Cost Volume Profit (CVP) Analysis, also known as break-even analysis, is a financial planning tool that leaders use when determining short-term strategies for their business. This conveys to business decision-makers the effects of changes in selling price, costs, and volume on profits (in the short term).

The most common application of CVP by financial planning and analysis (FP&A) leaders is performing break-even analysis. Put most simply, break-even analysis is calculating how many sales it takes to pay for the cost of doing business reaching a breakeven point (neither making nor losing money).

Let’s take a sub-tastic example of cost volume profit analysis in action:

Imagine you are opening a restaurant selling sub sandwiches. Through research, you discover that you can sell each sandwich for $5. But…you then need to know the variable cost.

Finding the variable costs

The variable cost is the cost to make the sandwich (this would be the bread, mustard, and pickles). This cost is known as “variable because it “varies” with the number of sandwiches you make. In our case, the cost of making each sandwich (each sandwich is considered a “unit”) is $3.

Now, what is the contribution margin?

Contribution margin is the amount by which revenue exceeds the variable costs of producing that revenue.

The formula for calculation contribution margin is:

CM=Contribution Margin = Sales – Variable Costs

Subtract the variable cost from the sale price ($5-the $3 in our sub example). This gives us the contribution margin. Therefore, in the case of our sandwich business, the contribution margin is $2 per unit/sandwich.

Fixed costs

Now we need to know fixed costs. These are costs that remain constant (in total) over some relevant range of output. Fixed costs include things like rent and insurance. This stays the same if the sandwich shop sells 50 subs or 50,000 subs. In our sandwich business example let’s say our fixed costs are $20,000.

The meat of the matter: Finding the Break Even point in units (or sandwiches)

To find out the number of units that need to be sold to break even, the fixed cost is divided by the contribution margin per unit.

Break-even units=fixed costs/contribution margin per unit

So, $20,000 fixed costs divided by our contribution margin (2000/$2) means we need to sell 10,000 sandwiches If we do not want to lose money.

Setting a dollar target for breaking even

But we more than likely need to put a figure of sales dollars that we must ring up on the register (rather than the number of units sold). This involves dividing the fixed costs by the contribution margin ratio.

Break-even dollars=fixed costs / contribution margin ratio

For our sub-business, the contribution margin ratio is 2/5, that is to say, 40 cents of each dollar contributes to fixed costs. With $20,000 fixed costs/divided by the contribution margin ratio (.4) we arrive at $50,000 in sales. Therefore, if we ring up $50,000 in sales this will allow us to break even.

Difference Between CVP Analysis and Break Even Analysis

Cost Volume Profit (CVP) analysis and Break Even Analysis are sometimes used interchangeably but in reality they differ from each other in that Break Even analysis is a subset of CVP.

CVP analysis is a comprehensive analysis that examines the relationship between sales volume, costs, and profit to determine breakeven points and profit targets. It considers various factors like sales price, costs, and sales mix.

Break Even analysis only identifies the sales volume required to break even. It is a subset of CVP analysis focused on finding the point where total revenue equals total costs, resulting in zero profit or loss. It helps determine the minimum sales volume needed to cover costs.

The real-world business dangers of CVP analysis

The dangers in not doing a CVP analysis are instantly clear. In a real-world example, the founder of Domino’s Pizza, Tom Managhan in his book Pizza Tiger, faced an early problem involving poorly calculated CVP. The company was providing small pizzas that cost almost as much to make and just as much to deliver as larger pizzas. Because they were small, the company could not charge enough to cover its costs. At one point the company’s founder was so busy producing small pizzas that he did not have time to determine that the company was losing money on them. In addition, real-time CVP analysis has been essential during the period of COVID-19, particularly in industries such as hotels, just to keep the lights on according to experts in the industry.

