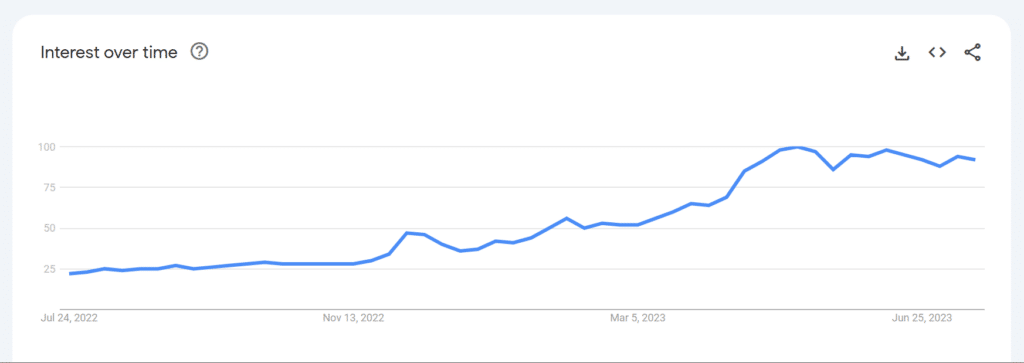

Artificial Intelligence (AI) has been a hot topic globally since OpenAI released ChaptGPT in November 2022. The popularity of this new AI tool and platform caught the attention and imagination of nearly every group of people a statistician can segment, from individuals and households, businesses and industries, to even countries. In fact, as can be seen in the Google Trends graph below, AI has been and continues to be one of the most popular Google Search topics – but why?

Fundamentally, the spark for this exponential interest and popularity of AI is due to the human-like intelligence and versatility of ChatGPT. This AI platform’s surprising, if not shocking, capability has triggered the global imagination of the endless possibilities for AI to disrupt and improve nearly every facet of life.

One area of business where AI will continue to disrupt and improve are in those financial functions that fall under Chief Financial Officers (CFO). In this article we will review six areas AI will enable CFOs to provide even greater value to their firms and increase shareholder value through enabling better decision making.

6 Ways AI Can Help CFOs Enable Better Decision Making

There are many different ways AI can help CFOs and their organization perform their duties and complete their activities faster, more accurately, and with less human involvement and resources. Below are six high-level ways AI will help CFOs now and in the future.

1) Less Human Error

Many functions that fall under the CFO, including accounting and finance, have many repetitive tasks involving large data sets, which can be in varying forms from different software platforms, such as enterprise resource planning (ERP) systems of FP&A software.

This commonly requires a human to export data from many different systems, paste the data into a spreadsheet such as Google Sheets or Microsoft Excel, normalize the data, and organize the reporting as needed. Even in this simple example, there are multiple human touch points in this relatively simple process that are open to human error, which can include: exporting incorrect data, assuming the data from each ERP system is collected using the same basis, incorrect data normalization, and providing inaccurate summary reporting. AI can reduce or even eliminate human error by automating these processes.

2) Better Information

CFO’s, other C-suite professionals, and business leaders will often have to make important decisions without all the information needed to make the best or most optimal decision. These decisions can be tactical such as product demand forecasting, to strategic decisions, such as entering or exiting a specific industry or market. Now consider if the information available to inform these decisions isn’t as accurate as the decision makers believe.

In fact, a global survey of C-suite executives and finance professionals found that 70% had “made a significant business decision based on inaccurate financial data.”

It is easier to see and understand how AI can improve the accuracy of financial information when it’s used to replace certain financial activities performed by a human, such as data input, collection, and financial reporting. AI won’t make silly mistakes such as simple number typos, incorrect data ranges, etc. However, it also removes lesser-known and appreciated human errors that we’ll cover next.

3) Removal of Human Bias and Self-interest

Two such potential human errors AI can remove are confirmation bias and dishonest reporting. Confirmation bias is when data and information are used to support or confirm an existing idea or preconceived notion. AI will simply provide an interpretation of the data as it is regardless of what competing interests may want. AI will also provide summary financial reporting based only on the financial information available. It does not have an interest in reporting the financial results in certain ways – bad, good, or other.

Humans, on the other hand, may have an interest in reporting financial information in a way that will benefit them the most. For example, if they want to show strong revenue results, they may include revenue results from months outside the reporting period. If they get caught, it’s easy to explain away the inaccurate reporting as human error.

4) Faster Financial Reporting

The required financial reporting responsibilities in the CFO organization are immense. The effort needed to manage daily, weekly, monthly, quarterly, and yearly reporting requires significant human and other resources. For example, a CFO.com article notes that out of 2,300 organizations surveyed, the median time required to close out and report month-end results took 6.4 calendar days, with the bottom 25% taking ten or more calendar days, and the top 25% taking 4.8 days.

