The cash flow statement (CFS), also known as a cash flow report, is a financial statement that sums up the amount of cash that enters and leaves an organization. Alongside the balance sheet and income statement, the cash flow statement is a mandatory component of an organization’s financial reports.

The cash flow statement aims to look at how cash is moving in and out of the business. By examining this, organizations can:

- Consider how funds are moving throughout the organization

- Observe what impact cash flow has on the business

What does a cash flow report include?

The three sections of the cash flow statement are:

1. Cash from operating activities

a. This includes receipts from sales of goods and services, interest payments, income tax payments, payments made to suppliers of goods and services used in production, salary and wage payments to employees, rent payments, and any other type of operating expenses

2. Cash from investing activities

a. Any sources and uses of cash from a company’s investments. This includes any payment that was made in relation to a merger or acquisition, or a purchase or sale of an asset. So, any changes in assets, equipment, or investments that relate to cash from investing.

3. Cash from financing activities

a. Sources of cash from investors or banks, as well as the uses of cash paid to shareholders. Payment of dividends, payments for stock repurchases, and the repayment of debt principal (loans) are also included.

Cash flow formula:

- Free Cash Flow = Net income + Depreciation/Amortization – Change in Working Capital – Capital Expenditure

- Operating Cash Flow = Operating Income + Depreciation – Taxes + Change in Working Capital

- Cash Flow Forecast = Beginning Cash + Projected Inflows – Projected Outflows = Ending Cash

Ultimately, there are two kinds of cash flow results – a positive cash flow or a negative cash flow. A positive cash flow occurs when the cash that enters your business, whether it be from sales, AR, or anything else, is greater than the amount of cash that leaves your business through AP, salaries, or any other expense. A negative cash flow, on the other hand, results when the outflow of cash is greater than the incoming flow of cash. This can be an issue for businesses.

What’s the purpose of a monthly cash flow report?

The primary aim of the monthly cash flow report is to present an overview of the financial activity experienced throughout the month.

Organizations rely on monthly cash flow statements to closely monitor cash inflows and outflows. Typical users of the cash flow report are CFOs, controllers, and accountants. When used appropriately, an organization can improve liquidity analysis in addition to reducing the chances that the organization will unexpectedly run into a cash crunch.

Oftentimes, the goal of a monthly cash flow forecast is management reporting focused. Senior management may request a monthly report that includes a month-end cash forecast so that they can get a good understanding of the health of the company’s liquidity reserves over time.

What can be the reason behind poor cash flow?

- Low profits – Profits are a major source of cash, usually coming in from customer payments of the selling of assets. If a business is not profitable, it won’t have enough money to cover outgoings.

- Over investment – If a business spends too much money on non-business things, it’ll only drain funds and result in insufficient cash funds.

- Expanding too fast – Expanding a business too fast can put a business in crisis mode.

- Poor financial planning – If you don’t set up your budget beforehand and don’t perform a cash flow forecast, you’re likely to find yourself dealing with cash shortages.

Budget report vs. cash flow report – what’s the difference?

Typically, a budget is shown for an entire year, or an otherwise specific period, and reflects all relevant income and expenditure for that period of time. It doesn’t reflect bank or cash movement separately. On the other hand, a cash flow forecast shows the expected cash coming in and out, and it usually divides transactions into monthly columns. While a budget is used to plan for spending or projects, the cash flow forecast is mainly utilized to manage cash tightly or to protect against overdraft.

A daily cash flow report template can look something like this:

Direct vs. the indirect method for generating cash flow statements

Generally speaking, there are two methods to generating the cash flow statement – the direct and indirect methods. Small and medium-sized businesses tend to favor the indirect method, as it’s pretty simple. Per the indirect method, you start with your net income and make changes in order to see how much cash you have on hand. Typically, large businesses use the direct method. With the direct method, businesses list out all their cash income and expenses for a period of time. This involves really digging into the numbers and unearthing what was paid in cash and what wasn’t.

Why is the cash flow statement important?

The cash flow statement, alongside the balance sheet and the P&L, is one of the three main financial statements that businesses produce. Altogether, these three financial statements are important as they hold significant information regarding an organization’s financial health. By taking a look at all three statements, companies can make informed business decisions.

How can you stay on top of cash flow?

To ensure you have enough cash to keep the business going, consider these steps:

- Stay on top of bookkeeping: this is the best way to evaluate all the transactions that occurred in your business.

- Frequently generate cash flow statements: this is vital, and it doesn’t have to be burdensome – with Datarails, you can generate automatic cash flow statements.

- Examine your cash flow: get an understanding of how money is moving throughout the business.

- Make analyzing statements a habit: the more you get used to analyzing your financial statements, the better you’ll be at noticing opportunities to increase cash flow and prevent shortages.

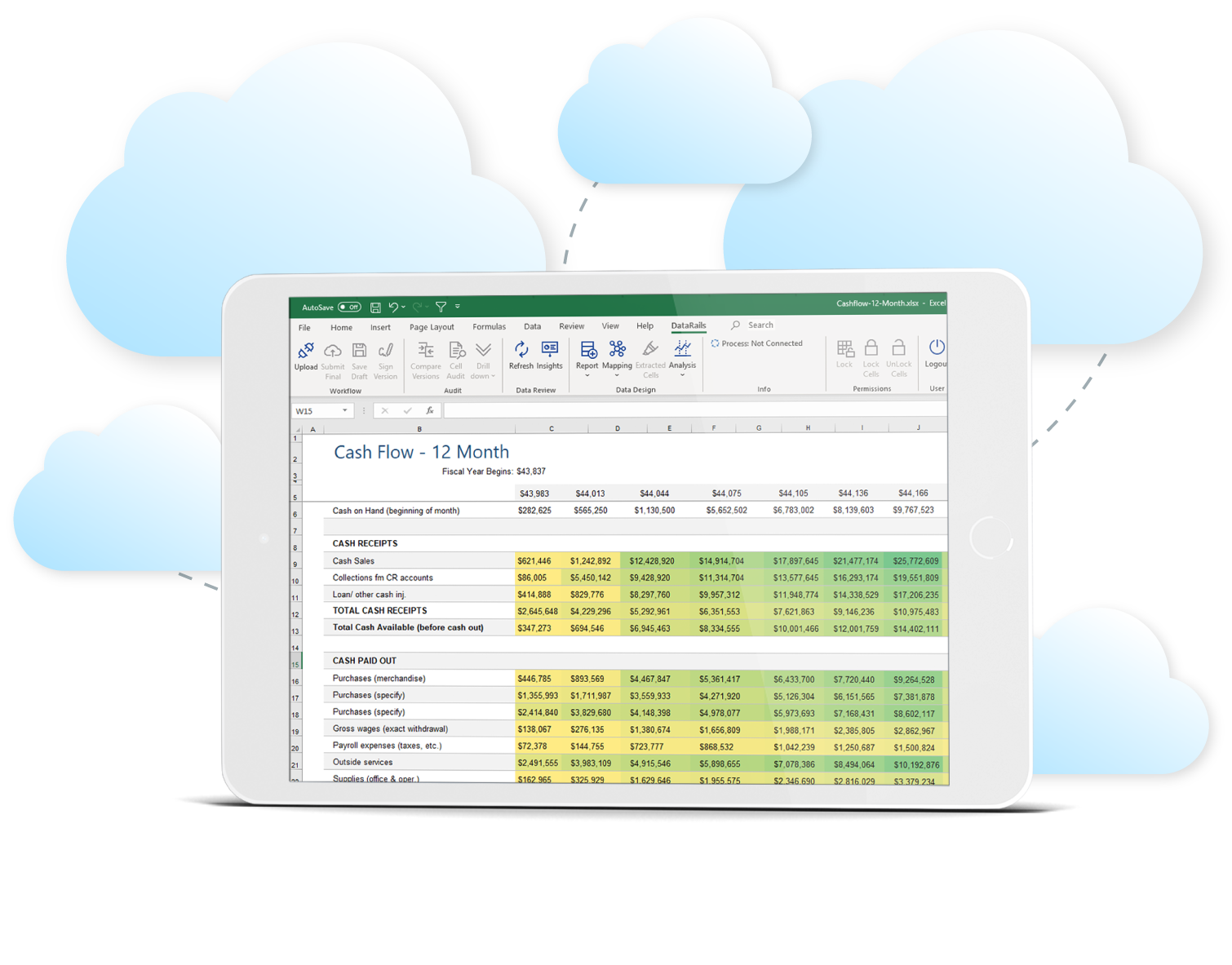

Automate cash flow reports with the tool built for FP&A professionals

To take financial reporting up a notch, cloud FP&A software such as Datarails can assist with creating automated financial reports. And the best part is that you don’t have to change the way you work to improve your processes. Datarails is an Excel-based solution, meaning that you can leverage your existing spreadsheets, models, and intellectual property that is built into your Excel spreadsheets. Keep using the interface you are familiar with while simultaneously boosting your capabilities. Datarails fits itself to you, not the other way around.

By automating cash flow reports, businesses can gain instant insights into cash movements between months, and quickly equip decision-makers with the numbers they need to make the best business decisions.