Tricks of the trade to earn (and stash) more resources

I’ve sat in hundreds of budgeting conversations with department leaders, and the ones who walk away with the most resources do their homework.

Here is a five step framework for going into conversations with your CFO or FP&A team, and it can be applied by all departments across the org. Think of it as your study guide, or better yet, the answers to the test.

If you’re in Product, Marketing, or Engineering, and whether you’re the VP of Marketing or a Junior PM, understanding how to present a business case in a format the finance team can easily absorb and react to will put you on the fast track to securing budget dollars.

Five guidelines to earn you more resources:

- Apply staffing ratios across your headcount asks

- Identify where your department is relative to the company’s overall lifecycle

- Use benchmarks to determine what a best in class department looks like

- Forecast your team’s travel by person and activity

- Ask for placeholders when it comes to tools and consultants

1. Apply staffing ratios across your headcount asks

There should be a clear throughline across all your headcount asks.

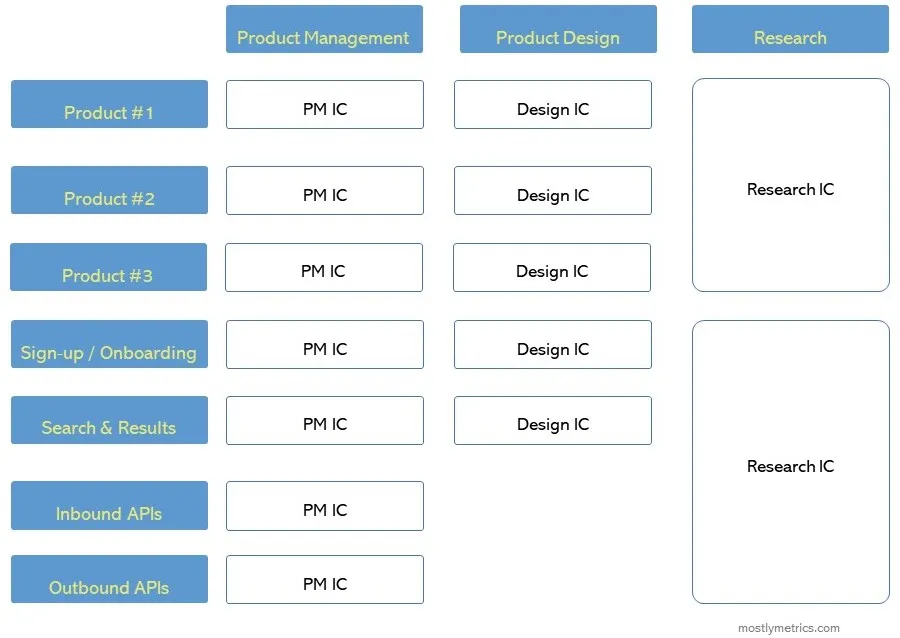

For most departments there’s a “core” role that the rest of the group is staffed around. In Sales, it’s the account executive – all the other resources are aligned through some ratio to the individual quota carrier. In product it tends to be the product manager, with designers and researchers (and even engineering bodies) falling into line.

Questions to ask yourself

- If you’re in product, what’s the ratio between PM’s, Designers, and Researchers? Are you staffing by product line? Do you need to tie it all back to engineering headcount?

- If you’re in Sales, what’s the appropriate ratio of Account Executives to System Engineers? How many Account Executives to a Business Development Representative? Does this ask change at all by Segment (SMB vs Enterprise?)

- If you’re in Engineering, how many developers are staffed to the front end vs the backend?

- If you’re in sales ops, how many people are responsible for reporting on behalf of each sales engine and sales geo?

Understanding this “pod” relationship will help you ask for the appropriate amount of headcount, and demonstrate rigor and logic behind your thinking.

2. Identify where your department is relative to the company’s overall lifecycle

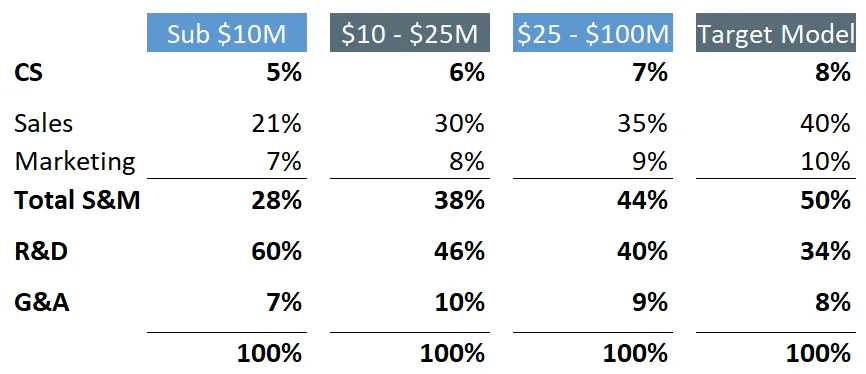

Companies hire for different roles at different stages in their revenue lifecycles. When you are sub $10M in ARR, you over index for people who can build the product. Otherwise, you’d have nothing to sell. And as you scale through, say, $20M, you increasingly layer on Sales and Marketing resources to distribute said product.

Now, this doesn’t mean that Product and Engineering fail to grow – they just don’t grow as fast as the Go-to-Market engine. Below is a hypothetical slicing of the pie across different revenue ranges.

The inflection point where GTM resources are hired at a faster rate, and may even overtake the R&D side of the house, usually coincides with the timing of a Series B or C fundraise. This is when companies pour fuel on the S&M fire.

You’ll observe how at most startups initial sales are done by the founder and a couple of engineers, timidly pounding the phones. But eventually you’ll need pros to run targeted sales campaigns.

Regardless of how big a company gets, Customer Support usually reaches its “terminal velocity” at about 8-10% of the org. The same range applies to G&A, give or take a couple of percentage points. However, be aware that CS and G&A may temporarily get out of whack during periods of “building” when the company is trying to get the foundational core support functions in place. So don’t fret.

Questions to ask yourself:

- Has your company found “Product Market Fit” yet?

- Has the CEO or CFO talked about where you will be prioritizing “investments” in the company?

- Are there any parts of the org that look out of whack, and are bound to change?

Be real about where your company is in it’s lifecycle. The org can only have big arms and skinny legs for so long.

3. Use benchmarks to determine what a best in class department looks like

Comparing yourself to “best in class” companies with the same monetization model (PLG vs Field Sales vs Usage Based) will win you more resources.

When a company has a “product led growth” motion, meaning customers can try before they buy, and maybe even “self serve”, meaning buy it with a credit card without talking to anyone, the Engineering and Product’s side of the house can lobby for significantly more resources. Why? They are building sales into the product itself.

Atlassian is a product led company, allowing customers to self serve within the existing modules they’ve previously purchased. In fact, they claim to have zero sales reps! Atlassian’s ability to sell products within their products frees up resources to be deployed elsewhere, like on more R&D people to build even more products.

If a company mainly sells to large enterprise corporations, like the Oracle’s or Workday’s of the world, they need highly compensated sales reps to sell through a heavy “tops down” sales motion. This requires more sales horsepower and also more people focused on implementation, which can skew the mix accordingly.

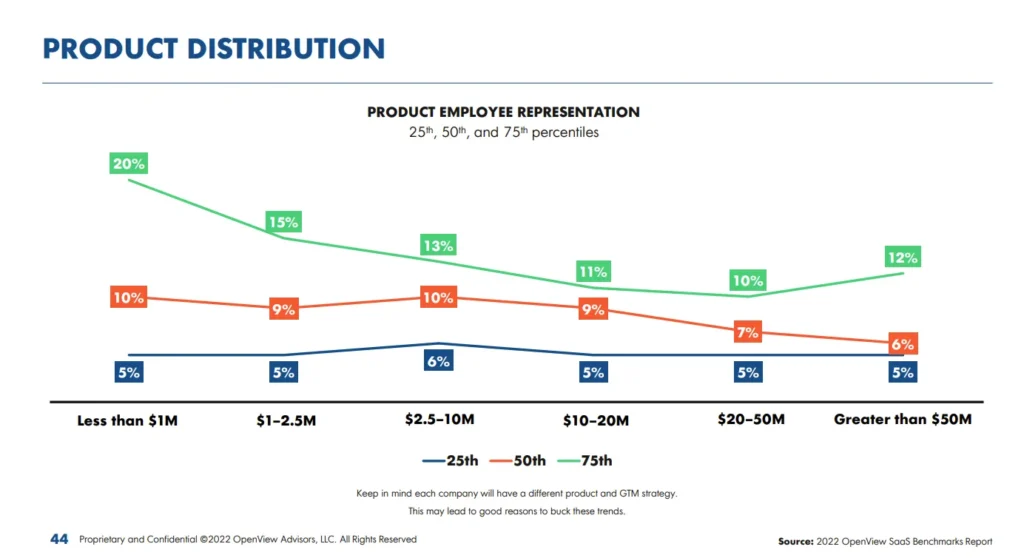

OpenView does a great job of laying out the common distributions by department. Here’s an example for the Product team. I’d recommend you check out their benchmarking work and compare your own company.

Questions to ask yourself:

- What is your company’s go to market motion? How is your department impacted?

- Does your department decrease customer acquisition cost?

- How much implementation does your product require?

- What are the names of companies you think the org strives to be like? How do they staff their Product / Engineering / Marketing teams in relation to the rest of the org?

As we already covered, there are only 100 percentage points to go around when it comes to company mix. So if you want the product team to be 13% of total headcount rather than 11%, you should show that’s what companies you’d like to emulate are doing.

4. Forecast your team’s travel by person and activity

If you don’t think through your travel budget, there’s a 99% chance the FP&A team will underestimate what you actually need. This isn’t because they don’t care – it’s because travel is usually a run away train, and they’d like to put tighter guardrails around it if you don’t come to the table with a gameplan on how you actually plan (effectively) use it.

Questions to ask yourself:

- If you’re in marketing, how many in person team meetings will you have per year (e.g., one per quarter)? How may people are needed to staff the booth?

- If you’re in sales, how many revenue generating customer meetings will you take in person per month?

- If you’re in product, how many site visits will you take for user research? Will team members drive and get reimbursed for the miles? Will they take the customers out to lunch?

Finally, aggregate the unique trip counts and show FP&A your plan.

They can do the rest – forecasting the food per diem, hotels, and associated flights to get you there. But if you don’t do some of the forecasting, you’re bound to get less.

5. Ask for placeholders when it comes to tools and consultants

A great example of this – my Chief Product Officer knew he’d need a feature flagging tool at some point in the year, but he didn’t know who the vendor would be, or when the product build would call for it. We talked through it and landed on a place holder of $5,000 per month, starting in Q3. Now he has the autonomy to make that decision later in the year.

Another example is if you know you are launching a new product or entering a new market and will need external consulting resources. Ask for a placeholder amount per quarter so you can tap into expert advice. I’ve helped Sales leaders ear mark consulting budget when we were entering the Asian market for the first time, and have done the same for the Marketing team when we knew we’d need external help on the SEO front.

Questions to ask yourself:

- If you’re in Engineering, what tools is my team using for free right now that we might need to pay for in the future? Finance people hate when free tools turn to paid and we didn’t expect it.

- If you’re in Product, will you be outsourcing any surveys to validate a market opportunity?

- If you’re in Sales, do you expect to need legal help with partnership or supplier contract reviews?

Best case – you have a slush fund to tap into when the need arises later in the year.

Worst case – you look like a hero when you don’t actually need that budget, and come in under plan for the year.

Win – win.

Like with most things in life, doing the work and helping to carry the load for whomever you are trying to win over is a sure fire way to get ahead.

And finance people are data driven. Play their game if you want more resources. After all, they need to go back to their boss at the end of the day and prove the return on investment the entire org is driving.

“In God we trust. All others, bring data.”

-An ancient FP&A saying

Subscribe to Mostly metrics

By CJ Gustafson · Hundreds of paid subscribers

Get smarter on your company’s performance. Written by a tech CFO. Read by world class Operators.