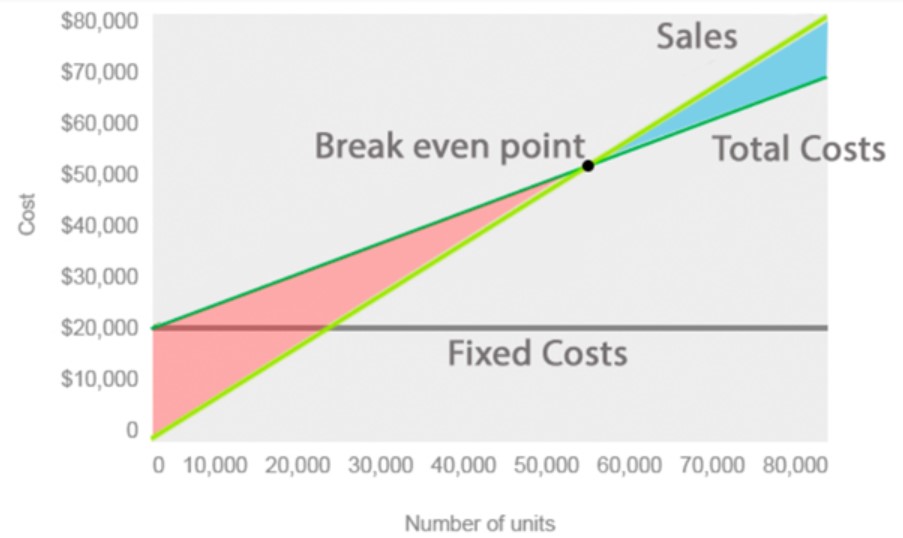

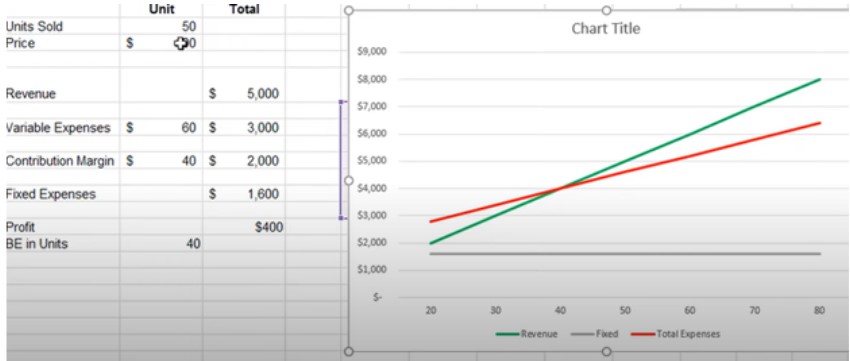

Plotting The CVP Graph

The cost volume profit chart, often abbreviated CVP chart, is a graphical representation of the cost-volume-profit analysis. In other words, it’s a graph that shows the relationship between the cost of units produced and the volume of units produced using fixed costs, total costs, and total sales. It is a clear and visual way to tell your company’s story and the effects when making changes to selling prices, costs, and volume.

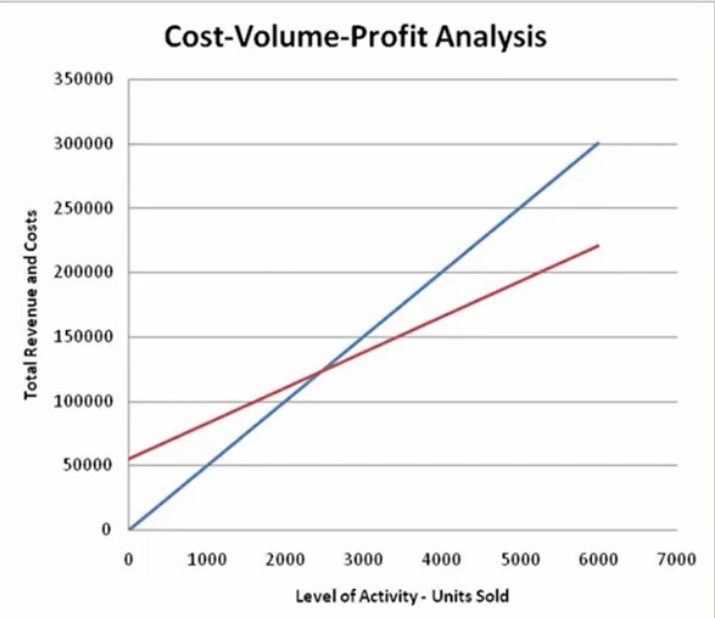

On the X-axis is “the level of activity” (for instance the number of units). On the Y-Axis we place the sales and total costs. The fixed cost remains the same regardless. The point where the total costs line crosses the total sales line represents the breakeven point. This is the point of production where sales revenue will cover the costs of production.

