When deciding on whether to implement a top-down or a bottom-up budget process, it is important for organizations to understand the differences between the two and how the organization aligns with both approaches. These are parts of a broader process known as top-down planning and bottom-up planning. Oftentimes, a budgeting process is chosen based on theoretical outcomes, but when practically applied it might not yield the best benefit.

Before undertaking any budget planning process, it is important for an organization to analyze what approach can be best executed in its current environment and attempt to balance that against its needs. The ability to execute on a budgeting methodology is equally as important, if not more important, than choosing the correct methodology.

Let’s dive into what exactly top-down and bottom-up budgeting is, how they differ, and how to identify which is the best approach for your organization.

What Is Top-Down Budgeting?

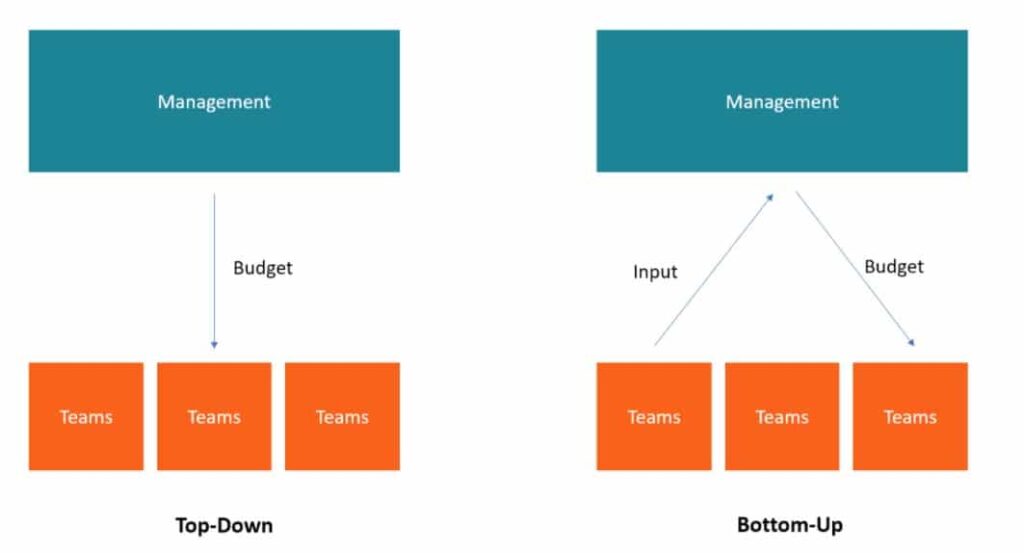

In its most basic form, a top-down budget (or top-down planning) is a budget that is created by upper management and then “pushed down” to department managers for implementation. The name “top-down” reflects where the budget originated and where it goes within the organization. The top-down approach to planning is common in many organizations.

The Top-Down Budgeting Process

The process begins with senior managers meeting to outline the objectives for the coming fiscal year. While doing this, senior leadership typically utilizes the previous year’s budget and financial statements and reviews the information in conjunction with market conditions and changes in the business model.

While developing the objectives of the business, management will often take into consideration feedback from department heads and the various contributions made by each department in the prior year. Once the objectives are clearly identified, the finance department works to integrate them into a financial plan in the form of a budget.

A finance department creates the budget by making allocations to various departments based on the previous year, adjusted for the current year’s goals. Once allocations are made, they are delivered to each department, putting the onus on management to prepare a budget specific to their department.

Each department level budget should aim to illustrate how the allocated expense estimates will be used to meet revenue or earnings goals. The department-level budget should be made specific and outline each expense to the best of its ability.

At the end of the process, the finance department will aggregate each department-level budget and review them to ensure they are properly aligned with meeting the goals laid down by management at the beginning of the process. Adjustments might be made depending on the needs identified by each department in the process.

Once the budget is finalized, the finance department should monitor the financial performance of the business to ensure it is within the constraints of the budget. Management should use it as a guide for implementing the change or deploying resources.

What Is Bottom-Up Budgeting?

In its most basic form, a bottom-up budget is a budget that is first generated by individual departments and then “pushed up” to senior management. The name “bottom-up” reflects where the budget originated and where it goes within the organization.

The Bottom-Up Budgeting Process

The process begins by having each department identify its goals and the projects they intend to implement in the coming year, along with the estimated cost associated with them. Once a department has its list of intended projects and their associated cost, it should aggregate them into a single budget.

These budgets are then submitted to the finance department to aggregate into one overall budget for the organization. The totals for each department budget should be coming directly from the department managers or project leads.

Finally, the budget is then submitted to senior leaders for review and approval. Management should take time to carefully consider if the budget is aligned with the goals they have outlined for the coming year. Once approved, the estimates are then sent back to the finance department who will allocate resources to the various departments.

Top-Down vs Bottom-Up Budgeting

Sometimes there is a tendency to refer to bottom-up budgeting as an expanded form of top-down budgeting. This is not the case, and the two represent two distinct disciplines of budgeting.

In a top-down planning, departments must generate budgets within the constraints set forth by senior leadership. In a bottom-up budget, departments create their own budget estimates and send them to senior leadership.

The two approaches are the two most widely adopted forms of budgeting. On the one hand, a top-down budget/top down planning takes less time, but it sacrifices intimate knowledge of each department’s needs. As a result, some departments may not be able to successfully operate within the constraints outlined by senior leadership. On the other hand, a bottom-up budget empowers employees to take ownership of the planning process and utilizes their expertise in the departments they operate, but sometimes the output of the departments may not align with the overall goals of the organization.

Pros and Cons of Top-Down and Bottom-Up Budgeting

Each approach has its own list of pros and cons, which we can compare and contrast.

Top-Down Budget Pros

- Budget is defined by management that is concerned with the overall growth of the company.

- Takes the burden off of lower management to create a budget on their own, saving time and resources.

- Easier to manage because only one budget is drafted and implemented rather than several department budgets.

- Allows for each department to align with the goals of the company.

Bottom-Up Budget Pros

- Because budget estimates are developed at the bottom, they are typically far more accurate.

- Gives the clearest picture of each department’s costs and resources.

- Empowers employees at the lowest level to take ownership of their department.

- Motivates employees to meet financial objectives because they took part in defining them.

Top-Down Budget Cons

- Senior managers might lack a critical understanding of the departments they are creating budgets for.

- Unrealistic expectations might permeate the budget due to a lack of experience with each department.

- Employees might be less motivated to implement a budget they have no input on.

Bottom-Up Budget Cons

- Each department makes its own budget without regard to other departments, which means there is a lack of cohesive budgeting. Bottom up budgeting may lead to not getting the upper management insights.

- A budget is being created by the least experienced team members, which might not incorporate the goals of the organization.

- Each employee making the budget needs to be in agreeance or there could be possible issues with staff.

Using Datarails to Build Your Budget

Every finance department knows how tedious building a budget can be. Regardless of the budgeting approach your organization adopts, it requires big data to ensure accuracy, timely execution, and of course, monitoring. Datarails’ FP&A software is a budgeting tool that can help your team create and monitor budgets faster and more accurately than ever before.

By integrating fragmented workbooks and data sources into one centralized location, you can work in the comfort of excel with the support of a much more sophisticated budgeting software behind you. This takes budgeting from time-consuming to rewarding.

Learn more about the benefits of Datarails‘ solution >>