A zero-based budget (ZBB) has long been deployed by personal finance experts to help individuals manage their money successfully. The premise of justifying every expense is daunting-yet-rewarding for those willing to put in the effort.

The same is true for organizations, no matter how big or small. Just as individuals can experience “lifestyle bloat,” organizations can experience bloating in their expenses over time.

Oftentimes, budgeting is an after-thought in a growing organization. While there is some emphasis put on managing expenses, a younger organization is typically concerned with revenue over expenses.

The result is that small organizations are at risk of losing out on bigger margins. A lack of overall resources is sometimes to blame for this, so a zero-based budget is a good way for smaller businesses to realign themselves with a financial plan before things get too far out of hand.

On the other end of the spectrum is a large organization, which has likely rolled its budget each year using some growth factor to determine expenses and revenue targets.

While this is not unacceptable by any means, a zero-based budget might be a great exercise to assist large organizations in identifying expenses that have bloated over time.

How Does A Zero-Based Budget Work?

As opposed to traditional, activity-based budgeting, cost-based budgeting, and top-down budgeting, a zero-based budget analyzes and justifies every single expense. The process involves both recurring and new expenses that might come up during the budgeting period. Every expense is scrutinized, justified and if needed, discontinued.

The idea of a zero-based budget rests on the fact that every revenue dollar must be allocated to something. Each of those “somethings” needs to be justified. Therefore, a zero-based budget needs to be drafted with a goal in mind, or else not every dollar of revenue will be allocated appropriately.

The Zero-Based Budget Process

The process is simple for zero-based budgets, but the amount of work that goes into one can be exhaustive depending on the size of the organization. This is why it is a great tool for younger organizations to deploy early on.

Naturally, as an organization grows, its costs rise over time, both in amounts and volume. As the sources of revenue and number of expenses rise, it’s more time consuming to design a zero-based budget.

For all organizations the process remains the same:

- Create a goal for the budgeting period

- Identify every source of revenue

- Identify every expense

- Analyze and adjust expenses if needed

- Allocate any left-over dollars to the goal

Because it is so granular, a zero-based budget (ZBB) is a helpful tool that business owners can use to navigate to their goals. Ideally, the budget can be rolled each period after the initial set-up is complete, making the process more efficient with each subsequent budget period.

To help you understand how this all works, you can use this budgeting example as inspiration in implementing zero-based budgeting in your own organization.

A Zero-Based Budgeting Example

To help break down the process and implementation of a zero-based budget, let’s assume that the business leaders of Newco have assembled to create a roadmap for the upcoming year.

Newco is a company that specializes in selling home appliances, and due to a boom in home construction, they have experienced significant growth over the last two years. At this point, the business leaders feel it’s prudent to design a budget and get a hold of the business’s expenses to fuel the next round of growth.

Step 1: Create a Goal

At the start, business Newco assumed some debt in the form of a long-term loan, with interest paid each period and a balloon payment due upon maturity. The amount of the loan is $2 MM, and it will be due in two years.

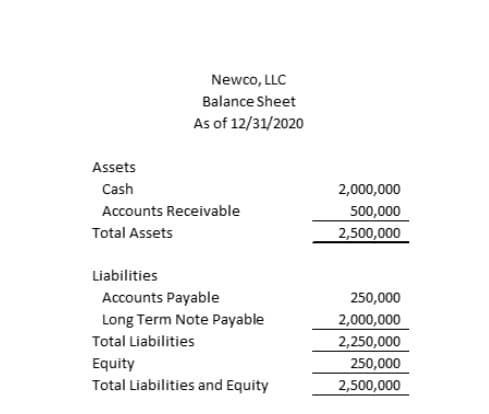

The balance sheet of Newco prior to the budgeting period looks like this:

Management determines they want to pay down this loan early and build equity in the company. Now that a goal has been set, they will move forward to design a path to achieve it.

Step 2: Identify Every Source of Revenue

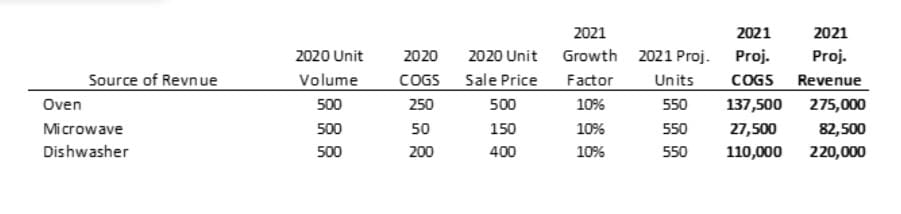

The company sells home appliances as its only source of revenue. Management reviews its sales from the last year, and they reasonably suspect that their sales will increase proportionately to the construction happening in their area.

They have contracts set in place, and they know that, for each home their contracted buyers build, they will sell one oven, one microwave, and one dishwasher. As with all budgets, it would be wise to create a worst-case/best-case scenario.

Management has sufficient reason to believe they will experience an increase in sales volume of 10% over the prior year (2020). They use this growth factor to calculate estimated revenue and cost of goods sold (COGS). For the purpose of this example, we will not take into account vendor terms or supply chain interruptions.

For the purpose of this example, the company’s revenue sources look like this:

Finally, management takes into account that there is $500,000 in accounts receivable on the books as of 12/31/2020. They will consider this a source of cash for the purpose of budgeting. This will not be considered revenue; it is simply a source of cash.

Step 3: Identify Expenses

The next step is at the heart of the budget process. The process of identifying, analyzing, and eliminating each expense. Fortunately, Newco is a relatively new business, and there are not a lot of expenses to manage.

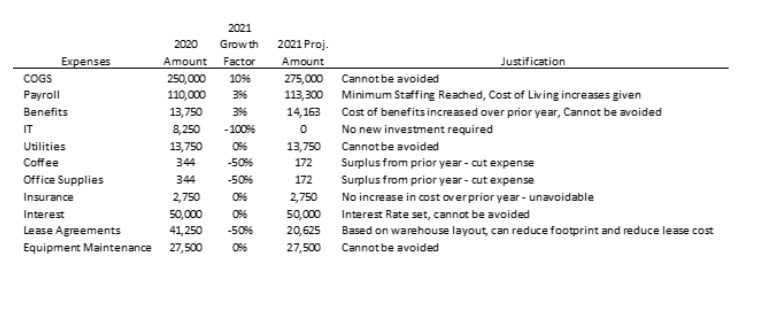

Management begins with the expenses from the prior year (2020). Then, they look at how much these expenses will rise in the coming year. After they project the expenses, they begin the process of analyzing and justifying each expense.

The exercise looks like this:

Step 4: Analyze and Adjust Expenses

Notice in the example that management has included a justification for each of the expenses on its income statement. Also, notice that there are some expenses that were reduced. This is an important outcome of a zero-based budget. By examining each expense, management has been able to identify ways to save money.

Often, these methods of reducing expenses are revealed through planning and research after the expense justification process takes place. For example, Newco understands it needs warehouse space, and the lease cost associated with it is justifiable. However, after thoroughly reviewing and justifying the lease expense, it is determined that the warehouse layout is inefficient and taking more space than is needed.

In this example, management determined that by investing in racks, the warehouse can stack appliances more efficiently, and they can negotiate a reduced lease. For this purpose, the reduction in leasing cost is 50% net of these investments and fees for breaking the original lease.

Step 5: Allocate Left-Over Resources to the Goal

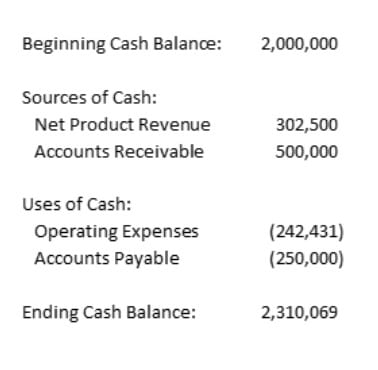

Now that management has made adjustments to the budget for the upcoming year, they can project their estimated cash balance. In practical application, this would be done monthly, or even weekly. The concept of a zero-based budget is that each dollar in will be allocated out to something.

Management’s cash projection for the upcoming year (2021) looks like this:

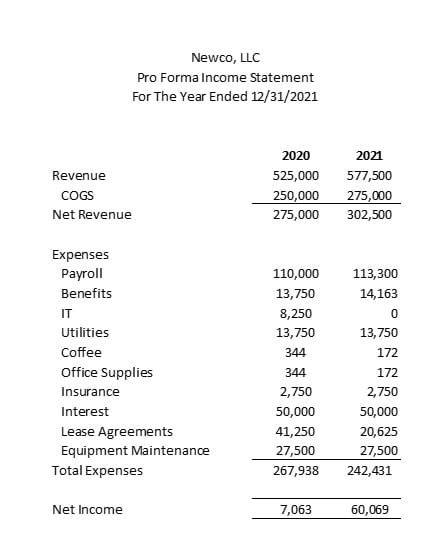

And the pro forma Income Statement looks like this:

The income statement is using a comparative format to the prior year. This will assist management in determining the best course of action. By viewing both a comparative income statement and a projected cash balance, management can make a decision on how to approach paying down the note payable.

Option 1 would be to take the entirety of the projected ending cash balance at the end of the year and pay off the entire amount of the line. This approach would leave the company with a small cash balance, but also yield another $50,000 in annual savings on interest expense.

Option 2 would be to take the surplus of cash at the end of the year ($310,000) and use this amount to pay down the note prematurely. This route would yield a savings of $7,750 in annual savings on interest expense.

Option 3 would be to take the surplus of net income at the end of the year ($60,069) and apply it to the principal balance of the note. Taking this approach yields a nominal interest savings of $1,502 per year.

All three of these options achieve the same result. Owners’ equity is increased, and the note payable is reduced. Now that management understands the impact of each option, they can choose which option makes the most sense for the business.

If the business is cash intensive, then management might be inclined to keep a larger cash balance. If the business is not cash-intensive, then they might be inclined to pay the loan off early and use the interest savings in the following year to expand or hire additional help.

Using Datarails to Build a Zero-Based Budget

Based on this example, it is easy to see how time-consuming a zero-based budget can be, but it is also easy to see the benefits. If your organization can yield benefits from a zero-based budget, but you don’t have the resources to deploy to make it happen, consider what Datarails’ FP&A solution can do for you.

By replacing spreadsheets with real-time data and integrating fragmented workbooks and data sources into one centralized location, you can work in the comfort of excel with the support of a much more sophisticated data management system behind you. This takes a zero-based budget from time-consuming to rewarding.

Learn more about the benefits of Datarails CPM software here.