In the above graph, the breakeven point stands at somewhere between 2000 and 3000 units sold. For FP&A leaders this method of cost accounting can be used to show executives the margin of safety or the risk that the company is exposed to if sales volumes decline.

For instance, the CVP can show an executive that in an economic downturn the company is at risk of losing money on sales of this product because they have a higher level of risk due to their lower margin of safety.

In conjunction with other types of financial analysis, leaders use this to set short-term goals that will be used to achieve operating and profitability targets.

CVP Analysis Limitations

Like all analytical methodologies, there are inherent limitations in CVP analysis.

This includes that CVP analysts face challenges when identifying what should be considered a fixed cost and what should be classified as a variable cost. Some fixed costs do not remain fixed costs indefinitely. Once seemingly fixed costs, such as contractual agreements, taxes, rents can change over time. In addition, assumptions made surrounding the treatment of semi-variable costs could be inaccurate. Therefore, having real-time data fed in with a solution such as Datarails is paramount.

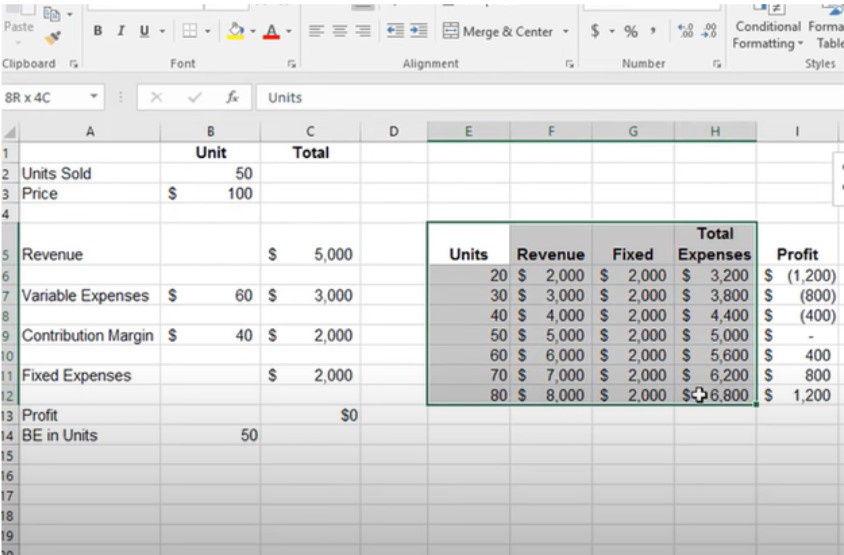

With that all said, for most, the best way to do a CVP analysis is to use Excel.

To build a chart first input the juicy data (price, variable expenses, contribution margin). In the “insert” tab, choose a line chart. Select the data and edit the graph appropriately to change to correct the labels.

This visual line chart tells your story clearly outlining revenue, fixed costs, and total expenses, and the breakeven point.

Using Datarails, a Budgeting and Forecasting Solution

CVP is a tried and tested method for businesses. Datarails is a budgeting and forecasting solution that integrates such spreadsheets with real-time data. Datarails integrates fragmented workbooks and data sources into one centralized location. This allows users to work in the comfort of Microsoft Excel with the support of a much more sophisticated but intuitive data management system. Being plugged into your financial reports ensures this valuable data is updated in real-time.

Everything you have built or can be built in Excel is available through Datarails – providing security and efficiency (and not copying, formatting, and pasting anymore. We do the mapping and updates ( which is normally hours of manual work) and the system does updates automatically. For instance, simple CVP analysis is automatically updated in PDF presentation in real-time through Datarails.