At its most basic level, financial modeling is a way of creating a structured picture of how a business is expected to perform in the future and inform decisions. But what exactly does the process of financial modeling entail, and why do finance teams rely on it so heavily?

This exhaustive guide breaks down everything you need to know. We’re going to cover it all: the basics of what financial models are, the types of models used, best practices, advantages and difficulties, the impact of AI, and the tools that can make modeling easier.

We’ll also explore how modern FP&A solutions, such as Datarails, add value, and more.

By the end, you’ll come away knowing why financial modeling is so important for finance professionals, businesses, and how to tackle it proficiently.

What is Financial Modeling?

Let’s kick off with the basics.

Financial modeling is the process of building a financial model – essentially a numerical representation of a business’s operations and finances, usually in Excel or similar software.

In a financial model, an analyst forecasts future outcomes by developing assumptions and projecting outcomes based on historical data and expected trends. The model typically includes a set of financial statements (income statement, balance sheet, and cash flow statement) interconnected through formulas, as well as schedules and assumptions.

By adjusting inputs (such as revenue growth rates or expense figures), a financial model can simulate how changes in business conditions or strategies might affect the company’s financial health.

At its core, a financial model is a predictive tool. It quantifies business expectations about the future. For example, a company could model how launching a new product line might impact its revenues, expenses, and cash flows over the next five years.

All financial models are quantitative, but they also rely on qualitative insight: the quality of a model depends on the validity of its assumptions.

Assumptions are only as good as the insight behind them. That’s why knowledge of the business and its environment matters so much, whether you’re putting together a basic projection or a detailed, multi-layered model.

In practice, financial modeling can range from the simplest outputs to extremely complex ones.

A basic model might project a single outcome (think next month’s cash flow) using a few inputs. A complex model could integrate detailed scenarios and hundreds of line items.

Regardless of complexity, the goal remains the same: financial modeling provides a logical and mathematical representation of financial reality, enabling finance professionals to analyze it and make smart calls.

Why is Financial Modeling Important?

So, we know what financial modeling is, but now it’s time to move on to the “why.” Specifically, why do businesses and finance professionals put so much effort into building financial models?

The importance of financial modeling comes down to better decision-making and planning. A good financial model operates as a decision-support tool. It allows executives and analysts to test “what if” scenarios and predict outcomes before committing to decisions.

Here are a few fundamental reasons financial modeling is so important in finance:

- Strategic Decisions: Companies use financial models to evaluate big moves like expansions, investment modeling, or mergers. Seeing how these choices could impact profits or cash reserves gives leaders the confidence to act on data rather than guesswork.

- Valuation and Investor Communication: In banking and equity research, models help estimate a company’s value and guide investor decisions. Tools like DCFs are central in setting prices for mergers and advising shareholders. Companies also use them to share earnings forecasts, and accurate models build trust by backing up projections with real assumptions.

- Budgeting and Forecasting: Annual budgets and ongoing forecasts rely heavily on financial models. They allow FP&A teams to allocate resources wisely and track performance in real time.

- Risk Management: With scenario analysis, companies can model both best- and worst-case outcomes. The exercise doesn’t remove risk but makes its financial impact clearer and easier to prepare for.

- Optimizing Business Operations: Models highlight which parts of a business are driving success and which are vulnerable. For example, financial models might demonstrate how even a tiny increase in raw material costs could erode margins. This tells decision-makers that it’s time to either renegotiate contracts or reduce waste.

Overall, financial modeling brings clarity to complex financial questions. It transforms abstract assumptions into concrete projections, enabling finance professionals to see the likely outcomes of decisions before they’re made.

6 Types of Financial Models

There are dozens of different financial models and variations, each tailored to a precise purpose. While all models share the basics of projecting financial statements, their structures and focuses can differ.

Here we outline six of the key types of financial models that finance professionals commonly use, along with a brief overview of each:

- Three-Statement Model: This is the core financial model linking the income statement, balance sheet, and cash flow statement. It shows how assumptions (such as revenue growth or new financing) flow through all three, providing a comprehensive picture of financial health.

- Discounted Cash Flow (DCF) Model: This model values a business or asset by projecting its future cash flows and discounting them back to the present using a required rate of return. In turn, you get an intrinsic value that you can compare to market price.

- Budget and Forecasting Models: These models aid in internal planning by projecting revenues, expenses, and profits over a specified period. Most of the time, budgets are annual, but forecasts are modified more often to reflect actual performance.

- Merger & Acquisition (M&A) Model: An M&A model evaluates the financial impact of combining two companies. It considers the purchase price, financing, and synergies to measure outcomes such as earnings accretion/dilution and ROI.

- Leveraged Buyout (LBO) Model: Private equity firms utilize LBO models to determine if acquiring a company with substantial debt financing will yield strong returns. Within this model, the forecast shows cash flows, debt repayment, and eventual sale value to calculate investor returns.

- Industry-Specific Models: Certain industries require customized models. Real estate focuses on rental income and property values, oil and gas on reserves, and SaaS on recurring revenue and churn. While often built on three-statement structures, they add the sector-specific drivers that truly shape performance.

Note: There are many other model types and variations (such as Comparable Company Analysis models for relative valuation, Project Finance models for long-term infrastructure projects, Option Pricing models for financial derivatives, etc.).

The six above are some of the most common “core” models encountered by finance professionals. Each model fulfills a different purpose, but all follow the principle of using quantitative inputs to forecast or value something of financial importance.

5 Examples Of Financial Modeling In Action

Next, let’s look at five real-world financial modeling examples that show the process (and its benefits) in action.

- Startup Financial Projection: A financial model for a startup raising capital usually spans three to five years of operating forecasts, including revenue growth, expenses, and burn rate. Beyond clarifying cash requirements, it provides a financial modeling valuation that investors can evaluate.

- “What-If” Scenario Analysis: A retailer can model base, best, and worst-case scenarios. In a recession scenario with a 15% sales drop, the model determines whether cost cuts or financing adjustments are necessary. In a demand surge, it shows whether capacity and working capital can keep up.

- Mergers & Acquisitions Evaluation: When a company considers acquiring a competitor, it develops an M&A model that combines financials and expected synergies. The model illustrates for a financial modeling analyst how the deal impacts earnings and establishes limits on the bid price.

- Capital Budgeting Project: A manufacturer deciding on a new factory uses a model to project costs, revenues, and cash flows. With DCF analysis, they calculate NPV and IRR to see if the project meets return targets. Positive results signal it’s a worthwhile investment.

- Budget vs. Actual Analysis: After budgeting, companies compare forecasts to actual results. If Q1 sales were projected at $10 million but came in at $9 million, the finance team updates the model to determine the reason and adjusts for future quarters.

These examples illustrate the versatility of financial modeling. Whether it’s for strategic planning, investment analysis, or day-to-day financial management, modeling scenarios and numbers helps translate abstract ideas into tangible outcomes.

From startups to Fortune 500 companies, financial models guide decisions by answering questions like “What might happen if…?” in a quantified way.

Financial Modeling: Best Practices

A solid financial model is as much an art as a science. While there’s no single “right” way to model, there are widely accepted best practices and techniques that help ensure your model is accurate, clear, and useful.

Here are some key best practices for financial modeling:

Keep It Structured and Logical

Organize models into clear sections: inputs, calculations, and outputs. Place all assumptions (growth, margins, financing) on a dedicated sheet so they’re easy to review and update. Follow a logical flow: revenues → expenses → profits → cash flows.

Maintain Formula Simplicity

Avoid long, complex formulas. Break calculations into smaller steps across rows or cells. Always reference inputs instead of hard-coding numbers. This way, one change updates everything automatically.

Use Consistent Formatting

Adopt clear formatting so models are easy to read and safe to use. For example, color-code inputs and formulas, label units, and apply consistent number formatting. Good formatting reduces errors and helps users follow the model quickly.

Check for Mistakes

Build in safeguards, such as checks to ensure the balance sheet balances or that the ending cash balance matches across statements. Use IF formulas or color flags to highlight discrepancies early.

Document Assumptions

Note why assumptions are used and where figures came from. For example, you can use financial models to explain if 5% sales growth is based on industry averages. Backing up your findings with powerful data builds trust and makes the model easier to review.

Use Scenario and Sensitivity Analysis

Go beyond a single forecast by testing different scenarios (base, optimistic, and pessimistic) and sensitivities (e.g., varying a key input, such as the growth rate or interest rate). Simple tables or multiple columns show how results shift under different conditions.

Audit and Test the Model

Check formulas carefully and test responses to changes. Cost increases, for example, should reduce profits. A colleague’s review can also catch mistakes you might miss.

Over time, developing a disciplined modeling approach will save you headaches (and late nights spent fixing errors). It also makes it much easier for others to collaborate with you on financial analyses.

Financial Modeling Techniques

Beyond types of financial modeling, finance teams also rely on a set of modeling techniques to make projections more useful and adaptable.

Here’s a quick overview of six of the most common financial modeling techniques:

- Historical Data Analysis: Uses past performance to establish baselines and trends that inform future projections.

- Driver-Based Modeling: In this case, the model focuses on the key business drivers (like sales volume, pricing, or headcount) that directly impact results. In turn, you create more dynamic and actionable models.

- Scenario and Sensitivity Analysis: Tests multiple “what-if” cases or tweaks single inputs to show how outcomes change under different assumptions.

- Rolling Forecasts: This technique entails continuously updating projections (e.g., every month or quarter). This way, the outlook always reflects the latest data.

- Best Practice Modeling Structures: Applies standards like separating inputs, calculations, and outputs, using consistent formatting, and building error checks for accuracy and clarity.

Benefits of Financial Modeling

Financial modeling delivers value well beyond projecting numbers. It transforms assumptions into measurable outcomes, giving finance professionals a way to test strategies before committing resources.

The advantages span decision-making, planning, communication, and more:

- Better decision-making

- Risk mitigation and planning

- Resource allocation

- Communication and transparency

- Financial valuation models and investor attraction

Challenges of Financial Modeling

Now, for the challenges it may pose.

- Data Quality and Availability: It bears repeating: models are only as good as the data behind them. When data comes from disparate systems, analysts often spend hours piecing together spreadsheets, which increases the likelihood of errors.

- Complexity and Error Risk: As models grow, so does the risk of errors. A single broken formula or mislinked cell can throw off results.

- Communication Gaps: Even the best model is wasted if its insights aren’t understood. Complex spreadsheets often lose non-financial stakeholders.

- Lack of Documentation: A well-built model can still be frustrating if no one knows how it works. Without notes on assumptions or logic, reviewing or handing off a model becomes a challenge.

- Resistance to New Tools or Methods: Many finance teams are reluctant to adopt new tools, even when they offer automation and collaboration benefits, and prefer to stick with Excel.

Key Components of a Financial Model

While financial models vary in complexity, most share a set of core building blocks that make them accurate, reliable, and practical for decision-making.

These components include:

- Assumptions and Drivers

- Income Statement (P&L)

- Balance Sheet

- Cash Flow Statement

- Supporting Schedules

- Outputs and KPIs

- Scenario and Sensitivity Analysis

The Role of AI in Financial Modeling

Advances in technology, especially artificial intelligence (AI), are beginning to reshape how financial modeling is conducted. In fact, they’re changing a lot of how finance operates as a whole.

For example, traditional models in Excel are now getting a boost from AI-driven tools that can automate calculations, identify patterns, and even generate insights on their own.

As it relates specifically to financial modeling, here are some ways AI is influencing this area:

- Automation of data handling

- Enhanced forecasting accuracy

- Real-time scenario analysis

- Risk detection and anomaly identification

- Natural language insights

- Adaptive learning models

Many FP&A software solutions have begun incorporating AI features, from automated financial forecasting to AI-driven analysis, directly into their platforms.

This brings us to our next topic: the tools that finance professionals are using for modeling in this new era.

Top Financial Modeling Tools and Software

The classic tool for financial data modeling is, of course, Microsoft Excel.

Excel has been the finance industry’s workhorse for decades, and it remains ubiquitous due to its flexibility and familiarity. However, the “must-have” toolkit is expanding.

Now, it includes:

- Excel (and spreadsheet tools)

- FP&A software and dedicated tools

- Programming and databases

- AI-powered financial modeling tools

- Visualization and BI tools

In practice, many organizations use a combination of these tools.

The magic lies in selecting tools that match the complexity of your modeling tasks and the size of your team/company. Small businesses often use Excel for just about everything. For their part, bigger enterprises frequently require the control and efficiency only provided by dedicated software.

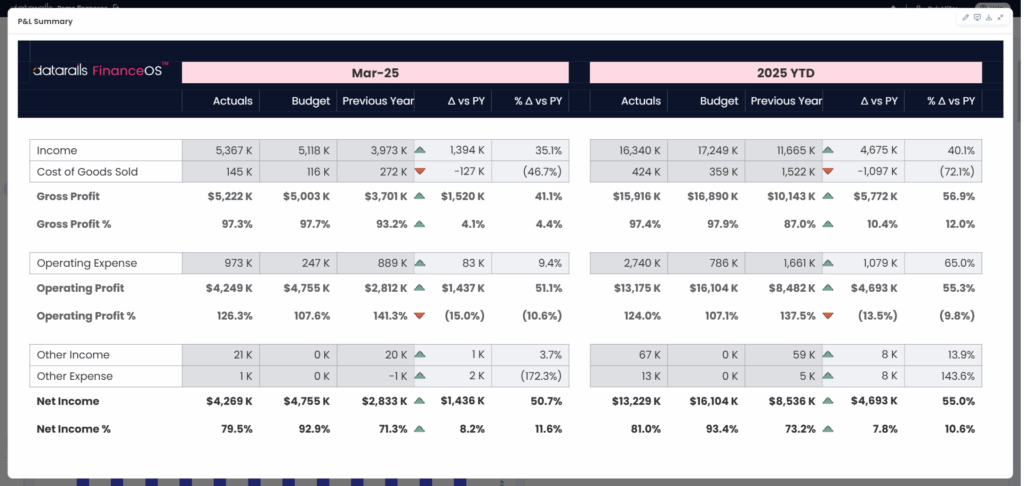

One notable option, Datarails, is specifically designed to let finance teams keep the familiarity of Excel while solving Excel’s biggest challenges. Learn more about scenario modeling with Datarails here.

The Future of Financial Modeling

Finance teams are working in different ways thanks to the changing nature of financial modeling. While no one can say for sure what the future holds, past and present trends give us a good idea of the direction it’s going.

Spreadsheets like Excel will remain foundational, but several trends are defining the future of this skill:

- AI and Machine Learning: As the use of AI for financial modeling continues to increase, models will become smarter and more adaptive. They will learn from historical data to improve forecasts and flag anomalies in real time.

- Automation and Integration: Manual spreadsheet consolidation will continue to decline as FP&A platforms connect directly to ERPs, CRMs, and other systems, ensuring live, accurate data.

- Real-Time Forecasting: Rolling forecasts and continuous updates will replace static annual models, giving leaders always-current insights.

- Conversational Interfaces: Natural language AI assistants will allow users to query models in plain English. For example, “Why did expenses increase in Q3?” and receive clear, data-driven answers.

- Visualization and Accessibility: Results will be increasingly shared through dashboards and BI tools, making complex financial outcomes easy for non-financial stakeholders to understand.

- Collaboration in the Cloud: Cloud-based platforms will enable multiple team members to work on the same model simultaneously, reducing version-control issues and making modeling a more collaborative process.

The future points toward models that are faster, smarter, and more connected.

Building a Solid Financial Model: Key Takeaways

We’ve covered a lot today, so let’s quickly recap some of the most important points to reinforce the concepts:

- Financial modeling creates a numerical representation of a business to forecast performance and guide decisions.

- The practice supports strategy, valuation, budgeting, forecasting, risk management, and operational improvements.

- Common models include the three-statement model, DCF, budgeting/forecasting, M&A, LBO, and industry-specific models.

- Best practices involve keeping models structured, using simple formulas, documenting assumptions, and running scenario/sensitivity checks.

- Benefits include enhanced decision-making, risk mitigation, effective resource allocation, and improved investor communication.

- Financial modeling can create difficulties for finance teams. These challenges include poor data quality, complex models, communication gaps, a lack of documentation, and relying too much on Excel.

- Financial modeling and artificial intelligence are closely linked, and the practice is changing with enhanced automation, improved forecasting, anomaly detection, and natural language features.

- The future points to a blend of Excel, FP&A platforms, and AI tools that make models smarter, faster, and easier to use.

See How Datarails Can Transform Your Financial Modeling

If your organization is struggling with complex Excel models, version control issues, or time-consuming budgeting processes, Datarails could be a game-changer. It’s an FP&A platform that empowers you to continue leveraging Excel while removing its traditional headaches.

When you adopt a solution like Datarails, finance teams can elevate their financial modeling, producing insights more efficiently and with greater confidence.

Request a Datarails demo today to see firsthand how it can enhance your financial modeling and planning workflows.

If the answer to those is yes, you likely have a tool that will amplify your financial forecasting process.

FAQ

The primary purpose of financial modeling is to forecast a company’s financial performance and evaluate the potential outcomes of decisions before they’re made.

Finance teams use these models to test strategies, assess risks, and inform decisions on a range of activities. This includes everything from daily budgeting to major investments and acquisitions.

This is going to depend on the scale of your business and modeling needs. For quick, flexible analysis, Excel (and Google Sheets) remain the industry standard.

For larger, ongoing processes, FP&A platforms like Datarails offer automation, collaboration, and integration that Excel alone can’t provide.

AI enhances accuracy by analyzing historical and external data for patterns humans may miss, automatically updating models with live data, and testing multiple scenarios instantly. While AI enhances forecasts, human oversight remains paramount to add judgment and context.

Finance teams commonly rely on unnecessarily complex formulas. Other common mistakes include using hard-coded assumptions instead of referencing inputs, failing to document logic, and using outdated or inconsistent data.

The best practices we cover in the above article help you avoid these mistakes.

Yes. While small businesses may not rely on highly complex models, even simple cash flow projections or budget forecasts can help businesses plan, allocate resources, and move forward effectively.

Affordable tools, such as Excel, paired with automation solutions, make it accessible to smaller teams.

Financial modeling typically begins by compiling historical results and establishing assumptions. Analysts then integrate the income statement, balance sheet, and cash flow statement to provide a comprehensive view of a company’s financial position. Along the way, they add forecasts and scenarios to evaluate different financial paths.

Analysts also utilize a range of tools and software for financial modeling.

Excel provides the grid, formulas, and flexibility to build models from scratch. You can set up inputs (such as revenue growth or expense assumptions), link them to calculations, and generate outputs. These outputs include financial statements or KPIs.

Features like pivot tables, scenario managers, and add-ins make Excel especially powerful for modeling.