What is XIRR?

The extended rate of return (XIRR) function is a financial function that calculates the internal rate of return (IRR) for a series of cash flows that occur at irregular intervals.

The XIRR function takes into account both the magnitude and timing of the cash flows and calculates the rate at which the net present value of the cash flows is zero. The function requires two arguments: a range of cash flows and a range of dates that correspond to each cash flow. The function returns the internal rate of return as a percentage.

What is XIRR Used For?

XIRR is particularly useful in analyzing investments or projects where cash flows occur at irregular intervals such as investments with lump-sum investments, regular contributions, and withdrawals. It is used to calculate the effective annual rate of return for investments such as stocks, mutual funds, real estate, and other types of investments that may have irregular cash flows.

By calculating the internal rate of return, XIRR can help determine the profitability of an investment or project, and can be used to compare the returns of different investment opportunities.

Difference Between IRR and XIRR

Both XIRR and IRR are financial metrics used to calculate the internal rate of return (IRR) for a series of cash flows. The main difference between XIRR and IRR is that XIRR can handle cash flows that occur at irregular intervals, whereas IRR assumes that cash flows occur at regular intervals.

Specifically, IRR assumes that cash flows occur at equal time intervals, such as monthly, quarterly or annually. This makes IRR appropriate for analyzing investments with regular cash flows, such as bonds or annuities. IRR calculates the discount rate at which the net present value (NPV) of all cash flows equals zero, which means the investment has a zero net present value. In other words, it occurs at equal intervals.

On the other hand, XIRR can handle cash flows that occur at irregular intervals, such as investments with varying cash flows or projects with unpredictable cash flows. XIRR calculates the discount rate at which the net present value of all cash flows, occurring at different time intervals, equals zero. XIRR is more flexible than IRR in handling cash flows that occur at different times.

XIRR Formula

The formula takes into account both the magnitude and timing of the cash flows, and calculates the rate at which the net present value of the cash flows is zero. The XIRR formula requires two arguments:

- A range of cash flows which represents the amount of money received or paid out at each date.

- A range of dates which corresponds to each cash flow.

The XIRR formula is calculated as follows:

XIRR = (1 + r) ^ (365 / d) – 1

where:

- XIRR = the internal rate of return

- r = the rate of return for a period

- d = the number of days between the initial cash flow and the final cash flow

The rate of return (r) is calculated using a method called iteration which involves repeatedly trying different values for r until the net present value of the cash flows is zero. The XIRR function in spreadsheet software, such as Excel or Google Sheets, automatically performs this iteration process and returns the internal rate of return as a percentage.

XIRR in Excel

You can use the XIRR function in Excel to calculate the internal rate of return for a series of cash flows that occur at irregular intervals. Here are the steps to perform XIRR in Excel:

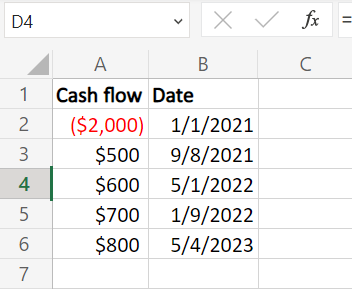

1. Enter the cash flows in one column and the corresponding dates in another column. The cash flows can be positive for money received and negative for money paid out. The dates must be entered as valid Excel dates, such as “12/31/2022” or “31-Dec-2022”. The first cash flow must be a negative number and the last cash flow must be a positive number.

