Aliyyah Abdullah is Strategic and Operational Finance Leader, Universal Foods Limited. Based in Trinidad and Tobago, Aliyya began studying management, which she describes as “closer to psychology”. Aliyya only shifted careers to finance when a friend told her about an opportunity. After getting a degree in accounting, she specializes today in working with top SMEs in finance in the food and beverage industry, most recently at Universal Foods Limited – maker of Charles Chocolates, Sunshine Snacks and Universal Lightly Frosted Corn.

Being a leading finance expert in a country of 1.4 million people, Aliyya gets to perform a number of roles including FP&A specializing in supply chain value.

In this episode of FP&A Today Aliyyah discusses

- The importance of leading and lagging indicators in food and beverage FP&A

- Why has focused in the past 12 years on small business FP&A

- Secrets to mixing finance and operations to add value

- How a food and beverage is managing supply chain issues such as the rise in the cost of a containers

- How her love of Horror movies has got her through anxious FP&A moments

Paul Barnhurst

Hello, everyone. Welcome to FP&A Today. I am your host, Paul Barnhurst aka the FP&A Guy, and you are listening to FP&A Today. FP&A Today Is brought to you by Datarails, the financial planning and analysis platform for Excel users. Every week, we welcome a thought leader from the world of FP&A to discuss some of the biggest stories and challenges that each of us face in FP&A Today. We’ll provide you with actionable advice about financial planning and analysis. This is going to be your go-to resource for everything FP&A. Today I have with me on the show, Aliyyah Abdullah. She got a degree in accounting. She works in finance and operations. She’s mostly worked with small and medium sized companies, and we’re really thrilled to have her today. She’s a thought leader. I’ve got to know her through LinkedIn on some of her posts and got to be friends with over the last couple years. And we just want to say Aliyyah thank you for being on the show. Welcome.

Aliyyah Abdullah

Thank you for having me.

Paul Barnhurst

Yeah, it’s our pleasure. So, could you start by just telling us a little bit about yourself, maybe walk us through your background and how you ended up where you’re at today?

Aliyyah Abdullah

Sure, sure. I can. To be honest, I didn’t exactly plan on having a career in finance. I studied management, which was closer to psychology and in my last year I switched to accounting because a friend told me about it. Throughout my career, I have held incredibly diverse roles. In fact, no two roles were alike and regardless of the job you learn at every position. And if you can synthesize the skills you learn in different places over time, then you are in a fantastic position. The positions that I’ve had include a controller role at a public sector entity, and I spoke about this at large in my most recent eBook. I’ve worked at an outsourced agency, but I’ve spent a majority of my last 15 years in finance in the food and beverage industry. So, at SMEs, the experience has mostly been unlocking the potential of what SMEs could actually bring because I’ve spent 13 out of the last 15 years career-wise at SMEs, working in finance, you are more centered towards bringing in all these skills that you can and incorporating that using technical business leadership, digital and people, I would always recommend finance professionals to select the right SME because you want one that is professional and also open to change.

Aliyyah Abdullah

My role right now is to really mix finance and operations to add value. And I have a team in finance, but I also work with value chain professionals.

Paul Barnhurst

Great. Thank you for that introduction. And I really appreciate that advice of, you know, just in general, whether it’s an SME, or even a large company, always being really careful where you work, selecting a company that’s going to allow you to grow. It has a healthy environment. You know, that is well structured. Those can make things a lot easier versus sometimes many of us have done it. You joined that company where it’s nothing like what you expect, and it ends up being a challenging experience. So, one thing I’d like to kind of focus on a little bit is you mentioned, you know, you switched to accounting. So, you didn’t start there. You did more management, a little bit more of a psychology degree. So, can you talk a little bit of maybe how that’s helped you in finance, you know, financial planning, you know, in particular business partnering, how has that degree helped you in your career?

Aliyyah Abdullah

Okay, well, honestly, when I joined LinkedIn officially in 2020, I recognized there were many FP&A and non-FP&A professionals who would routinely bash accountants. And I was puzzled, right? Puzzled because even for finance professionals, they may go with the name accountant in my country. For example, there are tremendous expectations placed on accountants to add value and to stay relevant. What I’ve realized is that an accountant has a cultural misconception. In Trinidad however, it’s respected because a career in management and financial accounting simply opens the door. Employers routinely ask for accounting degrees because, you know, they see that as part of being a finance professional. And I don’t know of any accountant who can keep a role without adding value. For me, my role, having the accounting degree is about adding value, making decisions on behalf of our company, solving business related problems and doing this from a strategic and operational side is part of the role if you are head of the department. It’s definitely not a bean counter type role. So, I didn’t exactly have a transition to see. It was what was expected of me.

Paul Barnhurst

Now. I appreciate that. And you know, you are right sometimes on LinkedIn accountants get a bad name, or just in general, I will admit I don’t have an accounting degree. You know, I did a finance MBA after working in procurement in different areas that were non-finance related. So, I’m probably one of those that has poked a little fun from time to time at accountants. But I’ll make sure to remember to be a little gentler to our accountants out there. Because the reality is, you know, as an FP&A professional, one of the best things I can have is a good accountant. Somebody who keeps the book straight can help me understand why the journal entry was processed and you know, the accruals and things like that. So, accountants are really critical, you know, as much as I joke, I’ve always appreciated having a good partner in accounting.

Aliyyah Abdullah

Definitely Paul, I think for me, it’s, it’s a little different, at least for finance professionals in Trinidad because you know, SMEs are normal for us. We have, because Trinidad is a small country, 1.4 million people. So, SMEs are normal. So, the role of our accountant it’s practically the same as the role of an FP&A professional. So, there are two different types of roles where one person’s actually doing the same thing, whereas in a larger firm, you know, the roles might actually be split.

Paul Barnhurst

That’s a great point and very true, right? If you work for an SME, you know, if I always had, especially the smaller the organization, the more hats you wear, right, as they get a little bigger, it becomes more and more defined. Even with small, you know, SMEs, if you’re working for a startup on that end, you might be doing everything, finance, accounting, operations. Like I talked to a guy the other day, who’s starting a job, you know, and he has all of the operations, all of HR and all of finance, you it’s a company of 30 people. And so, he wears multiple hats, whereas if you go and work somewhere like I did early in my career, American Express, you know, we had people that were strictly just doing the decision support portion of FP&A and other people that were just doing the planning portion, right.

It was very defined, very distinct roles because of the size of the organization. So definitely that, that makes a huge difference in what experiences you get and what you do. And, you know, I can imagine in a small country that accounting is a critical part of what you’re doing. You have to have that background. So that makes a lot of sense. So, you know, you’ve mentioned, you’ve mostly worked for FMCGs over your career. So, what are some of maybe the key kind of metrics that you’ve tracked? What are the things that you’ve found that helps unlock that value? That’s most important to kind of track and understand?

Aliyyah Abdullah

Well, there are finance KPIs and there are operational KPIs. So, we use a mix of leading and lagging indicators. Why? Because manufacturing is capital intensive, and the food and beverage industry involves manufacturing. So, it’s the nature of the business to have leading and lagging indicators because we always want to ensure we go to the root cause, or we have all of the information available. My firm is also a monopoly. So, there is no real competition from other cereal manufacturers in the Caribbean. Yes, we have imports, but we try to benchmark against competitors in larger and far-flung markets. The KPIs that I look at quality because we have ISO standards and customer service because it matters in this economic climate, productivity such as equipment efficiency and eventually turnover, and then there are also GP ratios and liquidity to make sure we actually hit the right markets.

Paul Barnhurst

Yeah, no everything you said there makes a lot of sense, right? Obviously, quality. If you don’t have quality, you’re going to have all kinds of problems. You know, you can get shut down if you’re not meeting certain standards, productivity is huge. Because of your cost, if you’re not being productive, everything’s going to cost more. You know, and then obviously liquidity cash, you know, at the end of the day, if we don’t meet our liquidity requirements, we’re not going to stay in business no matter how good our productivity or our quality is. Because when you know, the cash runs out, you have a major problem.

Aliyyah Abdullah

Yes. And they took an even higher precedence over the last two years. GP ratios on liquidity.

Paul Barnhurst

Yeah. I could see speaking of the last two years, obviously, you know, we’ve gone through a ton of change, you know, something, we, I don’t think any of us thought you’d see in such a short timeframe from COVID to conflicts abroad to energy crises, to a lot of inflation right now, right. A lot of supply chain issues. How have you been able to help the companies you’ve worked through kind of navigate that? How do you think about and manage in this environment of uncertainty?

Aliyyah Abdullah

Well, in order to manage the environment of uncertainty, you have to make sure that you are certain what you manage in, right? So, for me, that involves, you know, breaking what I could further down food down. So that involves analyzing operational data work in capital, leasing with value chain professionals, really trying to get to what the problems are, the urgent problems, prioritizing those and then trying to find a work around them. Budgeting and forecasting have also taken on, I would say a mind of its own as well. Within the last few years, there’s also been a focus on areas of risk to make sure that doesn’t filter down to finance and filtered on to financial statements and added to all of this was created and improved on processes. So, my role has really just involved a culmination of all of those things during, in uncertainty,

Paul Barnhurst

That’s a lot to manage. And when you talked about, you know, forecasting on risk in different areas, I was talking to, I think it was Bryan Lapidus who said this, but I was talking to one of our guests and they mentioned that over the last two years, the number of forecasts finance people are doing has gone up 50%. And I think what you’re talking about is having to, you know, forecast those different risk areas is, you know, evidence of seeing that increase. So how do you, how are you able to kind maintain a balance for you and your team in that environment when you’re constantly being asked to do more, how do you kind of balance those two things?

Aliyyah Abdullah

Well, I try to balance those two things by trying to make sense of what is required right now. So, when I mean that, I mean, so for rule and forecast, I mean, we use that for cash that is critical, so that needs to be done. But then there are some things that, you know, relate to forecasts and that we have little or no control over. An example of that will be the cost of a container. For example, the cost of a container has skyrocketed. In particular, over the last 15 months, a container that cost about 1600 now is actually about 8,000. So, it’s about having that information to manage the cash in particular and then prioritizing which markets we need to focus on. So, it’s a constant give and take so that we make sure we maximize in the markets that we settled to supply right now.

Paul Barnhurst

No, that makes a lot of sense. I mean, when an input’s gone up 500% and you can’t control it, you have to focus on controlling what you can, which are other expenses, your cash, your burn rate, things like that. So how often do you guys do cash forecasting? Is that something you’re doing on a weekly basis, a daily basis? Like how often are you managing that piece of the business?

Aliyyah Abdullah

I would say probably every two weeks.

Paul Barnhurst

Were you doing it every two weeks before or has it become more?

Aliyyah Abdullah

No, we were not doing it every two weeks. It’s only something that we had practically implemented from the start of this day. 2020 was a fantastic year for us. It was, yes, it was, um, the year of COVID. But with that, you know, people were home and of course with them being home, they would’ve purchased more cereal as a result of that, our thing had shot up to the roof. So, 2020 was probably the best year we had on record. So, this year in particular has been a little different because you know, of all these uncertainties. So, with cash, of course, liquidity is something that’s impacting, you know, suppliers, customers, people have less purchase and power. So, we are actually every form that I’ve spoken to are actually feeling the change in liquidity, this year in particular,

Paul Barnhurst

That makes sense. Because COVID initially was a big benefit for you with everybody being home and eating more cereal there wasn’t that need to watch cash closely where I remember the company, I was at was the opposite experience because we managed at the times, claims estimating for cars, nobody was driving. So, our numbers in Europe, right. Driving was down 95%. So, accidents were down 95%. So, you had no claims and those are transactional. You pay on the transactions. All right. We were watching cash very closely. Fortunately we had some other subscription businesses and things and we managed through it. Okay. But it was kind of the opposite of what you were experiencing there at the beginning of it, you know, all of a sudden, okay, look at every single vendor and don’t pay anything till the last day and try to get extensions and you know, all those types of things to manage it. It’s very interesting to see how each business, you know, has gone through it in a different way, depending on their industry and how it, you know, how it impacted them. So, I noticed you write quite a bit, you know, you’ve written an eBook, you write some articles on LinkedIn. What drove you to writing about finance and what is it you like about that? What do you like to write about?

Aliyyah Abdullah

Okay, so, uh, this was actually one of the questions I, I really like because I love talking about finance. I love talking about the industry that I worked for. I love talking about supply chain because writing is a skill that I learned before my career even took off. I wrote non-professionally for practically the last 17 years. And then I switched to professional writing only two years ago. But one of the things I learned is about really making the audience feel as if you are addressing the room or you are addressing them. So, you know, you have to be direct and then you also have to make it interesting because you know, people want to listen to something that is interesting. That’s just, just the reality. Finance is interesting. I love how finance is evolving and becoming more people centered. You know, there’s predictive analytics, you know, there is so much happening right now.

So, there are, there are a lot of things to talk about in finance. And for me right now, I have a couple of writing projects coming up. I have a graduation speech for finance professionals next month. And I’m also trying to write freelance for a part-time finance magazine as I would always recommend. And I would say, you know, finance professionals, writing skills, never get old. But my advice, if you are struggling is to read more, to ask yourself how you can make writing less as in brevity as best. And to ask if what you are saying is working for you or against you and to just, you know, incorporate the logos pathos and ethos so that everything once combined is really powerful.

Paul Barnhurst

That’s great advice. And I mean, the reality is whether we, you know, do freelance writing as FP&A professionals, we need to be able to write, you know, communication is critical, you know, whether it’s presenting data, visually writing up a report or in a room presenting, you know, all those skills are so important. So that’s great advice on the writing side. You know, we’ve had a lot who have talked about the verbal communication side, because I think that tends to often get more attention, but you know, we’ve all been there when you read something that’s hard to follow. That’s not interesting you know, is full of errors. You turn off really quick and you don’t read it. Writing is definitely something I’ve had to focus on throughout my career. So, I appreciate that answer. So, let’s just see here, we have a few more questions. I know we’re kind of getting up toward our time here. So, you know, as you look at FP&A, and you look to the future, you know, finance and FP&A, what do you see as the biggest opportunity going forward?

Aliyyah Abdullah

Okay. So I, I will speak at least on behalf of SMEs because that’s the majority of my experience, a big opportunity is the unification of data. That’s incredibly important for SMEs. Departmental data silos. It needs to be a thing of the past as well as just a lack of structure. So the opportunity that I see is more unified planning solutions, more collaboration. I’m also a fan of operating systems, just operating information that is coming from one source so that, you know, manufacturers can really boost your competitive advantage. It is not coming from somebody’s head or some file that was not incorporated until a package that a manager is supposed to use. The challenge with this is that there is a high potential for cyber security risks with everything being automated and linked. The challenge with this opportunity is that it’s easy for hackers to intercept technologies within the value chain and especially something that is fragile.

The value chain is very fragile right now. So, it’s definitely a challenge I see. And of course, FP&A professionals just need to hone in and support their firms, using professionals from it to mitigate this challenge. Another opportunity I see at least in the supply chain is just the whole market volatility. Right now, these are lessons for us to learn and improve our business acumen and to really be seen as our advisor in particular, what I mean is the potential for digital transformation. It should not just be within finance. It should really shine a light on other areas, new business, where we could facilitate transformation so that our firms are actually in a lot better place than we were before the pandemic. So, this means liaison with other departmental heads, prioritizing breaking things down into smaller bite size opportunities. But of course, numerous challenges would exist because, you know, we will have to hone in people’s skills and of course we’ll have cost on resource constraints

Paul Barnhurst

A lot to unpack there. But I think for me, there were two takeaways that I took out of that. And the first is we have to break down the silos, right? Finance can operate on its own. We have got to help the business kind of break down those silos. We need to better combine and unify our data. And with that, you have to be careful there’s security risks that come with that, you know, currently working for a security firm over the last year. I’ve learned a lot about that, you know, cybersecurity and just how really critical it is. It’s one of the things CFOs list as most important and where they’re spending more money because you know, one breach or one hack can bring a company to its knees. So, you know, a lot there and some, you know, great things to watch out for. But I agree, especially about bringing data together, getting those right systems and getting everybody on the same page and working together is just, you know, so important and great advice for anybody. Next question for you is what’s something that not many people know about you, something we couldn’t find online about you, something interesting.

Aliyyah Abdullah

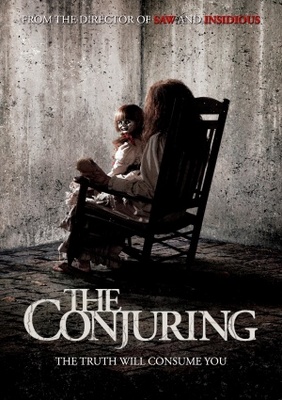

I’m a big fan of horror movies. So, I’ve seen the Exorcist, the Conjuring, The shining, the haunting of Emily Rose, the Candyman, sleepy hollow Children of the Corn,The Others, Ring. I’m a big fan of horror movies. So, whenever I feel nervous, supposed to talk, I would just think about, okay, well I’ve seen, you know, something even scarier, so I should be okay.

Paul Barnhurst

Have you always been a big fan of horror movies or what is it about horror movies? That’s kind of your thing?

Aliyyah Abdullah

Uh, I don’t know. I guess a few years ago, um, well as a kid, you know, I always had this, you know, having no fair mentality. So, I started watching horror movies and you know, my friends would always, you know, get scared and I would wonder, well, there’s really nothing to be scared about. And of course, I just developed it into a habit. So now I just, I just watched them, and you know, is it just, is it a hobby right now?

Paul Barnhurst

Cool. Well fun. We all have to have hobbies. Yes. So next question here is what is your favorite Excel function and why

Aliyyah Abdullah

It’s actually three, right. So, VLOOKUP, because it was the first Excel function I spent time with. Just a quick background. Out of the last 15 years, I spent two years at a large firm, and I used VLookUp there. So I got to learn it really well. And it gave me the confidence to try other functions in Excel. And I also felt like, wow, I was actually getting this Excel thing. Right. Because I had learned VLOOKUP right? Two other functions that I like that is very practical when it comes to quantitative analysis are ROUNDUP and ROUNDON. I think those two actually make sense when you have cash and liquidity reports.

Paul Barnhurst

No, that makes a lot of sense. And VLOOKUP is one that a lot of people, once you learn it, you start like, you’re really understanding Excel. I’ve heard sometimes like, almost like a gateway formula function. It leads to a lot of other things. Yes. So, it’s a great one. I remember when I first learned, you know, VLOOK up and it’s like, oh, cool. I can look things up and relate them together. And you know, so that’s, that’s a great function. I think a lot of people are, you know, big fans of that function. Yeah. So, I know we’re up against our time here. So last question for you, what advice would you offer our audience if they asked you what they should do today to become a better FP&A professional? So, if you could offer them a piece of advice, what would that be?

Aliyyah Abdullah

Well, as much as I would love to say that, you know, writing is something they should develop and, you know, they really should. I would also recommend just, you know, thinking beyond the numbers, when it comes to presenting, you know, we cannot forget that finance is a social endeavor, and we need influence. So, numbers are important, but kind of tell the entire story. So, in fact, finance just really needs to be practical, right? The most valuable company assets don’t even have a number. So, we are living in a cryptocurrency and digital assets age. So, something like a company’s brand and our reputation, it has no dollar value on that. So, to be able to tell a story really well, and to incorporate qualitative data is a skill that I took a lot of years to develop, but I still believe that it is something that will add value to FP&A professionals in the future. And to also have some passion, you know, when you actually tell any story to be in the moment and to be aware of your audience,

Paul Barnhurst

I appreciate that what great advice learning to communicate and in particular, telling stories, being able to really craft a great story and put it together and help bring the audience along with you allows us to influence the business so much more because stories have power, they have power beyond the words, they have power beyond, you know, many other things. So, I think that’s great advice. And I think we’ll go ahead and end there and just tell people to, you know, make sure you’re spending that time on storytelling to help improve your career. And again, thank you so much for joining us today. It was a pleasure to have you on the show and, you know, I’m sure our audience will enjoy listening to this as much as I’ve enjoyed recording it. So, thank

Aliyyah Abdullah

You. Thank you, Paul, for having me.