The need for financial planning and analysis software has shot up as finance leaders are looking for SaaS tools to make their work easier. These tools help with everyday tasks and also with planning, budgeting and forecasting in the long run.

Anaplan, Cube, Datarails, Planful, and Vena are all different types of FP&A software. These tools are designed to assist companies in making smarter financial choices by providing insights for planning, budgeting, and forecasting in addition to saving a tremendous amount of time through automation.

They serve various purposes, including:

- Consolidating data from different sources.

- Predicting future outcomes.

- Analyzing different scenarios.

- Creating financial models.

- Keeping track of and managing key performance indicators (KPIs).

- Planning for workforce needs.

- Creating strategic budgets.

- Automating the month end close and other time consuming processes.

Each of these platforms has its own unique benefits and features, so it’s crucial to pick the one that best suits your specific requirements.

Let’s examine each of them more closely to understand how they differ. While all of these top software options aim to help businesses in their financial planning, they have distinct functions and applications. Because every company is unique, it’s essential to compare the top FP&A software options to find the one that fits your needs best.

Vena Solutions vs. Cube Software vs. Datarails vs. Anaplan vs. Planful

1) Vena

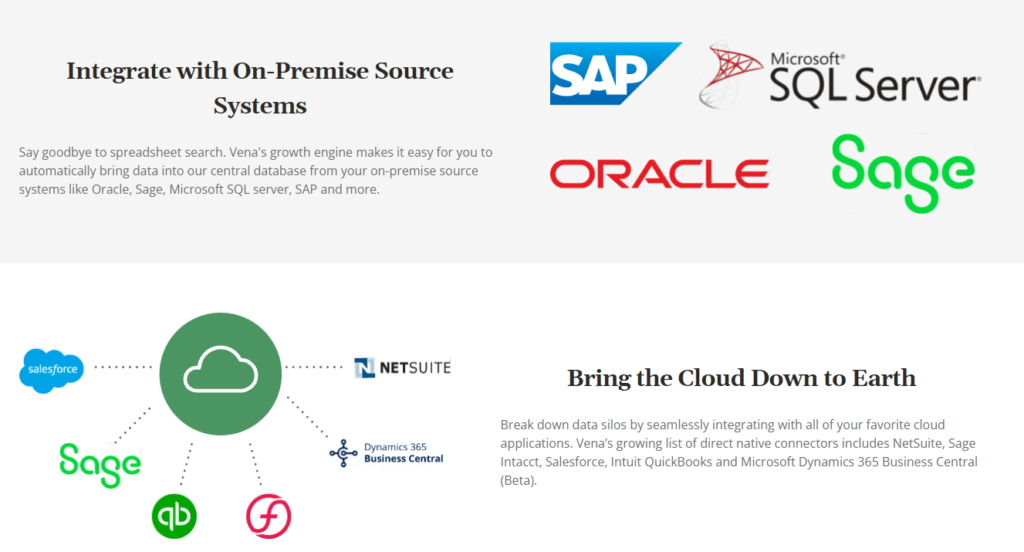

Vena Solutions is a tool that helps businesses make predictions and understand data better. It does this by quickly creating forecasts and useful information from historical and current data.

The software puts all the data in one place, so you don’t have to waste time gathering it. This makes it easier for you to work on important tasks and work with your team.

Vena also helps by automatically checking for differences in data, making special reports, and looking at your company’s money situation by breaking down data in different ways.

Key Features:

- Flexible Planning and Reporting: Easily plan and report for different scenarios, like growth or changes in your business.

- Financial Planning and Analysis: Vena Foundation for FP&A provides tools for financial planning and analysis, including data integration and analysis tools.

- Automated Financial Reporting: Save time by automating financial reporting tasks, allowing you to focus on analysis and insights.

- Simplified Regulatory Compliance: Streamline regulatory reporting and reduce errors.

Pros:

- Secure Templates: Keep your data safe with locked and secure templates.

- Improved Collaboration: Foster collaboration among departments for better business planning.

- Data Control: Easily track changes and data access in spreadsheets.

- Version Control: Ensure you’re always working with the latest spreadsheet version.

Cons:

- Complex Report Writing: Report writing can be cumbersome.

- Mac Performance: Mac users may experience slowdowns.

- Large Workbook Speed: It takes time to run/load large and complex workbooks.

- Template Automation Issues: Some Excel functions may cause problems with template automation.

- Costly Option: Vena can be expensive, potentially exceeding $60,000 in the first year, including implementation fees.

Pricing:

Vena’s website doesn’t show the prices directly, but 3rd party review sites talk about the pricing as mentioned above (can exceed $60,000 in the first year).

Vena offers two main options: “Professional” and “Complete” tiers, with special pricing for non-profit organizations. They also give personalized quotes. Please note that these prices don’t cover additional costs like implementation, consulting, and third-party management fees.

The final price also depends on how many administrators, contributors, and view-only users your company wants in the plan.

Best for:

Vena is a good fit for larger companies that need structured financial planning and analysis processes, either using pre-made templates or customizing them to suit their specific requirements.

Check out our more in-depth review of Vena vs. Datarails.

2) Cube Software

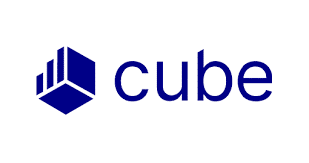

Cube is an FP&A tool that helps finance teams work together to plan and perform well. It’s a digital tool that makes financial planning and analysis easier, and it doesn’t force you to change how you work as it connects smoothly with Excel and Google Sheets. Cube Software is typically used by startups and small companies.

Key Features:

- Automatically collects data from multiple sources.

- Simplifies data comprehension.

- Integrates with various software.

- Compatible with Excel and Google Sheets.

- Supports multiple currencies for international work.

- Centralizes calculations.

Pros:

- Simplifies report creation and aids in tracking important figures.

- Enhances data handling and minimizes errors.

- Compatible with a wide range of other software.

- User-friendly, in comparison to large and confusing tools like Workday.

Cons:

- Cube is still relatively new on the market (founded in 2018).

- Very limited dimensional structure – with only four predefined custom dimensions (for instance “finance Cube” and “HR cube).

- Cube also has severe limitations when it comes to drill downs, as they can only publish drill-downs at a summary level.

- Cube is meant for small companies and startups.

- Companies quickly grow out of Cube as it is a basic FP&A software.

Pricing:

- Cube software offers different pricing plans, with their lowest-tier “Essentials” plan starting at $1,250 per month (very limited functions and users). This plan is designed for individuals or very small finance teams.

- The next tier for more standard sized companies is $29,400 per year.

- The enterprise plan is $45,000 per year.

Keep in mind that all plans come with an additional one-time implementation fee, which can range from $5,000 to $10,000, depending on how complex your implementation is and the size of your company. They also offer consulting services for an extra $250 per month, limited to 4 hours per month.

Best for:

Cube is best suited for startups, small companies, and lean FP&A teams who want to save time and expand their capabilities.

Check out our comparison of Cube Software and Datarails.

3) Datarails

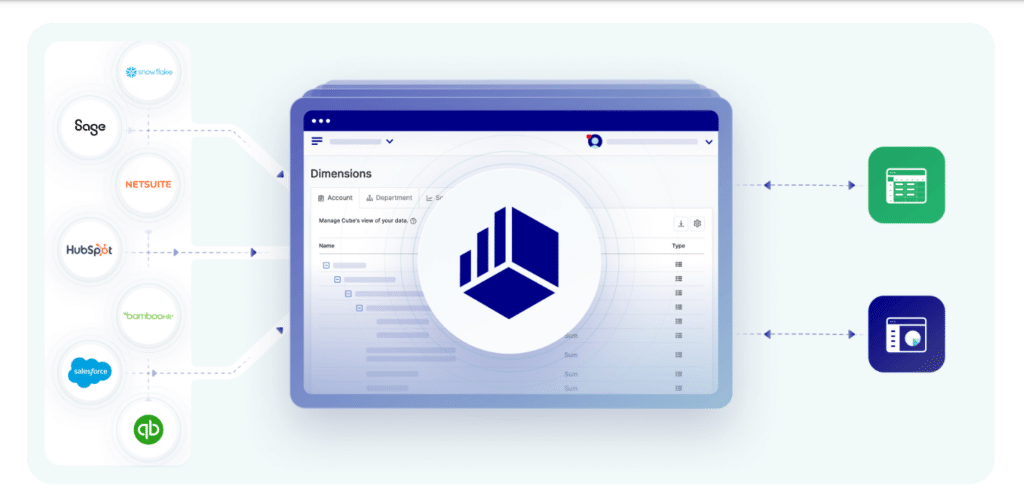

Datarails is a completely Excel-native and AI powered FP&A solution. It makes it easy for companies to make decisions by giving them one trustworthy source for their data. It does this by automatically putting all the data together and making reports, so finance experts can make important decisions and get insights in real time.

The new AI chatbot called FP&A Genius, is especially good at answering questions from management about different financial situations, and it does it really quickly and accurately.

Key Features:

- Forecasting Dashboard: Helps predict future finances for planning.

- Drill down capabilities: Allows you to drill down into any metric from any source of data.

- Data Visualization: Shows how different factors like prices, costs, and more affect your

- profits.

- AI feature: FP&A Genius allows for quick answers and visuals from any question you or management might have.

- Financial Data Analysis: Examines financial and operational data to find important trends.

- Monthly Reports: Makes monthly data and financial statements easy to create and export.

Pros:

- Dedicated Customer Manager: A personal service manager to help you.

- Automated Records: Keeps your data accurate and easy to track.

- Built-in Visualization: Includes a tool for creating charts and graphs.

- Native Excel: Makes for fast implementation and allows you to keep working how you usually do.

- Workflow Collaboration: Makes it simple to work together and control document versions.

Cons:

- Not for Large Corporations and enterprises: Designed for small to medium-sized businesses, not big ones.

- Limited International Reach: Most customers are in the US, Canada, and the UK.

Pricing:

Datarails offers finance software for small and medium-sized businesses, and their pricing is flexible. They don’t display prices on their website, but they provide personalized quotes. Datarails’ plans usually start at $24,000 per year and can increase depending on factors like your company’s size and data needs.

Best for:

Datarails is best suited for SMBs who use Excel.

4) Anaplan

Anaplan is a tool that helps organizations make decisions using real-time data. It lets you create and manage models, share data with teams, and work together on projects. Anaplan uses AI and machine learning to analyze your company’s data, providing insights and adapting to changing conditions.

Key Features:

- Forecasting: Uses machine learning and algorithms to analyze your data.

- Scenario modeling: Helps you understand how changes affect your strategy.

- Anaplan Workflow: Digitizes processes and facilitates communication.

- Anaplan Data Hub: Stores information needed for planning scenarios.

Pros:

- Centralizes data for accuracy.

- Supports real-time collaboration.

- Provides security and audit tracking.

- Helps keep models consistent.

- Well-known tool in the FP&A field.

Cons:

- Formula auto-complete similar to Excel.

- Can be challenging for new users with large models.

- Much higher learning curve and implementation time in comparison to other software.

- Some delays when saving data.

- Pricier than most competitors.

- Meant for large enterprises and doesn’t suit for small or medium size businesses.

- Limited customization and flexibility compared to other software.

Pricing:

The cost of Anaplan licenses depends on several factors, such as the number of users, usage plans, and the type of business you have. Additionally, the price is influenced by the amount of workspace storage you purchase, and it can increase significantly as you move to higher tiers with more complex applications.

According to Peerspot, Anaplan’s price typically ranges from $30,000 to $50,000 per year, but it can increase substantially based on complexity and storage needs. There are also other costs to consider, such as the expenses associated with learning the system and potentially hiring consultants. Some customers have reported having to pay an initial license fee of $50,000 just to get started.

For a basic subscription, most businesses should anticipate a cost exceeding $50,000 when including all of the additional fees.

Best for:

Anaplan is best suited for larger enterprises that have robust IT teams capable of supporting the implementation process.

5) Planful

Planful is a software that helps companies with their performance management and financial planning. It lets users see how well their business is doing in real-time, find problems and opportunities, and take action to make things better.

Planful Predict is a part of its FP&A software made for top-level executives like CFOs and CEOs. Its job is to make decision-making faster and more accurate by doing the complicated math and reporting tasks for them. It combines the data skills of FP&A tools with the smarts of AI and Machine Learning. This gives precise insights and suggestions to help businesses steer in the right direction.

Datarails FP&A Genius is different because it uses AI to give answers on dashboards and visuals. Planful Predict, on the other hand, focuses on finding weaknesses in a company’s money setup with its features called Planful Signals and Predict: Projections.

Key Features:

- Financial Close Management: Speeds up the process of closing financial accounts, freeing up your team from data-entry mistakes.

- Financial Consolidation: Quickens the process of combining financial information and allows your team to focus on understanding how the company is doing.

- Workforce Planning: Helps plan your workforce using accurate data, creating better alignment between different departments.

- Cash Flow Forecasting: Offers tools for predicting cash flow based on various factors, tailored to your needs.

Pros:

- Enhanced Planning with AI: Helps with better financial and operational planning using artificial intelligence.

- User Control: Gives users more control over managing financial processes.

- Emphasis on Trust and Security: Puts a strong focus on ensuring trust and security.

- Transparent Reporting: Provides clear and easily understandable reports.

Cons:

- Complex Collaboration: Collaboration can be tricky because the individual models are delicate and need online updates.

- Challenging Template Setup: Setting up templates can be difficult.

- Highest implementation time on the list: Sometimes more than 6 months.

- Businesses are usually required to sign multiyear contracts.

- Planful Predict uses AI to help predict forecasts and budgets but is more limited in the types of answers and visualizations that it provides in comparison to Datarails.

- Complicated Wage Data Entry: Entering employee wage data can be complex.

Pricing:

Planful is designed for big businesses and enterprises, so it’s more expensive than most of the other software we compared here. While it’s cheaper than some other enterprise-focused FP&A solutions like Workday Adaptive Planning, it’s still considered somewhat pricey and comparable to Anaplan.

Customers have also mentioned that you often have to commit to multi-year contracts, and the fees for getting it set up can be quite high because it’s done by a third-party.

Best for:

Planful is a good choice if you’re a large company with a big FP&A team that wants to work closely together within your business.

Conclusion

The demand for FP&A software has surged due to finance leaders seeking SaaS tools to streamline their work. These tools not only assist in day-to-day tasks but also in long-term budgeting and forecasting. Each tool has its unique strengths, catering to specific needs. Selecting the right software depends on your company’s size, goals, and preferences. Consider your specific requirements when making your choice.