The financial close process is a never ending task for finance teams. Month-end rolls into quarter-end and just when you think there’s breathing room, year-end close is already here.

With deadlines constantly looming, many teams feel trapped in a continous loop to finalize numbers.

Of all the financial processes to automate— budgeting, forecasting, consolidation—upgrading your financial close process can deliver the biggest return because it happens so often.

Our month-end close process guide covers the full process in detail, but here is a refresher before diving into the best financial close software of 2025.

Use this comparison table and detailed profiles to find the best tool for you and your team.

We’ve provided a score for each platform based on the average ratings from Gartner, G2, and Capterra (rounded to one decimal place).

| Software | Key Features | Pricing | Average Score |

| Datarails | Excel-native Financial Planning & Analysis (FP&A) platform; audit trail; data consolidation; real-time dashboards | Pricing available upon request | 4.8/5 |

| LucaNet | Financial close & consolidation focus; Excel integration; real-time data access | Pricing available upon request | 4.5/5 |

| Board | All-in-one FP&A with close automation; custom report templates; predictive analytics | Pricing available upon request | 4.5/5 |

| BlackLine | Close management suite, automated reconciliations, task management dashboard | Pricing available upon request | 4.4/5 |

| Anaplan | Close & consolidation for mid-market; native Excel interface; drag-and-drop workflows | Pricing available upon request | 4.4/5 |

| FloQast | Close collaboration tool; integrates with ERP/GL; real-time close status dashboard | Pricing available upon request | 4.7/5 |

| Oracle FCC (Cloud) | Enterprise consolidation & close, extensive integrations, robust workflow controls | Pricing available upon request | 4.2/5 |

| Workiva (Wdesk) | Connected reporting platform, automated report generation, strong compliance features. | Pricing available upon request | 4.3/5 |

Top 8 Financial Close Software

Below, we compare eight top financial close software solutions for 2025.

Each stands out in its own way—from specialized close automation platforms to broader FP&A suites that include close management.

We’ve evaluated them based on standout features, usability, integrations, support, and customer feedback to come up with an overall score for each.

1) Datarails

Datarails is a financial close software that is part of a complete FP&A software that improves all of your finance needs. The entire financial reporting process becomes easier as Datarails reduces the repetitive, error-prone tasks needed to collect data for your Profit & Loss (P&L), balance sheet, and cash flow statements.

Datarails case studies with Financial Close:

- MyCarrier is a shipment company that automates 2.5 million shipments annually. They used to manually map or export all of their financials from QuickBooks Online (QBO), put them in a spreadsheet, and then change all the formulas. Now with Datarails, it’s all done automatically, takes far less time, and doesn’t contain errors.

- Echo Engineering is a manufacturing company that supplies parts to customers in the heavy machinery and automotive industries. Before using Datarails it would take the finance team five days to conduct the financial close process.

Now they do it in two and have more accurate and up-to-date numbers that allow them, among other things, to access customer margin analytics. They now use that information to make targeted price increases and identify and resolve payment gaps among customers, all of which greatly increased their bottom line profit.

Features of Datarails’ financial close software:

- Stand alone month end close software, or can be purchased as part of the broader FinanceOS FP&A software package.

- Excel native software means that finance teams don’t need to change their data environments or spend time learning a new system.

- Audit control – Datarails’ system allows you to control who can edit which data, along with an audit trail that tracks when changes were made and by whom.

- Data consolidation – Consolidating data into one system helps the financial close process go smoother, quicker, and more accurately.

- Dashboards and AI insights allow finance teams to focus on decision making by creating automated dashboards from real-time data.

Cons:

- Datarails financial software is built for small and medium-sized businesses and is not designed for individual or large enterprises.

Pricing:

- Datarails doesn’t provide direct pricing on its website.

2) LucaNet

LucaNet is a CPM software for finance teams used to accelerate financial close and consolidation, planning, and reporting.

While it is not as complete a tool as many FP&A software products that cover all of the finance department’s needs, it focuses more on consolidation and financial close, which makes it a great tool for conducting the month or year-end close.

LucaNet case studies with financial close:

- ABL-TECHNIC is a construction company based in Germany that started using LucaNet software. It helped them increase the quality of their data, accelerate their reporting processes, and provide them with more precise account mapping. In addition, LucaNet upgraded their IC reconciliation down to an account basis and provided them with a centralized data warehouse.

- Energy company BlueLeaf needed a quick implementation due to unexpected management changes and time pressures. Implementation was completed in seven days, and the team can now carry out their consolidation duties easily. They also eliminated unnecessary versions of Excel reports and now collaborate in real-time, spending less time collecting data and more time performing meaningful analysis.

Features of LucaNet financial close software:

- Real-Time Collaboration: LucaNet enables users to collaborate on financial close operations in real time, allowing teams to work together more efficiently while improving accuracy and reducing errors.

- Integrated Workflows: LucaNet provides integrated workflow capabilities that help companies streamline the financial close process by automating tasks.

- Detailed data analysis and reporting capabilities.

- Multi-currency conversion and translation.

Cons:

- It does not offer many options to integrate with third-party systems, making it difficult to customize processes and automate certain tasks.

- It has slower adoption rates than some competitors due to a lack of awareness and understanding about the software.

LucaNet pricing

- LucaNet doesn’t provide pricing on their website, but they have different pricing tiers.

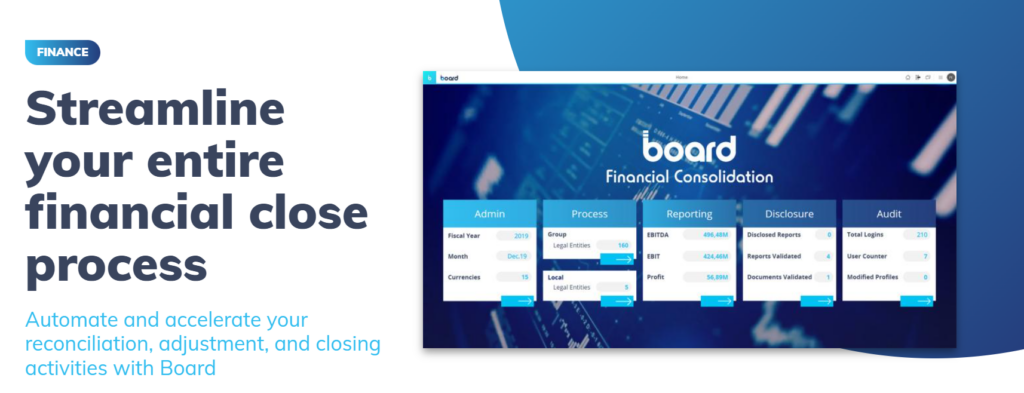

3) Board

Board is an FP&A software that caters to all sizes of businesses – small, mid-market, and enterprise. While some of its budgeting and forecasting features aren’t as popular as other FP&A solutions, Board’s financial close software is quite good thanks to its easy-to-use interface and the ability to create and audit financial reports quickly and easily.

Board case studies with financial close:

Coca-Cola European Partners uses Board for its financial automation. It has helped them gain complete visibility of supply chain activities, seeing a dramatic increase in overall planning efficiency and saved a lot of time on their heavy financial close processes.

Agribusiness specialist Syngenta started using Board for self-service reporting and function cost reporting. It cut down tremendously on their financial close time and provided them the flexibility to adapt to ever-changing requirements in the industry.

Features of Board financial close software:

- Custom and template reporting.

- Intuitive user interface for financial consolidation and close.

- Workflow automation for approvals.

- Board integrates with existing systems to automate many of the time-consuming processes associated with financial close.

Cons:

- Features are limited in customization options, making it difficult to tailor the software to the company’s specific needs.

- Longer implementation time than most software and may require extensive setup, especially for companies with a lot of data.

Board Pricing:

- Board’s pricing varies depending on the size of the business. Their pricing is by customized quote only.

4) Blackline

Blackline is different from most other software on the list as it is a cloud-based financial operations management platform, specifically designed for automating the financial close process.

Due to this, its financial close software is above average, but it doesn’t provide a great solution for other finance tasks that companies are looking to automate.

Blackline case studies for financial close:

- MedComp Sciences, a pharmacogenetic services company, integrated Blackline. Before then, it would take three finance team members a full week to conduct the month-end close. Afterwards, the financial close times were done five times faster and with fewer mistakes.

- When nonprofit liberal arts college Naropa University started using Blackline, they discovered they had 2000 General Ledger accounts they weren’t using. It allowed them to dive deeper into their data and make smarter financial decisions.

Features of Blackline financial close software:

- Pre-built reports make their reports standardized.

- Drillable dashboards.

- Automated journal entries.

- Automated substantiation and testing to help companies remain compliant with regulations.

Cons:

- Lack of integration into certain business applications tends to cause compatibility issues that can lead to disruption during the close process.

- The onboarding process can be time-consuming, even though it is customized just for the financial close process.

- Not built for large enterprises or those with complex close processes.

Blackline Pricing:

- Blackline does not provide specific pricing plans on its website.

5) Anaplan (Formerly Fluence)

Just like Blackline, Anaplan is specifically built for the financial close process and financial consolidation. Its interface is easier to use as it is meant for mid-size businesses, and just like Datarails, it offers a native Excel interface for easier integration.

In April 2024, Fluence was bought by FP&A software solution Anaplan and is now integrated into their product.

Features of Anaplan financial close software:

- Self-service and intuitive reporting mean that companies don’t need outside support and minimal implementation time.

- Anaplan claims it can reduce the amount of time it takes to do the financial close by 80%.

- Drag and drop workflows.

- Powerful journal entry tools that allow users to easily manage and enter transactions through a centralized interface.

- Secure audit trail.

Cons:

- Reporting features are not as comprehensive as other software.

- Limited integrations with other applications or services.

- Easy-to-use workflows but limited customization capabilities.

- Now part of Anaplan, therefore, need to pay for their whole software and implementation to get Anaplan’s financial close feature.

Anaplan Pricing:

- Anaplan (Fluence) does not have a pricing section on its website. Customers need to contact them for a quote.

6) Floqast

Floqast is the last of the three on this list that is exclusively a financial close software. They also focus on collaboration, which aims to reduce errors and increase the speed at which management can make decisions.

Floqast case studies with the financial close:

- Cybersecurity company Venafi found that their monthly close process continued to get longer until it eventually reached 15 business days to conduct the month-end close. They adopted Floqast, and tools like the integrated email sign-offs and quick reference task dashboards allowed them to cut down their month-end close by 10 days.

- Stack Overflow, the largest online developer community, used to conduct “soft month-end closes”, meaning they wouldn’t complete specific or detailed tasks, rather just go over their numbers, not in full detail. Floqast created a standardized process, reducing time and making it much more organized through the real-time dashboard.

Floqast financial close software features:

Its automated currency conversion feature simplifies data processing and ensures accuracy in multi-currency scenarios.

- The reporting suite allows users to track progress in real time and quickly generate insights into their financial close cycle.

- Personalized customer support, offering individualized training sessions and ongoing advice.

- Customizable and configurable tax packages that allow users to generate their tax returns automatically.

- Floqast is an AI accounting software that automates the financial close even faster with its new AI features.

Cons:

- The system is intuitive, but it’s also not as comprehensive as some of its competitors.

- Its lack of integration with other systems can be an issue for companies already using multiple solutions.

- Floqast does not provide a mobile app.

Floqast pricing

- Floqast does not have a pricing page on its website.

7) Oracle financial Consolidation

Oracle Financial Consolidation and Close Cloud is one of Oracle’s many financial software services that automates financial processes. This tool is specifically designed for the financial close process, but Oracle provides many other software tools, and most customers combine financial consolidation with them.

Oracle financial close software features:

- Oracle is one of the most popular financial software tools, so it naturally comes with many integrations, especially for those who use Oracle’s other services.

- Many analytics and reporting tools help do more with the financial close.

- Handles large amounts of data and changing business environments.

- Predefined workflows and approval processes for financial close.

Cons:

- Implementing Oracle can be lengthy and expensive.

- Best for large companies and enterprises who want to commit to a long-term solution.

- Does not offer detailed analytics in terms of its financial close process.

Oracle pricing

- Oracle doesn’t have pricing for their financial close software, as pricing depends on your software package and number of users. They do have some interesting pricing tools and information on their site, including the Oracle Cost Estimator tool.

8) Workiva

Workiva is an FP&A software designed for financial close, audit and risk, and ESG, mostly for large companies and enterprises.

They put a focus on connected data (along with audit and risk), which helps finance teams make the most of their automated and simplified financial close process, as they can now use that information for more data-driven decision making.

Workiva case studies with financial close

- Playa Hotels & Resorts was going public and had a lot of data and processes to change. In addition to helping them with all of the compliance and reports, Workiva cut down their financial close from 10 to 4 days.

- A big utility company integrated Workiva. Before using the software, they would have to decide whether to meet a deadline or give the data the analysis it deserves. Now, instead of having to make that decision each month, automation and data connectivity allow them to finish their financial close in plenty of time to conduct analysis and present decisions to management.

Workiva financial close software features:

- Custom financial close documentation.

- Auto-generation and distribution of reports.

- Comprehensive access controls that allow users to configure who has access to different areas of their financials.

Cons:

- Workiva requires a significant amount of training and configuration before it can be used to its full capacity

- The reporting feature has limited customization abilities.

- Workiva is reported to be pricier than other similar competitors.

Workiva pricing:

- Workiva doesn’t provide pricing quotes on its website. You can book a demo and get more information, including pricing.

Financial Close Process Explained

What Exactly Goes Into the Financial Close Process?

The financial close process, otherwise known as “closing the books” (finalizing numbers and financial statements for certain periods), can be done monthly, quarterly or yearly.

When doing a financial close, the finance and FP&A teams will review and adjust balances and journal entries.

The point of the financial close is to find mistakes, create management reports and audits, and most importantly, take action from the data.

The problem that companies run into when collecting, organizing, and reporting all of the data is that the process is too long and they don’t have enough time to analyze the data and take action based on the findings.

That’s where financial close software comes in.

What Are the Benefits of Financial Close Software?

- Speeds up your financial close process. Some financial close software has cut companies’ month-end close process times by 50-80%.

- Less human error and greater accuracy.

- Better collaboration across the finance team as well as with management.

- With audit control or audit trail, you can control who has access to edit certain data and see a history of what was changed by whom. All of this can be tracked.

- Custom workflows to fit each finance team’s particular processes.

How Can You Choose The Best Financial Close Software For Your Organization?

Choosing the best financial close software depends on your organization’s specific needs.

Here are a few steps and factors to consider:

- Assess your current process pain points.

- Get clear about non-negotiable features and nice-to-haves.

- Account for company size and growth.

- Check integration and compatibility.

- Evaluate ease of use vs. breadth.

- Research and demos.

- Stakeholder buy-in.

Does Financial Close Software Work For Both Month-End And Year-End Closes?

Yes. Financial close software is designed to support any accounting period close—monthly, quarterly, year-end, or even ad-hoc close processes.

The tools generally allow you to set up a close checklist and workflow that can be reused every month, with extra steps added for quarter-end or year-end as needed.

For example, you might have additional tasks in Q4 for tax provisions or preparing annual statements, and the software can include those in that period’s workflow.

One thing to note: year-end may involve additional reporting and audit tasks (like providing documents to external auditors or producing an annual report). Many closed software platforms have features to assist with those, too.

Can It Also Make Financial Reporting Easier?

Definitely. A major reason companies invest in financial close software is to improve and simplify financial reporting.

When the collection and reconciliation of data is automated, close software ensures that by the time you’re ready to report, you have a single set of trusted numbers. This alone makes reporting easier because you’re not scrambling to verify data across multiple spreadsheets.

When’s The Right Time To Start Using Financial Close Management Software?

The “right time” to implement financial close software is when your current closing process starts becoming a bottleneck or risk for your organization.

Here are a few signs it’s time to consider it:

- Closes are taking too long.

- Frequent errors or restatements.

- Lack of visibility into the process.

- Team burnout.

- Growing headcount.

- Your business gets more complex.

- You want to remain competitive with industry peers.

Conclusion: Finding The Best Financial Close Software for Your Business

There are many different types of financial close software. Each has many pros and cons and different features, so the choice can be difficult depending on your budget and financial needs.

Some software is exclusively built for the financial close process, while others improve broader aspects of FP&A and beyond.

Whether you’re looking for a simple stand-alone month end close software or a complete finance software that covers financial close, budgeting, forecasting, and saves dozens of hours on the month-end close, Datarails could be a good fit for you.

We hope this list helps you narrow down your search.