In the fast-paced world of finance, accurate and timely reporting is crucial for businesses to make informed decisions and stay ahead of the competition. Financial reporting plays a big part in that as numbers and trends need to be reported to management quickly and accurately. But with an overwhelming number of financial reporting software options available, choosing the right one can be a daunting task.

In this blog post, we will dive into the world of financial reporting software and explore some of the top solutions that empower organizations to transform raw data into actionable insights.

What is financial reporting software?

Financial reporting software refers to specialized tools and systems that enable businesses to efficiently gather, process, analyze, and present financial data in a structured and meaningful manner.

It automates the process of generating financial reports, such as income statements, balance sheets, cash flow statements, and more. Financial reporting tools provide organizations with accurate and up-to-date information in order to evaluate their financial performance, make informed decisions, comply with regulatory requirements, and communicate financial information to stakeholders.

A good financial reporting software will also be a good financial close software, a good budgeting software, financial consolidation software, and other features depending on what your company’s needs are.

Benefits of financial reporting software

The biggest benefit of financial reporting software is automation. This comes in a few categories:

- Automated data consolidation from different sources.

- Automated reports and dashboards.

- Automated collaboration and audit trail that allows you to control who sees and edits what.

Additional benefits of financial reporting software include:

- Time saving.

- More time for insights and analysis.

- More secure and less error prone than manual reports.

- Real time updates and most recent data allows for smarter decision making.

Different types of financial reporting software

Financial reporting software comes in many different sizes, prices, and complexity. Some software solutions are free and simple, while other reporting tools are just a small part of complex software that automates the entire financial planning process. Financial reporting software can cover any of these categories:

- Accounting software – Many accounting software solutions provide built-in financial reporting features and are important for monthly and yearly reports to the CFO and management.

- ERP Systems – ERP systems integrate various business functions, including finance and accounting, and usually include financial reporting capabilities with more advanced analysis and drill down reporting functions.

- BI tools – BI tools offer advanced analytics and reporting features, allowing users to create customized financial reports with interactive dashboards. Many include advanced analysis and drill down reporting functions.

- FP&A Software – FP&A software focuses on financial planning, budgeting, and forecasting, to go along with financial reporting. FP&A software is a complete tool that automates many of the manual processes in the finance department. Many FP&A tools come with advanced reporting capabilities that include dashboards and real time updates for the best and easiest reporting.

- Tax Software – Tax reporting software helps organizations comply with tax regulations through integration of other tax compliance software and updated laws. Tax software also automates the preparation and submission of tax reports, saving the finance team a lot of time on manual work.

In this blog we will cover a variety of solutions that can cater to many different sizes of finance teams and budgets.

Best financial reporting software

Oracle Netsuite

Oracle NetSuite’s financial reporting software is a cloud-based solution that helps businesses create, analyze, and distribute financial reports efficiently. Oracle is one of the biggest names in the financial software industry.

Key features

- Includes customizable report creation and real-time data visibility.

- Multi-dimensional reporting, consolidated reporting, and built-in financial analytics.

- Collaboration and distribution capabilities, compliance and governance tools, and seamless integration with other NetSuite modules.

Oracle Cons

- While it offers comprehensive functionality, a potential con is the learning curve for new users.

- The need for customization for specific reporting requirements.

- Complex software meant for finance teams that want more than just financial reporting.

Oracle Pricing

Oracle NetSuite’s financial reporting software is typically tailored to each organization’s needs and requirements. Contact the company for customized price quotes.

FreshBooks

FreshBooks is a popular cloud-based accounting and financial reporting software designed for small businesses and freelancers. FreshBooks is one of the leaders in the industry of accounting software for SMB’s, and its main focus is on accounting. However it does have financial reporting capabilities that are simple to use and more than enough for most small businesses.

Key Features

- Some key features of FreshBooks’ financial reporting software include invoicing, expense tracking, and time tracking.

- Over 100 integrations with payment gateways and other business tools for the most accurate accounting numbers.

- User-friendly interface and is accessible to users with limited accounting knowledge.

Freshbook Cons

- Limitations in advanced accounting functionalities compared to more comprehensive accounting software.

- Usually not suitable for larger businesses with complex accounting needs or small businesses expecting significant growth.

Freshbooks Pricing

Starting at $8.50 per month for the basic plan up to $55 per month for more advanced functionalities.

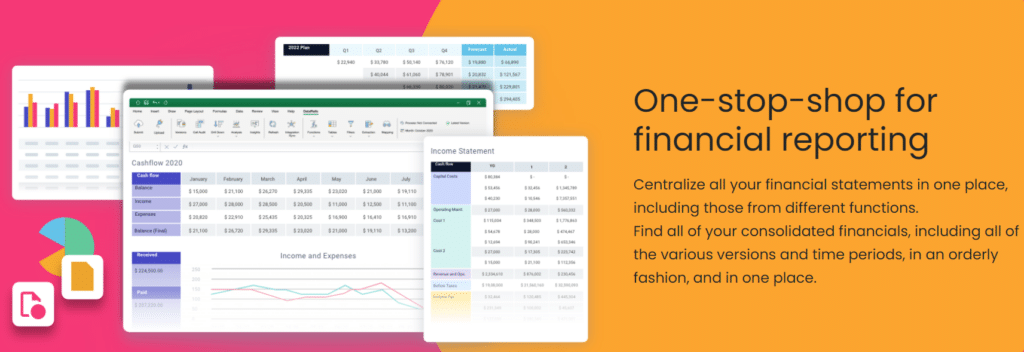

Datarails

Datarails is one of the top FP&A software that caters to small and medium sized businesses. While most FP&A software have some financial reporting capabilities, Datarails stands out in this case as it has dashboards with live updates and visuals, pre-built and customized data models, and an AI chatbot function that gives you quick answers with visuals for financial reporting.

Key Features

- Scenario modeling

- AI chatbot capabilities that give you answers and build reports in seconds.

- Drill down analysis that allows you to filter details by location, date, or any other metric that gives you deeper insights.

- Completely native Excel which makes an easy transition for finance professionals and short implementation time (2 weeks).

Cons

Datarails is an FP&A solution that covers all aspects of the finance department (budgeting, forecasting, planning, etc.) so those that are looking for a cheap solution that covers exclusively financial reporting might be better off with Freshbooks or Multiview ERP.

Datarails pricing

Datarails provides customized quotes based on the complexity, number of users, integrations, etc.

Workiva

Workiva is a leading provider of cloud-based financial reporting software designed to streamline and enhance the reporting processes for large businesses and corporations. Their platform offers a comprehensive set of features for financial reporting, compliance, and data management.

Key Features

- Collaborative reporting and real-time data connectivity.

- Automated workflows, version control, and data visualization tools that make it easy to conduct financial reporting.

- User-friendly interface.

- Flexibility, and scalability so it is meant for a wider range of users in comparison to Freshbooks.

Workiva Cons

- Some users may find the learning curve steep initially, especially if they are new to cloud-based reporting platforms.

- Workiva uses Spreadsheet functions instead of native Excel. This makes it difficult for finance professionals who are used to Excel as not all of the functions and flexibility are the same.

Workiva Pricing

Pricing for Workiva’s financial reporting software is typically based on individualized quotes, tailored to the specific needs and requirements of each organization.

Multiview ERP

Multiview ERP is a well tested company (been around for over 30 years) and is unique in the field of SaaS financial reporting in that it specifically features a team of in-house support that works alongside your company and “has your back from day one.” While other financial reporting companies and ERP software encourage independence and as little support as possible, Multiview ERP advertises their support team as an integral part of the software. In addition to reporting, it supports customized capabilities through core accounting, business insights, automations, inventory management.

Key Features

- Business Intelligence

- Automated Workflows

- Accounts Payable and Receivable

- Professional support and easy to work with

Multiview ERP Cons

- While customer support is a strong part of their business, some users have reported slow response times due to the overreliance on them.

- Difficulties creating custom reports. Sometimes they can be too rigid.

Multiview ERP Pricing

Pricing is not shown on their website but cloud pricing averages $150 per user.

Conclusion

Each company was chosen based on a number of factors with a focus on their financial reporting capabilities, key features, what part of the finance team they upgrade, and what size businesses they are meant for.

- Best for small and medium sized businesses and accounting – Freshbooks

- Best for small and medium sized businesses and upgrading the full finance and FP&A function – Datarails

- Best for small and medium sized businesses and those looking for an ERP solution with extra live support – Multiview ERP

- Best for medium and large businesses looking to improve their consolidation, real time insights, and financial reporting – Oracle Netsuite

- Best for large businesses and enterprises for financial reporting and compliance – Workiva