Approaching activity-based budgeting (ABB) requires dedication to the process but can prove to be fruitful to any organization of any size. Oftentimes, finance professionals find themselves stuck between the constraints of financial objectives and a budget that is not optimized to reach the desired goals.

Here’s the definition of activity-based budgeting: activity-based budgeting is a way for an organization to design a budget around each of the activities it performs and predict cost in a more meaningful way than a traditional budget.

The result is a better understanding of the cost drivers behind the organization, which can lead to a more clear approach to reaching financial objectives.

Activity-Based Budgeting vs Traditional Budgeting

While there are many approaches to budgeting such as top-down budgeting, the benchmark is always going to be the “traditional budget.” A traditional budget approach utilizes prior years’ costs and adjusts them for inflation and/or changes in the business activity for the upcoming budget period. It is easy to perform, the most identifiable, and the cheapest approach to budgeting that most organizations adopt.

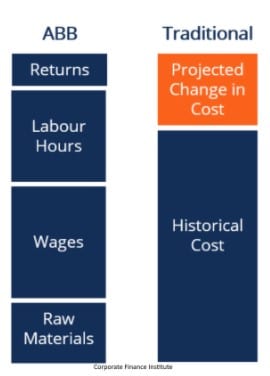

While a traditional budget starts with historical cost, the activity-based budget process is a three-part process. It includes analyzing various cost drivers within an organization and attempts to find ways to reduce cost through business optimization. The heavy emphasis makes the activity-based budget a better alternative for fledgling businesses with many changes to their operations or a lack of sufficient historical cost data.

Mature businesses tend to be more static in their operations, having reached a size where growth is not as explosive and there is a significant amount of historical years’ worth of data to analyze for budgeting purposes. This makes the activity-based budget a little more costly and often a little overkill. However, anytime there are major changes to a firm’s operations, an activity-based budget can yield significant benefits.

Activity-Based Budgeting vs Zero-Based Budgeting

A common misconception is that activity-based budgeting is similar to zero-based budgeting, which is not true. While the two disciplines are very similar, they work to achieve different things. A zero-based budget starts from a base of zero and requires every cost to be analyzed and justified. In the end, any amounts leftover are allocated to some particular goal. For example, the goal might be to pay down corporate debt, to which any amounts saved or identified in the zero-based budget would then be allocated.

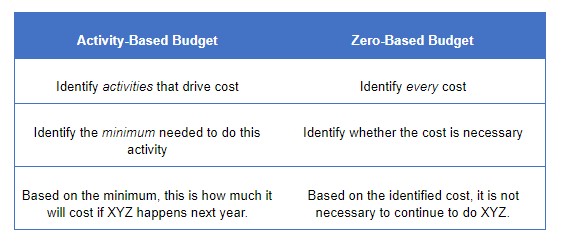

The only similarity between the two approaches rests in identifying costs. From there, the differences begin to emerge. This is because the activity-based budget is more concerned with analyzing cost drivers and driving profitability, whereas the zero-based budget is primarily concerned with expense justification.

It is the approach of analyzing costs that is commonly the activity that falsely relates the two budgeting approaches. The activity-based budget is not concerned with justifying each cost, it is concerned with optimizing the activities driving cost. A comparison between the two approaches can be seen below and will assist in demonstrating the key difference between the two, which is the outcome.

The comparison briefly shows the similarities and eventual differences in outcomes between the two budgeting approaches. Where the zero-based budget is aimed at reducing cost through review and justification, the activity-based budget attempts to maximize profit based on its understanding of the cost drivers associated with its operations.

How to Perform an Activity-Based Budget

Keeping in mind that the overall goal of an activity-based budget is to eliminate unnecessary costs and boost profitability, it is important to approach the budgeting process with a new set of eyes. In particular, having access to better data management tools will significantly alter the efficiency of identifying and optimizing cost drivers.

Activity-based budgeting is a three-part process:

1. Identify every activity associated with a particular cost.

These are known as “cost drivers”. Be sure to thoroughly identify every cost driver. Cost drivers can be considered the components of an overall cost. For example, some common cost drivers are the number of hours worked by employees, number of vendors, number of machine-hours, or amount of space required.

2. Calculate the baseline of units required for each activity.

For example, how many people are required to work at any given time? Who are they? What are their roles? Does the operation require a set amount of warehouse or office space? Is there a special need for custom components or products? Remember, the calculation of baseline units should be viewed from the perspective of “barebones” necessity.

3. Determine the cost per unit of every activity and then multiply it by the number of times the activity will be performed.

The outcome is a report that essentially identifies every cost driver of business activity and breaks it down into its bare needs. This is then used to determine future cost, margins, and helps to identify the break-even for the business under certain scenarios.

Activity-Based Budgeting Advantages and Disadvantages

As with all forms of budgeting, there is give and take when it comes to the activity-based budget. Examining the cost-benefit of utilizing an activity-based budget is important before investing the time and energy required to complete it.

Disadvantages of an Activity-Based Budget

Generally, the biggest disadvantage of the activity-based budget is the amount of time and the costs associated with implementation. A good data management tool can go a long way in mitigating this time and cost. Solutions like Datarails can make implementing an activity-based budget far more feasible.

Another challenge of implementing an activity-based budget is that all the parties involved need to have a good grasp of the business’s various processes. This can be a major hurdle in businesses with fragmented or complex operations.

Advantages of an Activity-Based Budget

As opposed to other approaches to budgeting, the activity-based budget breaks down each of the activities in a business’s operation and identifies exactly what drives the cost behind them. In doing this, it can reveal what activities are diminishing profitability and which activities need to be optimized.

Another major difference is that activity-based budgeting is concerned with the business outputs that drive cost rather than the cost of executing operations. It essentially views budgeting backward, gauging what each unit of production costs and what makes up that cost. This allows for more visibility into various business units relative to one another and can assist in identifying where deploying capital might yield the most profit.

Using Datarails to Build Your Budget

No matter what budgeting approach your firm chooses, you need data. Datarails is a powerful data management tool – it can make the difference between a long, tedious process and efficient implementation. Change the way you budget forever with a solution that’s strong enough to meet the needs of any organization without requiring staff to learn an entirely new way of doing things.

Learn more about the benefits of Datarails’ CPM software solution.