You have probably seen something like this before.

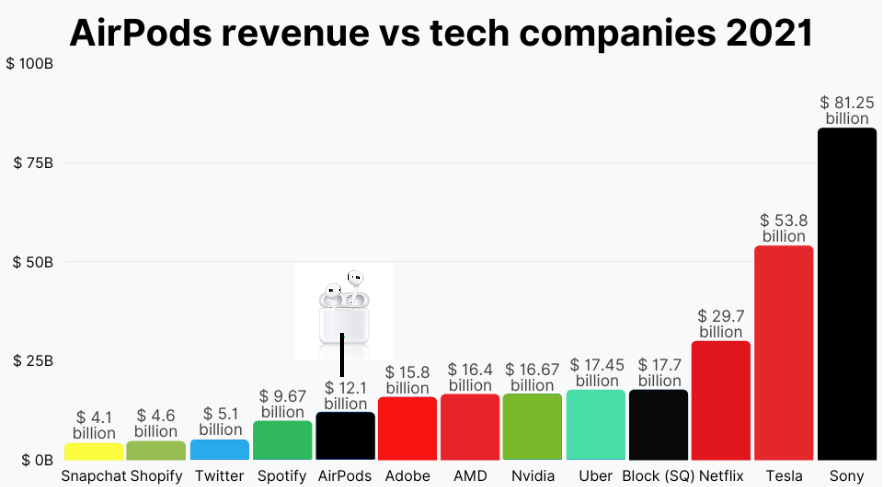

Apple’s AirPods revenues alone generates rougly $12.1 billion per year, more than the revenue of Spotify, Twitter, or Shopify.

There are of course a huge number of factors to take into account when calculating the fair value of a company or line of products – and revenue isn’t the only aspect that is considered. However, it is completely mind-blowing how successful Apple are at creating wants, needs, and then delivering a product to satisfy millions.

Now let’s apply the same analysis to another iconic produt: Microsoft Excel.

Microsoft Excel is a mainstay – one-third of all US SMB businesses keep the lights and the bills paid using Excel. Enthusiasts use it for everything from business analysis to dating. There are around 1.3 billion users. So, how much would Excel be worth as a standalone product?

Figuring out the economic value of Microsoft Excel

To answer this question we enlisted Dr Young, an economic adviser and active modeling professional who holds a Ph.D. in business economics. Let’s cut to his final answer on this question (before working back). Here goes…

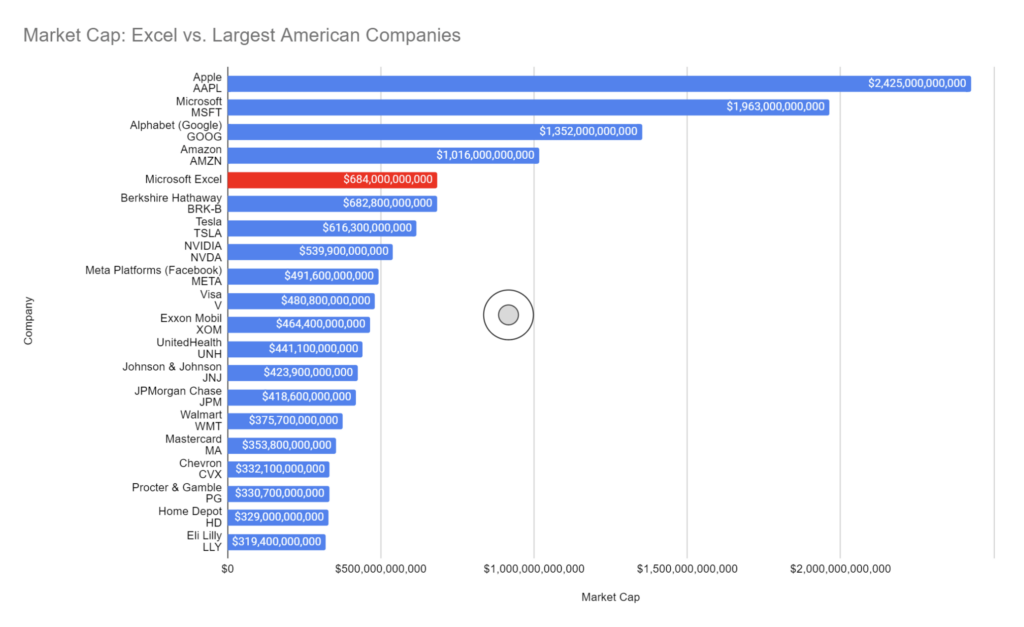

Dr Young has calculated that if Microsoft Excel was a standalone company it would be worth $684 billion.

Forget, the blink and you’ve lost them Airpods. In contrast if Excel (if hived off from its Microsoft product bundle) would instantly become the fifth most valuable company in the world, rubbing shoulders with giants like Berkshire Hathaway, Tesla, NVIDIA, and Meta.

Microsoft Excel’s has long held a reputation for keeping the world running and this gives it a price tag to match it’s business value.

How exactly does Microsoft Excel justify a $684 billion price tag?

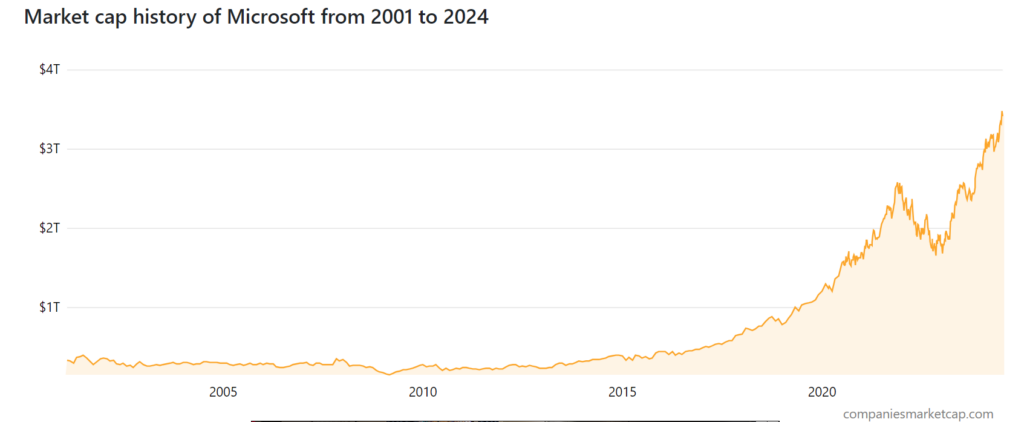

How can Excel really be worth that much? As a start, says Dr Young, let’s look at Microsoft’s market capitalization from 2001 to 2023. In 2001, Microsoft was worth $358 billion. Since then, Microsoft’s value continues to break all time records and currently stands at $3.42 trillion as of July, 2024. By this measure, Microsoft is the world’s most valuable company. How significant is Excel in the Microsoft mix?

The Office Products and Services Business Line (and Excel’s part in it)

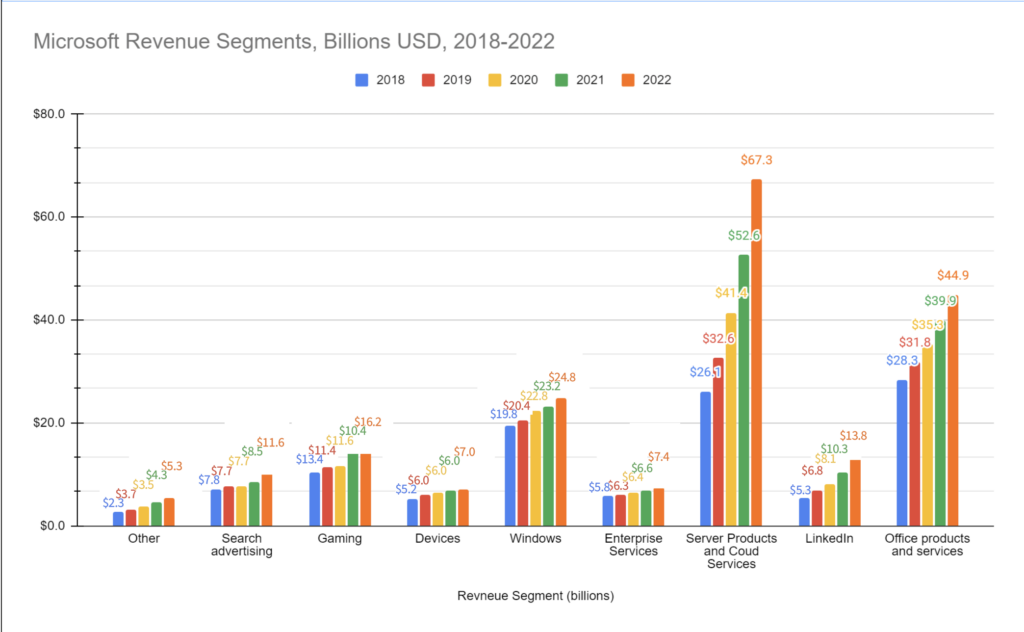

Now, Microsoft does more than just Excel to generate that $1.9 trillion valuation. It has a search advertising business, gaming, devices, windows, enterprise services, server product and cloud services, and Office Products and Services.

Excel is part of the Office Products and Services business generated the second most amount of revenue to Microsoft, at $44.9 billion in 2023. This is far in excess of the superstar Airpods ($12.1 billion revenue) races past Netflix revenues ($29.7 billion) and comes close to Tesla’s revenues of $53.8 billion. Not bad for the entirely unsexy Office 365 subscription of Outlook, OneDrive, Word, Excel, PowerPoint, OneNote, SharePoint, and Teams which comprise their office products and services. Only Microsoft’s Server Products and Cloud Services at $67.3 billion in 2023 beats the Excel-package for revenue.

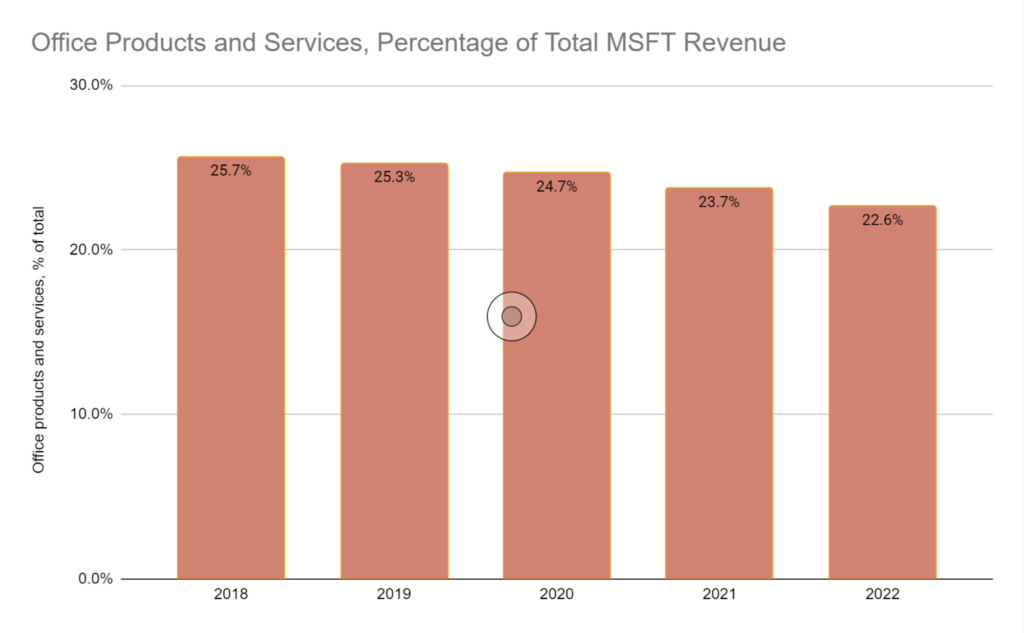

When looking at the segment Excel falls into the percentage of total revenue has

declined slightly in recent years, from 25.7% in 2018 to 22.6% in 2022.

