When you choose financial modeling software, you’re ultimately making a decision that will impact not only the efficiency and accuracy of your financial analysis but also your business’s long-term financial strategy.

With all of these options to sort through, finding the best financial modeling software can be like searching for a needle in a haystack. It requires balancing the ease of use with comprehensive features, ensuring data security while offering the flexibility of customization, and, of course, getting the most value for your investment.

With these challenges in mind, we put together a list of the top seven software with the best models that have proven their worth in the finance industry. Keep reading to understand their features and who each one is meant for.

Here is a quick overview of the top 7 financial modeling software for 2025. Keep reading for a more detailed overview of each one.

- Datarails

- Quickbooks

- Xero

- Planful

- Cube

- Forecastr

- Vena Solutions

What is Financial Modeling Software?

According to Datarails, “a financial model, often referred to as a predictive model, is a forecast of future performance based on a given set of variables. Financial models are used to quantify business expectations of future performance. The models themselves can be different but all financial models are quantitative in nature.”

In simple terms, a financial model is the process of combining historical and projected financial information to make business decisions.

What to Look for in Financial Modeling Software

Before we get into the specific software options, let’s discuss what to look for in financial modeling software.

Here are some key features and functionalities to consider when evaluating different options.

Ease of Use

An excellent financial modeling software should have a user-friendly interface and intuitive navigation, allowing users of all levels to easily create complex models without extensive training. If the software is difficult to use, it defeats the purpose of streamlining and simplifying financial analysis.

Comprehensive Features

Financial modeling involves various tasks such as budgeting, forecasting, scenario planning, and data analysis. The ideal software should have multiple features that cater to these different needs. It should also offer templates or pre-built models for common scenarios, saving the user time and effort.

Data Security

With sensitive financial data being handled, security is a significant concern in the finance industry. The software should have extensive security measures in place to protect confidential information from unauthorized access or cyber threats.

Customization Options

Every finance team has unique needs and processes, so the financial software should allow for customization to fit these specific requirements. This could include creating custom reports, dashboards, or workflows.

Collaboration Capabilities

Financial modeling often involves collaboration between team members and stakeholders. The software should have features that enable real-time collaboration and version control so everyone is working with the latest data and changes can be tracked.

Integration with Other Systems

To maximize efficiency, the financial modeling software should be able to integrate with other systems and tools used by the organization. This could include accounting software, data sources, or project management tools.

Training and Support

Even with a user-friendly interface, the software must offer training and support resources for users to fully utilize its features. These could include online tutorials, webinars, or a dedicated support team.

Scalability

As a company grows, its financial modeling needs may also change. The software should be able to accommodate these changes and scale accordingly without disrupting current processes.

The Best Financial Modeling Software

Now that we’ve covered the key features to look for in financial modeling software, here are seven of your best bets to consider.

1) Datarails

Known for its Excel native interface and data integration along with its AI capabilities, Datarails is a financial modeling software designed for virtually any industry. With an incredibly user-friendly and intuitive interface, Datarails enables finance teams to consolidate data from various sources easily, collaborate on models in real time, and track changes made by team members, among other things.

Datarails strives to make financial modeling as effortless as possible, removing much manual work and allowing users to focus on value-added analysis. One of the most exciting features Datarails offers is FP&A Genius.

This Gen AI feature allows us to provide finance teams with fast answers to financial questions based on complete and consolidated finance data from across their companies.

Key Features and Benefits:

- Budgeting and Forecasting

- Financial Close

- Scenario Modeling

- Dashboarding

- AI for FP&A

- Storyboards

- Extensive integrations

2) QuickBooks

Most people associate QuickBooks with its popular accounting software, but it also offers a comprehensive financial modeling solution. Primarily designed for small to medium businesses, QuickBooks allows users to create customizable financial models and forecasts based on real-time data.

What’s convenient about QuickBooks is the range of plans and programs they offer, so finance teams can choose a plan that works in terms of pricing and ensures they’re not paying for more software than they need.

Another standout feature of QuickBooks is its built-in collaboration capabilities, which make it easy for teams to collaborate on budgeting and forecasting. Its user-friendly interface and accessibility from both desktop and mobile devices make it a popular choice for smaller finance teams.

Key Features and Benefits:

Depending on the plan you choose, some of the features and tools you’ll have access to include:

- Track income, expenses, sales, and tax

- Capture and organize receipts

- Invoice and accept payments

- Progress invoicing

- Maximize tax deductions

- Manage bills and payments

- Track project profitability

3) Xero

Xero is known for its uniquely designed solutions for accountants and small business owners. These solutions include a financial modeling feature that allows users to create accurate and dynamic financial models.

What sets Xero apart is its ability to integrate with so many third-party apps. This allows finance teams to customize their modeling software according to their specific needs. Xero’s cloud-based platform also enables real-time updates and collaboration among finance team members, making it a convenient choice for small businesses.

Key Features and Benefits:

- Bill payment

- Expense claiming

- Bank connections

- Payment acceptance

- Payroll

- Bank reconciliation

- Data capture

- Analytics

- Accounting app and dashboard

4) Planful

In their words, Planful was built for speed, accuracy, and confidence in financial modeling and other financial planning tasks. Their cloud-based platform offers flexibility, real-time updates, and powerful automation features to enable finance teams to focus on the bigger picture while their financial modeling software takes care of the details.

Key Features and Benefits:

- Automated data integration

- Scalability

- Real-time reporting

- Collaboration capabilities

- Integration tools

- Scenario planning

- Built-in formulas for fast calculations

- Advanced security measures for data protection

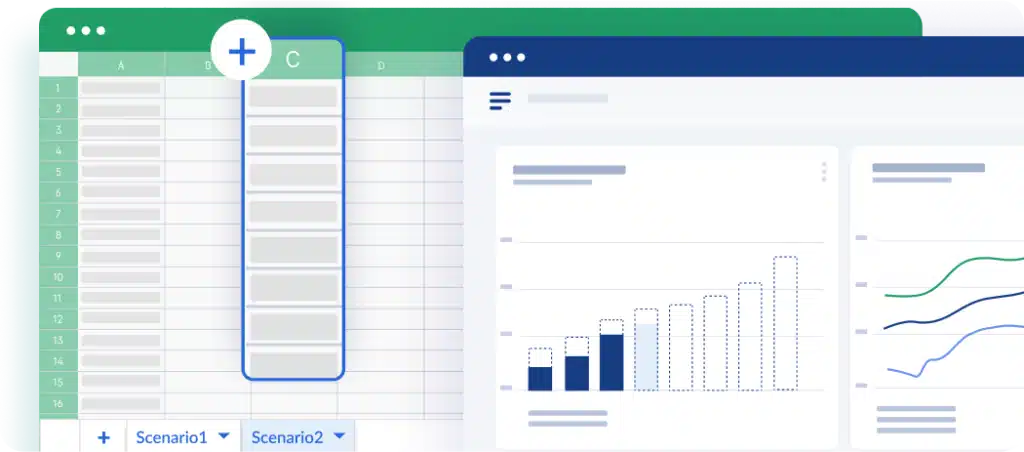

5) Cube Software

Cube boasts a fast onboarding process and impressive user-friendliness for its financial modeling software, making it a strong contender for small businesses and startups that don’t have the resources or time to wait for extensive training. The platform also offers a variety of forecasting tools to help finance teams make more accurate predictions and projections.

Cube works with Microsoft Excel and Google Sheets. It’s also compatible with Macs and PCs.

Key Features and Benefits:

Relating specifically to its planning and modeling capabilities, Cube Software offers:

- Annual budgets

- Break-even analysis

- Multi-scenario planning

- Sales forecasting

- CapEx/Opex planning

- Headcount planning

- Monthly/quarterly forecasting

- Driver-based planning

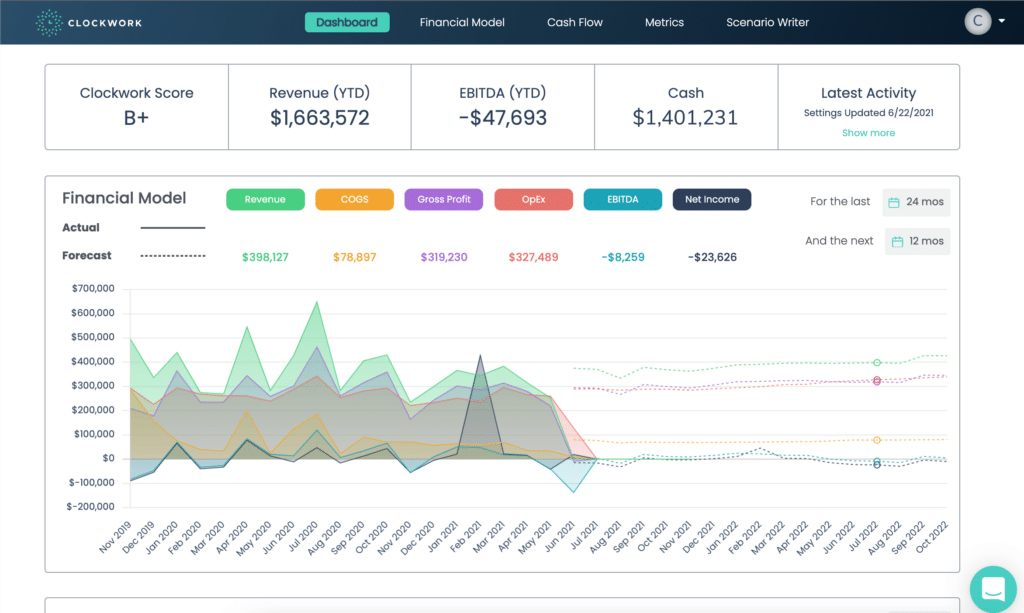

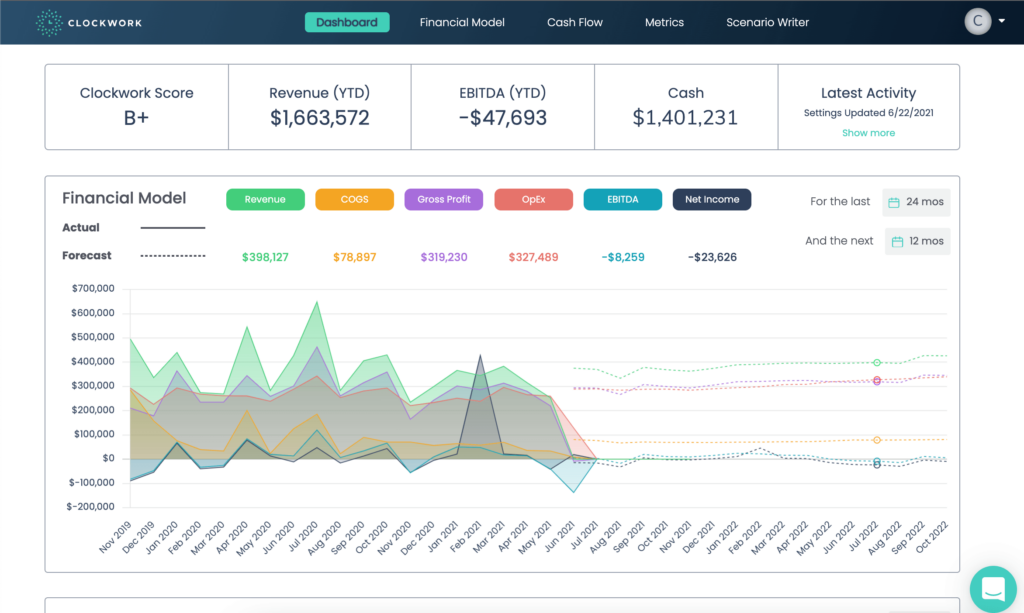

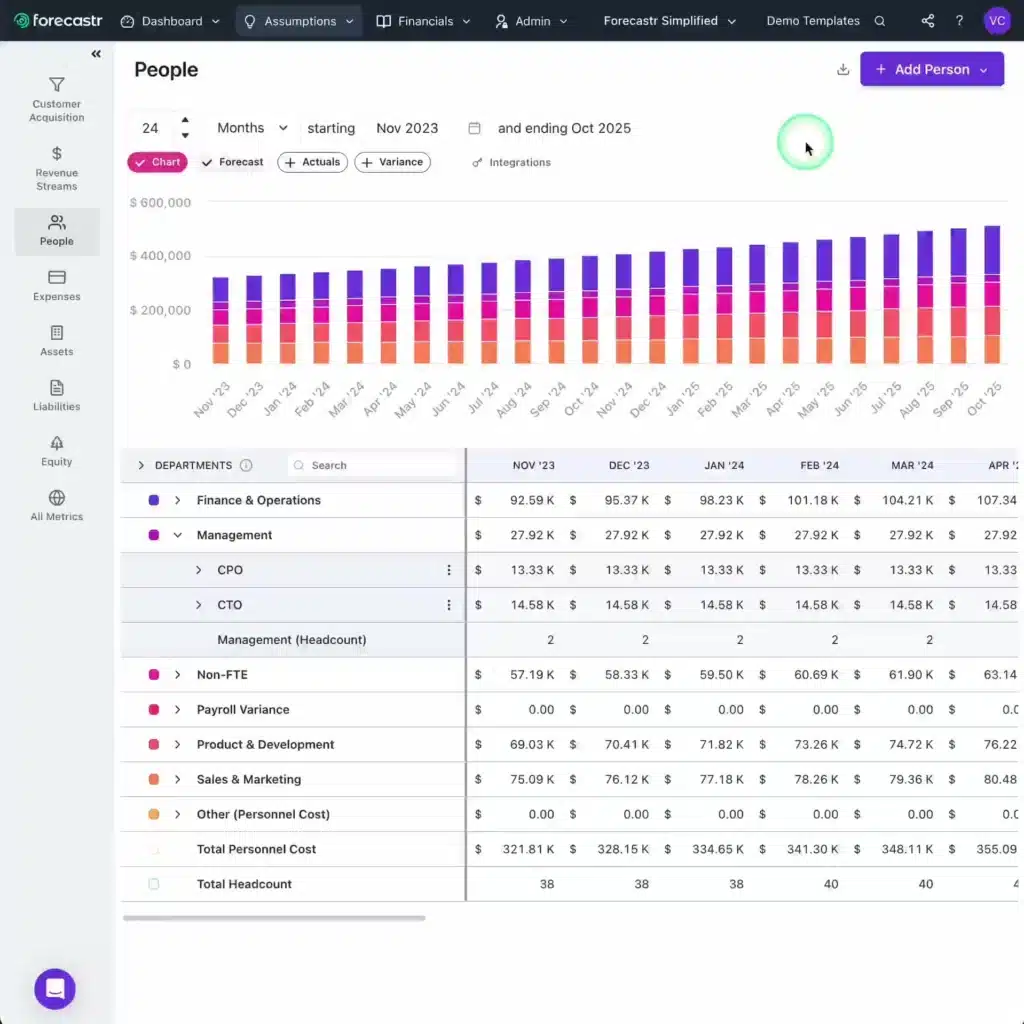

6) Forecastr

Forecastr is another option for financial modeling software that lets finance teams build custom financial models from their existing data. The platform comes with the support of software and financial experts who ensure teams get the most out of the software.

With their automated accounting integrations, finance teams will save time and gain valuable insights from their accurate financial models.

Forecastr integrates seamlessly with popular accounting software QuickBooks and Xero. It also offers fractional CFO services and financial analyst support.

Key Features and Benefits:

- Real-time dashboard

- “Assumptions” tab with key business metrics

- Automated projections

- Strategic planning based on “what if” scenarios

- Easy to share with stakeholders and investors

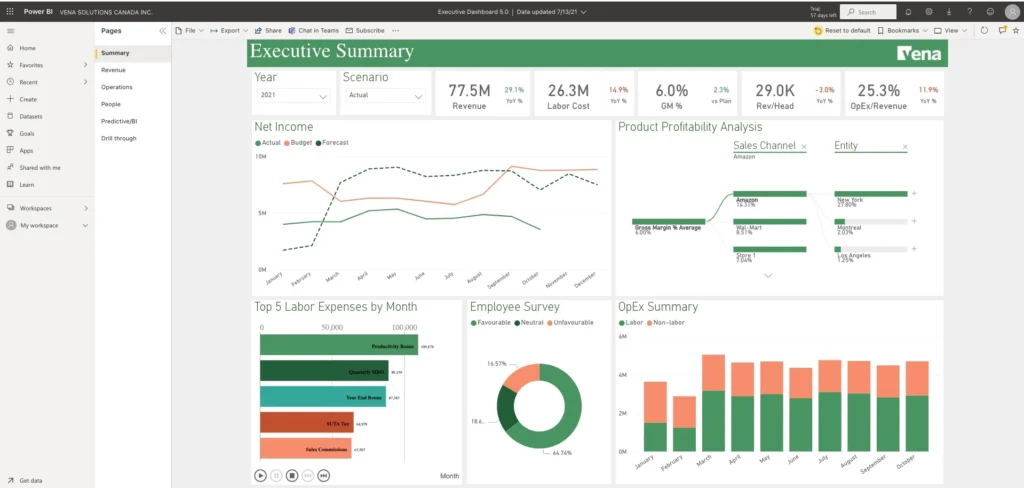

7) Vena Solutions

For a more comprehensive financial planning and modeling solution, Vena Solutions offers robust features for budgeting, forecasting, reporting, and analytics. With its user-friendly interface and robust data management skills, Vena has become a popular choice for businesses of all sizes.

With its flexible modeling capabilities and advanced analytics, Vena strives to help users “plan for anything.” It also offers seamless integration with Microsoft Excel, CSV, and flat files, making it easier for users to adapt to the new software. You can also connect Vena to several CRMs, including Salesforce, HubSpot, NetSuite, and Microsoft Dynamics.

Key Features and Benefits:

- ERP and GL integration

- HRIS integration

- Flexible scenario modeling

- Revenue and CapEX planning

- Budgeting and forecasting

- Cash flow management

Start Using the Best Financial Planning and Modeling Software Today

As businesses face challenging economic conditions, reliable financial planning and modeling software have become more important than ever. With the right tool, you can accurately forecast your company’s financial future and make informed decisions to drive growth and success.

Book a demo with Datarails to see why so many businesses trust us with their financial planning and modeling needs. Our experts can guide you through all the features and benefits of our FP&A software and help you determine how it aligns with your business goals.