The person-hours required to complete this task are material, and this is only one reporting cycle the CFO organization needs to prepare and provide. When you consider every reporting cycle, it’s clear there is an opportunity to use AI and machine learning to simplify and reduce the time it takes to complete any form of financial reporting.

5) Automate Financial Transaction

Finance and accounting professionals often joke that they are always in a reporting cycle – and this is typically true. However, reporting is only on onerous activities the CFO group needs to contend with. To name a few, the CFO group is also responsible for ensuring the day-to-day financial functions of the business run smoothly, such as ensuring invoices are paid, that there is enough cash on hand for accounts payable, to invoicing clients, and ensuring compliance with agreed covenants in their debt products.

Automating these day-to-day repetitive transactions is an obvious benefit of using technology and AI. It will reduce the person-hours required to complete or support the repetitive transactions and ensure the transactions are completed on time. When transactions are completed on time, they will be included in the required financial reporting. It’s not uncommon for financial transactions to be late and manual estimates are needed to ensure they are accounted for in the financial reports. As with anything manually completed, it’s prone to human error and requires valuable time that can be better spent on value-added activities and strategic efforts.

6) More Time for Value Added Activities and Strategic Efforts

Ad-hoc reporting and financial analysis requests are common for finance and accounting professionals under the CFO. They need to support all areas in a company when it comes to providing financial information to inform decisions being considered. These ad-hoc requests could be as simple and non-urgent as comparing sales data across a suite of products, to the more urgent and difficult such as determining the Net Present Value (NPV) of a material investment being considered by a board of directors.

With the significant time requirement for both reporting and day-to-day financial activities such as FP&A, groups under the CFO have little time to allocate to support the tactical decisions of the company.

According to a CFO.com article, when Chief Executive Officers (CEOs) and members of the Board of Directors are asked what they need most from their finance functions, they say they want “fast, reliable, and concise information” on the economic consideration of tactical and strategic decisions. However, the article contrasts this with information from 832 organizations that found that 50% of a finance team’s time is spent completing and managing transactions.

When Datarails launched its AI Solution FP&A Genius it solved this problem. Finance teams can grant executives the opportunity to self-serve and ask detailed questions about the numbers.

Rather than tying up finance teams for days fulfilling such requests, CEOs and other company executives can directly access answers.

Typical questions asked by CFOs and CEOs include: ‘How is our revenue trending vs last year?’, ’Which customers drove our revenue variance to budget last month? ‘Visualize our sales trend for the last 12 months’, and ‘which cost owners are overspending in February’?

In each case, the CEO or other executive receives the information instantly and allows their finance team to focus on value-added and more interesting strategic tasks.

Conclusion

It’s clear that if companies want to improve the financial information they have when making both tactical and strategic decisions, they need to do things differently and embrace technology. AI has the potential to improve the many business functions within a business, including the CFO organization. It will reduce human error and bias and decrease the time required to complete onerous financial reporting and day-to-day financial transactions.

The ultimate results of these AI benefits will be more accurate and timely financial information, and highly paid and educated finance professionals will have more time to provide greater value in supporting important business decisions, such as mergers, acquisitions, divestitures, capital investments, and so on.

Frequently Asked Questions (FAQs)

How can AI help CFOs?

Artificial Intelligence (AI) can improve the efficiency and effectiveness of the many financial and other functions that fall under the Chief Financial Officer (CFO) organization. These include, but are certainly not limited to: analyzing vast amounts of financial and non-financial information; reducing the time and effort needed to prepare routine reporting and financial transactions; and, can improve the quality of information by replacing human input and its associated human error.

How can AI improve decision-making?

AI can improve decision-making by providing better and faster data analysis. It also can improve the quality of information through reduced human error by replacing human input. By replacing and, or improving the once time-consuming activities such as financial reporting, and daily financial transactions, AI allows finance and accounting professionals more time to spend on tactical and strategic decisions.

How can AI empower finance leaders?

AI empowers finance leaders by providing data-driven insights, enhancing risk management and compliance, and offering valuable customer behavior insights, giving them the tools they need to make smarter business decisions.

These tools can help finance leaders make decisions faster and with more confidence, allowing them to focus on strategic initiatives and long-term goals. AI can also help reduce costs and improve efficiency, allowing finance leaders to maximize their resources and get the most out of their budgets.

Did you enjoy this article on how AI can help CFOs enable better decision-making?

Here are three more to read next on the topic of AI: