Jack Alexander: How a Top Gun Maverick FP&A Keeps their Seat at The Table

Jack Alexander is an in-demand speaker, author and advisor coaching the world’s leading finance teams. Jack has been a CFO of companies, such as Mercury Computer systems, and EG&G, before becoming a best-selling author of the FP&A handbook, Financial Planning & Analysis and Performance Management (Wiley Finance). As CFO of EG&G Inc. (renamed PerkinElmer), he brought revolutionary finance principles to the global $2.5B technology and services company with over 40 operating units.

As the founder of Jack Alexander & Associates, LLC, he provides advice to businesses across a wide range of financial and operating areas, with a focus and passion on Financial Planning & Analysis (FP&A) and Business Performance Management (BPM). The firm also offers customized training and workshops on FP&A. He is a frequent speaker on FP&A and BPM. Jack was a Senior Lecturer in Babson College’s MBA program and School of Executive Education. He is a CPA and earned an MBA from Rider University and a BS from Indiana University of Pennsylvania.

Paul Barnhurst

Hello, everyone. Welcome to a brand new FP&A podcast. I am your host, Paul Barners aka the FP&A guy, and you are listening to FP&A Today. FP&A Today is brought to you by datarails, the financial planning and analysis platform for Excel users. Every week, we will welcome a leader from the world of financial planning and analysis and discuss some of the biggest stories and challenges in the world of FP&A. We will provide you with actionable advice about financial planning and analysis. This is going to be your go-to resource for everything FP&A. Today’s guest is Jack Alexander. A little bit about Jack. Jack currently lives in North Carolina. He’s had a distinguished 44-year career. He has been a CFO of companies, such as Mercury computer systems, and EG&G. He currently runs Jack Alexander and Associates, a strategic and financial advisory firm. He’s also been a lecturer at Babson college in their MBA program, an author of two books, one called Financial Planning and Analysis and Performance Management, published by Wiley and another about dashboards called Performance Dashboards and Analysis for Value creation. He has a CPA and an MBA from Rider university. Welcome to the show, Jack.

Jack Alexander

Thanks, Paul. Good to be here.

Paul Barnhurst

Well, we’re really excited to have you. We’re thrilled, you know, to welcome you on our show today. So we’ll go ahead and get started here. You’ve had a long and distinguished career, you know, 44 years working in accounting and finance. What changes have you seen over those years in finance and specifically in FP&A?

Jack Alexander

Yeah, great question. And I use the framework of people, process and technology for a lot of things and, and add environment to that. So, you know, from a technology standpoint, it’s been an unbelievable transformation over that period of time. I mean, I started my career with Coopers & Lybrand in 1978 and we really used spreadsheets, green accounting paper.

And if you needed more than 32 columns, you taped them together and you had to run a 10 key calculator and you actually had to have a competency in running that, being able to cross foot and foot documents like that. So it was, it was very interesting. The business computing was done on very large mainframe computers, even in separate buildings or in large installations on site, very hard to access to input data. You had to use card key readers. And it’s just unbelievable to think about the transformation that’s occurred with technology.

You know, starting, I can remember when the Apple Twos came out and VisiCalc was the spreadsheet program at that time. It morphed into Lotus and Symphony and then into Excel finally. And of course, Excel has continued to increase the level of things that they can do over time. And fortunately mainframe computing has also transformed. It’s now more accessible. We can input it directly and we can also extract things directly and, and be able to access all that information. So huge technology changes.

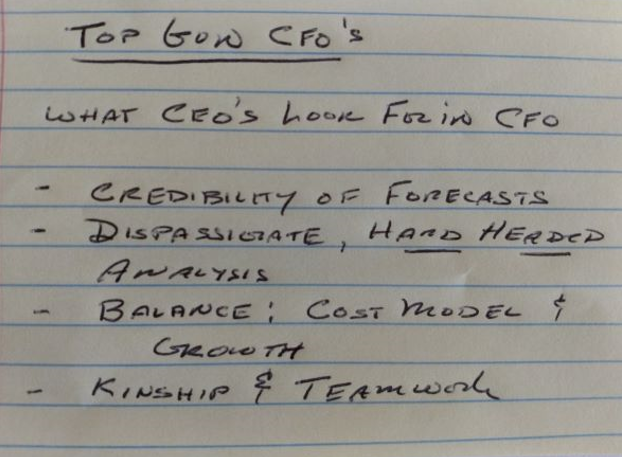

CFOs look at FP&A for credibility of forecasts; dispassionate hard-headed analysis; balanced focus between the cost model and growth; and finally kinship and teamwork.

Jack Alexander

From a people standpoint, this is very important. When I started out the analysis function was typically quite small and it reported into the control function. And interestingly enough, it would be one or two analysts, and they would be mostly generating month end reports, variance analysis, and they would do the annual budget or plan.

You know, now of course it’s transformed to where the analysis function has largely been pulled out and often reports directly to the CFO under the moniker of FP&A, and we pulled all the analysis functions and consolidated them. And I think that’s important and a good move with one limitation. In the process, you know, we talked about what happened in the seventies and of course that’s morphed in the eighties. I worked for that company EG&G and started out in the operations. It was a publicly traded company, very good financial and control systems. So we had monthly forecasting, monthly analysis, we implemented rolling forecasts in 1987, you know, and we changed the whole budgeting, moved away from budgeting and much more of a reliance on a business outlook. So it’s just unbelievable the changes I’ve seen over that time and I laugh about that, but the more things change, the more they stay the same. And some of the fundamental things that were important back then are still important now.

And Paul, I found an article probably in 1978, 1979. I found an article in The Wall Street Journal. I think I can remember who the author was or who the CEO was being interviewed. But the question was, what do you look for in a CFO? And it was titled Top Gun CFOs, and the CEO answered four things.

One is the credibility of forecasts. The second is, and I love this dispassionate hard-headed analysis. The third is a balanced focus between the cost model and growth and finally kinship and teamwork. And that still incorporates what we’re trying to do in FP&A today. And I sort of referred to this, I’ve kept it for 40 some years. I’ve referred to that over time and always kind of checked myself in terms of, of how I was going and how the organization was going on those fronts. And of course, kinship and teamwork, you know, has morphed into an expression we use as a business partner these days. So there’s been a lot that’s changed, but this idea of really understanding the business, partnering with the operating and executive team to really add insight and to achieve the goals is really what’s important. So, you know, again, a lot has changed, but a lot has stayed the same. From an environmental standpoint, you know, there was a lot of uncertainty and stuff happening in the seventies too, and we’re being reminded of some of that, right. An oil crisis, a competitive threat from a far Eastern country, Japan, who was knocking the cover off the ball in terms of technology and autos and things like that. We had high inflation, the cold war. And so we’re sort of back to the future in 2022 on these things. However I think the pace of change and the level of uncertainty is at a level that I haven’t seen over those 44 years. And so that really requires us to hit the pause button and think about how we want to change to be able to, to cope with that and to continue to add value to the folks that we’re serving.

Paul Barnhurst

Well, thank you. I really appreciate that answer. I love you sharing, you know, how you started with the mainframe and, you know, the green spreadsheet. And for me, I remember getting my first computer when I was in high school and using, you know, Lotus 1, 2, 3, and, and Quattro Pro and, you know, some of those precursors to Excel. So we’ve come a long way from, you know, 30, 40 years ago, as you mentioned, but it’s amazing how much things stay the same.

And I think the other thing I love in your answer is just the uncertainty in the world we have today. You know, I mean the oil crisis, conflicts abroad, the global pandemic. I mean, I would imagine, you know, the last two years, you know, in some ways it may remind you of, you know, different periods. But like you said, it’s probably different than any other time in your career, more uncertainty, more, you know, and more change. Speaking to that uncertainty, what advice would you offer to people in FP&A about managing all this uncertainty we deal with today?

Jack Alexander

Well, I think first of all, it really underscores the need to focus on the future and not be looking at the past. And, and we’ve got to very quickly get our arms around the past historical results and get them out there. But they’re of almost limited usefulness now because things are changing on a day to day basis.

FP&A can add a lot of value by looking externally at the information out there and paying attention to what’s going on with customers, with the broader industry the competitive environment, financial performance rates, economic forecasts – and integrating them into the work we’re doing

Jack Alexander

So I think shifting the emphasis to looking forward into the future and trying to understand what the drivers are, and then also looking external, and this is really important. FP&A used to be directed primarily to inside the operations. So the four walls: manufacturing, sales, marketing supply chain, all of that good stuff. And I think it’s really important and FP&A can add a lot of value by looking externally at the information that’s out there and paying attention to what’s going on with customers, with the broader industry the competitive environment, financial performance rates, economic forecasts, all of those things and integrate them into the work that we’re doing in FP&A. Then, we got a really good chance to add value. And part of that then is also recognizing the potential value of scenario planning. I think at the end of the day, that’s [scenario planning is] really the primary tool we have to cope with the high uncertainty that we have right now.

Paul Barnhurst

No, that’s a great point. I appreciate, you know, the scenario planning. I love the external factors and, you know, you’ve held a number of CFO positions over your career including some large public companies. So what role did FP&A play in your career development?

For the control and CFO path, it’s important to have a number of boxes checked. The FP&A part is really important – being able to understand, digest, and contribute to the business performance and share that with the rest of the team. It absolutely contributed to my career growth.

Jack Alexander

You know, as I mentioned I was drawn to that and when I left public accounting, I went to essentially an assistant controller position in the division of this large publicly traded company. And I was responsible for transaction processing and control and reporting, but also essentially most of the analytical responsibilities and we had an analyst reporting to me, but I was engaged heavily in that process. I loved it and I just really enjoyed the ability for us to look across all the data that was at our fingertips and to try to make sense of that and communicate that to the rest of the organization. And frankly, we didn’t call it FP&A back then or anything. It was probably just management analysis and reporting, but it was very interesting because I think my passion for that and my investment in time and energy for that definitely contributed to my career growth. And so, you know, for the control and CFO path, it’s important to have, you know, a number of boxes checked. The FP&A part I think is really important and being able to understand, digest, and contribute to the business performance and share that with the rest of the team is very, very important. And so it absolutely contributed to my career growth.

Paul Barnhurst

No, that’s great. And you know, something interesting. I was reading an article the other day that talked about how a much larger percentage of CFOs are starting to come out of FP&A having spent more of their career there versus the traditional just controller route, not to say some haven’t been controllers, but you’re definitely seeing a growth in how FP&A’s viewed and the value it brings to an organization. So I’m curious to know, how did your, you know, C-suite experience change your view of FP&A, what was it like being, you know, a CFO and working with FP&A?

I began to see how little most people – even in the C-Suite – understood the drivers of value creation, what drives the share price, and be able to link that to operating processes

Jack Alexander

Jack Alexander

Yeah, great question. Because you know, that’s where at the CFO role you’re sitting between the board of directors, the executives, and all of the people within the organization, the financial community, the analysts. So it was just a terrific experience to be talking to somebody from Fidelity, an investor one day, to be reviewing an operating plan the next day, and then to be reviewing cash forecasts and managing the investment portfolio the next. But, what it really did in my mind, Paul, was connect all the dots. And I began to see how little most of the people in the organization, even in the C-suite understood the drivers of value creation and what drives the share price, and be able to link that to operating processes and activities that they can relate to and that they understand how it’s all connected.

Many analysts had a narrow perspective, a financial lens that they looked at the world. So everything was seen through that lens of an accountant. And without context, they often missed the big picture.

Jack Alexander

So I developed this overall context view, which was very helpful, but you know, what I found with the analysts that I was working with, many of them were quite good, but there were some limitations that were there that I, I thought we needed to improve on. And one is that they were very good at producing the numbers, but not so good at making observations, takeaways and recommendations.

