39%.

That is the abysmal proportion of salespeople bashing phones who hit their quota in 2023, according to sales aggregator RepVue. It gets worse. Salespeople are suffering a 16% decline in closed wons – deals that get signed – compared to a year ago. The mysterious culprit for many sales and marketing teams?

The CFO.

CFOs involved in x2 the deals

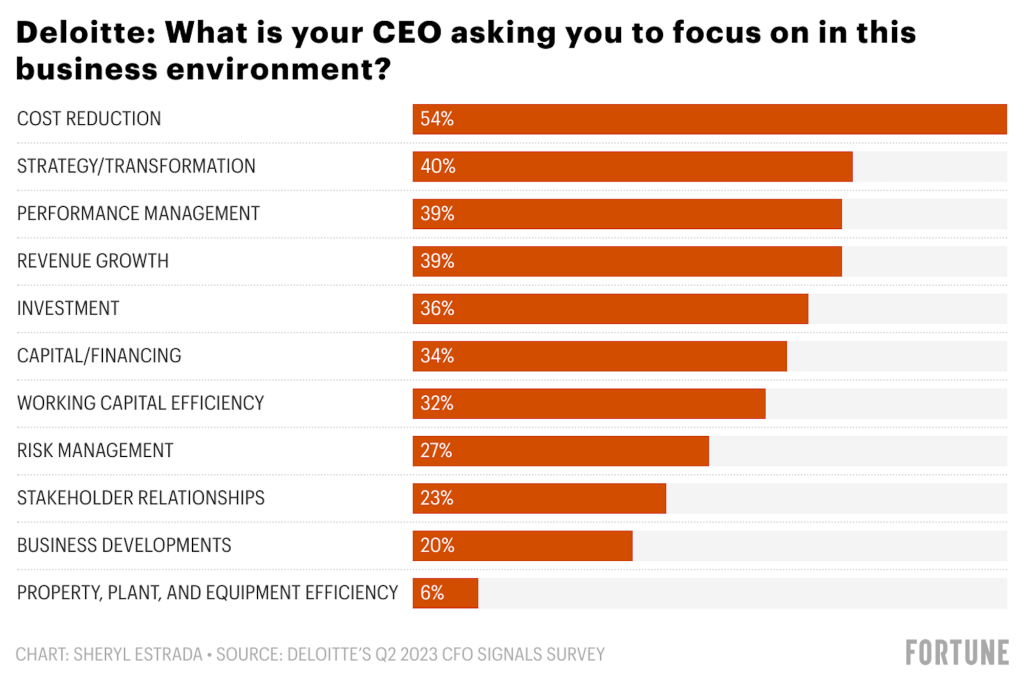

Another sales company, Gong, found that CFO involvement in sales deals has doubled over the past three years. This tallies with a culture of cost-reduction overseen by CFOs. Big four audit firm, Deloitte, finds that in 2023 that cost reduction is the top business priority by CFOs they polled. Cost-cutting came ahead of strategy, performance management and even revenue growth (Deloitte’s Q2 2023 CFO Signals Survey).

Chris Orlob, CEO at pclub.io who sells online Courses for SaaS and Tech Sales hosted a webinar with 3 CFOs at Gong, Drift and Invoca exploring the theme of selling to CFOs in a quicksand economy for deal-making. Orlob says: “We have seen CFOs, even in big companies approval thresholds dip from 500,000 to $50,000, sometimes even less. In today’s day and age. I know one CFO who won’t let any spend $3,000 or more be approved without his approval. So we’ve got a lot of scrutiny on this. That’s the economic environment we’re in.”

So how do you convince the CFO to buy?

Thankfully at Datarails we know CFOs. We have sold directly to CFOs for many years. This is your guide to making the arguments that will get you quota hitting rather than mining the dregs of Salesforce for old leads. We carrie dout an extensive analysis into the buying habits of CFOs in 2023 based on a survey of 260 CFOs. In this post we provide not just these extensive findings but the curated findings of surveys past and present and interviews with CFOs.

1. Clear benefit for the business (not price) is the CFO’s North star

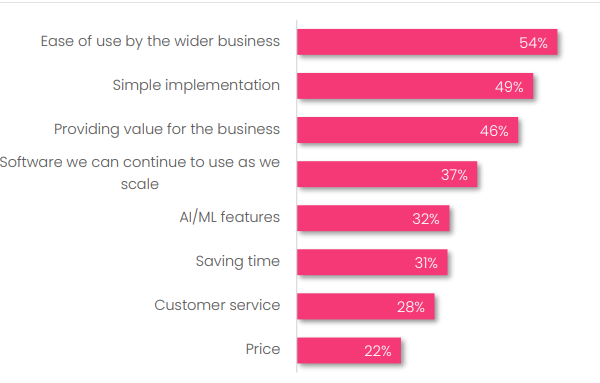

You might assume that CFOs only care only about spending as little as possible in an era of cost-cutting. But there will always be budget for deals that execute business priorities in a business. Datarails’ 2023 SMB CFO sentiments reveals that their biggest motivation in greenlighting new services is “ease of use by the wider business” and “simple implemenation” with a requirement to show services or products that are seamless and effective for the wider business.

In contrast, price is last placed in CFO’s concerns only cited by around one in five CFOs. Tellingly, also high on the list (for 32% of CFOs) is the need for software to demonstrate AI and machine learning capabilities given the ongoing AI impact in corporate finance.

2. Show clear timelines and implementation processes

To show the benefits to a business, sales must create a realistic timeline for both the sales and the after-sales process including implementation details. This reflects the fact that simple implementation is rated as the second highest priority for CFOs. Six-time CFO and Board Director Murray Demo describes the importance of this on an episode of the Revenue Builders Podcast: “To sell to the CFO, reps need to be prepared to fully understand the current process and explain how your solution will efficiently and seamlessly draft into that process. They should work to construct a 30, 60, 90-day plan with the internal implementation owner and your customer success team before the deal reaches the CFO.”

3. Treat company money like it’s your own

For those trying to buy new software or services you need to show that you are thinking about the company’s money as if it is your own. Just like in your personal life trade offs must happen – forgoing a trip to a restaurant when you have urgent repairs to your home. If you are asking for something new what can you give up that you currently have? Michael DiFilippo, CFO, Invoca says: “I will react favorably to people who are purporting to spend the company’s money, their own money.”

4. Show clear ROI

Those seeking to persuade CFOs need to show a return on investment (ROI). This may be a plan to increase sales, reduces costs or improves efficiency. Though this is easier said than done for most salesteams. A survey by UK consultancy, Positive Momentum shows that only 11% of CFOs feel that buyers have done adequate homework before making the long walk to the CFO’s office. In an equally troubling finding 93% of CFOs say that salespeople are only sometimes or rarely fluent in financial language.Tim Ritters, CFO at Gong, says: ” I have the saying, what’s the R in the ROI? A lot of people will bring me sort of proposals that will show the ‘I’ investment. Well, investment is cost, but what are you going to get from it? And generally it’s got to be a hard saving. Certainly there’s some intangibles as well. But if you come with an ask without an R on the roi that’s a tough discussion pretty quickly out of the gates as well.” Melissa Fisher, Chief Financial Officer at Outreach.io, writes in a blog post on convincing your CFOs that ROI-building means alos “showing your work”. She says ” I do want to understand ROI — but I also need to understand the assumptions behind your model, so I can validate your conclusion myself.

“Don’t worry. I’m a realist here. I know you may be operating under imperfect assumptions — these things are hard to predict. But you do need to do more than deliver me a big ROI number. Show your work, and help me see how that ROI number can happen. Make it make sense.”

5. Learn the magical metrics to get you through the gates

Particularly in a tight economy, sellers must find and attach to the biggest business issues in a businesss. A good place to start is a solution that ramps up productivity, efficient growth of revenue, and pipleline ( the stages that your sales rep goes through to convert a lead into a customer). The company stage will also be a crucial factor in determining the ROI approach of a CFO. For instance,a company with a long term plan to IPO may be ripe for the best financial planning and analysis (FP&A) software or an Enterprise Resource Planning (ERP).

Michael DiFilippo CFO, Invoca says: “An example that I’ve got is in the dark days of COVID when we had pretty much just shut down everything, if you will, from a spend and from a hiring perspective NetSuite reached out to me and just with a very attractive offer. We were on QuickBooks at the time and it wasn’t something that was on my radar screen, it wasn’t something that I certainly had budget for or whatever, but the deal that was offered was so good and I thought about it, I’m like, it’s actually going to be a pretty quiet six or nine months with not a lot going on.

“Stuff that automates the close process or will help from a future kind of SOX (the Sarbanes-Oxley Act) perspective, stuff that can help in terms of forecast accuracy, just like selfishly, those sorts of services will resonate with me at least.”

6. Get FP&A Buy-In

This one may be new to salespeople – many of whom have never heard of Financial Planning and Analysis (FP&A). In short, though the CFO is likely to be involved at a later stage before a contract gets signed, they are unlikely to be involved in any early parts of a deal. That task falls to a company’s FP&A analysts who sit within the CFO’s office. FP&A professionals have the CFO’s ear and understands what is within budget and how to shape a deal that succeeds.

Carmen Turner The Director of Financial Planning and Analysis at Carmen Consulting Group who has managed the FP&A business partnerships at top companies such as McGraw Hill, told top FP&A podcast FP&A Today: “One thing that I will say was key in establishing a good relationship with the sales team was building that partnership. Finance is often known as the team of no. So they automatically have that assumption built in that you’re just always going to say no. So they’re constantly trying to persuade you. So for me that was a great learning experience in just making them feel like a partner versus you dictating to them what was going on. And I can tell you with working with the sales team, there’s never a dull moment. There was always something to be done, which is so part of it involved coming up with processes that quickly allowed me to get them an answer back so that they could move fast and not get beat up by the competition.”

