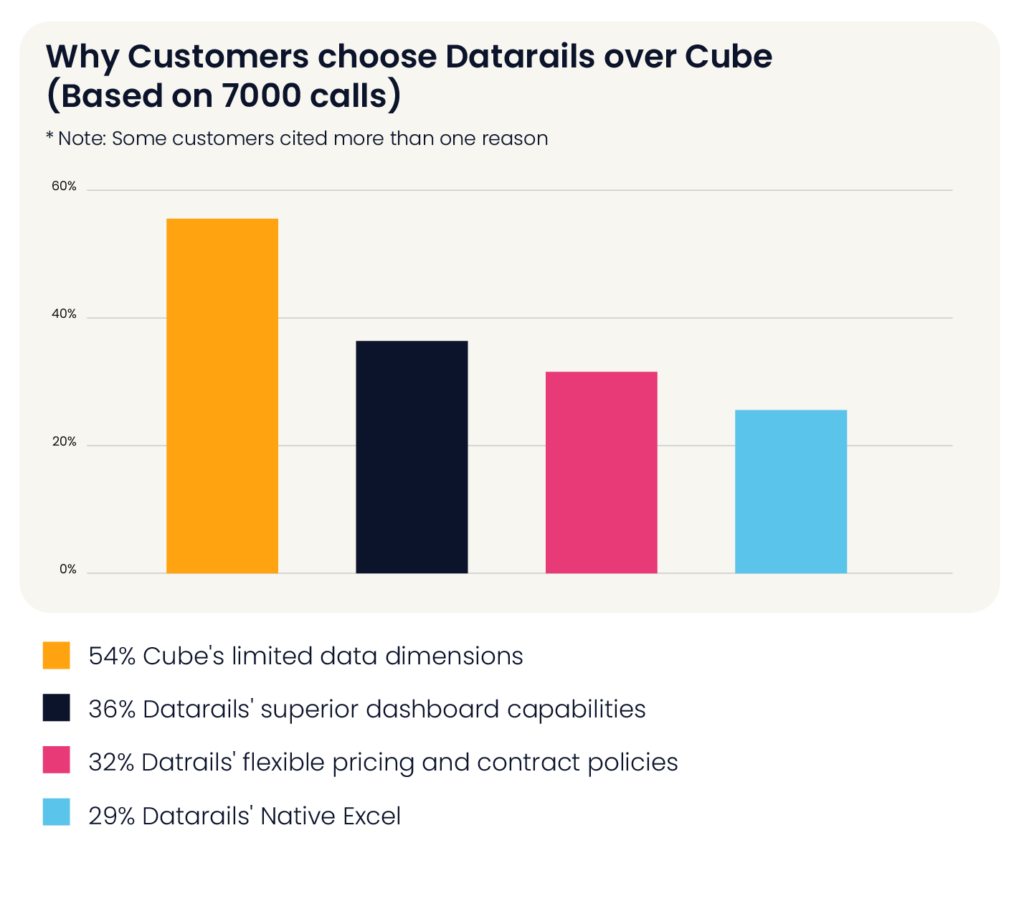

After analyzing over 7,000 calls we have had with buyers implementing FP&A solutions, we found that there are 4 main reasons why customers consistently choose Datarails over similar FP&A tools such as Cube Software.

Using real calls from buyers in exactly your position, and filtering the data behind their decisions, we reveal the complete and unfiltered reasons FP&A leaders and CFOs opted for Datarails as the most powerful and flexible solution that satisfied their KPIs and provide the easiest and most powerful implementation for the business .

Though we decided not to name the customers in this post, for anyone on the fence about Datarails, we would be happy to pass on the many references who are happy to explain their decision-making about choosing Datarails vs. other competitors and why they are happy with the choice.

The research involves current Datarails customers that chose the native Excel FP&A software over the competition, and it includes businesses from all different types of sizes and industries including transportation management, consulting, manufacturing, media, healthcare, oil and gas, technology, and real estate, just to name a few.

Limited Data Dimensions is the #1 Reason Customers opted Against Cube

These are the 4 main reasons that organizations chose Datarails over Cube’s FP&A tool:

54% of customers chose Datarails because of Cube’s Limited data dimensions

In more than half (54%) of talks with customers who opted for Datarails, they mentioned Cube’s limited data dimensions (and Datarails subsequent unlimited data source aggregation) as a reason for choosing Datarails over Cube.

The two FP&A software are similar in many aspects, but this is a main differentiator. What exactly does limited data dimensions mean? As the name suggests, Cube uses an OLAP database where all of the data is in data cubes. With an OLAP database, each additional dimension that you add causes a significantly more cumbersome load on the processing time. This diminishes the return time by each dimension due to the fact that there are more relations to each one of the data cubes.

Larger FP&A platform tools, such as Datarails, can allocate multiple resources to handle the extra burden of additional dimensions, while Cube, being a startup, chose to limit their number of dimensions to 8, instead of allowing for a scalable solution. Due to this limitation of dimensions, they have to isolate the specific data sources into individual cubes (for example HR data goes into HR cubes, finance data goes into finance cubes, etc.).

Adding more data cubes causes two issues:

1) Customers have to maintain ETL channels between the cubes

2) Cube Software charges additional fees for each additional data cube.

This means that instead of aggregating all of the data from different sources (finance, HR, etc.) into one platform with a click (such as Datarails does), Cube Software only has the ability to use 8 different data cube dimensions, 4 of which are predefined system dimensions by the company and cannot be changed (you cannot add your own variables such as BU, region, etc.)

Let’s look at some of the companies that chose Datarails over Cube and their exact quotes:

Quote #1

The Financial Analyst of a Global Visual Effects Media company with 550 employees during a demo describing how Datarails data and mapping capabilities is far better than the competition:

“God, this is so much better than the 3 other products that I tried – Cube, Vena, and another one – I can’t remember the name. This is way better because it’s complex. The ability to map from any point is important.”

Quote #2

The Director of Accounting at an HVAC, Plumbing, and Electrical company with 200 employees talked about the differences between Datarails and other competitors in regards to mapping data:

“I’ve gotten demos from Cube, Vena Solutions and a couple of other ones, and honestly Datarails has been the best outside of Hyperion that I’ve seen. I didn’t like some of the other ones for various reasons but this looks very intuitive. It seems like it’s easy to blend different types of data in with that P&L data. And that’s been one of the benefits of Datarails over other platforms. We’ve talked a lot about GL data and it sounds like it’s pretty streamlined. I see the workflows, you have different CSV files to put them in, and you got mappings to kind of create a common chart.”

36% of customers chose Datarails due to its superior dashboard capabilities

The second biggest reason for choosing Datarails over Cube was due to Cube Software’s extremely limited and almost non-existent dashboarding options. This includes the limitations on reports, visuals, and drill down capabilities.

Datarails, on the other hand, has very robust and easy-to-use dashboards. These not only help the finance team analyze the data and trends but also help greatly with presentations to other leaders and stakeholders in the business who don’t necessarily have a strong finance background. Bringing the rest of the business on board is a major reason companies consistently choose Datarails over less robust software such as Cube. There are multiple options of standardized Datarails dashboards as well as customizable ones for any type of analysis.

In addition, Datarails has drilldown capabilities down to the granular level. This helps finance teams understand the details in any metric they might want – by time period, customer profile, price, location, weight, or any other metric that a business uses.

Quote #1

The Senior Financial Analyst at a Biotechnology research company with 60 employees said that Datarails’ dashboards had a big part in choosing them as their FP&A solution:

“Yeah, I think this is really helpful on the functionality and it’s nice to see the dashboards and the action behind it. I think you guys definitely have a pretty big edge over Cube in terms of the dashboarding capabilities.”

Quote #2

The CFO of a Business Consulting and Management firm with 150 employees explained that the clear and simple data presentation was his top reasoning for going with the market leader, Datarails:

“We looked at Cube, we looked at Planning Maestro, but I would tell you one of the things I liked about Datarails was the ease of being able to get around the tool and how the data is presented. It’s easy for the CEO, the Chief Growth Officer, or the COO to understand even without a technical background. So for me it was more about the presentation side.”

32% of customers chose Datarails because it has more attractive pricing and contract policies

Nearly one-third (32%) of customers named Datarails’ pricing policies as the reason, or one of the reasons, for choosing Datarails over Cube. Our data shows the flexibility of Datarails’ pricing has grown as a major reason for customers since the economic downturn.

The CFO of a trucking transportation company said that “Cube wanted to charge us a $10,000 implementation fee.” That ended up being one of the reasons for opting out of Cube’s offer.

In addition, Cube Software tends to charge high consulting fees, especially in the lower tier pricing packages.

Quote #1

The Financial Analyst of a Global Industrial Machine Manufacturing company with 520 employees explained how Datarails’ pricing options was one of the difference makers in his buying decision:

“I think the flexible contract is a pretty big deal. And obviously having an Infor Syteline CSI (confidential supervisory information) person there that can help us with stuff is pretty beneficial.”

Later on in the call he explained why he didn’t want to go with Cube Software:

“I met with Cube today, and I just know that one’s not gonna work… I met with a sales rep and when I said our processes, she hadn’t even heard of Infor Syteline.”

29% of customers chose Datarails because it is completely Native Excel

Finally, Datarails’ patented native Excel platform was the reason that 29% of the companies named for choosing Datarails over the competition. This differs from Cube that lacks the full range of Excel flexibility (dynamic formulas and dynamic references) and doesn’t have built in visualization. While it is similar to Excel in usability, these shortcomings limit users, especially those who are proficient in Excel.

Datarails’ completely native Excel platform provides a couple of benefits for businesses looking to implement FP&A software, according to buyers.

- The vast majority of high level management know how to use Excel, at least on a basic level, so it is much easier to show the value of the FP&A software to management and get their approval.

- Implementation time is far quicker than the competition, as so much of the platform is a continuation of the Excel interface. Implementation time at Datarails is 2 weeks, while customers at Cube only get a simple P&L report after 2 weeks.

- It is much easier to teach new employees how to use Datarails in comparison to other FP&A software, which prevents the risk of the business blaming you for poor purchase decisions. When a new member of the finance team joins, it will be much easier to teach them the ropes as part of the onboarding process instead of having to spend weeks teaching them new software in addition to the new job.

In addition, Cube has limited to no workflow options or process control features. This makes managing multiple models extremely difficult, especially when the process requires multi-user collaboration.

Quote #1

The CFO of a 50 employee, Texas-based healthcare company explained why a native Excel platform was the perfect fit for his growing business:

“As a CFO, I need a tool and Datarails was exactly what I was looking for. I love the Excel connections because obviously I’ve been doing Excel since God knows how long and I’m not 16 anymore – I don’t have time to learn a new language. I’m looking to hire at some point a controller and a director of Finance. And I’m convinced that those people would also be able to take on Datarails quickly because obviously they will have an Excel background.”

Quote #2

The Controller at a combustion equipment manufacturing company for Oil and Gas explained his reasoning for going with Datarails:

“Initially I was leaning heavily towards Prophix but after seeing you guys – the interface and the fact that it leverages Excel – I think it is very user friendly and will aid in user acceptance. The amount of training for users would be less – I don’t think it’s nearly as intimidating as telling someone they need to learn a whole new system.”

Conclusion

Based on our research and analysis, there are 4 overwhelming reasons why customers choose Datarails over Cube Software:

1) Datarails’ unlimited data dimensions and aggregation vs. Cube’s very limited data dimensions (only 8 data cubes, 4 of which are predefined and can’t be changed)

2) Datarails’ simple, intuitive, and customizable dashboards vs. Cube’s almost non-existent dashboarding capabilities.

3) Datarails’ more attractive pricing contracts

4) Datarails’ completely native Excel platform vs. Cube’s spreadsheet platform that is not native Excel.

– The CFO of a 50 employee, Texas-based healthcare company