Financial statements are the cornerstone of any business, providing a snapshot of its financial health at a given time. They serve as critical tools for decision-making, helping businesses track performance, attract investors, secure loans, and ensure compliance with regulatory requirements.

Finance teams create financial statements in all shapes and sizes. For example, the balance sheet, income statement and cash flow statement are all different types of financial statements that give the company and its stakeholders an overview of their financial health.

These statements are then combined into financial reports that tell the story to management and decision makers.

Many organizations turn to financial statement software to streamline the process of creating financial statements. But how do you know which financial statement software is best for your business?

In this article, we will explore the 10 best software solutions available in 2024.

Understanding Financial Statement Software

Let’s begin with an overview of what financial statement preparation software entails, its most valuable features, and how it can benefit your business.

What is financial statement software?

Financial statement software is a specialized tool designed to facilitate financial statement creation, analysis, and management.

These statements typically include:

- The balance sheet

- Full or partial income statement

- Cash flow statement

- Other reports that summarize a company’s financial performance

This software automates the tedious and error-prone aspects of financial reporting, resulting in more accuracy and efficiency.

How does financial statement software work?

Financial statement software has powerful capabilities to develop complex documents, such as pro forma financial statements and cash flow forecasts, sometimes through artificial intelligence.

AI automates several tasks while creating financial statements, including automating calculations, catching and reducing errors, and data analysis.

Financial statement software also improves accessibility by enabling statement customizations and team collaboration.

Must-Have features of financial statement software

You’ll begin your search by determining the most essential features for your business in regard to financial statement software.

These are some of the features to consider:

- Report Templates: The software should provide a variety of pre-built templates for financial statements, making it easier to create reports quickly.

- Data Import: The ability to import financial data from multiple sources, including accounting software, spreadsheets, and databases.

- Automation: Automation features that minimize manual data entry and reduce the risk of errors.

- Customization: The flexibility to customize reports to match your company’s specific needs and branding.

- Collaboration: Tools for collaboration allow multiple team members to work on financial statements simultaneously.

How financial statement software can help your business

Financial statement software serves essential purposes for businesses, and often, the value of finding robust, reliable software for creating financial statements isn’t realized until your organization finally has it:

- Time Savings with financial statement automation: Automating the financial statement preparation process saves valuable time, allowing finance professionals to focus on analysis and strategy.

- Accuracy: By reducing manual data entry, the software cuts the risk of errors, ensuring that financial statements are accurate and reliable.

- Data Insights: Advanced software often includes AI-driven analytics, providing valuable insights into financial trends and opportunities.

- Compliance: Ensures compliance with accounting standards and regulatory requirements.

Choosing the Right Financial Statement Software

When selecting financial statement software, consider the following factors:

Key Features

Look for FP&A software that offers comprehensive features such as:

- Customizable report templates

- Data import capabilities

- Automation

- Collaboration tools

- AI power

Integrations

Ensure the financial software can integrate seamlessly with your existing financial systems and software, including accounting software and ERP systems.

Ease of Use

User-friendliness is crucial. The software should be intuitive, not requiring extensive training to use effectively.

Pricing

Consider your budget and choose software with a pricing structure that will work with your organization’s budget.

| Tool | Best For | Pricing |

| Datarails | Small to Enterprise | Custom Quote |

| Vena Solutions | Midsize to Enterprise | Custom Quote |

| Board | Enterprise | Custom Quote |

| Cube | Startups and Small Businesses | Starts at $1,500/month |

| Oracle Netsuite | Startups to Enterprises | Custom Quote |

| QuickBooks | Small Businesses | Starts at $20/month |

| Workiva | Accounting, Audit, Risk, ESG | Custom Quote |

| Workday Adaptive Planning | Various Organizations | Custom Quote |

| Freshbooks | Business Owners and Accountants | Starts at $7.60/month |

| Jedox | Businesses of All Sizes | Custom Quote |

The 10 Best Financial Statement Software

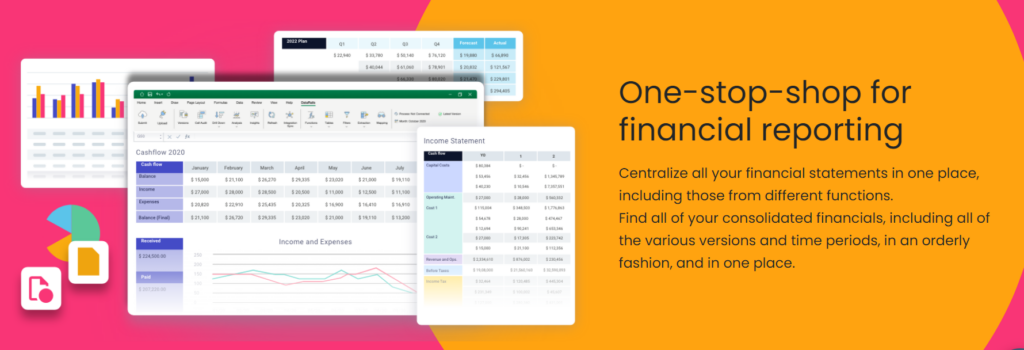

1. Datarails

Key Features

● Use of modern AI technologies

● Ease of use

● Financial forecasting

● Intuitive dashboard

● Stakeholder-friendly

● Financial statement templates

Integrations

Datarails supports over 200 integrations, including essential tools like Quickbooks, Hubspot, Shopify, and OneDrive. See the complete list here.

Who is DataRails for?

Datarails is a valuable tool for financial service companies and FP&A teams seeking

streamlined financial reporting for themselves and their stakeholders.

Pricing

Datarails offers customized pricing based on the needs of the user. Contact us for a custom quote.

What users say

Users on G2 praise Datarails for its user-friendly interface and extensive data analysis capabilities. They appreciate how it simplifies financial statement preparation.

“Datarails is an FP&A team’s dream. The tool makes pulling in financial information so easy.” – Richard, Finance of mid market company (51-1000 employees).

What we say

Datarails is one of the most influential and flexible software on the market. With a native Excel integration and data storyboards, Datarails lets users combine billions of data points to produce accurate consolidated financial statements. As our top financial statement preparation software contender, Datarails leads the pack in modern features, simple navigation, and financial reporting abilities.

2. Vena Solutions

Vena Solutions is a financial statement software focused on corporate performance

management integrated with Microsoft 365.

Key Features

● Advanced consolidation financial statement and reporting capabilities

● Multidimensional analysis

● Cloud-based or on-premise deployment options

● Integrated with leading ERP systems

Integrations

● Oracle

● Sage

● Microsoft SQL Server

● SAP

Who is Vena Solutions for?

Vena Solutions supports financial management teams in several industries, including banking, real estate, insurance, and more.

Pricing

Contact Vena for a custom quote.

What users say

As one G2 user puts it: “The Excel interface is one of my favorite aspects of Vena because it is familiar to me. It makes it easier to slice and dice the data for our business partners. I use the Vena often for reporting and forecast updates. It is also my source for internal/external reporting.”

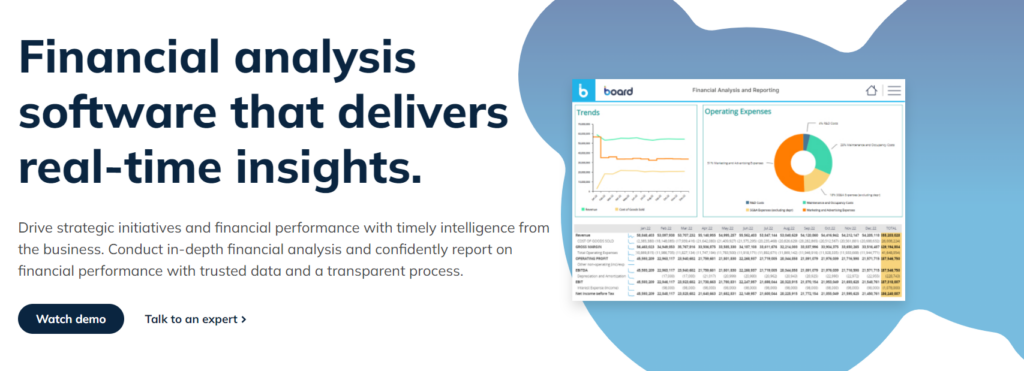

3. Board

Key Features

- Dashboard and analytics functionality

- Flexibility to customize workflows and data structures

- Scalable for large or complex organizations

- Personalized and flexible reports

Who is Board for?

Board is best for enterprises with complex financial processes. Many large organizations, including KPMG, rely on it.

Pricing

Contact Board for a custom quote.

What users say

One G2 user summarized their favorite features like this:

- “Easy to enter and update forecast/budget information.

- Our general ledger system interfaces with BOARD and is updated daily. So it’s also easy to see actuals posted at a point in time.

- A number of individuals in our company use BOARD multiple times per day with few, if any, issues. [The software has never crashed on us].”

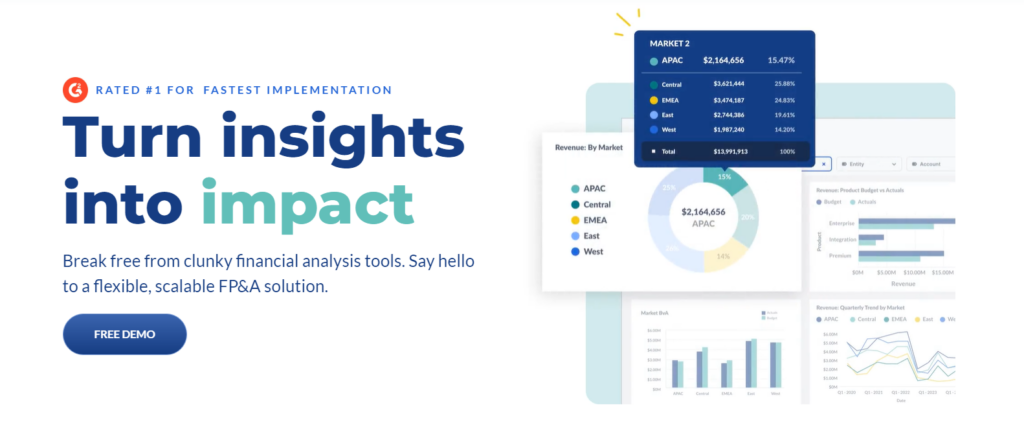

4. Cube

Key Features

● Low learning curve

● Multidimensional and multi-currency support

● Collaboration and workflow capabilities

● Connects to existing tech stacks

Integrations

Cube offers several integrations, including Google Spreadsheets, Sage, and Workday.

Who is Cube for?

Ideal for finance teams in most industries, as Cube offers flexibility and scalability..

Pricing

Prices start at $1500 per month for the basic plan and $2800 per month for the pro plan. Custom quotes available for the enterprise plan.

What users say

Jesse Ingram, the VP & Head of Finance at Veryable, says, “Cube is the simple version of what you want from a multidimensional database.”

5. Oracle NetSuite

Key Features

- Real-time modeling

- Automated budget allocations

- Multidimensional planning – income statement, balance sheet, cash flow

- Speeds up your monthly close

- Increases customer visibility

Integrations

● Salesforce

● SAP

● Shopify

● Snowflake

● Workday

Who is Oracle NetSuite for?

Oracle NetSuite is adaptable and flexible and can be used by everyone, from startups to bigger enterprises.

Pricing

Pricing is customized based on business needs—contact Oracle for a custom quote.

What users say

One user remarks that the software is easy to use, there’s good customer support, and documentation features.

6. QuickBooks

Key Features

- Automated financial reports

- Budgeting tools

- Comprehensive dashboard

- Integration with other apps and software

Integrations

QuickBooks is ideal for small businesses, freelancers, and solopreneurs looking for an intuitive and affordable finance management tool.

Who is Quickbooks for?

Quickbooks best serves individuals and small businesses that require a simple bookkeeping management tool and straightforward data insights.

Pricing

Monthly prices range from $30 to $200.

What users say

A G2 user explains: “I like the ease of use of Quickbooks and how easy it was to implement in my business. We use the software frequently, in fact on a daily basis because the features it has are just amazing. The customer support has been great as well. It also easily integrates with other applications to make email invoicing easy.”

7. Workiva

Key Features

- Real-time collaboration

- Automated data linking

- Workflow automation

- Version control and audit trail

- Unites financial reporting, ESG, audit, and risk in one platform

Integrations

Workiva integrates with many applications, including Amazon S3, Hubspot, and Trintech.

Who is Workiva for?

Workiva is often used by accounting and finance, audit, risk and compliance, ESG and sustainability, and legal teams.

Pricing

Pricing is customized based on business needs—contact Workiva for a custom quote and demo.

What users say

Hershey is a customer of Workiva, and they say,”

“I would tell my peers it’s a must that they use the Workiva platform. It saves time, allows for collaboration, and makes the entire reporting process so much easier.”

8. Workday Adaptive Planning

Key Features

- User-friendly

- Built-in analytics

- Flexibility and adaptability

- Real-time modeling and analysis

- Integration with other business systems

Integrations

Workday Adaptive Planning offers 4,000 integrations across over 350 unique source systems, including Oracle, SAP, NetSuite, and Sage Intacct.

Who is Workday for?

Workday Adaptive Planning says it is meant to “support even the most complex planning requirements—so it can work for any organization. We have customers across all industries, geographies, and company sizes.”

Pricing

Contact Workday Adaptive Planning for a quote.

What users say

Erin Levy, the Head of Financial System Advisory, CNA, says it “has given us the ability to bring our full financial picture together in a way we were never able to before. It has unlocked our corporate reporting.”

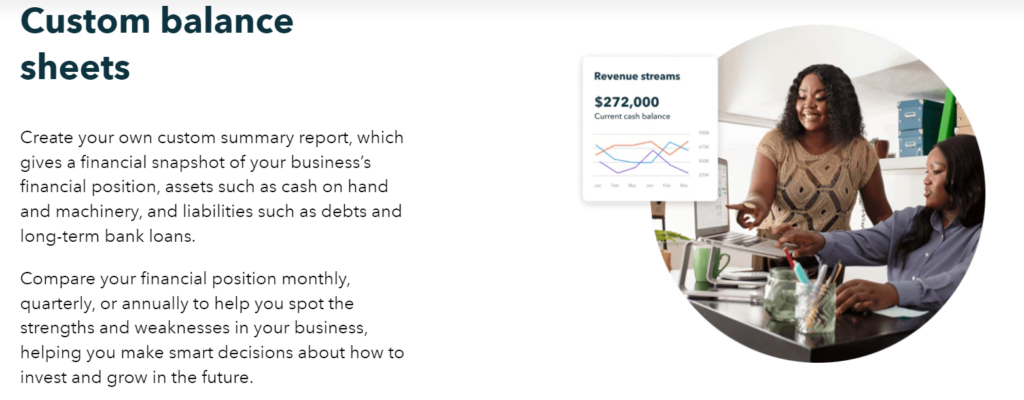

9. FreshBooks

Key Features

- Invoicing and billing

- Expense tracking

- Time tracking

- Reporting and analytics

- Integration with other business systems

- Convenient mobile app

Integrations

FreshBooks provides users an app store with Square, Stripe, and more integrations.

Who is FreshBooks for?

FreshBooks best suits freelancers, business owners, and accountants.

Pricing

Monthly prices start at $7.60 for the Lite plan up to $24.00 for the premium plan.

What users say

On G2, one user says,“I love being able to track my time for each project, and later be able to quickly add that to an invoice. Easy to track clients and projects, and to set prices for different situations.”

10. Jedox

Key Features

- Financial planning and analysis

- Budgeting and forecasting

- Eliminates uncertainty and boosts investor confidence

- Automated reporting

- Visual analytics

- Works similarly to Excel, and no coding is needed

Integrations

Jedox can be integrated into tools like Microsoft Power BI, Qlik, and Salesforce.

Who is Jedox for?

Jedox was made for businesses of all sizes. .

Pricing

Contact Jedox for a custom quote.

What users say

One user had this to say on G2:“Jedox offers a very user-friendly experience, simplifying budgeting, financial analysis and reporting process effortlessly.”

Conclusion

Financial statement software is important for automating and upgrading all of your financial reports. A good software not only saves time, but it also creates better, faster, and more accurate financial statements and reports. We invite you to check out Datarails native Excel FP&A software that will take care of all of your financial statement and reporting needs.

Did you learn a lot from this article about financial statement software?

Here are three more to read next: