In 2025, finance teams continue to rely on the best cash flow forecasting software to plan ahead with confidence.

These top tools, including Datarails, combine real-time data integration, scenario planning, and user-friendly dashboards. They support your team’s financial and operational planning, streamline financial reporting, and improve overall cash flow management by reducing manual work and errors.

The result? A clearer picture of money moving in and out of the business enables faster and more grounded decision-making. In the sections ahead, we’ll look at some of the best tools and why they’ve become such a necessity.

What Is Cash Flow Forecasting Software?

Manually building cash forecasts in spreadsheets is time-consuming and prone to mistakes. A dedicated cash flow forecasting tool automatically pulls together all your financial data (from bank accounts, ERP systems, etc.) and updates your projections in real time.

This means you get an up-to-date view of your cash position at any moment. Teams that use software can quickly run what-if scenarios and see the results instantly, rather than wrestling with complex Excel formulas.

Why Businesses Need a Cash Flow Forecasting Tool

Even a small boost in forecast accuracy can have a big payoff. For example, according to Abacum, a 15% improvement in cash forecasting accuracy can drive a more than 3% increase in pre-tax profits.

Put simply, today’s software takes the busywork off your plate. It reduces errors, sharpens your reporting, and frees finance teams to spend more time on strategy instead of spreadsheet upkeep.

Key Features of Cash Flow Planning Software

The best cash flow forecasting software provides more than just projections. Strong cash flow planning software typically includes:

- Real-time integrations with accounting, ERP, and banking systems so forecasts always reflect current numbers.

- Scenario planning and cash flow modeling software to test different assumptions and outcomes.

- Rolling forecasts that update automatically, replacing static, one-time projections.

- Custom dashboards and reporting provide executives and stakeholders with clear visibility.

- Collaboration features enable multiple departments to contribute inputs without version control issues.

With these features working in unison, you’re left with the most accurate and actionable picture of your liquidity.

Benefits of Using a Cash Flow Forecast Tool Over Spreadsheets

A dedicated cash flow forecast tool offers unmistakable advantages:

- Accuracy: Automated updates reduce the risk of broken formulas and manual entry errors.

- Speed: Running a new scenario takes seconds instead of hours of spreadsheet adjustments.

- Scalability: Cash forecasting software handles multi-entity, multi-currency forecasting that spreadsheets can’t.

- Visibility: Cash flow tracking software gives teams a live view of liquidity, which you simply can’t get from static spreadsheets

To sum it up, software for real-time cash flow forecasting frees finance professionals from administrative tasks and provides the clarity needed for better decision-making.

12 Best Cash Flow Forecasting Software Solutions in 2025

- Datarails

- Planful

- Vena

- Workday Adaptive Planning

- Anaplan

- Cube

- Jirav

- Kyriba

- Float

- Abacum

- Fathom

- Planning Maestro (Now Centage)

Finance professionals have many options when it comes to cash flow software.

Below, we highlight 12 of the best cash forecasting software solutions for finance teams in 2025. We cover what makes each tool stand out so you can find the one that fits your needs.

1. Datarails

Datarails is an FP&A platform built for Excel users that brings automation and data centralization to your cash flow forecasts. It connects directly to your company’s data sources (ERPs, bank accounts, CRM, etc.) and pulls them into one source of truth.

You can keep working in Excel’s familiar interface, but with the power of a centralized database behind it.

How Does Datarails Simplify Cash Flow Forecasting For Finance Teams?

Datarails automates data consolidation and updates your cash flow models in real-time, so your forecasts are always up to date. Finance teams love that it supports detailed drill-downs: you can break down cash flow by account, department, or currency to see exactly what’s driving your cash position.

The software also features robust scenario planning and version control, allowing you to easily create and compare multiple forecast versions.

In short, Datarails gives you the best of both worlds (the flexibility of Excel and the reliability of a modern cash forecasting solution) to improve accuracy and confidence in your cash planning.

Ready to try the only 100% native Excel FP&A solution?

2. Planful

Planful (formerly Host Analytics) is a cloud-based financial planning suite that includes strong cash flow forecasting capabilities. It’s known for supporting end-to-end financial planning, reporting, and analysis in a single platform.

What Features Make Planful A Top Cash Flow Forecasting Tool?

For cash forecasting, Planful lets you effortlessly generate rolling forecasts and scenario analyses. For example, finance teams can create rolling 12-month cash forecasts with just a few clicks, a task that might take days in spreadsheets.

Planful comes with pre-built templates and integrates with your accounting and ERP systems, ensuring your cash projections use the latest actuals.

Planful is especially popular with mid-size and enterprise companies that need a scalable solution for multi-entity planning.

3. Vena

Vena is another leading FP&A software that many finance teams use for cash flow forecasting. Vena’s claim to fame is its Excel-based interface combined with a central database.

In practice, this means you can design and improve cash flow models in Excel, but have Vena handle the heavy lifting of data consolidation, version control, and user permissions.

How Can Vena Solutions Help With Cash Flow Planning And Reporting?

Vena offers driver-based modeling, which you’ll see a few times in this list. This means you can set up key cash flow drivers (such as collection periods or payment terms) and the software adjusts the forecast based on those assumptions.

The software also adds structure through workflows that guide teams through the process. This is particularly useful in budgeting cycles. And when it’s time to present, Vena makes it simple to create polished reports and dashboards.

4. Workday Adaptive Planning

Workday Adaptive Planning (formerly Adaptive Insights) is an enterprise-grade planning tool known for its scalability. Often, it’s chosen by teams that need to move beyond Excel for forecasting. It supports complex, multi-year financial models and has strong collaboration features for big teams.

Why Is Workday Adaptive Planning Useful For Cash Flow Forecasting?

In terms of cash flow forecasting, Adaptive Planning lets you build both direct forecasts (based on cash transactions) and indirect forecasts (based on P&L and balance sheet drivers) within its platform.

You can integrate Workday Adaptive Planning with your major ERP systems like Workday, NetSuite, SAP, etc. Then, you’ll know your cash forecasts pull in up-to-date actuals from your GL.

Adaptive Planning comes with a learning curve due to its extensive feature set, but for mid-to-large businesses, it provides a robust framework for managing and forecasting cash flow at scale.

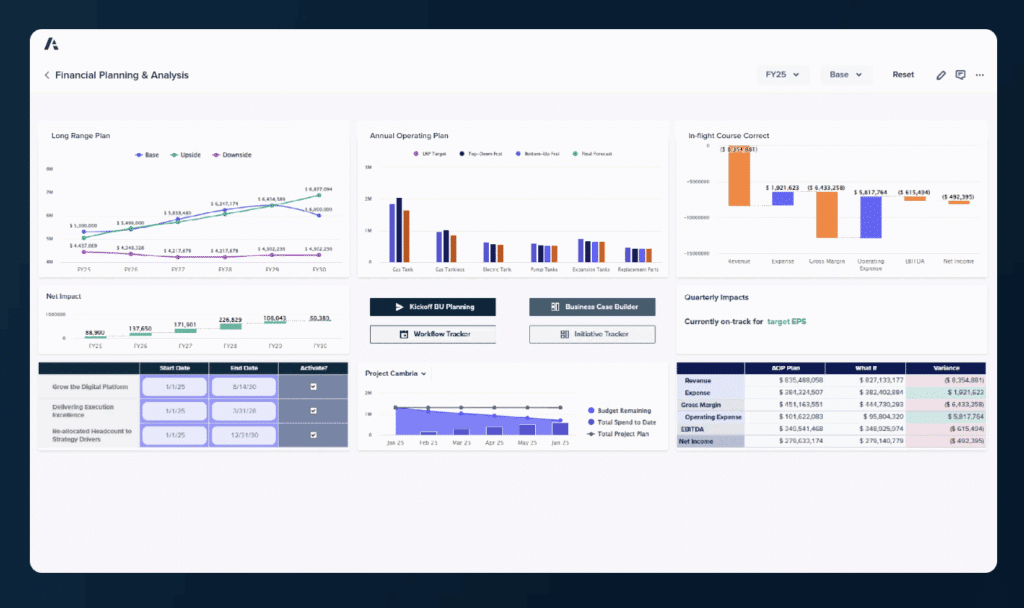

5. Anaplan

Anaplan is well-known for its “connected planning” approach, and it’s widely used by enterprises for complex financial modeling, including cash flow forecasts. Anaplan’s platform is cloud-based. With it, you can build highly customized models that can handle multiple dimensions all within one model.

What Makes Anaplan A Powerful Cash Flow Forecasting Solution?

For cash flow forecasting, Anaplan excels at scenario planning and multi-dimensional analysis.

Anaplan integrates with many data sources and can pull in both internal data and external factors (like economic indicators) if needed for more advanced cash predictions.

The downside is that Anaplan can be complex and typically requires an experienced model builder to maximize its potential.

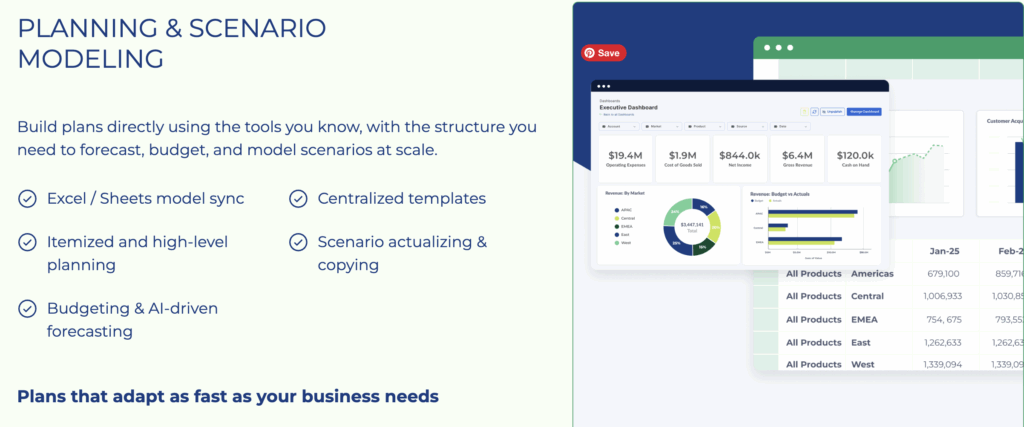

6. Cube

Cube is a modern planning software designed for finance teams that still love working in spreadsheets. It’s ideal for companies that want to maintain a familiar workflow while eliminating manual data entry.

How Does Cube Assist In Cash Flow Forecasting For Excel Lovers?

Cube connects to Excel and Google Sheets, allowing you to pull actuals and push forecasts between the Cube system and your spreadsheets.

In practice, you might build a cash flow forecast template in Excel, but Cube will feed it with live data from your financial systems, so you’re not copying and pasting numbers anymore.

We also cover the best AI tools for finance teams that use Excel in this article.

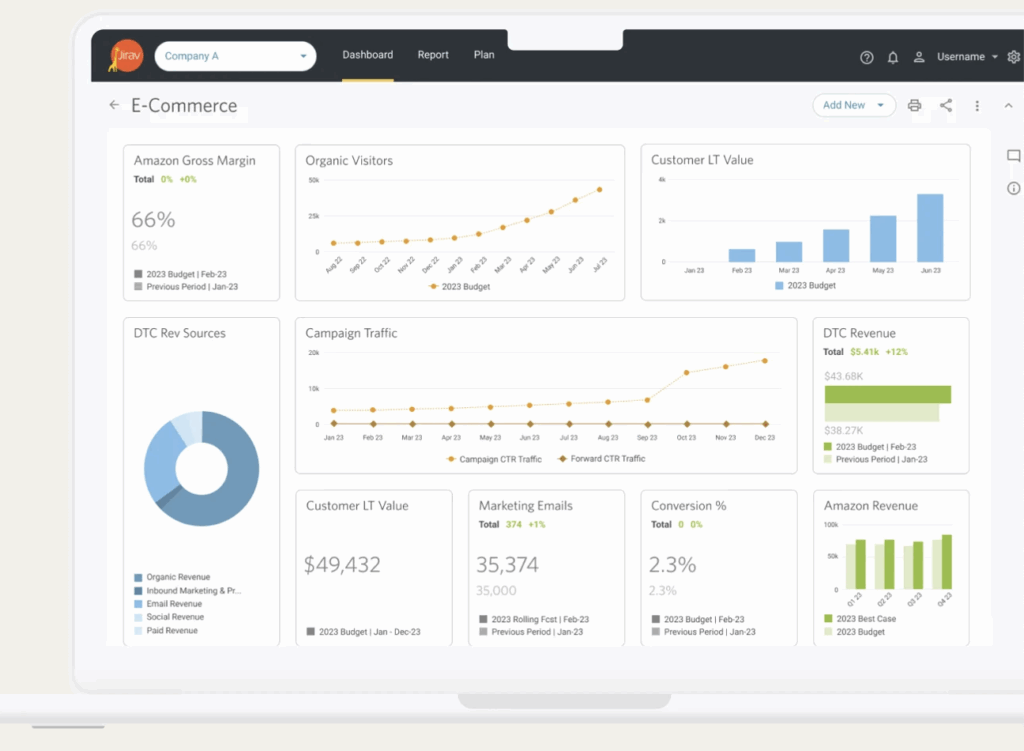

7. Jirav

Jirav is a cloud-based financial planning platform focused on small to mid-size businesses and accounting. Its strength lies in driver-based financial models that make it easy to connect revenue, expenses, and headcount to future cash flow projections.

Why Do Finance Teams Choose Jirav for Forecasting?

With Jirav, you can quickly build rolling forecasts and tie them directly to your business assumptions. The software integrates with QuickBooks, Xero, NetSuite, and popular HR systems. In turn, your cash flow forecasts automatically reflect current payroll and expense data.

Jirav’s dashboards provide straightforward visuals that help anyone (including non-finance team members) understand the cash outlook, making it a popular choice for companies needing board-ready reporting.

8. Kyriba

Kyriba is best known as a treasury management system, but it also delivers powerful cash flow forecasting capabilities. It’s designed for large organizations that require visibility across global subsidiaries and multiple banking relationships.

What Sets Kyriba Apart in Cash Forecasting?

Kyriba connects directly with banks to provide real-time cash positions. Treasurers and finance teams use Kyriba to consolidate forecasts from dozens of entities and update them automatically as transactions occur.

The platform supports scenario planning, stress testing, and liquidity optimization, making it optimal for enterprises with complex structures. Kyriba recently launched “TAI,” its agentic treasury AI built to improve liquidity performance.

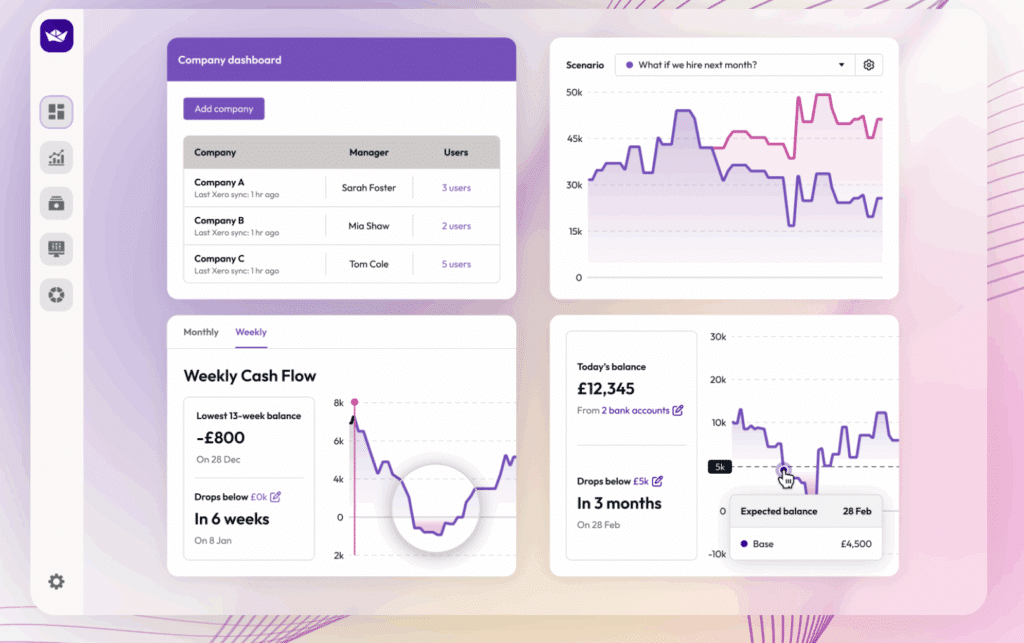

9. Float

Float is a cash flow forecasting app marketed largely toward fractional CFOs, agencies, construction, and architecture. Unlike some larger FP&A suites, Float emphasizes simplicity, user-friendliness, and quick setup.

How Does Float Simplify Cash Flow for Small Businesses?

Float integrates directly with accounting systems like QuickBooks Online, Xero, and FreeAgent, then automatically builds daily, weekly, or monthly forecasts. Users can track invoices, bills, and expected payments to get a short-term view of liquidity.

Its approachable interface makes it a favorite among startups and SMBs that don’t need enterprise-level features but want real-time cash clarity.

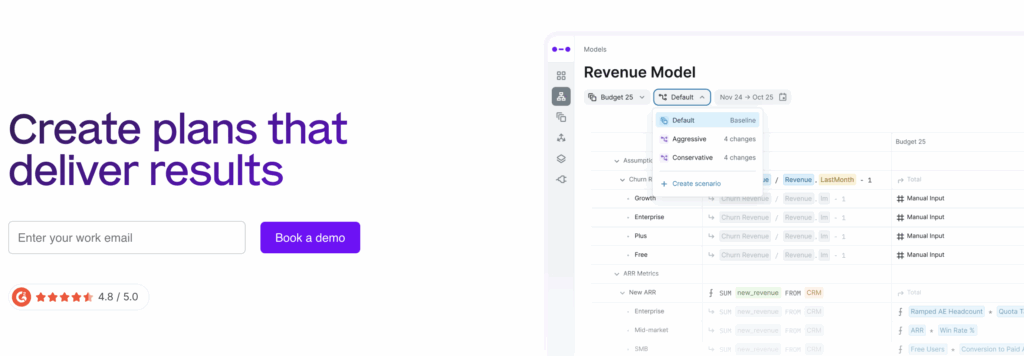

10. Abacum

Abacum is an FP&A platform that prides itself on its distinctive blend of cash flow forecasting simplicity and enterprise-grade flexibility. The platform helps finance teams collaborate across departments while building accurate, real-time forecasts.

Why Does Abacum Work Well for Cash Flow Forecasting?

The Abacum platform connects directly to accounting and CRM systems, letting you model cash inflows and outflows by customer, region, or business unit. Abacum emphasizes team workflows, allowing department heads to contribute their inputs to the forecast.

Its strong visualization tools make cash runway, burn rates, and financing needs easier to track for maturing businesses.

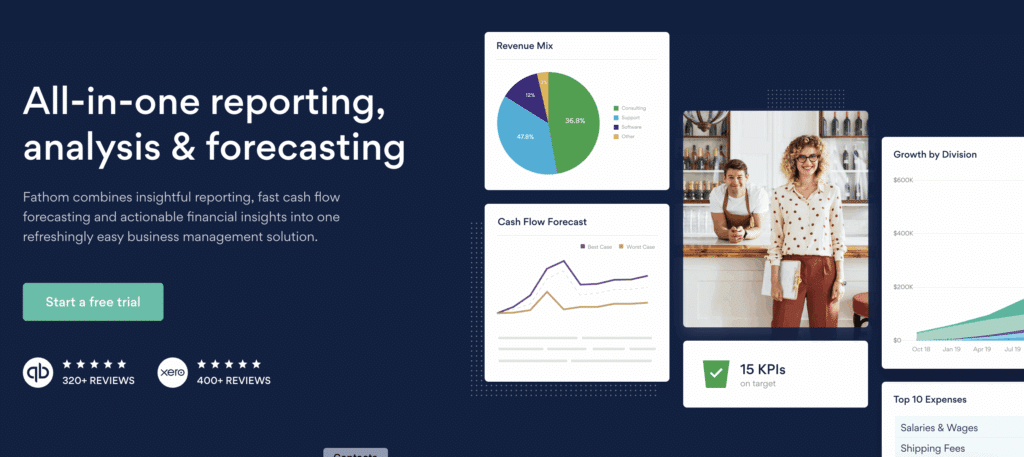

11. Fathom

Fathom is another reporting and forecasting platform to consider. Accountants and financial advisors often use Fathom to provide easy-to-understand financial analyses to their clients. Its intuitive design makes it accessible to non-financial users while still offering deep forecasting capabilities.

How is Cash Flow Forecasting Improved with Fathom?

Fathom integrates with QuickBooks, Xero, and MYOB, pulling in accurate financials to produce rolling cash forecasts. Like Jirav and Vena, Fathom offers driver-based modeling and scenario testing, so you can answer questions like “What if sales drop X% next quarter?”

Other notable features include consolidations and group benchmarking. The platform is especially popular among advisory firms that want to deliver value-added takeaways to multiple clients at once.

12. Planning Maestro (Now Centage)

What was once known as Planning Maestro has been rebuilt as Centage. Now cloud-based, the platform offers many new and improved features. Centage markets its platform to “labor-intensive” industries, with a focus on automation and financial accuracy.

Why is Centage a Popular Cash Flow Forecasting Tool?

Centage provides integrated balance sheet, income statement, and cash flow forecasts, ensuring all three stay aligned. Its automation means that when you change assumptions in one area (like adjusting revenue), the impact on cash flow is reflected instantly.

Centage is a good fit for labor-intensive companies that want a reliable system of record for all forward-looking financials without the complexity of enterprise platforms.

Role of AI in Cash Flow Forecasting Accuracy

We mentioned a few of the best cash forecasting tools that also offer AI capabilities, which are now highly sought-after by many businesses. In fact, AI has quickly become a defining feature of the best cash flow forecasting software.

Traditional business cash flow models rely heavily on historical data and manual assumptions. While that approach works, it often misses sudden shifts in customer behaviour, supply chain disruptions, or economic changes.

Modern AI finance tools improve accuracy because they’re dynamic: they keep learning from both historical patterns and live financial data. They can automatically adjust projections based on seasonality, payment delays, or real-time banking transactions. For finance teams, this means forecasts that stay relevant even when business conditions change quickly.

AI also enables faster “what-if” analysis. Instead of manually testing each assumption, the software can generate multiple scenarios and highlight risks or opportunities in seconds.

For companies that need to scale financial forecasting beyond spreadsheets, AI-powered cash flow software offers both speed and reliability. From small businesses using affordable tools to enterprises adopting advanced treasury cash flow forecasting software, AI ensures teams spend less time crunching numbers and more time acting on insights.

How to Choose the Best Cash Flow Forecasting Solution for Your Business

Choosing the right tool ultimately hinges on your company’s needs and available resources.

Here are a few tips to keep in mind when evaluating options:

- Match the tool to your business size: Some solutions are better for small businesses, while others cater to large enterprises. Pick software that fits the scale and complexity of your operations.

- Integration with your data: Make sure the software can connect to your existing systems (your accounting software, ERP, banking data, etc.). Automatic data updates are a huge time-saver and reduce errors. If you live in Excel, consider tools that integrate with Excel so you don’t disrupt your workflow.

- Ease of use vs. advanced features: Identify what’s most important for your team. Do you need a simple, easy-to-use tool for basic forecasts, or a comprehensive FP&A platform with custom modeling and multi-scenario planning? The best cash flow tool is one that your team will actually use, so review demos and screenshots to assess the user experience.

- Budget and ROI: Unsurprisingly, platform costs vary widely. Some tools charge monthly subscriptions, others have hefty enterprise pricing. It’s not just about the sticker price: consider how much time you’ll save and the financial impact of better decisions. A more expensive tool may be worth it if it greatly improves your forecasting accuracy (preventing cash crises or idle cash).

Challenges in Cash Flow Forecasting and How Software Solves Them

Even the most experienced finance teams face challenges when managing liquidity. Without a dedicated cash flow forecasting tool, many fall into the same traps:

- Data silos: Accounting, ERP, and banking systems often don’t communicate, leading to outdated or incomplete forecasts.

- Human error: Manual spreadsheets introduce formula mistakes, broken links, and version control problems.

- Slow updates: Forecasts built once a quarter quickly lose relevance when business conditions shift.

- Limited visibility: Companies with multiple entities or currencies often lack a consolidated view of cash positions.

This is where the best cash flow software steps in. By centralizing data across systems, automation ensures every forecast uses real-time information. Cash flow planning software eliminates the risks of spreadsheet errors, while built-in workflows keep teams aligned during budgeting cycles.

Level Up with Cash Flow Forecasting Software

Whether you’re a small business trying to automate a simple cash forecast or a large enterprise needing a powerful planning platform, there’s a solution out there for you.

FAQs

Spreadsheets work, but they’re slow and fragile. Software automatically pulls in your bank data, invoices, and payments, then updates your forecast without requiring any manual input. It also gives you built-in scenarios and error checks. In short, you spend less time fixing formulas and more time making decisions.

No, a budget sets goals for revenue and expenses, while a cash flow forecast shows when money actually moves in and out of your account.

You might budget $100,000 for Q3, but the forecast indicates whether the cash will be spent in July or distributed over three months.

Both matter: the budget sets the plan, and the forecast shows whether you’ll have the cash to follow through.

They’re fine when you’re just starting, and you can build models that fit your business. But over time, they prove to be error-prone, difficult to keep updated, and challenging to share across a team.

Businesses tend to outgrow them and switch to tools that integrate with their accounting systems and update automatically. Determined to stick with Excel? Keep things simple and closely monitor version control.

Cash flow forecasting software automatically collects financial data from your systems (like bank accounts, ERPs, and accounting tools) and uses it to project future inflows and outflows.

Rather than manually updating spreadsheets, you get live forecasts that reflect the most recent numbers. Most tools also allow for scenario planning, so you can model different situations and see their impact on liquidity.

Real-time data integration, rolling forecasts, scenario planning, and customizable dashboards are the bare minimum in terms of key cash flow forecasting features. Strong reporting, multi-entity support, and collaboration features also set the best tools apart. CFOs and finance managers value software like Datarails that eliminates manual data entry while improving accuracy.

AI-powered tools can analyze historical trends, detect anomalies, and automatically adjust projections as new data comes in. This helps finance teams spot risks earlier, test more scenarios, and get forecasts that reflect changing business conditions in real time.

AI also reduces the burden of manual modeling by suggesting assumptions based on actual patterns.

For companies with subsidiaries or international operations, platforms like Datarails, Kyriba, Anaplan, and Workday Adaptive Planning stand out. They allow finance teams to consolidate forecasts across entities, currencies, and banking relationships. This provides a unified view of liquidity and enables better treasury and cash management decisions.