It usually only happened once, but an analyst would bring in a spreadsheet or a document to me and say, here’s the analysis. And I would look at it and just nicely push it back to ’em and say, that’s not an analysis. You know, there’s no, there’s no words, there’s no description. What did you take away from this exercise? What I often found is they haven’t really stepped back and looked at it from the objective of the analysis. They just answer the primary question. And so I tried to ask people to come back with, you know, summarizing four or five bullet points: what takeaways, what recommendations are there? Are there other different alternative actions we should consider? So that was really important. The other thing was that I found that many analysts had a narrow perspective, a financial lens that they looked at the world. So everything was seen through that lens of an accountant. And without context, they often missed the big picture. And that contributed to their perception as an accountant, you know, pigeonholed as an accountant . So they were only looking at the numbers aspect. Then they had trouble producing presentations or summaries that effectively communicated the findings. And I think that is probably the single most important factor in career growth and in terms of contribution.

Because if you complete a great analysis, but you can’t effectively present it or communicate it, it’s not worth the paper that it’s been printed on or the screen that you’re looking at.

When I started at one company, they spent two weeks developing a management reporting package. I went around with a controller when I joined a CFO and asked the 17 recipients of that If they used it? One person looked at one schedule

Jack Alexander

Right. So that was really important. And we tried to emphasize and develop that, and that’s a really important competency that people need to develop. And I think looking back over my career, the people ahead of me and the people that have followed me, the folks that could communicate have a profound advantage over those that struggle with it. And so it’s something that we all need to work at, and try and improve on, and we can all improve for sure.

The other thing that I always found interesting is that they didn’t view their function, that is the analyst, as a service function. They viewed it as if it was a service function then that was satisfying, the CFO and controller. It wasn’t serving the broader organization. So we actually turned it into a financial services organization, the whole finance structure, treasury tax, everything, so that we could serve and speak with a unified voice on things. And so that service orientation is really important. And we began asking, operating executives questions like: do you use the information that we give you? And oftentimes the answer was no. When I started at one company, they spent two weeks developing a management reporting package. I went around with a controller when I joined a CFO and asked the 17 recipients of that If they used it? One person looked at one schedule and that is what we found.

So we nuked it and got back a ton of time. And we replaced that with two dashboards. One that tracked what was really critical to understand – whether we were on track to hit the quarterly performance, very important as a publicly traded company. And the other one with a longer term view. And then we ask the executives, well, what is it you would like help with?What issues around understanding information are you struggling with? What are your major objectives for the year and how can we help? And do you view us as a service organization that you can tie into?

And that, that just made a huge change in the dynamics of the relationship. People then started to come and solicit our input, our participation and things at a much earlier date and viewing us as a service function. You know, sometimes those lights come on that just change the whole picture of things.

Paul Barnhurst

Yeah, no, thanks there’s a lot there. And one that kind of really stood out to me is I love the idea and we’re seeing it much more today to make sure the business knows that finance is a service organization. We’re there to serve the business. Right? You hear the term business partnering today, right. That’s kind of the buzzword, but I love that idea. I still remember, you know, having one leader that I’d worked really closely with, and really it’s when I really gained an appreciation for business partnering. And I can remember him saying you’ve helped shape the P and L, which says, okay, you’re not just reporting. You’ve made a difference to the business. And finance can do that when they do things you talk about when they’re able to communicate, when they provide more than a report. We have all been there. Like you mentioned, one out of 17 people is using the report. I mean, I think every company has that experience. And so is the analyst just doing reporting? Or are they actually providing analysis and trying to influence the business? And so I love those things there and how your experience in the C-suite helped improve your FP&A organization and have it be a service organization. I think that’s great. So, you know, my next question here, you know, one thing that I’ve seen vary from company to company is the role that FP&A plays in strategic planning, you know, so from your experience, what role do you think FP&A should play in strategic planning?

Yeah, that’s a great question. A terrific issue. And I hear a lot of finance people say they don’t have a seat at the table in strategic planning. In fact, I was at a very large conference. Last one I went to before COVID. And the speaker before me answered that question and said, you just have to pound on the table and insist, and I’m like I think that’s the wrong answer. Here’s what I recommend. One is that you demonstrate that you have a capability to contribute. So you’re invited to those, to those meetings and sessions. And when you’re there, there are a couple of key areas. And even if you want to get invited to it, there are a couple of key things you can do to directly contribute and demonstrate the fact that you should be at the table.

So there’s two major details here. One is being a preparer of strategic analysis and the other one is assisting and developing the strategy and the plan. So for strategic analysis, of course, this is right in our wheelhouse, right? So provide historical context. Put together a three or four year financial summary and not just the P and L and I’m a big one in terms of comprehensive financial performance. So I wanna see a capsule P and L. I like to use capsule financial statements, no need to show every line in the income statement. Show the three or four key ones, right? I want key balance sheet accounts or net investment accounts. I want to capsule cash flow. And I also like to look at valuation and returns (ROIC). I always like to emphasize and do that over a three or four year period of time. For each significant business unit, other summaries of performance looking back three or four years are really important.

We have these hockey stick plans, mostly where people are preparing plans that are completely disconnected from recent performance and recent performance trends.

Jack Alexander

That sets the stage. That’s so important because as I’m sure you’ve experienced Paul, we have these hockey stick plans, mostly where people are preparing plans that are completely disconnected from recent performance and recent performance trends. And so that’s a way of challenging that and eliminating that potential risk. Another area is portfolio analysis. So Boston consulting group Mckinsey, almost every consulting firm has a grid that you can look at portfolios, right for product lines or business units or subsidiaries. And generally it’s some profitability versus growth matrix. And you can actually do a bubble chart by posting those individual product lines in there to see what the overall portfolio looks like. So are all of our bubbles in the low growth, high profitability area? How much are represented in the star area where they’re growing and profitable? Who are the question marks or what used to be described as the dogs? That’s unfair to dogs. But you know, who or what are the ones that are not growing and are not profitable or generating cash flow?

One tip: Read the management’s discussion and analysis (MD&A)for competitors. Look at the risk factors, look through the critical footnotes, and then synthesize this down to a few pages of summary, and graphic presentations

Jack Alexander

And obviously those are targets to be addressed, disposed of, restructured or in some way improved so that they contribute to the future performance. SWOT analysis. Finance can contribute to that and encourage the development of these things. Again, if you’re not invited to the table, do these things and share them with the people that are at the table, right. And they’ll inform, and also demonstrate your capability to contribute to these areas. So strengths, weaknesses, opportunities, and threats are again harder than it sounds to do effectively, but very, very important.

Another one is to do benchmarking and competitor analysis. And so I find this is limited in most strategic plans. And so what I like to encourage Paul is that we pick a competitor – and it’s much easier for publicly traded companies – and we actually go through their SCC filings and we listen to their conference calls and we look at the investor reports. No operating executive, very few of them are gonna have the patients or the understanding to do that. Read the MD&A (management’s discussion and analysis) for those businesses. Look at the risk factors, look through the critical footnotes, and then synthesize this down to a few pages of summary, graphic presentations, and also tables. You know in the 10ks companies are required to disclose what their strategy is, who their competitors are, define their markets, tons of information that’s useful in preparing this strategic context. So then I summarize all of those for competitors, customers and suppliers. And then I pick a few wild cards or best practice companies. And I look at them in 10 or 12 different categories.

How fast are they growing? What’s their profitability level? What’s their asset turnover and investment structure? What’s their ROIC? And what’s their valuation metrics? Price to sales and price to to EBITDA? And so that just almost always generates a huge discussion about why our performance is different or why the market is growing faster than we are, or vice versa. And again, just very, very important.

So even human capital. Finance should link up with human capital. Until very recently there weren’t a lot of analytics done around the workforce. You know, everything from demographics, which has really come back to bite many organizations because the boomers are retiring at 10,000 a day or something like that. And that was accelerated during COVID. But also what are the skill sets? How many people have been in their positions for more than five years?

How many people have been with the company for more than five or 10 years? And just stratifying all that. Just huge insights in terms of the workforce and how you’re growing and developing people. So, you know, that analysis helps to inform your thinking.

And I think the most important part of strategic planning and thinking is that analysis and critical evaluation of where we stand and what the driving forces are. And then obviously finance can play a big role in converting that then into a strategy. And many times back to scenario planning.

Many times companies will just have a single strategic plan and financial outcome going out three to five or seven years. And that really is unfortunate because we can’t predict three to five years out. There are a lot of variables that are going to occur. But why not create a base case, using the current course that we’re on and then develop alternative scenarios, either other things that could happen – like what happens if a recession occurs within that planning horizon – or what happens if we take a more aggressive posture on growth or make acquisitions, and we can assist by modeling that all out, and also then by showing right through all the financials, what that does in terms of value creation.

So, you know, that is essential and I think it should be done with every strategic plan. And then we can think about the execution planning and make sure that that plan is grounded with an execution plan. Too often strategy plans aren’t, so what are we gonna do tomorrow to execute the strategy? And how can we help the management team focus on it and make sure that we’re making progress towards those ultimate strategic objectives that are going to lead to the results that we’re projecting?

And oftentimes, you know, we fall down in that area and that’s why, you know, reporting from FP&A, and dashboards and monitoring and KPIs have to involve those strategic initiatives and objectives as well. So I think there’s a lot of opportunity there. And, you know, one of the things that I’ve observed is that when many finance people sit at the start planning table, their contributions are generally nits and nets, pointing out typos and pointing out a number that doesn’t tick and tie to a previous page or something like that. And that’s okay. And probably best done offline, but again, it just creates a perception that you’re a numbers person and you don’t understand the business. And so if you want to be at the table, you have to also develop a business perspective and a knowledge of the business, you know, which is a whole other topic there, but it’s very important. So finance should be at the table. And I think we have to demonstrate that we can add value and you can do that proactively even if not invited by generating this analysis that we spoke about and sharing it.

Paul Barnhurst

Yeah, no, I, I love that of, you know, even if you’re not asked, generating that analysis, and I like how you mentioned, you know, the financials encapsulating them in a way that you’re focusing on the key elements of the different financial statements, instead of just providing, you know, 10 pages of financial reports that nobody’s gonna read through.

I love your idea there of, you know, listening to other companies quarterly calls and also reading their statements. I did that, you know, I’ve done that with a competitor, reading one of our main competitor’s statements that was public, and it was great to learn, helped you understand the business better, helped you understand how they were thinking compared to how you were thinking. So I think there’s a lot of value in what you said there.

And, you know, I think if you don’t have that seat at the table, be proactive. Provide analysis and provide value. And, you know, that goes a long way toward helping. One thing you mentioned there, you talked a little bit about, you know, making sure in those long range plans, you have scenarios. You’ve been a big advocate of scenario analysis and planning, you know, long before. It’s kind of become the super popular thing lately the last couple years with COVID. In your mind, what are some of the major benefits of scenario planning and how should an organization go about conducting scenario planning that they are not doing today. How should they think about it?

Sure. Yeah. I think scenario planning is a vital tool. And you know, just prior to COVID it at that same conference I gave a talk on scenario planning. We had a breakout session. Maybe there were 150 people in the group. It was a large conference and I took a rump survey and just said, how many people next year are assuming a recession? So this was the fall of 2019. A couple hands went up. How many are assuming continued economic expansion? A couple hands went up. How many have not made an explicit assumption about the economy and their plans for next year? Which they just finished because it was November of 2019, almost all the hands went up. And so there was a thought at that time that there was a strong chance that we were going to enter a recession anyway, pre-COVID.

And it was certainly an issue that was on the table. And so that further reinforced in my mind that a lot of people are not, number one, thinking about different scenarios. Number two, looking externally at factors that could affect internal performance. People will say, well, I’m not not in an economically sensitive business. Yes you are, because you’re gonna be competing for labor, or you are competing for labor. You’re gonna make assumptions about salary increases and pricing and all that stuff. So it absolutely impacts your performance. So in general scenario analysis, and it applies to strategic plans, but I even like it in annual plans, and short term forecasts is a really effective mechanism that allows us to say, you know, we’re not certain what’s gonna happen in the future. And there are a lot of variables or assumptions that we have to make that are important to recognize.

So, a lot of people mix up scenario planning and sensitivity analysis. Sensitivity analysis just flexes two variables: what happens if we get a 10% change in revenue or a 2% change in labor costs? That type of thing. A scenario analysis is a plausible future story. So it’s something that could happen in the future. And it’s not just one variable. So for example a story will impact a lot of different areas in your P &L and balance sheet. That recession scenario we talked about could impact unit volumes pricing, human capital, turnover, compensation, expense customer mix, all those kinds of things. And so we step back and think about a recession scenario, and we begin to think about how that might impact all of our financials and, you know, it’s really important that it, it not be just a finance exercise.

A scenario analysis is a plausible future story.

Jack Alexander

It has to involve the business people to do this. It’s not an Excel spreadsheet exercise, right. It will be done there, or on some other vehicle, but it needs to have the critical inputs from business people and people that are looking out there. What are the competitive threats? What’s happening in the markets? What’s happening with the economy? So what I like about it, the benefits are that it generates a deeper understanding into the critical drivers and assumptions, because we’re gonna take that base forecast that we start with. And then we’re gonna say, what are our critical assumptions that are in there? And too often, they’re buried in the bowels of a planning system, or an Excel spreadsheet. They’re not called out explicitly. So we can’t even identify them, let alone evaluate them.

So very important to explicitly identify and call out and have them be inputs that are easily flexed so that we can change them. We need to evaluate them and not just at the finance level, but at the executive level to see whether or not we’re okay with that.

if you have a clunky, old planning model and you go and try and do scenario analysis, it’s gonna be very, very difficult.

Jack Alexander

It promotes an awareness of uncertainty that might not exist. So it says, you know, we can’t predict the future and we’ve got these three or four things out there that might happen. Not saying they’re gonna happen. But if they do happen, here’s the impact on the organization. And what’s really important is that it’s not just a finance exercise, but we think about a scenario like recession. Well, what would happen to our business if that recession scenario plays out and what actions would we take? And so that’s really important. So we’re defining upfront the actions we might take if that scenario applies and then a very important tool within that is a trigger event.

And that trigger event says, okay, if customer sentiment goes below some number that triggers our contingency plan. We immediately begin to take those actions, we’re not gonna wait until the Federal Reserve tells us six months later that we were in a recession in the first quarter, which, which might be happening very soon, of course, right? So that’s a lagging indicator. We want to be thinking about the leading indicators for our business. So that’s really important and it prepares us for each of those scenarios. So a couple things are embedded there. Paul one is, you know, you have to identify the critical assumptions and uncertainties. You have to have a robust model because if you have a clunky, old planning model and you go and try and do scenario analysis, it’s gonna be very, very difficult.

After you develop a base case think about the alternative scenarios that might occur, recession, competitor threat, Black Swan event. You know, everybody says, well, you can’t predict them, but guess what, they’ve been happening every six or seven years. So I don’t know whether it’s going to be COVID or the financial crisis or what, but it’s likely, especially in the long term horizon, that something is gonna happen. And the organization needs to think about ways in which it could be preparing itself for crisis situations as they emerge. Model those scenarios out including identifying the actions, the leading indicators, and the trigger events, and then really important and a FP&A to add value is monitor those critical assumptions and highlight those that start to, to indicate that we’re on track for a different scenario other than the base case. So that we flag that for action.

Paul Barnhurst

No, there’s, there’s a lot there. And I appreciate that. I, I like how you made sure to separate scenario planning and sensitivity analysis, right? Sensitivity analysis is adjusting a couple of different variables and seeing how sensitive they are, what happens to your financials. Which is very different from a scenario analysis. Obviously you can do some of that together, but “scenario” is trying to plan out for distinct situations that might happen. That’s one, I’ve confused more than once in my career. It’s, it’s good to know, but it’s, it’s different from a scenario, not as, not as insightful as the scenario analysis.

No, I, I would agree with you there and you know, definitely something companies need to think about, and I loved how you said you can’t have a clunky model because you know, I know I’ve seen my share of, I like call ’em I call Franken models, kinda reminds me of a little bit of Frankenstein cause they’ve been duct taped together and you’re just looking at this thing and go, where do I start? Right. Versus if you have a clean model, that’s really based on drivers, you can do that scenario planning. So I really, you know, I appreciate you mentioning that and just the importance of being able to design a good model so that you can support the business. So something you’re a big advocate of, and you talk about it in your book and you’ve talked about, you know, in your, in your practices, the performance management framework. You are an advocate for the development of a comprehensive framework for performance management and FP&A. Can you tell us what you mean by a performance management framework and why is that so important? Why are you such a big advocate?

Jack Alexander

Yeah. You know, I think there’s a debate. In fact, I struggled with how to title the most recent book that you referred to. And I went with FP&A. But I added performance management to that. And so I think FP&A might limit the context we’re looking at for performance management, that label. So I think performance management in a broad sense is the cycle of planning, execution, planning, monitoring, adjusting, reporting. So it’s a complete loop there – the management activity. And so I step back and think of it very broadly. And whenever I get engaged with anyone seriously about theirFP&A, or their performance management, I like to walk them through one of the best visuals I can suggest. And that’s the instrument panel of an aircraft flight instrument panel of an aircraft.

And I use the space shuttle because it’s a neat graphic, but there are five things thatI take away from that. One is that it’s providing real time and predictive insights. Everything about the engine performance, air speed, electronics, fuel levels, everything right there visually in front of them. And that visual impact is really important. The pilot, the operator of that craft can quickly scan the dashboard and understand exactly what’s happening to their aircraft. There are alerts and alarms that go off, if something is, is likely to impact or is awry with that. So the visual impact is really important. And also they’re measuring what’s important. They’re watching what’s important. So a hundred years of aviation experience and a lot of taxpayer dollars went into making sure that the important stuff is presented to the people that are executing that mission.

So the question is, do we have an instrument panel for our business and are the leaders of the organization using that to run the business and execute the mission?

Jack Alexander

And then fourth, it provides information not just about the internal aspects of the craft, but about the environment. So there’s radar, there’s air speed, there’s wind speed, there is knowledge of competitive threats. There’s knowledge. If somebody has you on missile lock or something like that, where a craft can take evasive evasive maneuvers thinking about a fighter craft mm-hmm <affirmative>. So it’s looking externally, which is really important. And finally, the pilot is able to use all of that information and combine it with their intuition and experience to execute the mission. Right? And so we’re not handing that crew a 50 page Excel report when they land the plane that tells them how it performed that obviously you know, wouldn’t suffice when they’re in the air trying to operate that craft and execute a mission. So the question is, do we have an instrument panel for our business and are the leaders of the organization using that to run the business and execute the mission?

Paul Barnhurst

You know, I love the instrument panel analogy because right. You know, and I think of you thinking of an airplane or whatever might be a car. The first thing you see is one of the most important, right? A car, first thing, you see the miles you’re going, how much fuel you have left. You see where your, your heat’s at, what your RPMs are at all those things that are gonna critically impact you. You know, they’re kind of what I like to think of as key drivers, right? If you’re flying a plane, what are key things you need to know? It’s all right there. And what’s important is known.

Jack Alexander

Exactly. Yeah. And the rear view mirror is fairly small and by the way, you can’t, you can’t drive the car by looking at the rear view mirror. Right. Try it sometime.

Paul Barnhurst

I love that. I hadn’t thought of that, but that’s a very good point, right? I mean, it’s up in the top and you have to kind of go outta your way to look at it. It’s small, it’s the reminder. It’s not about what’s in the past, it’s, you know, what’s impacting your goal. You go forward.

Jack Alexander

One question that comes up then is how do you develop that context for finding out what we should be looking at and putting into the performance framework? And so we start with that idea of the instrument panel. But then too often I see people going off and just creating dashboards and there’s no architecture, there’s no context created. So I like to grab things like the strategic, the market and competitive analysis, strategic objectives, what the situational analysis is, the SWAT, performance assessment, that four or five year historical performance trend, valuation value creation. What are the critical programs that are underway? What are the key growth things that are happening? What’s happening with human capital? And then you can start to think about what things you wanna measure and what are really important to the organization.

I’ve thought about six drivers of value: revenue growth, competitive position, operating effectiveness, capital effectiveness, cost of capital, and then the intangibles.

Jack Alexander

So we might not be you know, putting this one KPI then in the mix of our thinking, because we realize now that it’s really not important in the grand scheme of things. So it allows you to really develop that context and to think about that architecture and that architecture is what are we gonna measure then and how is that gonna cascade down? And so how can we link our key results measures lagging measures, for example, value creation or revenue growth to the operating processes and activities that contribute to those things and that people can relate to and that we can measure and that are predictive of future performance, right? So I like to start with value creation as the ultimate goal, right? And I’ve thought about six drivers of value: revenue growth, competitive position, operating effectiveness, capital effectiveness, cost of capital, and then the intangibles.

And if you think about that, those are all basic inputs into a discounted cash flow valuation model as well. But then I can take each of those and make that link down, cascading down, for example, revenue growth to think about what is our revenue growth? Where is it coming from in the future? How much is coming from retaining and growing existing customers? And what are the key performance indicators that we’re gonna make sure we track to ensure that we hit that number. For example, customer satisfaction on time delivery, those kinds of things. New customers? Same thing. What’s the pipeline look like? What are our actual experience? These are leading indicators that are ultimately gonna show up in the P and L on the revenue line.

What are we looking at in terms of new product introductions or program introductions, and are they on schedule? And do we still believe they will have that revenue contribution into the future that we did when we created the plan and so on? And so this becomes very, very powerful then because you link performance that people can relate to right up to the stock price. And you can create, if not a mathematical linkage, certainly a conceptual one, you know, that shows how the performance will be reflected in terms of long term value creation.

Paul Barnhurst

No, I love that of making sure you’re linking what you’re, you’re measuring long term value creation and just the importance of what are the key things, right? Linking it back to the strategy in those operational plans and saying, okay, what are those leading indicators? What’s gonna help me predict where the business is going, set off the alarm bells when there’s a problem, versus just taking every metric you can find and throwing it on a dashboard, which seems to have kind of, you know, happened a lot over the last few years as data is just exploded, right? It’s all available. So now you wanna track everything. And I really like the process you’ve given there, there’s a framework and a way to work through it and develop that instrument panel that guides you.

So, you know, let’s talk a little bit about professional development for FP&A. You know, one thing we’re seeing is, you know, the last couple years have definitely highlighted the need for FP&A, and an interesting thing I saw recently as somebody had posted about how, if you take a FP&A job from two years ago, it was two or three years ago to today there’s 20, it’s like 23% more skills being listed that are required.

So, you know, what do you think are the key skills today that are required and what can professionals do to continue to develop and grow in such an uncertain and rapidly changing environment?

Jack Alexander

Yeah, it’s a great question. And I got a great piece of advice going back to the 1980s. And, one of the best experiences I had that relates to this topic is when I was division CFO. My boss was terminated. The general manager of the division, and I was asked to look after it for a couple of months, which turned out to be nine months. And so that was an incredibly important experience for me from a learning and perspective-shifting chain. So I presented the strategic and operating plans to the corporation. You know actually participated in the next level operating executive meetings and that type of thing. It forever changed my perspective on finance and business performance. But as part of that exercise, my boss, who was a group executive said, you have to own your own personal growth and development.

if I know somebody is analytical, they’re a good communicator, they are interested in business. They relate well with people. They have a service mindset. That person’s going to be very successful in FP&A even if they don’t understand power BI or some other technology, right? We can teach them that within a relatively short period of time, the other stuff you can’t teach.

Jack Alexander

And there may be systems within the company and you might have HCM or head of people or organization, and they might have processes and that type of thing. But each individual has to own that. And I think that’s really good advice right through the ages. So it is important that we think about our development and that we make that explicit each year. So we want to actually make sure that we’re spending time in learning and development personally. And so by accepting that, and by developing a plan to grow what skills you know, of those 25% that are out there. Where do I stack up? What do I have, what don’t I have and what is my long term career trajectory and direction, and even looking a position or two beyond that. In other words, two promotions down the road, what are the critical competencies for that?

And, you know, as you alluded to before Paul, there’s been an explosion of people wanting technical requirements experience with this software or that software. And I think, yeah, okay. But those can be learned relatively easily, right? So what I’ve, what I’ve learned and what many companies are doing now is they’re looking for sort of natural abilities and inclinations and drive, knowing that you can teach a lot of the other things to people. So for example, if I know somebody is analytical, they’re a good communicator, they are interested in business. They relate well with people. They have a service mindset. That person’s going to be very successful in FP&A even if they don’t understand power BI or some other technology, right? We can teach them that within a relatively short period of time, the other stuff you can’t teach.

And so I think that’s really important. And so one of the things that we also have to think about is, as we service our customers, do we have a reputation for being credible and objective? And I find that finance tends to be typically critical and negative, and creating more of a balanced approach and always searching for these are the improvement opportunities, but these are the things that are going well, because I’ve been in situations where, you know, operating executives have said, do you finance people ever have anything good to say about anything?

And there are always things that are going well in an organization. And that balance leads to credibility for sure. Becoming a better communicator and presenter is one of those core skills. I think that’s really important. So working at that and taking advantage of every opportunity you have to stand up or to write or to prepare presentations is really important.

Look at the people in your organization that communicate very effectively. And while you have to have your own style, you can pick up best practices. There are a lot of great training seminars that are really, really helpful. And we should be, we should think about investing in that. You know, one of the most important things that happened to me was as a CPA, I had to get 40 hours a year of continuing education, and it’s always hard, especially in finance. We’re always busy and taxed, forcing myself to find 40 hours. And sometimes I had to work really hard to find good topics for CPA as in industry. But that forced me to continue on that path of getting continuing education and continuing to think, and grow and learn and develop. You know, developing a business perspective is really important.

And some of the more successful FP&A organizations that I’m familiar with don’t just hire accountants or finance people. They move people over from marketing or operations. And these rotational assignments can be very useful in larger organizations. It’s a bit more challenging and smaller organizations, but if you start to get a mix of talent with different skills, but also different perspectives, it really raises the level of the whole organization up. And, you know, the critical skills, again in FP&A are not so much the finance skills, really they’re the analytical ones, the communication, understanding the business. And of course the drive to really be able to distill things down and present them to other people. So you know, that’s really important. So I’m a little skeptical whenever I see ‘must have experience in’. I just saw one the other day and there were eight technologies listed after it.

Well, the likelihood that you have experience with all eight of those technologies is somewhat limited, and they’re probably not gonna have a lot to do, by the way, this is for a senior FP&A position like a director level. You know, I would suggest that you know, the people skills, the business understanding the big picture view would be much more helpful to that person’s success than all of those technical skills.

So you know, that’s, that’s very, very interesting. And I think again, I go back to that advice that I got about you really have to take ownership of your own career development, think about where you want to be, think about how you’re performing in those critical areas and working towards growing and developing yourself. I talked about rotating staff from other functions.

That’s terrific if if the organization can do that, but if you can’t, you know, we created process teams at one organization where we pulled people from different functions and put them in, for example, an M&A process so they could learn and be exposed to that process, even though they were outside of finance and also contribute to it. The other opportunity that I find a lot of people don’t take advantage of is these opportunities where, for example, I’ve had two situations where my bosses left and I had the position on a temporary basis, unbelievable opportunities to demonstrate your ability to perform at that level, but also to increase the scope of your thinking and your perspective on things. But there are opportunities every day in terms of special projects. You know, we’re, we’re working with a consultant to look at this particular business. Well, hey, raise your hand and say, I wanna work with that team, because guess what? If I work with people from whatever consulting house that is, and the key business managers, I’m gonna learn a lot And, and you do. And so I find a lot of people pulling away from those kinds of opportunities and just saying, well, I do that. You’re not getting paid anymore. You’re not, you’re gonna have to work more, et cetera. Nobody else is gonna backfill the things that you’re not doing. So that comes back to making an investment in your future, right. In your growth and development.

Paul Barnhurst

Okay. No, thank you. I appreciate the answer and, you know, totally agree with, you know, we’re, we need to be the navigator of our own career. We need to own our own development and fully behind the idea that it’s not so much about the tools. If you have good analytical skills, you understand how to build a model, you understand good principles, you understand communication, you’ll figure out the tools, right? I mean, yes, sometimes you might need technical proficiency, but that usually can be applied to multiple different tools. It’s not like, all right, right. Eight different tools listed, especially a director. You know, that example really kind of resonated with me. And I love how you talked about doing rotations. You know, I’ve talked a number of times about, you know, finance should be willing to work outside of finance, whether that’s through special projects, whether that’s through taking a job that takes you outside of there, whatever it may be.

You know, I had the opportunity to start my career in a business analyst role and, you know, some supply chain that weren’t in finance and then moved over to FP&A. And those experiences really helped me try to pride myself on being an expert within finance and understanding the business, instead of understanding the spreadsheet or the financials. Not that I didn’t know them, but it was amazing how much I get people asking me questions about a business, because I always made sure I took the time to learn it. And so I think, you know, you make some great points of focusing your career on the business, charting your own course on those, what we often call soft skills. Making sure you have the technical proficiency, but that’s not what’s most important to developing and advancing in your career.

Jack Alexander

Indeed.

Paul Barnhurst

So some great points there. So we just have a couple more questions here. We’re kind of coming toward the end of this, but one I just wanted to ask you about is you’ve written two books, one about performance management and one about dashboards and a little bit about, you know, value creation. So maybe, can you talk a little bit about why you wrote those books and what do you hope people take away from them?

Jack Alexander :

Yeah. When I left the CFO ranks, Paul, I decided to focus on helping organizations improve FP&A and performance management and to link value creation down to the operating processes. The deficiency that I mentioned I had seen, and it was interesting. I was teaching at Babson college in the MBA program and, this is really to the point, the textbooks we were using were fine and their classic textbooks, but I kept reading them and saying, geez, this is completely from a financial perspective from a financial lens. They’re not integrating this with business performance and operations and process thinking and that type of thing. And there are several very good ones out there. So I began replacing the reading in the textbooks with white papers I was writing. The first one was Cost of Capital, which just makes people’s eyes glaze over in the typical textbook, but we broke it down and found a way to make it look like, to understand how it impacts valuation, and also what are the drivers of that and how do operating people influence the cost of capital? Many times it’s believed just to be a finance ownership deal.

So I had a couple students walk up to me towards the end of that semester. And by this time I had two or three of these white papers and they said, Hey, your white paid papers are like 10 times better than what’s in the text. And we were using a very highly acclaimed textbook. And I said, well thanks. And they said, they look like chapters in a future book. I said, well, maybe. And they encouraged me actually, and was one of the reasons why I moved forward with that. And so the hope is that they are useful to finance people, but also to non-finance people in terms of understanding how operations connect to finance and to valuation. And also I thought that there was really nothing out there that sort of took an integrated look at what we think of as FP&A, in a very broad sense. So I thought I would take the time and do just that.

Paul Barnhurst

Well, great. You know, Jack, I’m glad you wrote the books and, you know, since we kinda got introduced a couple weeks ago, I’ve added it to my list as something to look at here in the future, you know, to kinda pick that up and take a look. So I’m excited to learn a little bit more about what you’ve written there and that’s, you know, great feedback you got from your students. And so I think that will be, you know, a great book for a lot of people, because they are subjects that sometimes can be difficult to explain. They can be hard for non-finance people. And so I’m glad you went ahead and wrote that book. So now we’re just gonna get a little bit kind of a little bit of fun, a little more personal here as we wrap up and the first, you know, we’re our podcast here is sponsored by DataRails, which is a financial planning tool that uses Excel it’s, you know, integrated closely with Excel. And so our question is what’s your favorite Excel function?

Jack Alexander

You know, that’s an interesting question and, and I still use Excel quite extensively, but I tend not to be a function guru or passionately interested in functions. And one of the reasons for this is that I see actually a decrease in people’s understanding of mathematical functions as we use Excel more and more and so we can have, I’ll use the example of net present value in evaluation analysis. You can do that. And you’ll come up with the right answer perhaps, but

if you have screwed up anything, as we all know in any one of those cells or the formula, you’re gonna get the wrong answer. And it’s very difficult to evaluate unless you really understand the mechanics, at least in your mind. So I actually advocate in Excel for detailing things out a little bit. So in that present value of a stream of future cash flows, I don’t want to just have one NPV number. I want to look at the present value of each of those years of cash flow and the terminal value or post horizon growth value. And then I can see how that contributes to the total present value or to the total valuation. So I find that very useful then, because then we can say, well, all of this value is based on years eight and beyond. We should be concerned about that. You know, because that’s where all the cash flow is being generated from. So I think, you know, Excel is a wonderful tool and it gets criticized, but it continues to improve itself. I think where it’s used as intended, it is still one of the best sort of dynamic ad hoc analysis tools that I’ve come across. And as a guy who started with physical green spreadsheets I’m thankful for Excel every day.

Paul Barnhurst

No, I bet. And you know, I, I love how you said just the importance of breaking things apart and understanding the math behind it, understanding what’s going on. That’s great advice and you know, Excel is a wonderful tool.

So next question here we just got two more left is what’s something that not many people know about you, something they couldn’t find online, maybe, you know, an interesting, interesting thing about yourself.

Well, I’m, I’ve got a wide range of interests is probably the the thing that people would not predict because I’ve always been intensely focused in my career in finance, but very family oriented and I’ve got probably too many hobbies, everything from gardening and propagating plants to, and had a nursery business at one point in time. To modeling, not on spreadsheets, but actually creating physical models of things, and recently taken up the guitar as well. And I’ve been a lifelong fitness enthusiast that is coming back to haunt me a little bit with a couple of injuries after 50 years of running for example. But I, and by the way, I think that’s important to be involved in a lot of different kinds of things, because there are so many things that are metaphors or analogies that exist, for example, in gardening or farming that are important. You know, the idea of planting a seed and harvest and, and things of that nature that are really important. And you know, a lot of times I’ll find something that will occur to me when I’m creating a model of something which has relevance to a financial model or some financial issues that you’re dealing with. And I think it’s really good to get your brain into a lot of different areas in terms of critical thinking.

Paul Barnhurst

No, that makes a lot of sense and, I can relate a little bit to the running and starting to fill it. I’m a runner and I’ve done a lot of races and trying to get back in shape and starting to recognize all the little things from over the years. So can, can appreciate that one a little bit and the gardening trying to do a little bit more of that. So that’s great. Agree hobbies really can be applied in a lot of different places. So last question here for our, for our audience. So let’s just say someone’s starting their career today. They just finished college. They know they wanna, you know,do FP&A. What would be the number one piece of advice you’d offer them?

Finding a job with a mentor or a teacher and somebody who is going to contribute to your growth and development, where there are perhaps these rotational experiences that you have, I think are really important.

Jack Alexander

Jack Alexander

You know, Paul, that’s a really good question because what I find and I’ve done some teaching since my Babson years just filling in for people at undergraduate level and graduate level recently, and I serve on the curriculum committee at a large university. I’m very, very disappointed in what still is being taught in the college environment. And there’s been a lot of criticism of college and how it prepares you for the real world and of much of what we’re continuing to teach. For example, most universities do not have a course resembling FP&A. Some of them now are putting in analytics programs, but they’re even a little bit different maybe than what you, or I would suggest. So I think it’s really trying to leverage what you’ve learned in college, but recognizing that the practical application and the things people are looking for are going to be very different in the real world.

And so finding a job with a mentor or a teacher, and as your boss and somebody who is going to contribute to your growth and development, where there are perhaps these rotational experiences that you have, I think are really important. And not getting pigeonholed into for example, being a revenue analyst or an OPEX analyst or something like that, you know. The downside to these larger FP&A organizations is they become highly specialized in how they’ve carved up the activity. And, and I, I don’t see as much opportunity for people to become well rounded, let alone transfer out of the organization. And I think, you know, all of this speaks to taking ownership for your learning and development. You ain’t done learning. You have just begun. That really would be the best piece of advice I think, to give people.

Paul Barnhurst

I love that, that, that idea of just always continuing to learn. You’re just starting, you’re just, you know, beginning on that journey and we’ll, you know, we’ll end on that note there and just, you know, I’ll kind of remind people to, to learn after they think they go through this podcast, try to apply something and learn something new you can do in your job, because there’s a lot of great material Jack’s given us here. I’ve thoroughly enjoyed the time with you. This has been a great hour and I really appreciate you having you on the show today, Jack. And we’ll look forward to chatting again in the near future. Thanks, Jack.

My pleasure. Thanks, Paul.