The overall economic outlook for 2023 is not good, and CFOs in particular are quite pessimistic about the slow economic growth rate this year. A Duke University survey shows that CFOs believe the economy is expected to grow by only 0.7%, far below the expected inflation rate.

The wave of troubling economic news hasn’t subsided in 2023 either. Inflation is still rampant, and the consumer price index (CPI) rose 0.5% in January after increasing by only 0.1% in December. In January alone, there have already been more than 58,000 job cuts from US based tech companies, including tens of thousands from Google, Microsoft, and Amazon. The collapse of SVB strengthened the fears of instability among tech companies, while creating new worries about banking.

In 2022, many companies started making the change from “growth at any cost” to “efficient growth” and CFOs were expected to lead the way with this initiative. CFOs were caught at the crossroads of initiating changes in order to save money, while also trying to lead the company’s growth.

This two-part report will give expert advice on common actions taken during a market downturn, some of their common mistakes, and tips for coming out of the inevitable recession even stronger.

Part 1: Reducing Expenses

1a) Reducing Headcount

After conducting a simple P&L report, many companies realize they are in financial trouble and begin by cutting headcount. Employees are usually the biggest and most glaring expense in an organization and therefore are the first to go when the market takes a downturn. But depending on the situation, it is not necessarily the best course of action.

CFOs need to analyze how each department and employee contributes to the company. This is known as the law of diminishing marginal returns and finding that perfect sweet spot of employee efficiency is the key to maximizing revenue. For example, if a sales team of 16 people is reduced to 15, would the department be able to handle the same workload? If it’s in marketing, what effect do cuts have on generating new leads and the cost of acquisition. As an alternative option, can that person be replaced by a freelancer or agency?

On the flip side, many CFO surveys show that the recession is expected to be over by the second half of 2023, with the economy making a recovery by then. Therefore it’s important to understand the long term implications of cutting headcount in an expected “short” recession. Having to rehire employees less than a year after layoffs can be an expensive and difficult process in today’s employee market, and can quickly erase any money that was saved. Lastly, CFOs need to consider the implications on culture and team morale once layoffs are introduced.

Part 1b) Evaluating Salaries

Reducing expenses isn’t only about headcount.

- One way to cut down on expenses is by creating higher targets and goals for your team. This will lead to less bonuses while simultaneously getting more out of the same resources.

- In addition, there is plenty of room for cutting costs by evaluating salaries and doing an ROI analysis as well. This works both for individual contributors as well as in a team setting with other employees who do the same work. For example, in a team of 15 Sales Development Representatives, where one of them is making 20% more than the rest of the team, management needs to understand why. Is that individual contributing 20% more, or maybe it was a salary negotiating mistake by management. If they are indeed better than the rest, maybe they should get promoted or consider raising the bar higher for the rest of the team. If not, maybe it’s a good time to consider removing those who are costing more and not producing in order to get a better ROI from employees.

Part 1c) Reducing Subscription Costs

After evaluating, and potentially reducing headcount, companies will look for other ways to cut costs. This usually pans out by focusing on recurring costs such as software subscriptions. Here are 5 ways to greatly reduce subscription costs through simple checks and evaluations:

1: Unused licenses

The first thing to focus on is reevaluating systems that the company doesn’t use. There can be forgotten subscriptions or ones that aren’t used to their full potential. For example, if the VP of Sales bought a software tool for VOIP calls which included 20 subscriptions for all of the Account Executives in the company, a quick check by the CFO can help the company realize that only 12 Account Executives are actually using the service.

In addition, employees who left the company and still have active accounts (such as Slack) is another common occurrence where monthly payments are being burned. Identifying systems that the company no longer uses in any number of ways can save thousands of dollars per month.

2: Reducing packages

Often, when a company takes on a new software service, they think the premium package will give them the most out of the service. For example, an organization that uses Monday.com and started off with the Pro Package, can reevaluate their usage and realize that in reality they can accomplish everything they need with the Standard Package. A small downgrade like this can add up to a hefty sum when there are dozens or hundreds of users per month.

3: Renegotiating contracts

A quick look into existing contracts will give the CFO insight into each software deal. Now is a good time for rethinking or renegotiating contract prices, especially for those expiring in the near future. For example, if the company’s accounting software contract with FreshBooks is expiring at the end of the month, it might be a good idea to research competitor prices and use that for negotiation. In times like these, many companies are willing to negotiate and lower prices, and you might even find a cheaper software that fits better for the Organization.

4: Duplicate Software

Without spend management, many companies end up with duplicate software subscriptions, that is different companies providing the same service. For example, a company might use both Lusha and ZoomInfo for databases of prospective clients, but in reality they do the same thing. Canceling one will save money and keep the team more organized and efficient.

5: Using Software to Gain Control of your Software Spending

What better way to understand where and how you can save on software subscriptions than by using a software to evaluate it?

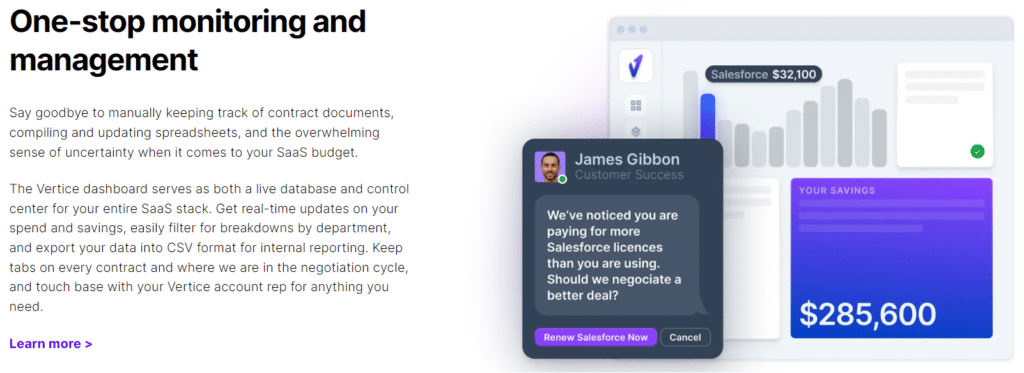

SaaS purchasing platform Vertice is a great option and it saves your business money and time by taking the burden of buying, renewing, and managing software off your hands. With access to the pricing and discounting data of more than 16,000 software vendors, Vertice’s team of SaaS negotiators can secure the best possible deal on all types of contracts. Vertice’s platform also gives you total visibility into your software tech stack and helps you understand how these apps are being used– automatically giving you visibility into the previous 4 money saving tips.

In addition, the integration report function in FP&A software allows users to download a comprehensive list with all of the softwares that your company uses along with details such as number of users, payments, and package options. Having them all in one report will help the finance team make better decisions about the value of each one.

Part 1d) Using One Company’s Complete Product Packages

Companies like employing “the best of breed” technique when it comes to software selection. This means picking and choosing the best products in each category. While Slack might be the organization’s communication software of choice, Zoom the video meeting solution, and Workday the best HR solution, a company can save a lot of money by sticking with the same parent company for all of their software services.

For example, Microsoft has Office, Teams, and HR Dynamics, while Google has Meet and Chat. If your organization already has Microsoft Suite or Google Workspace (G Suite), then the organization can get Microsoft Teams or Google Meet and Chat for free as part of the package. Using the full list of services from one company can cut down tremendously on costs and keep everything in one system- even if they aren’t all the employees’ solutions of choice.

Part 1e) Control spending!

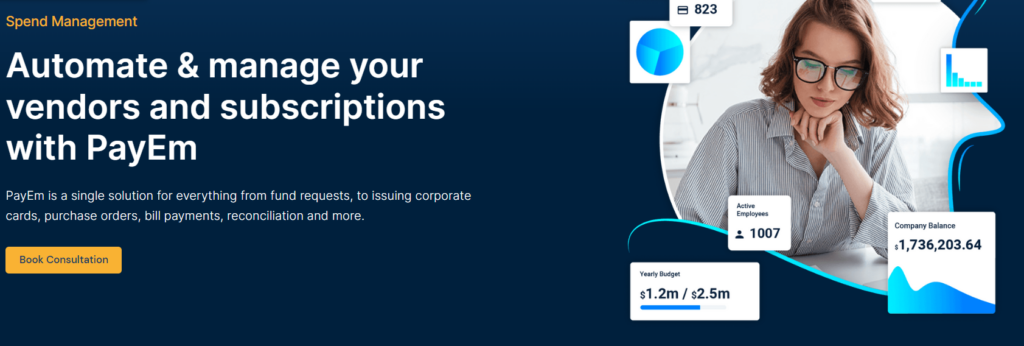

Today, many department managers can spend without an official approval process, meaning misunderstandings and inefficient spending occurs frequently. Software such as Tipalti and PayEm have spend management and approval flow functions, making the process smoother and more controlled. In addition, they integrate with many FP&A software solutions which helps create up to date planning and forecasting scenarios to better understand the long term implications of additional spending actions.

Part 2: Being Proactive What Can you do to Scenario Plan?

One department that works extra hard during market downturns is the finance department. Everything that happens both inside the company and in the general market influences the organization one way or another. This is especially true when companies are trying to cut down on costs, as there are always repercussions involved.

Expert tip: In the current market volatility, it isn’t a good idea to sign on yearly or multi year deals for a financial planning software. Customer sentiment and markets change overnight, and organizations’ needs and budgets change just as quickly. While many companies do annual subscriptions, it is best to switch the focus on ones that provide flexible and monthly contracts.

Part 2a) Planning with FP&A Software

Cancelling subscriptions and reducing headcount is not the only way to prepare for the incoming recession. There are also proactive ways to prepare for all possible scenarios and increase company efficiency. Companies that implement FP&A software solutions will be able to conduct scenario planning and make the best decisions possible for the organization. With all of the extra work needed to analyze and plan during uncertainty, organizations need more financial automation in order to fill the gap. Software solutions such as Datarails and Anaplan, are significantly cheaper than bringing on another finance expert to give that boost, and they will also provide far more value in the long run through forecasting and scenario planning.

Expert Tip: The biggest example of “automation being cheaper than employees” is Microsoft. Since the 2008 Great Recession, their revenue has nearly tripled but they have kept their finance department’s headcount flat, simply by investing in financial technologies and automation. This has made their finance department far more professional and accurate, all while saving a huge amount of money on salaries.

Part 2b) Increased Collaboration with the Finance Team

In order to be prepared for future possibilities and their implications on the market, CFOs need to analyze all different kinds of scenarios and how they will affect the company’s revenue. Finance teams often find themselves with a significantly larger workload during volatile times, and that’s in addition to the regular day to day budgeting and month end close that is already a full time job.

In times like these, other department leaders need to step up and contribute by helping the finance team identify and understand where the weak points are and how to improve them. All of the increased contributions from other employees and analysis of the potential outcomes and scenarios will be far easier to conduct with an FP&A software solution.

Expert Tip: Be proactive and fast! While most FP&A software tools take a long time to implement (multiple months for full implementation), Datarails has a much shorter implementation time of 2 weeks. This is because it is one of the only Excel based financial planning softwares on the market, meaning that anyone who knows Excel can contribute and understand the system in minimal time.

Conclusion

Many organizations jump to cash saving conclusions in times like these, but there needs to be a strategy involved as well. There are many ways to save money on subscription costs and other monthly expenses that contribute greatly to cash burn. In addition, using FP&A tools will help companies understand the long term implications and forecasts that each action will cause.

CFO checklist for immediate action:

- Reduce headcount when needed but only after a thorough understanding of all of the implications involved.

- Cut down on subscription costs. This can be canceling unused licenses, renegotiating contacts, or using one company’s solutions for all your needs.

- Proactive scenario planning. Using FP&A software solutions will help the company gain better insights into each action’s implications and how it will negatively or positively affect the company.