FP&A teams have decades of experience of going to bat for business partners in their organization. Ritters says: “The first protocol here at Gong is that chief executive officers work with their FP&A business person and the seller to develop a business case. The FP&A person is keeping me in the loop in the background if it’s going to be substantial enough of an investment.” Michael DiFilippo, CFO, Invoca adds: “The likelihood of something getting to the CFO that hasn’t already got to an FP&A team is pretty low.”

7. Get (the right) Internal Champions

The right internal champion is not just the FP&A analyst. The definition of a “sales champion” is an internal advocate within the customer’s organization who energetically supports and enables your solution. They hold a notable amount of influence in the decision-making process and can help steer the inner workings. Salespeople need to select and develop the right champion to be able to navigate that sales process internally. “If a seller can get a champion and someone who understands the numbers that has the ear of the CFO, their odds of success are going to increase” says Ritters. Linked to the attitudes of financial savvy that need to be deployed in dealing with finance teams, CFOs are not going to be receptive to champions with a history of freewheeling spending. Identify whether your proposed champion has proposed large expenditures in the past and successfully got approval.

8. Prove Ongoing Accountability

The internal sales process doesn’t end with a completed Docusign. You will need to look beyond the sale and put quarterly calls on the CFO or FP&A lead’s calendar to track progress and measure the actual benefits after the fact.This will be tied to a specific action plan laid out in the sales process.

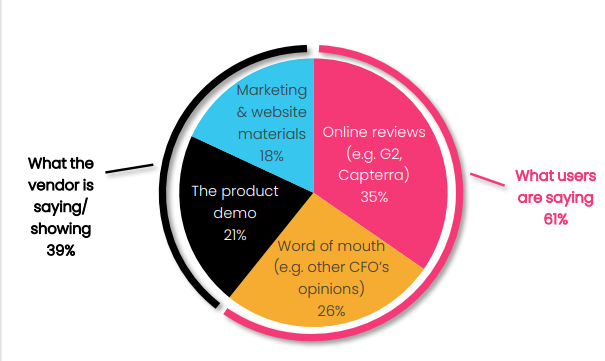

9. Don’t forget CFOs talk

The CFO community is close-knit and many decisions are based on finance chiefs talking to each other on closed groups. This includes validation of software or services. In fact, 61% of CFOs rely on online customer reviews and word of mouth recommendations to verify the claims of a potential new tech product, the Datarails survey revealed.

One intimate Slack community called “Off The Ledger” and run by spend management platform, Airbase, announced last year that it had surpassed 2,500 members, up from 50 members in January 2020. They chalked this up “to the growing demand for a hub of finance professionals to interact online.” Spendesk, another spend management platform, has 6,500 members in its closed Slack channel.

Datarails CFO Zviki Shimon says: “I asked in one CFO WhatsApp group for startup VPs of finance and CFOs about a particular software to manage and scale our corporate travel management. This led to a longer call. I spoke with a CFO willing to tell me about the ups and downs she faced using the software. I could really dig into addressing my biggest concerns with my big fear being another painful implementation which I have been burned by in the past.” In short do not expect that claims (or worse still false claims) wont be checked out.

10. Ask the Right Questions (early)

To get finance on board, you also have got to ask some of these hard questions to penetrate the finance and deal-making process. These include the following: What steps does your company make need to take to make a confident yes or no decision? What is the process to get a sale? To what extent is the CFO going to be involved? How does he or she want to be involved? Will the FP&A team be involved? Fisher adds: “What I have personally found effective is when salespeople ask me questions designed to pull out the “why.” They want to understand the assumption behind my viewpoints.”

11. Don’t Bullshit

CFOs are analytical and are not likely to stand for substandard sales techniques. Fisher says: “No exploding offers, please (unless real!) CFOs know that the price you’ve offered rarely expires, so be careful with offering deadlines and discounts. Only use the term “final price” when it’s truly final, or you’ll lose your credibility (and likeability).”

12. Rember: CFOs are not “CF-No’s”

Finally, a note of optimism: CFOs are not big bad budget slashers. Rather than outdated stereotypes as CF-Nos, or bean counters, CFOs role (is in the vast majority of cases) that of a strategic leader second only to the CEO in driving their business forward on the right footing. Fisher puts it this way: “I’ve gotten involved in approving more expenses than I normally would. And while I can be tough, I’m also passionate about helping sellers win.”

Kelliher adds: ” We don’t try to be black and white and simply exist by a spreadsheet. We are trying to be smart about it, and even if it’s in the budget, we’re in the smartness of do we need it? Do we need it now? And does it make sense? So I think it gets some more scrutiny, but it still doesn’t mean it’s not going to get done.”