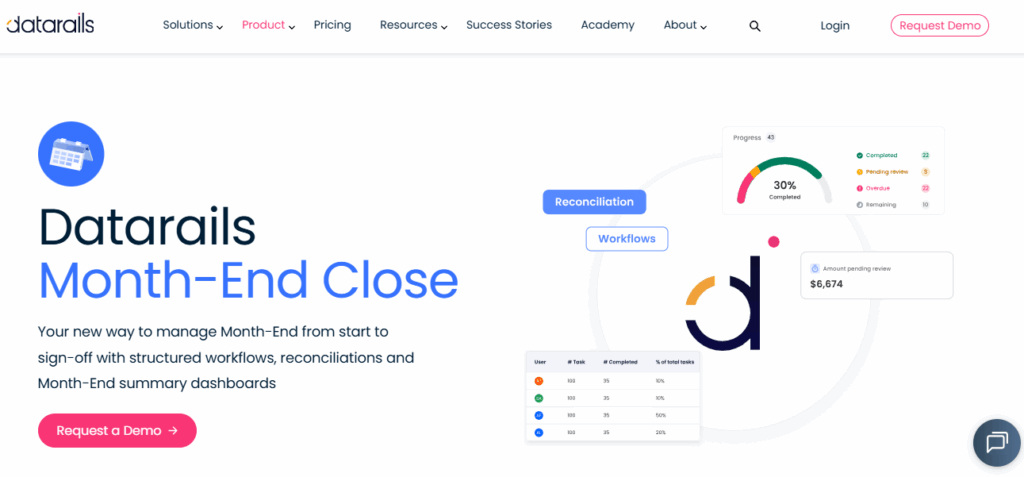

1. Datarails Month-End Close

Best For: Finance teams that rely heavily on Excel and want to modernize their month-end close

Datarails Month-End Close is an accounting reconciliation software for finance teams that want better structure and control over their closing process. It combines reconciliation management, task tracking, and real-time dashboards in one place while keeping the familiar Excel interface intact.

Key Features

- Structured Workflows: The software allows users to create and customize checklists that match their preferred close process. Each task can be assigned to specific team members, complete with deadlines and completion tracking for full accountability.

- Centralized Reconciliation Hub: Datarails offers a single dashboard where all account reconciliations are managed, including version history, approval workflows, and sign-off tracking.

- Variance Analysis: Finance teams can perform variance analysis directly in Excel or through interactive dashboards to identify and investigate discrepancies.

- Integrations: The platform integrates securely with both internal and external data sources, including major ERP systems.

- Excel-Native Interface: The tool works directly within Excel, allowing teams to continue using their established models and templates without needing to learn a new system.

Pros

- Easy to adopt for finance teams that already depend on Excel.

- Strong SOX compliance.

- Month-end summary dashboards for close monitoring.

Cons

- It may not be ideal for companies moving away from Excel-based systems.

- Higher implementation efforts.

Pricing

Custom pricing is available upon request. Datarails provides personalized quotes based on company size, reporting complexity, and month-end close requirements.

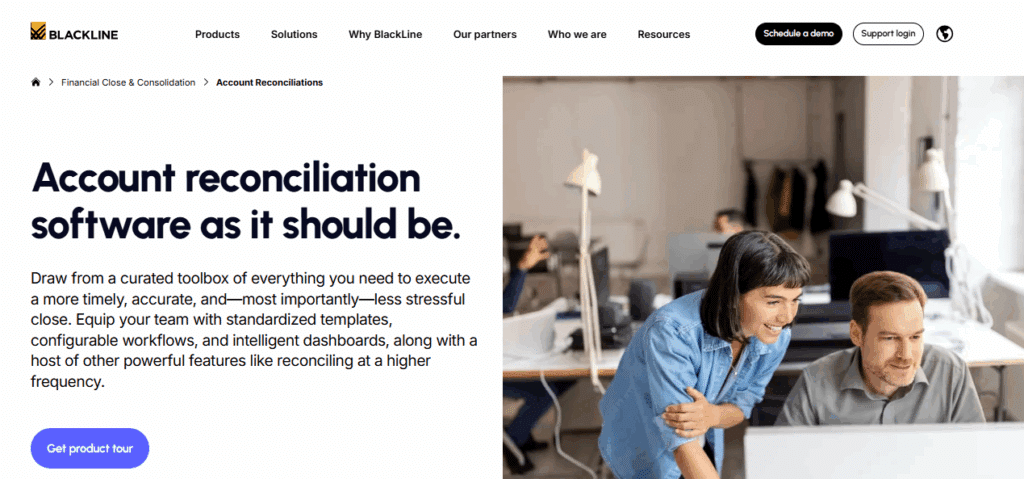

2. BlackLine

Best For: Large enterprises and global organizations that need reliable financial reconciliation tools for high-volume account management and compliance

BlackLine stands out among reconciliation software solutions for its ability to transform manual, time-consuming reconciliation tasks into an automated process. The platform provides standardized templates and intelligent dashboards that give full visibility across every reconciliation cycle.

Key Features

- Verity AI: Built specifically for finance, this AI engine understands complex workflows and helps detect anomalies while maintaining control and data integrity.

- High-Frequency Reconciliation: The platform supports daily or as-needed reconciliations to address discrepancies faster.

- Centralized Dashboards: It offers a single, actionable view of reconciliations, account statuses, and historical data for quick audits.

- Compliance and Audit Control: BlackLine strengthens internal controls with approval tracking, version history and audit-ready documentation.

Pros

- Scalable solution ideal for enterprise-level accounting teams.

- Strong automation and audit compliance features.

- Proven time savings with measurable results from global users.

Cons

- Implementation and customization may require dedicated IT or training resources.

- Pricing may be higher than mid-market alternatives.

Pricing

Pricing is available upon request.

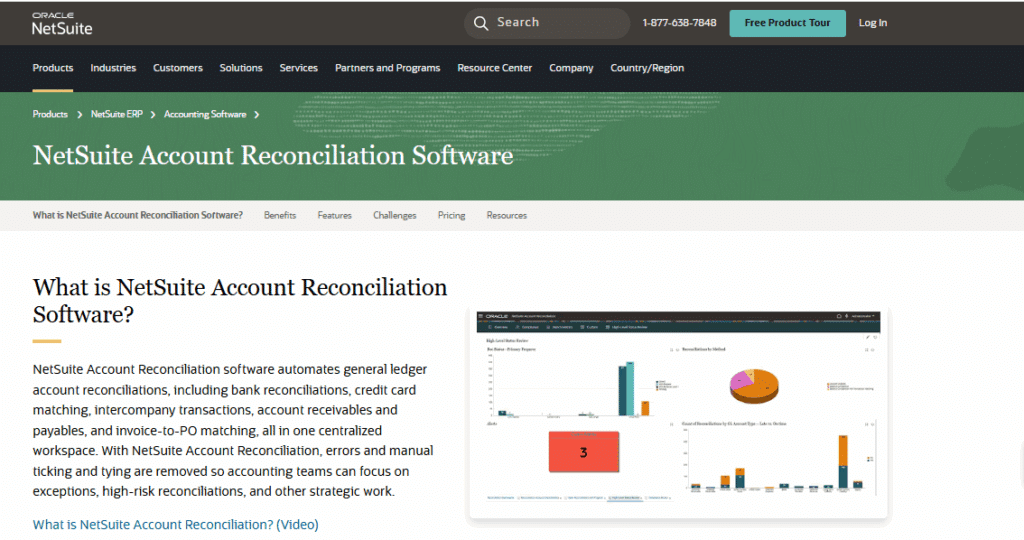

3. NetSuite Account Reconciliation Software

Best For: Businesses using Oracle NetSuite ERP

NetSuite Account Reconciliation Software brings together all reconciliation activities into one secure workspace. The system’s auto-match engine can handle millions of transactions within minutes, so it’s ideal for large or fast-growing companies managing high volumes of financial data.

Key Features

- Reconciliation Compliance: It tracks justification for adjusting entries, manages approvals, and keeps a detailed audit log for accountability.

- Transaction Matching: NetSuite uses an intelligent auto-match engine to match one-to-one or many-to-many transactions across multiple accounts.

- Flux Analysis: The platform highlights balance changes across periods to help identify discrepancies early.

- Task Management: It monitors every step of the close with task assignments, approvals, and automated calendars for recurring cycles.

Pros

- Direct NetSuite ERP integration.

- Large transaction volume handling efficiency.

- Strong audit trail and compliance support.

Cons

- Works best within the NetSuite ecosystem.

- Steep learning curve.

Pricing

The account reconciliation software is available as an add-on module at an extra cost. Pricing is available upon request.

4. FloQast

Best For: Companies using Microsoft Dynamics and SAP

FloQast is the first accounting transformation platform powered by AI agents. It helps finance teams automate accounting workflows, optimize and centralize the close process, and gain full visibility across operations.

Key Features

- AI-Driven Reconciliation: FloQast matches thousands of transactions automatically.

- Smart Checklists: The platform creates customized close checklists based on industry, company size, and stage.

- Variance Detection: AI scans transactional data to identify variance drivers and automatically generate explanations.

- Inbox Automation: The tool automates up to 40% of close-related email communication and document requests.

Pros

- Automates end-to-end close workflows.

- Strong AI for reconciliation and variance analysis.

- Integration with Excel.

Cons

- Limited flux analysis.

- It may be expensive for some teams.

Pricing

Pricing is available upon request.

5. Xero

Best For: Small business owners

Xero’s bank account reconciliation software makes it easy for businesses to keep their financial records accurate and up to date. It automatically imports data from connected bank accounts to allow users to reconcile transactions daily and view real-time cash flow insights.

Key Features

- Bulk Reconciliation: Users on Standard or Premium plans can reconcile multiple transactions at once.

- Bank Rules: You can set up bank rules to manage recurring transactions consistently.

- Automated Transaction Matching: Xero’s banking reconciliation software matches transactions to invoices, bills or receipts automatically.

- Mobile-Friendly: The Xero Accounting app allows business owners to complete their account reconciliation in minutes, even on their phones.

Pros

- Real-time bank data synchronization.

- User-friendly mobile interface.

- Automated transaction matching.

Cons

- Bulk features require higher-tier plans.

- Limited customization for complex reconciliations.

Pricing

The Starter plan comes at $29 per month, the Standard plan is $46 per month, while the Premium plan is $69 per month.

6. Adra

Best For: Mid-sized organizations that want to automate financial close

Adra by Trintech is a financial reconciliation software built to help finance and accounting teams close the books faster. It seamlessly integrates with leading ERPs and automates key workflows such as transaction matching, reconciliations and journal entries.

Key Features

- Multi-Way Transaction Management: Adra enables complex transaction matching across multiple data sources for accurate reconciliation.

- Real-Time Insights and Analytics: Built-in dashboards deliver live financial insights, helping users monitor close status and identify process improvements.

- Journal Entry Automation: Adra streamlines journal entry creation, validation and posting to minimize errors and support audit readiness.

- Financial Close Task Management: Teams can automate close-related tasks and track progress from a single dashboard.

Pros

- NetSuite, Microsoft Dynamics and Planful integrations.

- Time reduction in the month-end close.

- Improved accuracy and visibility across the financial process.

Cons

- It may be complex for small businesses.

- Time-consuming implementation.

Pricing

Pricing is available upon request.

7. Solvexia

Best For: Finance teams managing high transaction volumes

Solvexia is a powerful account reconciliation software that eliminates manual checks and repetitive spreadsheet work. The platform combines automation, AI-powered matching, and real-time dashboards to deliver control at scale.

Key Features

- AI-Powered Transaction Matching: Solvexia automatically matches transactions across multiple systems using AI and fuzzy logic, achieving up to a 99% match rate.

- Real-Time Dashboards: Finance leaders can monitor every reconciliation process in real-time for faster reporting and better control.

- Exception Handling and Transparency: Built-in audit trails and intelligent exception handling reduce manual intervention by 98%.

- Customizable Workflows: The platform allows users to build rules that fit their data and processes to support both simple and complex reconciliation requirements.

Pros

- 100x faster reconciliation processing.

- 98% reduction in manual errors.

- Built-in compliance and audit-ready controls.

Cons

- Requires training for full customization.

- Not suited for smaller organizations.

Pricing

Pricing is customized based on your company’s requirements.

8. Redwood

Best For: Enterprise finance teams managing large-scale reconciliations.

Redwood offers robust account reconciliation software to save accounting teams hundreds of hours by automating up to 80% of manual reconciliations. Its finance automation solution provides greater control across every phase of the financial close, whether deployed in the cloud or on-premises.

Key Features

- Top-Down Automation: The platform automates up to 70% of work across the financial close process through a top-down, risk-based approach to balance sheet certification.

- Fraud Detection: The system’s built-in monitoring and alerts identify anomalies, unauthorized transactions, or inconsistencies that could indicate fraud.

- Account Verification: Automated matching and verification keep reconciliations ready for stakeholder reporting.

- Dashboards: Users can monitor reconciliation progress in real time with dashboards that highlight bottlenecks and provide a complete overview of all processes.

Pros

- Automation of up to 80% of reconciliations.

- Real-time visibility into progress.

- Strong fraud protection.

Cons

- Customization is required for complex enterprise workflows.

- Time-consuming onboarding process for large data sets.

Pricing

Custom pricing is available upon request.

9. HighRadius

Best For: Large enterprises seeking AI-powered automation for faster financial close

HighRadius brings AI and machine learning to the heart of financial operations. It automatically matches transactions, posts journal entries, detects exceptions and keeps balance sheets audit-ready in real time.

Key Features

- AI Transaction Matching: The software achieves up to a 95% transaction auto-match rate by using self-learning algorithms that continually improve over time.

- Automated Journal Entries: HighRadius automatically posts journal entries to reduce manual workloads.

- Exception Detection: AI agents quickly flag unusual transactions or discrepancies and help teams act before they become issues.

- Continuous Audit Readiness: The system maintains real-time audit trails for compliance across all reconciliations.

Pros

- Exceptional automation and accuracy rates.

- Time close reduction by up to 30%.

- ERP-agnostic and easy to integrate.

Cons

- Complex setup for smaller teams.

- Customer service delays.

Pricing

Pricing is available upon request.

10. OneStream

Best For: Enterprises needing unified financial close and reconciliation management

OneStream combines powerful automation with connected reporting to help finance teams manage complexity and improve accuracy. It aligns account reconciliations with financial reporting to provide real-time visibility into every balance.

Key Features

- Integrated Platform: OneStream unifies reconciliation, consolidation, and reporting within one system, eliminating the need for multiple tools.

- Real-Time Risk Management: Finance teams can access a complete, risk-adjusted view of their balance sheet for better decision-making.

- Audit Trails: Every reconciliation is tracked with timestamps, showing who prepared, reviewed, and approved it.

- Advanced Reporting: Analytics and dashboards provide deep insights into account status, exceptions, and progress.

Pros

- Unified CPM platform.

- Strong audit readiness.

- Improved internal controls and compliance.

Cons

- Designed primarily for large organizations.

- Requires time for implementation.

Pricing

Pricing is available upon request.

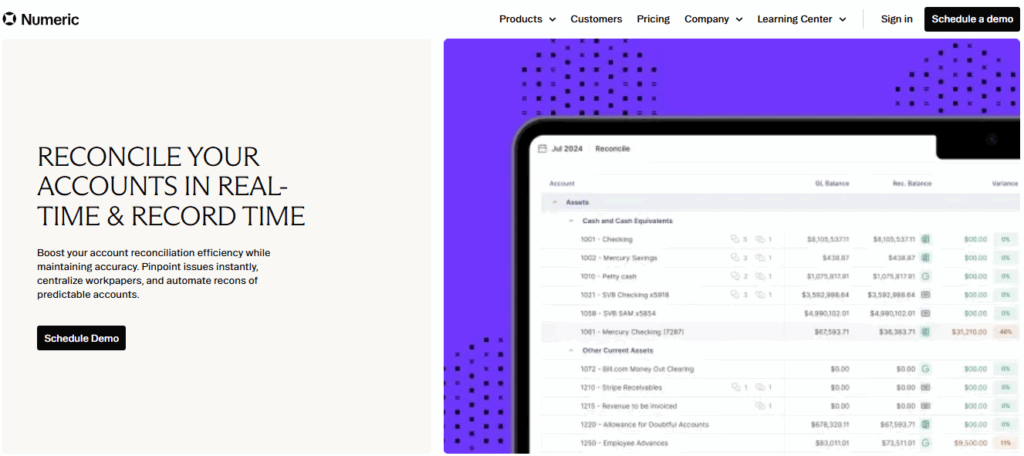

11. Numeric

Best For: Accounting teams that want real-time, intelligent reconciliations

Numeric’s transaction reconciliation software connects directly to your ERP to give you a complete, always-updated balance sheet view. It automatically highlights the GL transactions causing accounts to fall out of balance and centralizes all your workpapers in one place. You can even integrate your cloud storage to pull subledger balances automatically.

Key Features

- Real-Time Data Sync: The platform connects directly to your ERP and updates balances automatically.

- Centralized Workpapers: It manages all documentation, notes, and GL transactions in one platform.

- Discrepancy Detection: The account reconciliation tool instantly identifies the transactions responsible for balance issues.

- Cloud Storage Integration: It syncs subledger balances from connected drives or folders.

Pros

- Strong data visualization tools.

- Improved audit readiness and financial accuracy.

- Automated discrepancy identification.

Cons

- Limited customizations for complex workflows.

- Challenges with task management.

Pricing

The Essentials plan starts at $30 per month per user. Custom pricing is available for the Growth and Enterprise plans.

12. Kosh

Best For: Businesses managing high transaction volumes across industries like marketplaces, retail, payments and gaming.

Kosh.ai is advanced software for reconciliation that simplifies financial data management. It enables businesses to reconcile transactions in under 60 seconds through seamless ERP and bank integrations, granular transaction matching and real-time analytics.