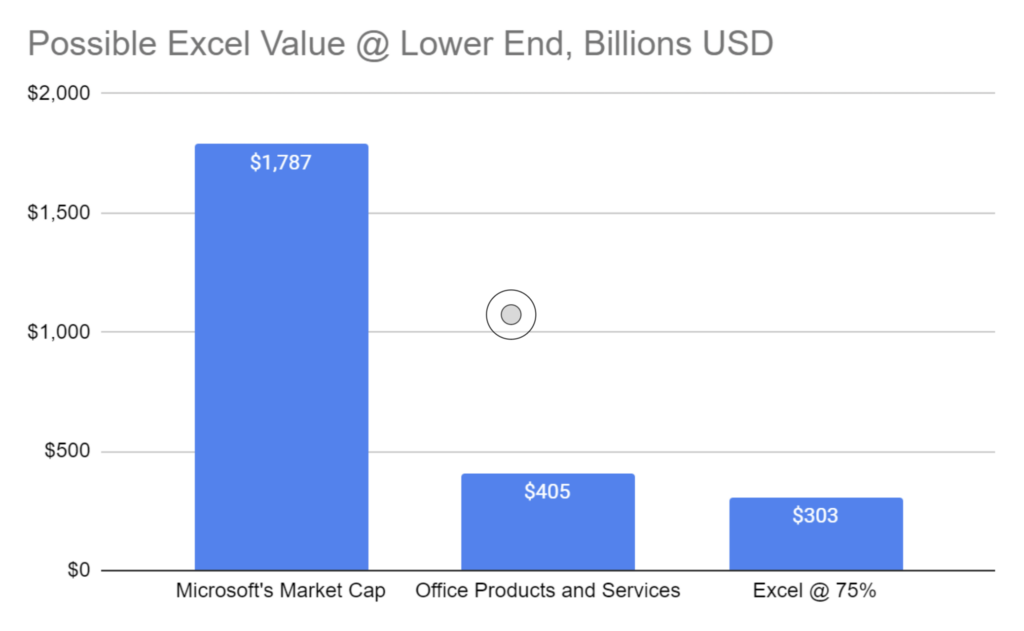

If Direct Revenue Equates to Valuation …

While acknowledging that direct revenue does not necessarily equate to direct

valuation, let’s do the calculation. Presuming that 22.6% of Microsoft’s value

stemmed from its Office Products and Services line, and presuming Excel is worth

75% of that value, then Microsoft Excel would be worth $303 billion.

Bigger Than Just the Direct Accounting?

Now, is Excel worth 75% of Microsoft’s Office Products and Services Lines

business? And does Excel have no contributory value to the other lines of services

Microsoft offers? The answer to both questions is likely no. Excel is so intertwined

with all of the other products Microsoft offers, that it’s difficult to decipher.

Businesses partially buy Microsoft’s server and cloud applications because of the

easy integration with Excel.

Let’s suppose that Microsoft would lose half of its server, cloud, and enterprise business if it didn’t have Excel, in addition to a 75% drop in Office subscriptions without Excel. How much is Excel’s standalone value in this case? Well, a lot – about $684 billion a lot, says Dr Young.

Excel: higher market cap than Adobe, Salesforce, Netflix and Intuit combined

This entirely fair valuation of $684 billion market cap would give Excel a higher market cap than the combined value of four buzzy SaaS companies Adobe ($173 billion market cap) , Salesforce ($169 billion), Netflix ($163 billion) and Intuit ($163 billion).

It also towers among other these types of tech companies for users which makes the valuation even even more secure. There are at least 1.3 billion users of Excel who are fanatical about Excel spending half of their day in Excel in the case of business finance leaders. This vast sea of more than a billion Excel users easily outmuscles Salesforce (150,000 users), or Netflix (233 million subscribers) which grab so much of the public conversation.

The future of Microsoft Excel

Microsoft as a company has acknowledged that the least glamorous part of its business remains a powerful driver of revenue. In 2022 as Microsoft Product and Services Business line saw record revenue growth, Microsoft’s finance chief, Amy Hood acknowledged: “I should have been talking about Windows. Now we can continue to make it better, more integrated, and make it easier to do the things you like to do. For me, that’s Excel. For others, maybe something else is fun.”

Despite constant talk of replacing Excel, the spreadsheet’s dominance is

undisputed especially among finance teams. While alternatives to Word and

PowerPoint have achieved significant traction in businesses – Excel is almost

universally favored in finance teams – for instance at least 70% of CFOs use Excel

for financial reporting and analysis and more than three-quarters of top finance

jobs roles require advanced use of Excel to get a job.

Summing Up

Overall, Microsoft’s Excel standalone value as it approaches its 40th birthday

is large. It is potentially worth as little as $303 billion at the lowest scale and as much as $684 billion at the highest end, concludes Dr Young.

Though Microsoft Excel is often viewed among outsiders as a nerdy or back-office pursuit, it has become one of the towering titans of the modern business world.

About Dr Thomas Young

Dr Young is an economic adviser and active modeling professional. His work sees him advise a diverse group of clients across the globe, including the United States, Europe, and Asia. He holds a Ph.D. in business economics.