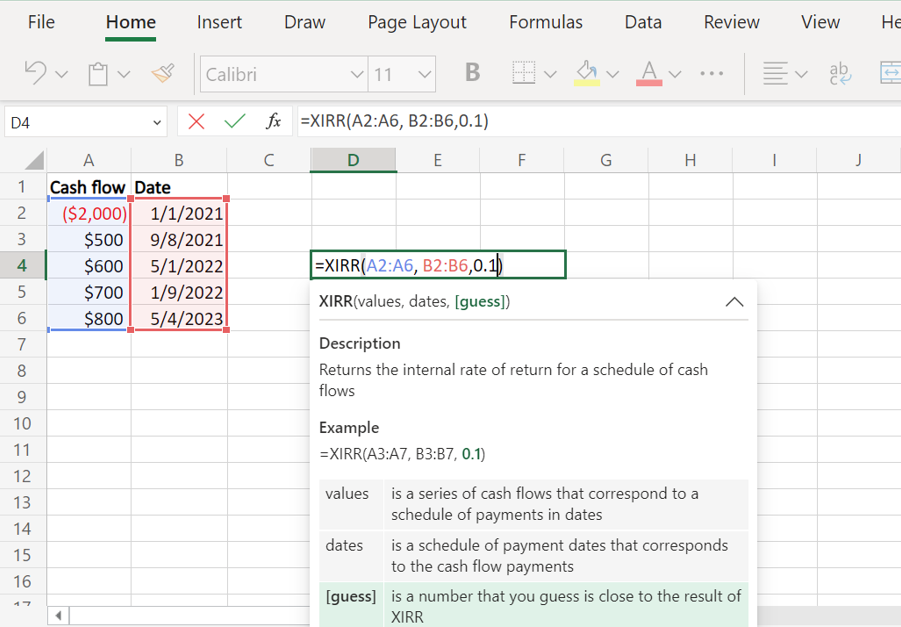

2. In an empty cell, enter the XIRR function. The syntax of the XIRR function is:

=XIRR(values, dates, [guess])

“values” is the range of cells containing the cash flows.

“dates” is the range of cells containing the corresponding dates.

“guess” is an optional argument that represents your estimate of the internal rate of return. If omitted, the function uses 0.1 (10%) as the default value for the guess.

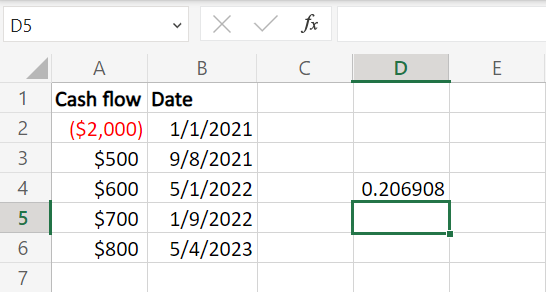

3. Press Enter. The XIRR function will calculate the internal rate of return and display it as a percentage.

Note: If the XIRR function returns an error value, such as #NUM or #VALUE, try adjusting the guess argument to a different value until the function returns a valid result. The guess argument is the estimated rate of return for the investment, and it affects the accuracy of the XIRR calculation.

In addition, Excel also offers another function that can be used in IRR calculations: the MIRR. The MIRR is a rate-of-return measure that includes the integration of the cost of capital and the risk-free rate.

XIRR Limitations

- XIRR calculations rely on the accuracy and completeness of cash flow estimates. Any inaccuracies in these estimates can significantly affect the XIRR calculation and produce misleading results.

- It assumes that cash flows are reinvested at the same rate as the calculated XIRR. However, this assumption may not reflect real-world conditions, where reinvestment opportunities may not be available at the calculated rate.

- XIRR does not account for market risk, which is a critical consideration when evaluating investment opportunities.

- It is a relative measure of return, and may not be appropriate to compare the XIRR of investments with significantly different risk profiles, durations, or cash flow patterns.

Learn How Datarails Can Help Your Organization Create A More Agile FP&A Team

Datarails can help your company implement automation that can help your FP&A team operate more efficiently and effectively. Datarails is helping FP&A teams all over the globe reduce the time they spend on traditional reporting and planning, including XIRR calculations.

By replacing spreadsheets with real-time data and integrating fragmented workbooks and data sources into one centralized location, you can work in the comfort of Excel with the support of a much more sophisticated data management system behind you.