Key Features

- Advanced Data Ingestion: You can integrate multiple data sources with built-in support for diverse formats and pre-configured financial system connections.

- User-Centric Data Management: The platform lets you organize, cleanse and govern financial data with no IT dependency. Plus, you can merge data sources, enrich raw datasets and maintain a full audit trail of original and transformed files.

- Intelligent Matching: It lets you employ adaptive, automated matching that supports one-to-one, one-to-many and many-to-many relationships.

- Reporting: Users can maintain full data lineage, access unified databases for transparent reporting and generate automated reports through interactive dashboards with drill-down capabilities.

Pros

- Complex, high-volume reconciliation handling.

- Real-time analytics and dashboards.

- Minimal IT involvement required.

Cons

- Integration limitations.

- Customization issues.

Pricing

Pricing is available upon request.

How to Choose the Best Account Reconciliation Software

Now that you’ve seen the list, which is the best account reconciliation software? The right platform for you will be different from one that’s ideal for another business.

The platform you choose should help your finance team stay audit-ready and provide real-time visibility into your cash position. With so many options on the market, making the right choice can be overwhelming.

Worry not; we’ve got you covered. Let’s discuss what to look for when comparing tools, from payment reconciliation software to accurate bank reconciliation software and beyond.

Identify Your Reconciliation Volume

Before you get into account reconciliation software comparison, get clear on your needs. Are you reconciling a few bank accounts or thousands of transactions a day?

Smaller businesses often do great with simple tools like Xero, which makes daily bank reconciliation accounting easy and reliable.

If you’re handling high volumes or complex multi-entity operations, you’ll want something more powerful. Tools like Kosh.ai or Numeric shine here, as they can automate large-scale cash reconciliation and handle exceptions intelligently.

Check How Well It Integrates with Your Systems

If your banking reconciliation software doesn’t play nicely with your ERP, bank feeds or payment systems, it’s going to slow you down. Datarails and BlackLine are great examples of tools built for integration. They connect easily to your financial systems and sync data seamlessly.

For teams pulling data from multiple sources, Kosh.ai stands out again. It supports OCR uploads, APIs, and ready-made connectors.

Pro Tip: The easier your system integrates, the less time you’ll spend chasing files or fixing sync issues.

Make Sure It’s Audit-Proof and Compliant

The best bank reconciliation accounting software keeps a full audit trail of every adjustment and user action. Datarails does this exceptionally well, helping companies maintain SOX compliance with ease. These features help during audits and give your team confidence that your financial data is airtight.

Test for Ease of Use and Support

You shouldn’t need a PhD in accounting tech to use your reconciliation software. A clean interface and guided workflows go a long way in making adoption easy. Again, Datarails is pretty easy to use and learn. Similarly, Xero’s mobile-friendly dashboard lets you reconcile on the go.

Customer support also matters. Tools like NetSuite and BlackLine offer strong training and onboarding programs, while others like Numeric focus on intuitive design that minimizes the learning curve.

Compare Pricing and Growth Potential

When doing an account reconciliation software comparison, don’t just look at the sticker price. Some charge per user, others per transaction or account. Most of these tools offer customized pricing based on your needs, so you don’t pay more than you have to.

However, when you’re selecting an accountant reconciliation software, don’t just limit yourself to today’s needs. Think about the future, too. A flexible reconciliation software that grows with your business will save you time and money later on. The best investment is one that continues to deliver efficiency as your operations expand.

Automate Account Reconciliation With Datarails

Do you want to step away from manual checklists and spreadsheets? With Datarails, you can manage tasks, approvals, and documentation from a single dashboard. Track your close progress in real time and stay audit-ready with built-in transparency.

Request a demo to see how Datarails helps you automate financial planning and analysis.

FAQs

Most companies perform balance sheet reconciliations monthly as part of the financial close process. You can also perform balance sheet reconciliations quarterly or as specified by the company policy.

Account reconciliation verifies individual ledger accounts, while balance sheet reconciliations review assets, liabilities and equity as a whole to confirm that financial data aligns with supporting records and statements.

Manual reconciliation of balance sheet accounts often leads to data entry mistakes, timing mismatches, missing transactions and inconsistent documentation.

Automated reconciliation tools simplify the balance sheet reconciliation process by matching data, tracking variances and maintaining audit trails automatically. They help reduce human error and improve accuracy across all balance sheet accounts.

The main accounts for monthly balance sheet reconciliations include cash, accounts receivable, accounts payable, inventory, fixed assets, accrued expenses and equity accounts.